HS2 Contractor Practices Questioned: Focus On Worker Supply And Tax Compliance

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

HS2 Contractor Practices Questioned: Concerns Mount Over Worker Supply and Tax Compliance

The controversial High-Speed 2 (HS2) rail project is facing renewed scrutiny, this time focusing on the practices of its contractors. Concerns are rising regarding the sourcing of workers and the rigorousness of tax compliance measures within the vast supply chain supporting this ambitious undertaking. The project, already facing significant budget overruns and delays, now finds itself embroiled in a debate about ethical and legal compliance within its contractor network.

Worker Supply: A Shadow of Exploitation?

One of the primary concerns revolves around the supply of workers for the HS2 project. Reports suggest a reliance on agencies that may not always adhere to fair labor practices. The sheer scale of the project demands a massive workforce, creating an environment where exploitation, potentially involving low wages, poor working conditions, and a lack of worker protections, could easily fester. This raises serious ethical questions about the project's overall sustainability and its impact on the wellbeing of its workforce. [Link to relevant government report on worker exploitation in large-scale infrastructure projects].

Furthermore, questions are being raised about the transparency of the supply chains. Determining the precise origin and working conditions of every worker involved in the project is a monumental task, leaving room for unethical practices to remain hidden. Experts are calling for greater transparency and robust auditing mechanisms to ensure that all workers are treated fairly and receive the compensation and benefits they are legally entitled to.

Tax Compliance: A Loopholes-Filled Landscape?

Beyond worker welfare, concerns are also being raised about tax compliance amongst HS2 contractors. The complexity of the project's supply chain, involving numerous subcontractors and tiered partnerships, makes effective tax oversight challenging. This complex web of contracting creates fertile ground for potential tax evasion and avoidance strategies. The potential loss of tax revenue to the UK government is a significant concern, especially given the project's already substantial cost.

The government needs to implement stricter measures to ensure all contractors, regardless of size or position in the supply chain, fully comply with tax regulations. This might involve strengthening auditing procedures, implementing more robust verification systems, and imposing stricter penalties for non-compliance. Failing to do so could not only undermine the project's financial viability but also damage public trust.

Calls for Greater Transparency and Accountability

Several MPs have called for a thorough independent review into the contractor practices on HS2, demanding greater transparency and accountability. They've emphasized the need for a robust framework to ensure compliance with both labor laws and tax regulations, highlighting the potential long-term reputational damage to the project and the UK government if these issues are not addressed effectively.

What's Next for HS2?

The future of HS2 hinges on addressing these crucial issues. A failure to ensure fair labor practices and robust tax compliance could lead to further delays, cost overruns, and ultimately, damage the project's legacy. Moving forward, a commitment to transparency, stricter regulations, and rigorous oversight is crucial to ensuring that HS2 is not only a feat of engineering but also a responsible and ethical undertaking. The government needs to demonstrate its commitment to ethical procurement practices and robust monitoring of its contractors. The public deserves assurances that this massive project is being delivered responsibly and ethically.

Keywords: HS2, High-Speed 2, contractor practices, worker exploitation, tax compliance, supply chain, ethical concerns, government regulation, infrastructure projects, labor laws, auditing, transparency, accountability.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on HS2 Contractor Practices Questioned: Focus On Worker Supply And Tax Compliance. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Dont Miss Yungbluds New Album And The Traitors Series Launch This Week

