HS2 Contractor Practices Questioned: Tax Investigation Into Worker Supply

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

HS2 Contractor Practices Questioned: Tax Investigation into Worker Supply Sparks Outrage

The controversial High Speed 2 (HS2) rail project is facing fresh scrutiny following a tax investigation into the practices of one of its major contractors regarding the supply of workers. Concerns are mounting over potential exploitation of agency workers and a possible widespread avoidance of tax liabilities, raising serious questions about the project's ethical and financial management.

The investigation, launched by HMRC (Her Majesty's Revenue and Customs), focuses on [Contractor Name], a significant player in the HS2 construction phase. Sources close to the investigation suggest the probe centers around the use of intermediary agencies and complex payroll structures, raising suspicions of "cum-ex" style tax avoidance schemes. While details remain scarce, the investigation could have significant ramifications for the project’s budget and timeline, as well as the reputation of HS2 Ltd.

H2: Concerns Over Worker Exploitation and Tax Avoidance

The investigation isn't just about lost tax revenue; it also raises serious concerns about the treatment of workers employed on the HS2 project. Allegations suggest that some agency workers may have been paid less than the national minimum wage, potentially through opaque contracting practices that obscure their true employment status. This echoes concerns raised previously about the working conditions and pay of individuals involved in large-scale infrastructure projects in the UK. [Link to previous article on worker exploitation in UK infrastructure projects]

The use of multiple layers of subcontracting and agency workers can make it difficult to track wages and ensure compliance with employment law. This opacity, experts suggest, creates a fertile ground for exploitation and tax evasion. The investigation aims to unravel these complex arrangements and determine whether tax regulations have been breached.

H2: Potential Impact on HS2 Budget and Timeline

The implications of this tax investigation extend far beyond the contractor in question. Any significant financial penalties levied against [Contractor Name] could have a ripple effect on the already inflated HS2 budget. Delays caused by the investigation – and potential legal challenges that may follow – could further push back the project's completion date, already subject to considerable delays and cost overruns. This raises serious questions about the project's overall viability and the effectiveness of its oversight mechanisms.

H2: Calls for Greater Transparency and Accountability

The situation underscores the need for greater transparency and accountability within the HS2 project. Critics argue that the current procurement and contracting processes are too opaque, allowing for potential abuses and making it difficult to monitor compliance with employment and tax regulations. They are calling for stricter regulations and more robust oversight to prevent similar situations from arising in the future.

- Increased scrutiny of contractor practices: Regular audits and independent reviews of contractor compliance with employment and tax laws are essential.

- Strengthened whistleblower protection: Measures to encourage and protect workers who report potential wrongdoing are crucial.

- Improved transparency in procurement processes: Greater clarity and openness in how contracts are awarded and managed will enhance accountability.

H2: What Happens Next?

The HMRC investigation is ongoing, and the outcome remains uncertain. However, the mere existence of this investigation casts a long shadow over the HS2 project. The public and politicians alike will be closely watching for updates and demanding answers about how such a situation could occur on a project of national significance. The final report from HMRC will be critical in determining the extent of any wrongdoing and the consequences for those involved. Further updates will be provided as the situation develops.

Call to Action: Stay informed about the latest developments on the HS2 project by subscribing to our newsletter [link to newsletter signup].

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on HS2 Contractor Practices Questioned: Tax Investigation Into Worker Supply. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

