HS2 Worker Supply Practices Under Scrutiny: Contractors Face Tax Authority Review

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

HS2 Worker Supply Practices Under Scrutiny: Contractors Face Tax Authority Review

The high-speed rail project HS2 is facing increased scrutiny over the supply practices of its contractors, with the UK tax authority, HMRC, launching a review into potential tax irregularities related to the provision of workers. This development casts a shadow over the already controversial project, raising concerns about fair employment practices and the efficient use of taxpayer money.

The investigation, confirmed by HMRC, focuses on several major contractors involved in various stages of the HS2 construction. Sources suggest the review centers around the use of intermediary agencies and the potential misclassification of workers, leading to underpayment of tax and national insurance contributions. This practice, if proven, could result in significant financial penalties for the contractors involved and raise serious questions about corporate governance and ethical conduct within the HS2 supply chain.

HMRC's Investigation: What's at Stake?

HMRC's involvement signifies a serious escalation in the scrutiny surrounding HS2's labor practices. The tax authority's investigation will likely examine:

- Worker classification: The key focus will be on whether contractors correctly classified workers as employees, independent contractors, or agency workers. Misclassification can lead to significant tax avoidance and deprive the government of vital revenue.

- Agency use: The review will scrutinize the use of intermediary agencies, exploring whether these agencies were used legitimately or to obscure employment arrangements and potentially facilitate tax evasion.

- Payroll practices: HMRC will examine payroll records to ensure accurate tax and national insurance contributions were made. Any discrepancies could result in substantial back taxes and penalties.

The ramifications of this investigation are far-reaching. Not only could contractors face hefty fines, but the entire HS2 project could suffer reputational damage. This comes at a time when the project is already facing significant cost overruns and delays.

Concerns Over Fair Employment and Project Costs

Beyond the tax implications, the HMRC investigation highlights wider concerns about fair employment practices within the HS2 project. The potential misclassification of workers could mean that individuals are being underpaid and denied crucial employment rights. This raises ethical questions about the treatment of workers involved in such a large-scale infrastructure project.

Furthermore, the cost of any potential penalties and remedial actions will likely impact the overall budget of HS2, further straining an already financially stretched project. This could lead to further delays and potential cuts to other aspects of the project.

What Happens Next?

The timeline of HMRC's investigation remains unclear. However, the seriousness of the allegations suggests a thorough and potentially lengthy process. The outcome will have significant consequences for the contractors involved, the HS2 project, and the government's ability to manage large-scale infrastructure projects effectively. The investigation underscores the crucial importance of robust oversight and ethical procurement practices in such massive undertakings. Further updates are expected as the investigation progresses.

Further Reading:

- [Link to a relevant government report on HS2]

- [Link to a news article about previous HS2 controversies]

Call to Action: Stay informed about the latest developments in the HS2 project by following reputable news sources and official government channels. Transparency and accountability are crucial in ensuring the responsible execution of large-scale public works projects.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on HS2 Worker Supply Practices Under Scrutiny: Contractors Face Tax Authority Review. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

