HS2 Construction: Contractors Face Tax Probe On Worker Provision

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

HS2 Construction: Contractors Face Tax Probe Over Worker Provision

A major investigation is underway into potential tax irregularities surrounding the provision of workers on the controversial HS2 high-speed rail project. The probe, launched by HMRC (Her Majesty's Revenue and Customs), focuses on several large construction contractors involved in building Britain's ambitious new rail network. This development casts a shadow over the already-fraught project, raising concerns about transparency and fair practices within the multi-billion-pound undertaking.

The investigation, sources close to the matter reveal, centers on allegations of "off-payroll working" practices, also known as IR35. This refers to situations where contractors engage workers through intermediary companies, potentially leading to tax avoidance. HMRC is scrutinizing contracts and payment structures to determine whether contractors have correctly declared and paid taxes on behalf of their workers. The scale of the probe remains undisclosed, but multiple contractors are reportedly under investigation.

<h3>The Implications for HS2</h3>

The timing of this investigation is particularly sensitive. The HS2 project is already facing significant scrutiny over its ballooning budget and ongoing delays. The potential for widespread tax evasion adds another layer of complexity, further damaging public confidence. This investigation could lead to significant financial penalties for the contractors involved, potentially impacting the project's timeline and overall cost. Furthermore, the reputational damage could be substantial, impacting future bidding opportunities for these companies.

<h3>What is IR35 and Why is it Relevant?</h3>

IR35 legislation aims to prevent individuals from working through intermediary companies to avoid paying income tax and National Insurance contributions. It's a complex area of tax law, and many contractors struggle to navigate its intricacies. The allegations suggest that some contractors involved in HS2 may have misclassified workers, potentially leading to significant underpayment of taxes. This practice not only defrauds the government but also puts those workers at a disadvantage, potentially limiting their access to employee benefits and protections.

<h3>The Contractors Involved (Currently Unnamed)</h3>

While HMRC has yet to publicly name the contractors under investigation, sources suggest that several major players in the construction industry are implicated. The secrecy surrounding the names highlights the sensitivity of the situation and the potential repercussions for those involved. This lack of transparency is fueling speculation and concerns about accountability within the HS2 project.

<h3>Looking Ahead: What's Next for HS2?</h3>

The ongoing tax probe will undoubtedly intensify the pressure on the already beleaguered HS2 project. The government will need to address these concerns transparently and decisively to maintain public trust. Further investigations and potential legal proceedings could lead to significant delays and cost overruns, further exacerbating the challenges facing this crucial infrastructure project. The outcome of this investigation will have significant implications not just for HS2, but also for the wider construction industry and its approach to worker provision. We will continue to update this story as more information becomes available.

Keywords: HS2, High Speed Rail, Construction, Tax Probe, HMRC, IR35, Off-Payroll Working, Tax Evasion, Contractors, Investigation, Budget, Delays, Infrastructure, UK News, Finance News

Call to Action (subtle): Stay informed about the latest developments on this crucial story by subscribing to our newsletter for regular updates.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on HS2 Construction: Contractors Face Tax Probe On Worker Provision. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Jornal Espanhol Preocupa Se Com O Flamengo Filipe Luis Como Fator Decisivo No Mundial

Jun 17, 2025

Jornal Espanhol Preocupa Se Com O Flamengo Filipe Luis Como Fator Decisivo No Mundial

Jun 17, 2025 -

Omaha College World Series A Look At Day 2s Triumphs And Setbacks

Jun 17, 2025

Omaha College World Series A Look At Day 2s Triumphs And Setbacks

Jun 17, 2025 -

Analise Espanhola Flamengo Assusta E E Apontado Como Favorito No Mundial De Clubes

Jun 17, 2025

Analise Espanhola Flamengo Assusta E E Apontado Como Favorito No Mundial De Clubes

