How Will State Farm's Emergency Rate Increase Impact Your Premiums?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

How Will State Farm's Emergency Rate Increase Impact Your Premiums?

State Farm, one of the nation's largest auto insurers, recently announced emergency rate increases in several states. This move, impacting millions of policyholders, has left many wondering: how much will my premiums actually go up? The answer, unfortunately, isn't a simple one, but understanding the factors involved can help you prepare.

Understanding the Rationale Behind the Increase

State Farm attributes the need for these emergency rate hikes to a confluence of factors, primarily the increasing cost of auto repairs and rising claims severity. This isn't just about inflation; it's also about the escalating prices of vehicle parts, particularly those incorporating advanced technology. The rising cost of labor for repairs further exacerbates the problem. Additionally, the severity of accidents, often resulting in higher medical bills and more extensive vehicle damage, plays a significant role. State Farm isn't alone in facing these challenges; many other major insurers are grappling with similar pressures.

How Much Will Your Premium Increase?

The percentage increase varies significantly by state and even by individual policy. State Farm hasn't released a uniform percentage for all policyholders. Instead, the impact depends on several key factors:

- Your Location: Rate increases differ based on location due to variations in claim frequency and severity. States with higher accident rates or higher repair costs will likely see larger premium increases.

- Your Driving Record: A clean driving record typically translates to lower premiums. However, even with a clean record, you'll still experience the increase, though perhaps at a slightly lower percentage.

- Your Vehicle: The type of vehicle you insure, its age, and its safety features all impact your premium. Expensive vehicles to repair will naturally lead to higher premiums.

- Your Coverage: The level of coverage you choose (liability, collision, comprehensive) directly influences your premium. More comprehensive coverage typically means higher premiums.

What Can You Do?

While you can't avoid the increase entirely, there are steps you can take to potentially mitigate its impact:

- Shop Around: Don't be afraid to compare quotes from other insurers. The competitive landscape may offer you a better rate elsewhere. Use online comparison tools to streamline this process.

- Review Your Coverage: Carefully assess your current coverage. Could you reduce your coverage slightly without sacrificing necessary protection? This could lead to lower premiums. However, remember that underinsurance can leave you financially vulnerable in the event of a serious accident.

- Improve Your Driving Habits: Safe driving habits can reduce your risk profile and potentially lead to discounts in the future. Consider taking a defensive driving course to demonstrate your commitment to safe driving.

Looking Ahead:

The insurance industry is constantly evolving, and the challenges posed by rising repair costs and claim severity are likely to persist. Staying informed about changes in your insurance policy and proactively managing your risk are crucial steps in maintaining affordable auto insurance. Regularly reviewing your policy and shopping around for the best rates remain essential strategies for managing your insurance costs. This proactive approach can help you navigate the complexities of auto insurance and ensure you have the right coverage at a price you can afford.

Disclaimer: This article provides general information and should not be considered financial or insurance advice. Consult with a qualified insurance professional for personalized guidance.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on How Will State Farm's Emergency Rate Increase Impact Your Premiums?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Mudanca De Vida Militares Estadunidenses Trocam Os Eua Pelo Brasil Motivos E Implicacoes

May 18, 2025

Mudanca De Vida Militares Estadunidenses Trocam Os Eua Pelo Brasil Motivos E Implicacoes

May 18, 2025 -

10 Defining Moments In New York Baseball History Goliath Battles And Broken Bats

May 18, 2025

10 Defining Moments In New York Baseball History Goliath Battles And Broken Bats

May 18, 2025 -

Heated Exchange Trump Vs Springsteen Over Treason Label

May 18, 2025

Heated Exchange Trump Vs Springsteen Over Treason Label

May 18, 2025 -

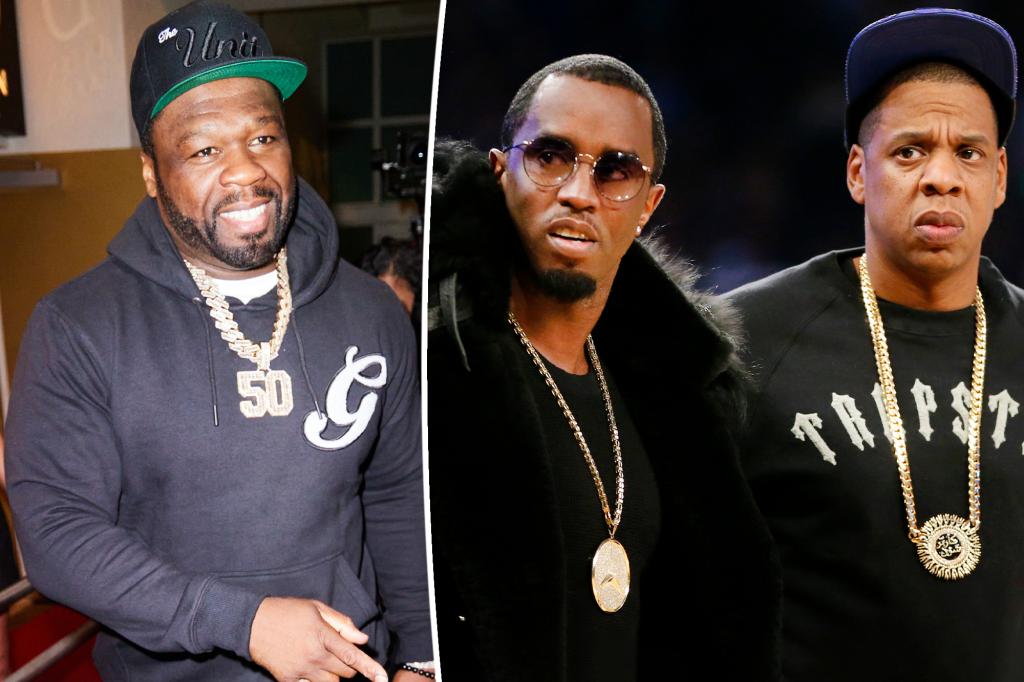

Jay Z Diddy And 50 Cent A Triangular Hip Hop Rivalry Explodes

May 18, 2025

Jay Z Diddy And 50 Cent A Triangular Hip Hop Rivalry Explodes

May 18, 2025 -

Kakegurui The Complete Cast Guide For Netflixs Series

May 18, 2025

Kakegurui The Complete Cast Guide For Netflixs Series

May 18, 2025

Latest Posts

-

Twelve In A Row Twins Winning Streak Powered By Joe Ryans Dominant Pitching

May 18, 2025

Twelve In A Row Twins Winning Streak Powered By Joe Ryans Dominant Pitching

May 18, 2025 -

Kakegurui The Complete Cast Guide For Netflixs Series

May 18, 2025

Kakegurui The Complete Cast Guide For Netflixs Series

May 18, 2025 -

Destination X Bus Jeffrey Dean Morgan Reveals The Journey Video

May 18, 2025

Destination X Bus Jeffrey Dean Morgan Reveals The Journey Video

May 18, 2025 -

Sfpd Rookie Officer Arrested Dui Crash Results In Multiple Injuries

May 18, 2025

Sfpd Rookie Officer Arrested Dui Crash Results In Multiple Injuries

May 18, 2025 -

Minnesota Twins Dominate 13th Straight Win 3rd Straight Shutout

May 18, 2025

Minnesota Twins Dominate 13th Straight Win 3rd Straight Shutout

May 18, 2025