London Luton Airport Investigation Launched Following Car Park Injury

Jun 17, 2025

London Luton Airport Investigation Launched Following Car Park Injury

Jun 17, 2025 -

Mlb Betting Picks June 16th Phillies Marlins And Red Sox Mariners Analysis

Jun 17, 2025

Mlb Betting Picks June 16th Phillies Marlins And Red Sox Mariners Analysis

Jun 17, 2025 -

Scott Jennings Sharp Rebuttal Responding To Tucker Carlsons Drop Israel Remark

Jun 17, 2025

Scott Jennings Sharp Rebuttal Responding To Tucker Carlsons Drop Israel Remark

Jun 17, 2025 -

Live F1 Movie Red Carpet See The Stars And Drivers Arrive

Jun 17, 2025

Live F1 Movie Red Carpet See The Stars And Drivers Arrive

Jun 17, 2025 -

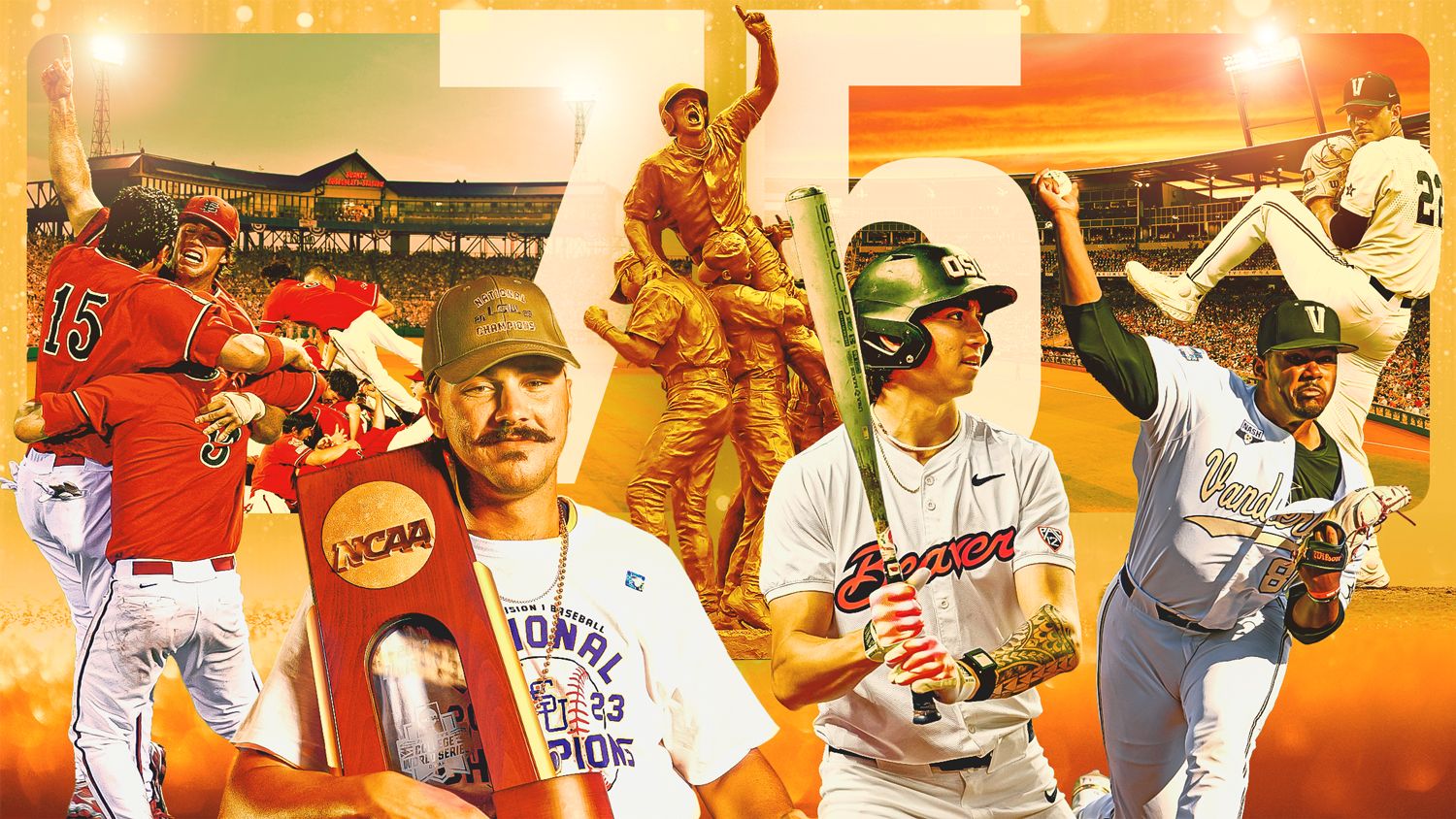

The Mcws A Story Of Community And Triumph In Omaha Nebraska

Jun 17, 2025

The Mcws A Story Of Community And Triumph In Omaha Nebraska

