How To Interpret VRNA Information In My Stocks Portfolio

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Decoding the Mystery: How to Interpret VRNA Information in Your Stock Portfolio

Understanding your investment portfolio can feel like deciphering a complex code, especially when faced with unfamiliar acronyms like VRNA. For many investors, navigating the world of financial data can be daunting. But fear not! This article will demystify VRNA information and empower you to interpret it effectively, allowing you to make more informed decisions about your stock portfolio.

What does VRNA actually mean?

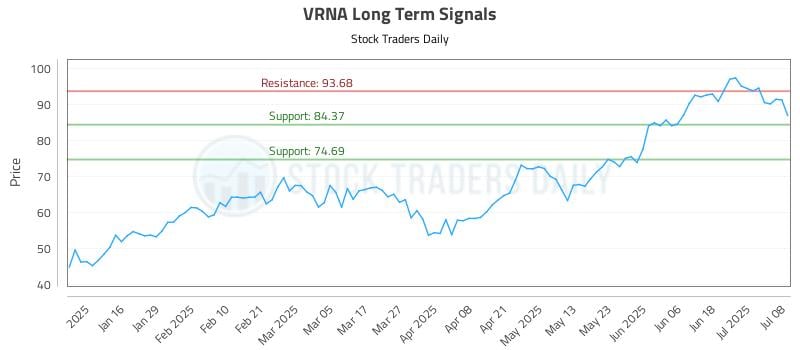

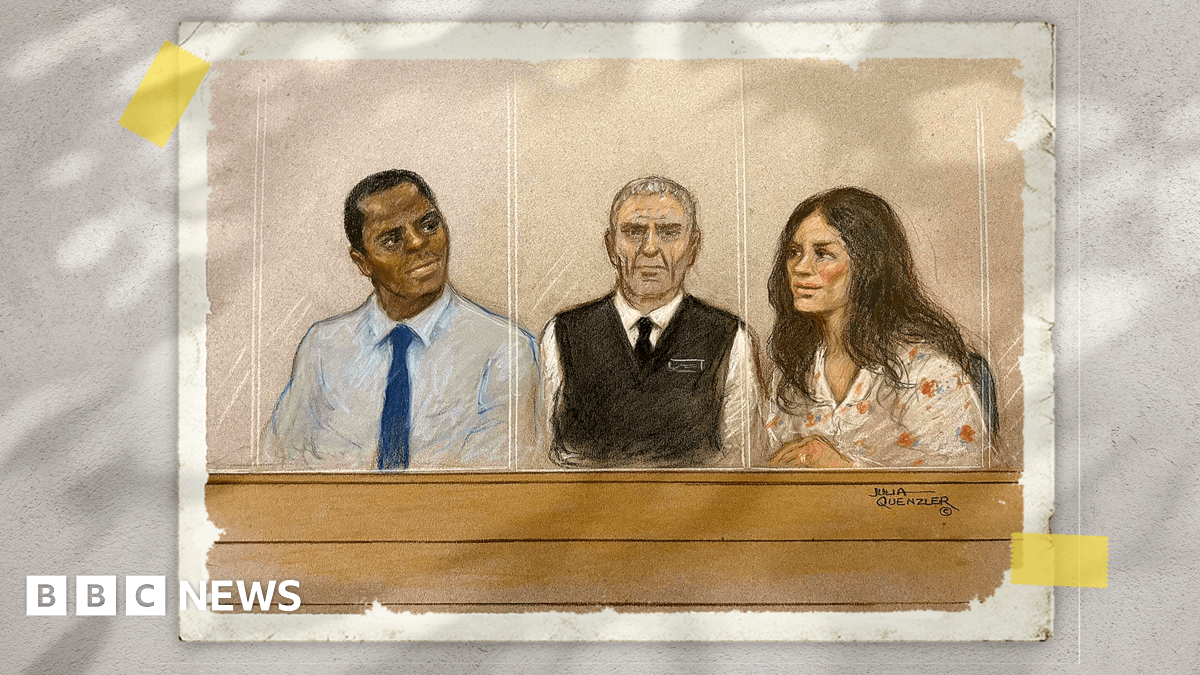

Before diving into interpretation, let's clarify what VRNA represents. VRNA, or Volume Relative to Average, is a technical indicator used to assess the current trading volume of a stock in relation to its average volume over a specific period. It essentially tells you whether a stock's current trading activity is unusually high or low compared to its historical pattern. Understanding VRNA helps you gauge market sentiment and potential price movements.

Why is VRNA Important for Stock Analysis?

VRNA provides valuable insights into market dynamics. A high VRNA suggests significantly increased trading activity, potentially indicating strong buying or selling pressure. Conversely, a low VRNA may signify a period of low investor interest. By comparing the current volume to the average, you can identify potential anomalies that might foreshadow significant price changes.

