How To Profit From Broadcom's Earnings Report With Options

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

How to Profit from Broadcom's Earnings Report with Options Trading

Broadcom (AVGO) earnings reports are major market events. These quarterly announcements often cause significant price swings, presenting savvy investors with opportunities to profit using options trading. However, navigating the complexities of options trading requires careful planning and understanding. This article explores strategies to potentially capitalize on Broadcom's earnings reports, emphasizing risk management and informed decision-making. Disclaimer: Options trading involves significant risk and may not be suitable for all investors.

Understanding Broadcom and its Earnings Reports

Broadcom, a leading semiconductor company, plays a crucial role in various technological sectors. Its earnings reports reveal crucial information about its financial health, future projections, and overall market position. Analyzing these reports – focusing on revenue, earnings per share (EPS), guidance, and any significant announcements – is paramount for successful options trading. Keep an eye on reputable financial news sources like the and for immediate post-earnings analysis.

Options Strategies for Broadcom Earnings:

Several options strategies can be employed before and after a Broadcom earnings release. Each carries its own level of risk and reward:

1. Long Straddle/Strangle: This strategy involves buying both a call and a put option with the same expiration date and strike price (straddle) or different strike prices (strangle). This benefits from large price movements in either direction. However, it's expensive and loses money if the price remains relatively stable.

- Pros: Profit potential is high with significant price movement.

- Cons: High initial cost; substantial losses if price remains within the range of the strike prices.

2. Short Straddle/Strangle: This is the opposite of a long straddle/strangle. You sell both a call and a put option. This strategy profits from low volatility, but the potential losses can be unlimited if the price moves significantly. Extremely risky and not recommended for inexperienced traders.

- Pros: High profit potential if the price remains stable.

- Cons: Unlimited loss potential if the price moves substantially; requires significant margin.

3. Bullish/Bearish Call/Put Spreads: These strategies involve buying one option and selling another with a different strike price to limit risk and reduce the initial cost. A Bullish Call Spread profits from price increases, while a Bearish Put Spread profits from price decreases.

- Pros: Defined risk and lower initial cost compared to outright option purchases.

- Cons: Limited profit potential compared to uncapped strategies.

Risk Management is Crucial

Regardless of the chosen strategy, effective risk management is crucial. Before engaging in options trading around Broadcom's earnings, consider:

- Defining your risk tolerance: How much are you willing to lose?

- Diversification: Don't put all your eggs in one basket. Diversify your portfolio.

- Position sizing: Don't over-leverage your account.

- Understanding Implied Volatility (IV): IV reflects market expectations of price fluctuations. High IV before earnings often translates to higher option premiums.

Analyzing Pre-Earnings Sentiment:

Before the earnings announcement, monitor analyst ratings, news articles, and social media sentiment to gauge market expectations. This information can help you refine your strategy and manage your risk.

Post-Earnings Analysis:

After the earnings release, carefully analyze the actual results against expectations. This will help you determine whether your chosen strategy was successful and inform future trading decisions.

Conclusion:

Profiting from Broadcom's earnings reports with options requires careful planning, research, and risk management. Understanding different options strategies and properly assessing market sentiment are crucial for success. Remember to always trade within your risk tolerance and consult with a qualified financial advisor before making any investment decisions. This information is for educational purposes only and should not be considered financial advice.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on How To Profit From Broadcom's Earnings Report With Options. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Broadcom Avgo Stock Analyst And Trader Outlook Following Q Quarter Earnings

Jun 06, 2025

Broadcom Avgo Stock Analyst And Trader Outlook Following Q Quarter Earnings

Jun 06, 2025 -

Penguins Coaching Staff Bolstered David Quinns Return To The Rangers Organization

Jun 06, 2025

Penguins Coaching Staff Bolstered David Quinns Return To The Rangers Organization