Jun 17, 2025

Latest Posts

-

Phillies Vs Marlins Odds Expert Predictions And Picks For Todays Game

Jun 17, 2025

Phillies Vs Marlins Odds Expert Predictions And Picks For Todays Game

Jun 17, 2025 -

Political Commentary Bill Mahers View On Protests Against Trump

Jun 17, 2025

Political Commentary Bill Mahers View On Protests Against Trump

Jun 17, 2025 -

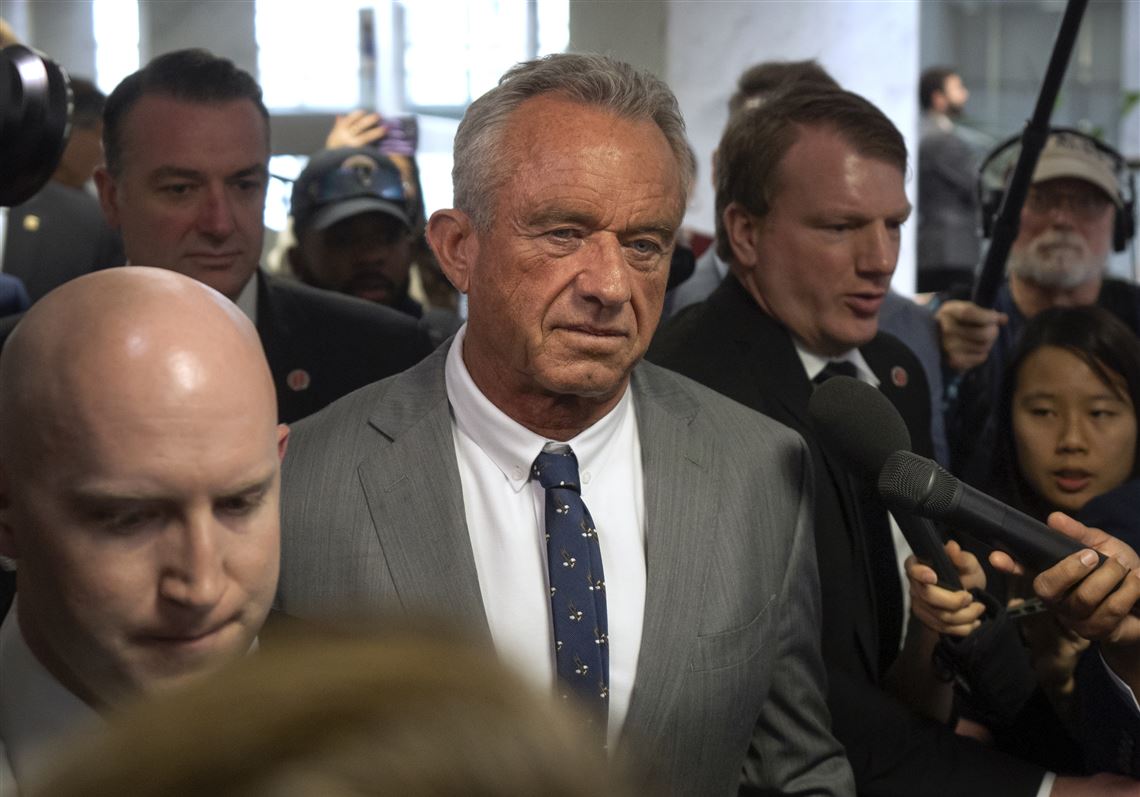

Rfk Jr S Actions Criticized Ex Cdc Advisors Call Them Destabilizing

Jun 17, 2025

Rfk Jr S Actions Criticized Ex Cdc Advisors Call Them Destabilizing

Jun 17, 2025 -

Partido En Directo Boca Juniors Contra Benfica Mundial De Clubes

Jun 17, 2025

Partido En Directo Boca Juniors Contra Benfica Mundial De Clubes

Jun 17, 2025 -

Blaise Metreweli Breaking Barriers At Mi 6

Jun 17, 2025

Blaise Metreweli Breaking Barriers At Mi 6

Jun 17, 2025