Jun 17, 2025 -

Mi 6s New Chief Blaise Metreweli Ushers In Era Of Female Leadership

Jun 17, 2025

Mi 6s New Chief Blaise Metreweli Ushers In Era Of Female Leadership

Jun 17, 2025 -

Three Times Higher Millennial Appendix Cancer Risk Highlights A Concerning Trend

Jun 17, 2025

Three Times Higher Millennial Appendix Cancer Risk Highlights A Concerning Trend

Jun 17, 2025

Latest Posts

-

Tax Authorities Probe Hs 2 Contractors Over Worker Provision

Jun 17, 2025

Tax Authorities Probe Hs 2 Contractors Over Worker Provision

Jun 17, 2025 -

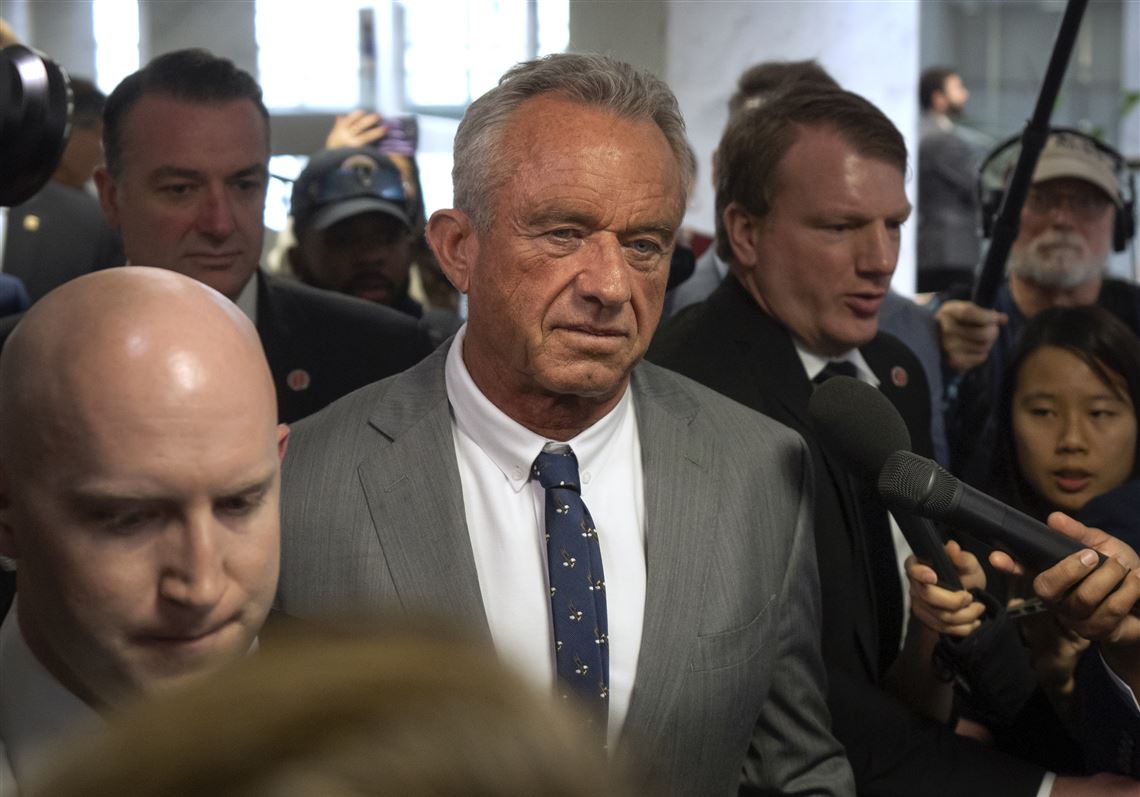

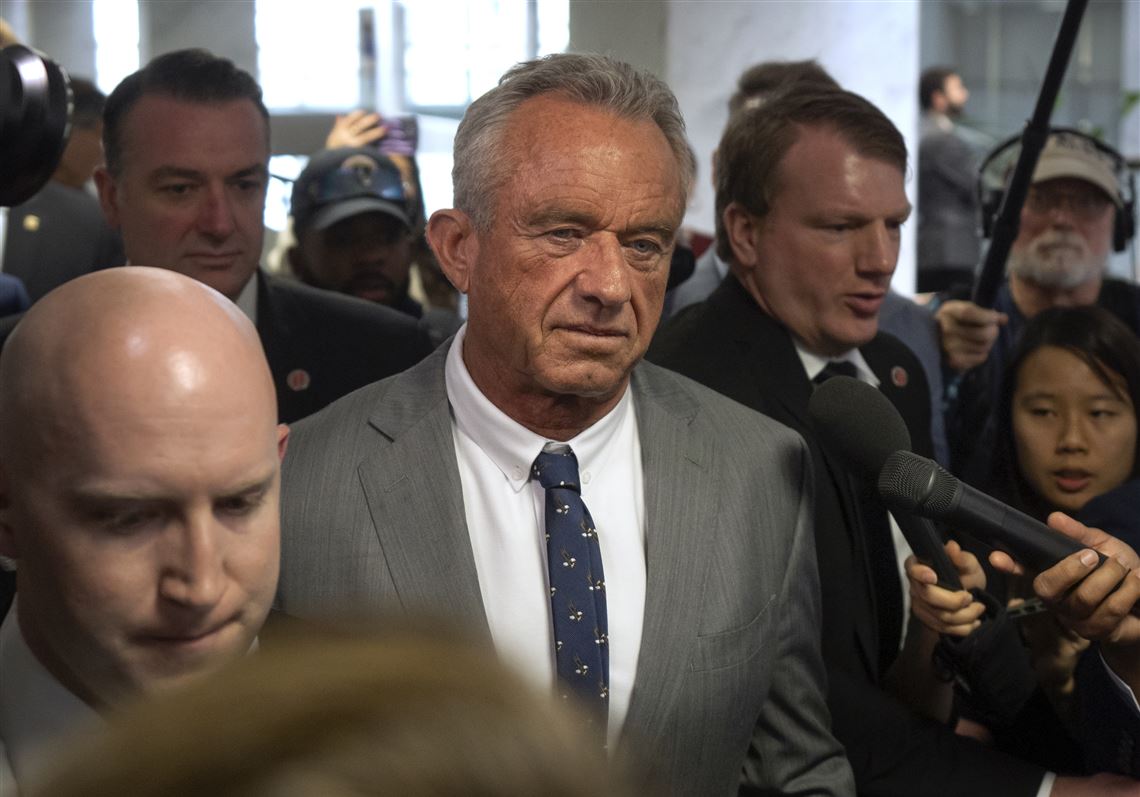

Kennedy Jr S Vaccine Rhetoric Former Cdc Committee Members Express Alarm

Jun 17, 2025

Kennedy Jr S Vaccine Rhetoric Former Cdc Committee Members Express Alarm

Jun 17, 2025 -

Macrons Greenland Trip A Strategic Response To Trumps Claims

Jun 17, 2025

Macrons Greenland Trip A Strategic Response To Trumps Claims

Jun 17, 2025 -

Philadelphia Phillies At Miami Marlins Betting Preview Odds And Predictions

Jun 17, 2025

Philadelphia Phillies At Miami Marlins Betting Preview Odds And Predictions

Jun 17, 2025 -

Former Cdc Advisors Criticize Robert F Kennedy Jr S Anti Vaccine Stance

Jun 17, 2025

Former Cdc Advisors Criticize Robert F Kennedy Jr S Anti Vaccine Stance

Jun 17, 2025