Jun 06, 2025 -

Maxwell Anderson Trial Update Proceedings Begin In Sade Robinson Killing

Jun 06, 2025

Maxwell Anderson Trial Update Proceedings Begin In Sade Robinson Killing

Jun 06, 2025 -

Second Day Of Testimony Cassie Venturas Friend In Combs Case

Jun 06, 2025

Second Day Of Testimony Cassie Venturas Friend In Combs Case

Jun 06, 2025 -

Broadcom Earnings Impact Trader Sentiment And Stock Price Projections For Avgo

Jun 06, 2025

Broadcom Earnings Impact Trader Sentiment And Stock Price Projections For Avgo

Jun 06, 2025

Latest Posts

-

Infant Microbiome And Its Effect On Future Health

Jun 06, 2025

Infant Microbiome And Its Effect On Future Health

Jun 06, 2025 -

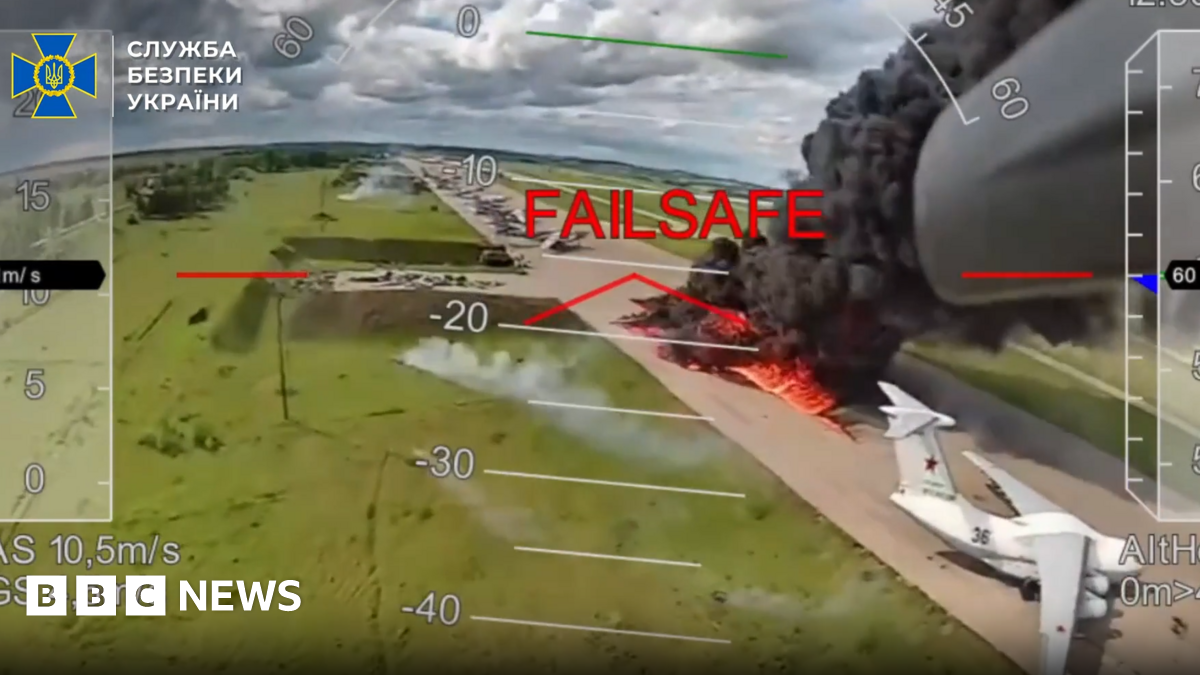

Analyzing The Impact Were Ukraines Airfield Strikes A Turning Point

Jun 06, 2025

Analyzing The Impact Were Ukraines Airfield Strikes A Turning Point

Jun 06, 2025 -

Aplds Hyperscale Expansion A 5 Billion Commitment

Jun 06, 2025

Aplds Hyperscale Expansion A 5 Billion Commitment

Jun 06, 2025 -

Massive Ai Lease Agreement Fuels 48 Rise In Applied Digital Shares

Jun 06, 2025

Massive Ai Lease Agreement Fuels 48 Rise In Applied Digital Shares

Jun 06, 2025 -

Southern Syria Israeli Raid Leads To Bbc Crews Gunpoint Detention

Jun 06, 2025

Southern Syria Israeli Raid Leads To Bbc Crews Gunpoint Detention

Jun 06, 2025