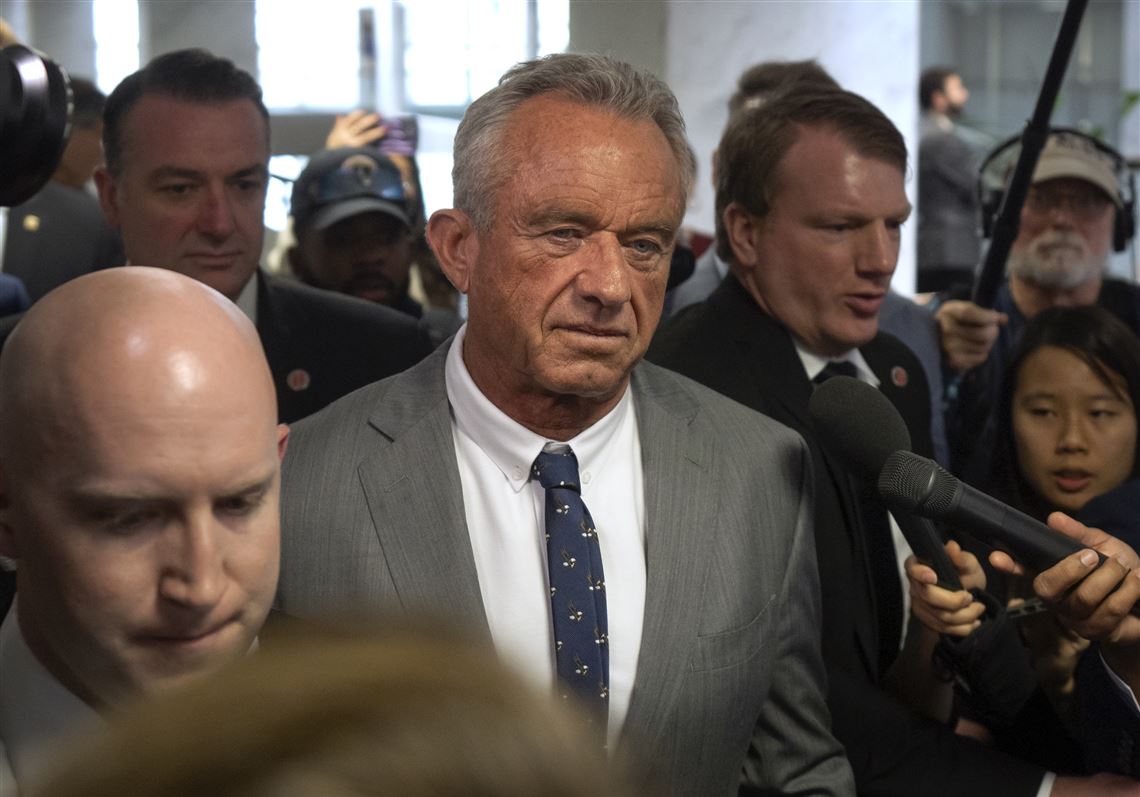

Fallout From Cdc Vaccine Committee Shakeup Removed Members Accuse Rfk Jr Of Destabilization

Jun 17, 2025

Fallout From Cdc Vaccine Committee Shakeup Removed Members Accuse Rfk Jr Of Destabilization

Jun 17, 2025 -

College World Series Day 2 Results Lsu Ucla Advance In Omaha

Jun 17, 2025

College World Series Day 2 Results Lsu Ucla Advance In Omaha

Jun 17, 2025 -

Beckham Brand Under Pressure Impact Of Reported Family Feud

Jun 17, 2025

Beckham Brand Under Pressure Impact Of Reported Family Feud

Jun 17, 2025 -

Bill Maher Trump Parade A Success But Tanks In The Streets Unacceptable

Jun 17, 2025

Bill Maher Trump Parade A Success But Tanks In The Streets Unacceptable

Jun 17, 2025 -

Execution Allegations A Russian Soldiers Account In The Ukraine War Crimes Trial

Jun 17, 2025

Execution Allegations A Russian Soldiers Account In The Ukraine War Crimes Trial

Jun 17, 2025

Latest Posts

-

Proven Models Picks Phillies Vs Marlins Odds Prediction And Betting Line June 16 2025

Jun 17, 2025

Proven Models Picks Phillies Vs Marlins Odds Prediction And Betting Line June 16 2025

Jun 17, 2025 -

College World Series 2025 Lsus And Uclas Wins Highlight Day 2 Action

Jun 17, 2025

College World Series 2025 Lsus And Uclas Wins Highlight Day 2 Action

Jun 17, 2025 -

Political Commentary Bill Mahers Analysis Of No Kings Protests And Trump

Jun 17, 2025

Political Commentary Bill Mahers Analysis Of No Kings Protests And Trump

Jun 17, 2025 -

Tourist Destination Devastated Bridge Collapse Kills Several In India

Jun 17, 2025

Tourist Destination Devastated Bridge Collapse Kills Several In India

Jun 17, 2025 -

Expert Mlb Picks Red Sox Mariners And Phillies Marlins Monday June 16

Jun 17, 2025

Expert Mlb Picks Red Sox Mariners And Phillies Marlins Monday June 16

Jun 17, 2025