How to Interpret VRNA Values:

-

High VRNA (Above 1): This signals above-average trading volume. This could indicate strong buying pressure (if the price is also rising), suggesting potential upward momentum. However, a high VRNA with a falling price might signify significant selling pressure, indicating a potential downward trend. It's crucial to analyze this in conjunction with price movements and other technical indicators.

-

Low VRNA (Below 1): A low VRNA indicates below-average trading volume. This can signify a period of consolidation or low investor interest. It doesn't necessarily predict future price movements, but it suggests a lack of strong buying or selling pressure.

-

VRNA Around 1: A VRNA close to 1 suggests trading volume is relatively normal compared to its historical average. This doesn't offer particularly strong insights on its own, but it provides a baseline for comparison against periods of higher or lower activity.

Using VRNA in Conjunction with Other Indicators:

It's crucial to remember that VRNA should not be used in isolation. It's most effective when combined with other technical analysis tools like:

- Moving Averages: Analyzing VRNA alongside moving averages (e.g., 50-day or 200-day) can help identify potential breakouts or trend reversals.

- Relative Strength Index (RSI): Combining VRNA with RSI provides a more comprehensive view of both price momentum and trading volume.

- Price Charts: Visualizing VRNA alongside candlestick charts or other price charts gives a better context for interpreting volume changes relative to price fluctuations.

Where to Find VRNA Information:

Many reputable online brokerage platforms and financial data websites provide VRNA data. Check your brokerage platform's charting tools or search for financial data providers that offer detailed technical analysis indicators.

Conclusion:

VRNA is a powerful tool for enhancing your stock analysis capabilities. By understanding how to interpret VRNA in conjunction with other technical indicators and price action, you can gain a more nuanced perspective on market sentiment and potential price movements. Remember to always conduct thorough research and consider your overall investment strategy before making any trading decisions. This information is for educational purposes only and not financial advice. Consult with a qualified financial advisor before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on How To Interpret VRNA Information In My Stocks Portfolio. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Thaksin Shinawatra Forbes Ranks Former Pm 11th On 2025 Thailands Richest List

Jul 10, 2025

Thaksin Shinawatra Forbes Ranks Former Pm 11th On 2025 Thailands Richest List

Jul 10, 2025 -

New Covid Variant Stratus Hoarseness Among Emerging Symptoms

Jul 10, 2025

New Covid Variant Stratus Hoarseness Among Emerging Symptoms

Jul 10, 2025 -

Yorkshire Water Implements County Wide Hosepipe Restrictions

Jul 10, 2025

Yorkshire Water Implements County Wide Hosepipe Restrictions

Jul 10, 2025 -

Construction Crane Accident Involving Public Bus

Jul 10, 2025

Construction Crane Accident Involving Public Bus

Jul 10, 2025 -

Delta Air Lines Plane Suffers Battery Fire Makes Emergency Landing

Jul 10, 2025

Delta Air Lines Plane Suffers Battery Fire Makes Emergency Landing

Jul 10, 2025

Latest Posts

-

A Students Guide To Personal Injury Law Challenges And Rewards Of The Legal Profession

Jul 16, 2025

A Students Guide To Personal Injury Law Challenges And Rewards Of The Legal Profession