Jun 17, 2025

Dont Miss Yungbluds New Album And The Traitors Series Launch This Week

Jun 17, 2025 -

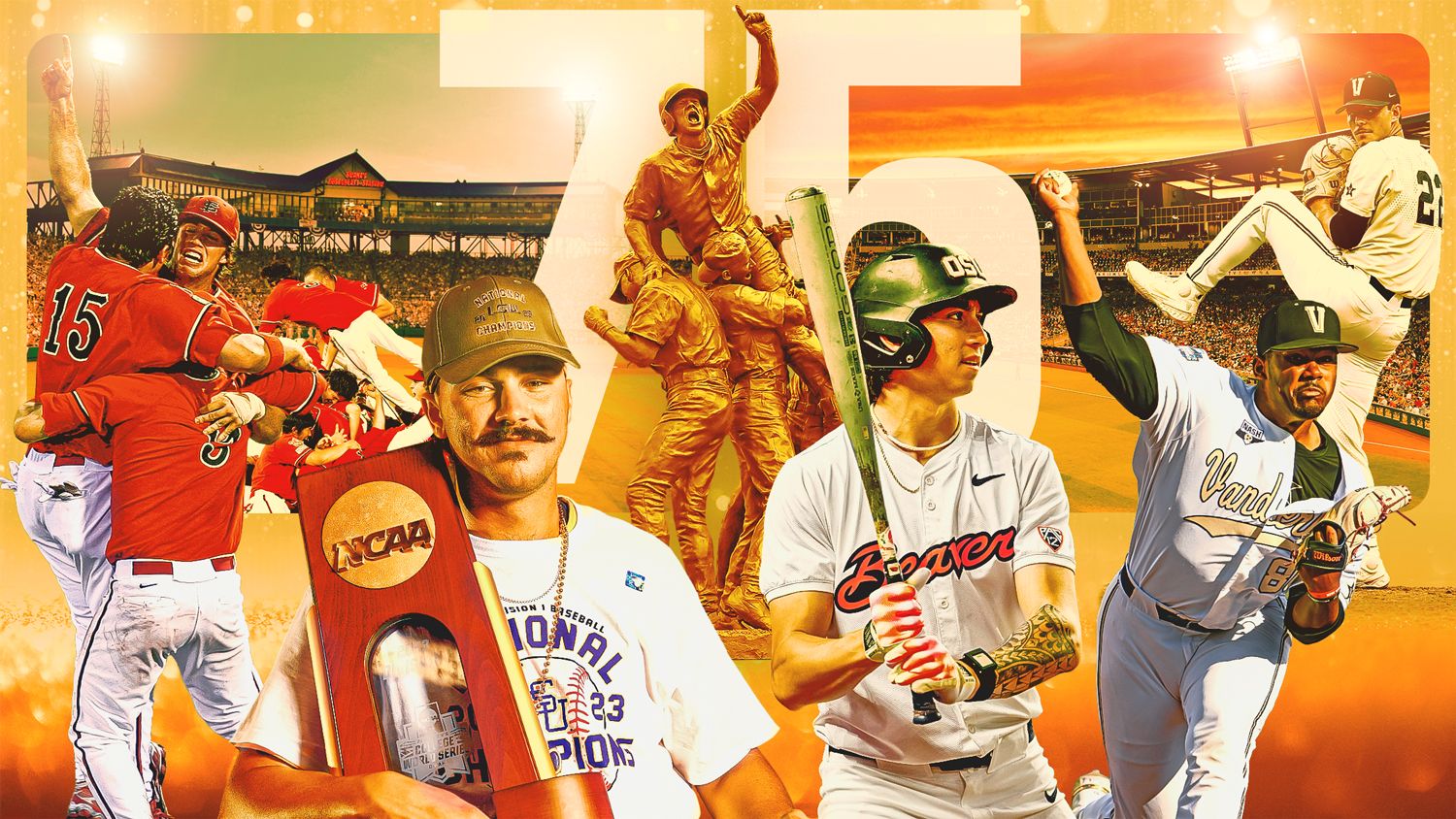

Omahas Mcws Years Of Growth And Community Impact

Jun 17, 2025

Omahas Mcws Years Of Growth And Community Impact

Jun 17, 2025 -

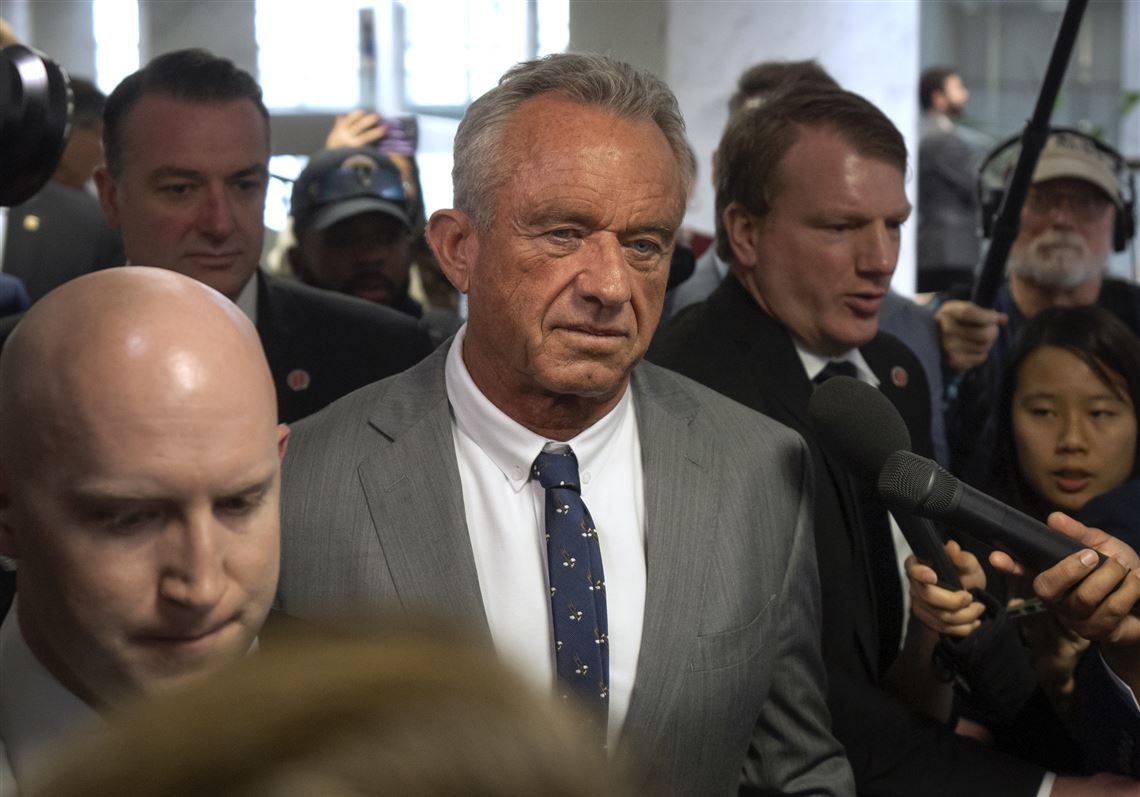

Dismissed Cdc Experts Sound Alarm Over Rfk Jr S Impact On Vaccine Discourse

Jun 17, 2025

Dismissed Cdc Experts Sound Alarm Over Rfk Jr S Impact On Vaccine Discourse

Jun 17, 2025 -

Analise Espanhola Flamengo E Ameaca Real No Mundial Mas Filipe Luis Preocupa

Jun 17, 2025

Analise Espanhola Flamengo E Ameaca Real No Mundial Mas Filipe Luis Preocupa

Jun 17, 2025 -

Critical Roles Production Team Enhanced By Ex Dungeons And Dragons Staff

Jun 17, 2025

Critical Roles Production Team Enhanced By Ex Dungeons And Dragons Staff

Jun 17, 2025

Latest Posts

-

Mlb Odds Phillies Marlins Betting Analysis And Predictions

Jun 17, 2025

Mlb Odds Phillies Marlins Betting Analysis And Predictions

Jun 17, 2025 -

Winning Picks Philadelphia Phillies Vs Miami Marlins Betting Preview

Jun 17, 2025

Winning Picks Philadelphia Phillies Vs Miami Marlins Betting Preview

Jun 17, 2025 -

Trump Excluded Naacp Announces Decision On Convention Attendance

Jun 17, 2025

Trump Excluded Naacp Announces Decision On Convention Attendance

Jun 17, 2025 -

Critical Roles Expansion Two Former Dungeons And Dragons Leads Join The Team

Jun 17, 2025

Critical Roles Expansion Two Former Dungeons And Dragons Leads Join The Team

Jun 17, 2025 -

Flamengo No Mundial Analise Da Imprensa Espanhola Sobre As Chances Do Time Brasileiro

Jun 17, 2025

Flamengo No Mundial Analise Da Imprensa Espanhola Sobre As Chances Do Time Brasileiro

Jun 17, 2025