HS2: Contractors Face Tax Probe Over Labour Supply Practices

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

HS2: Contractors Face Tax Probe Over Labour Supply Practices

High-speed rail project embroiled in controversy as HMRC investigates potential tax evasion linked to labour supply chains.

The construction of HS2, Britain's ambitious high-speed rail network, is facing another major setback. HMRC (Her Majesty's Revenue and Customs) has launched a wide-ranging investigation into several contractors involved in the project, focusing on their labour supply practices and potential tax evasion. This development casts a significant shadow over the already controversial project, raising serious questions about transparency and accountability within the multi-billion pound undertaking.

The investigation, according to sources close to the matter, centres around concerns about the use of intermediary agencies and the potential misclassification of workers. This practice, often referred to as "IR35 avoidance," involves classifying workers as self-employed contractors to avoid paying national insurance contributions and other employment taxes. While perfectly legal in some circumstances, HMRC suspects widespread abuse, potentially costing the taxpayer millions of pounds.

<h3>The Scale of the Investigation</h3>

The scope of the HMRC probe remains unclear, with the exact number of contractors under scrutiny yet to be revealed. However, sources suggest that several major players in the HS2 supply chain are involved, spanning various aspects of the project, from track laying to station construction. This suggests a systemic issue rather than isolated incidents of non-compliance.

The timing of the investigation is particularly sensitive, given the ongoing delays and escalating costs associated with HS2. The project is already facing intense public scrutiny over its budget, environmental impact, and disruption to communities along the proposed route. This tax investigation adds another layer of complexity and fuels concerns about the project's overall viability.

<h3>Implications for HS2 and the Construction Industry</h3>

This investigation has significant implications, not only for HS2 but also for the broader construction industry. It highlights the persistent challenges in ensuring fair employment practices and tax compliance within complex large-scale infrastructure projects. The outcome of the HMRC investigation could lead to significant fines, reputational damage for the contractors involved, and potentially even delays to the HS2 project itself.

Furthermore, the investigation could trigger a wider review of labour supply practices across the UK construction sector. This could lead to increased regulatory scrutiny and a greater emphasis on transparent and ethical employment practices.

<h3>What Happens Next?</h3>

HMRC is known for its robust approach to tax evasion, and the penalties for non-compliance can be severe. The investigation is likely to be lengthy and complex, involving detailed examination of contracts, payroll records, and worker classifications. The outcome will depend on the evidence gathered and the findings of the HMRC investigation.

The situation underscores the need for greater transparency and accountability within large-scale infrastructure projects. Robust auditing mechanisms and stricter enforcement of employment regulations are crucial to preventing future occurrences of this nature. The public deserves to know that their tax money is being used responsibly and ethically.

Further Reading:

Call to Action: Stay informed about the latest developments in the HS2 project and the ongoing HMRC investigation by subscribing to our newsletter or following us on social media.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on HS2: Contractors Face Tax Probe Over Labour Supply Practices. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

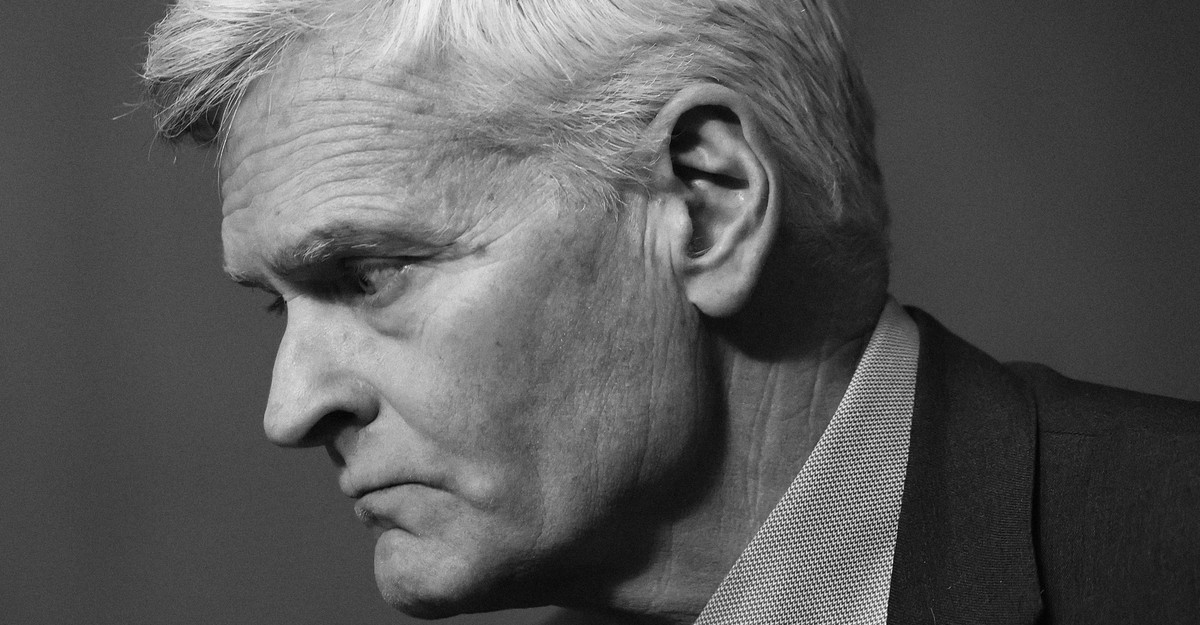

Did Bill Cassidys Vote Cost Him Support Examining The Consequences

Jun 17, 2025

Did Bill Cassidys Vote Cost Him Support Examining The Consequences

Jun 17, 2025 -

Betting Preview Philadelphia Phillies Miami Marlins Odds And Picks

Jun 17, 2025

Betting Preview Philadelphia Phillies Miami Marlins Odds And Picks

Jun 17, 2025 -

Concerns Raised Hs 2 Contractors Worker Supply Practices Investigated

Jun 17, 2025

Concerns Raised Hs 2 Contractors Worker Supply Practices Investigated

Jun 17, 2025 -

Clarissa Ward Investigates Iranian Rocket Impact On Palestinian Israeli Village Life

Jun 17, 2025

Clarissa Ward Investigates Iranian Rocket Impact On Palestinian Israeli Village Life

Jun 17, 2025 -

Iranian Rocket Attack Clarissa Ward Investigates Aftermath In Israeli Palestinian Community

Jun 17, 2025

Iranian Rocket Attack Clarissa Ward Investigates Aftermath In Israeli Palestinian Community

Jun 17, 2025

Latest Posts

-

Family Fallout Can The Beckhams Maintain Their Brand Image

Jun 17, 2025

Family Fallout Can The Beckhams Maintain Their Brand Image

Jun 17, 2025 -

Dupla Brasileira E Idolo Do Vasco O Ataque Do Rival Do Flamengo

Jun 17, 2025

Dupla Brasileira E Idolo Do Vasco O Ataque Do Rival Do Flamengo

Jun 17, 2025 -

Live Red Carpet F1 Movie Premiere Drivers And Stars Arrive

Jun 17, 2025

Live Red Carpet F1 Movie Premiere Drivers And Stars Arrive

Jun 17, 2025 -

Exclusive The Inside Story On A D And D Storytelling Duos Critical Role Partnership

Jun 17, 2025

Exclusive The Inside Story On A D And D Storytelling Duos Critical Role Partnership

Jun 17, 2025 -

No Kings Protests Bill Mahers Controversial Opinion On Trump

Jun 17, 2025

No Kings Protests Bill Mahers Controversial Opinion On Trump

Jun 17, 2025