Jul 16, 2025 -

Putin And Trump A Continuing Conflict Despite Trumps Disappointment

Jul 16, 2025

Putin And Trump A Continuing Conflict Despite Trumps Disappointment

Jul 16, 2025 -

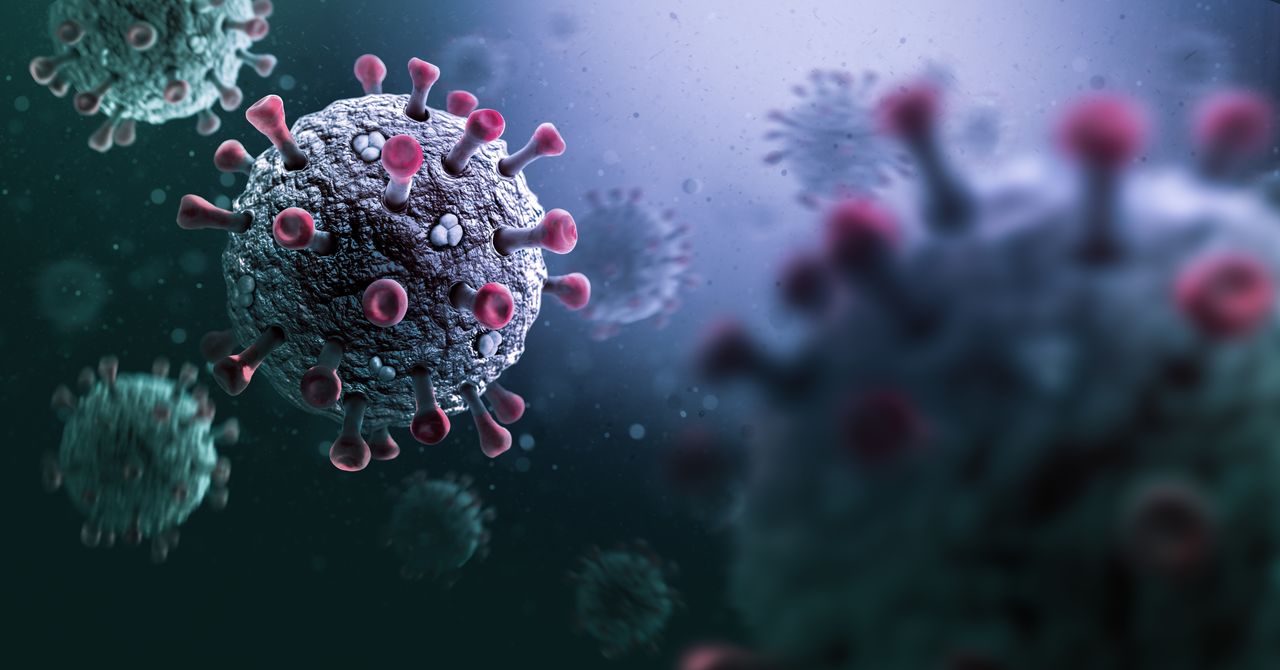

The Shocking Details Of The Marten And Gordon Case A Nations Disbelief

Jul 16, 2025

The Shocking Details Of The Marten And Gordon Case A Nations Disbelief

Jul 16, 2025 -

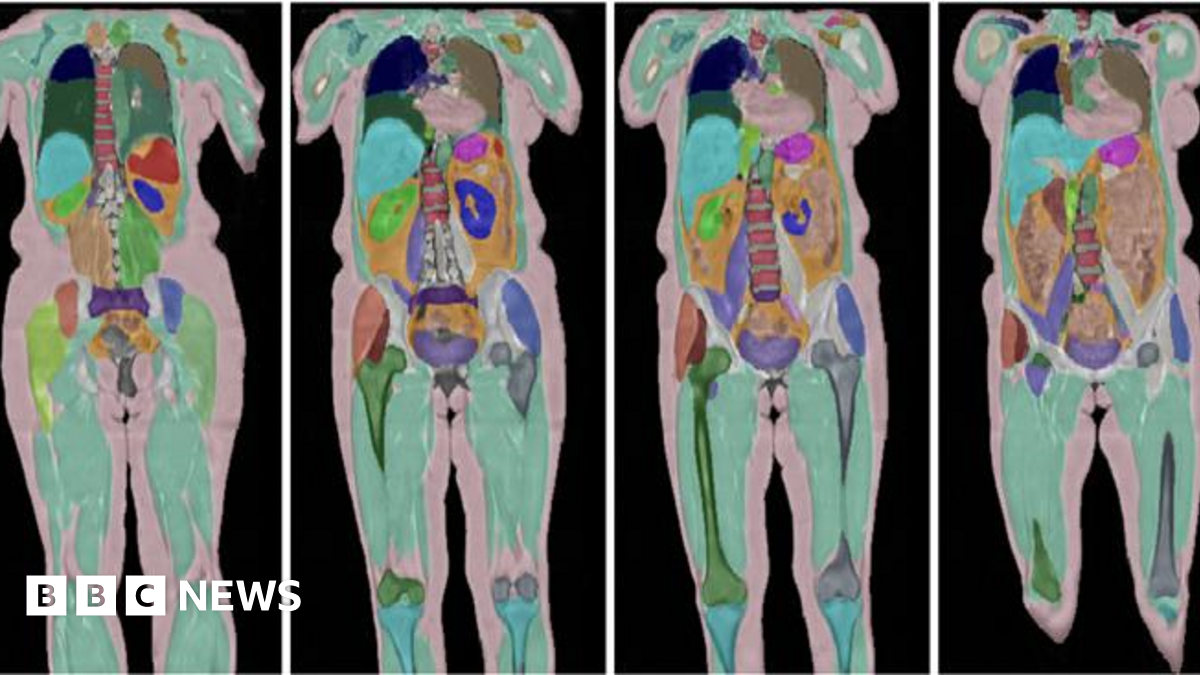

100 000 Uk Volunteers Contribute To Massive Human Imaging Study

Jul 16, 2025

100 000 Uk Volunteers Contribute To Massive Human Imaging Study

Jul 16, 2025 -

Laid Off King Employees Replaced By Ai They Helped Create

Jul 16, 2025

Laid Off King Employees Replaced By Ai They Helped Create

Jul 16, 2025