I Slowly Realized I Was Running Two Households: A Difficult Truth

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

I Slowly Realized I Was Running Two Households: A Difficult Truth

The quiet hum of the second refrigerator. The subtle scent of a different brand of coffee lingering in the air. These were the seemingly insignificant details that slowly coalesced into a horrifying realization: I was unknowingly maintaining two separate households. This wasn't a case of a lavish secret life; it was a slow, insidious creep of financial and emotional mismanagement that left me reeling. This is a story about the difficult truth of hidden expenses and the crushing weight of unspoken responsibilities.

This wasn't a dramatic revelation born from a scandalous affair. Instead, it was a gradual erosion of awareness, masked by the everyday chaos of modern life. It started with small things: a forgotten credit card bill, an unexplained bank withdrawal, a second phone bill inexplicably appearing. Each incident, individually, was easily explainable—or so I told myself. But the accumulation of these seemingly minor discrepancies painted a stark and unsettling picture.

The Unraveling: Identifying the Hidden Expenses

The process of uncovering the truth was excruciatingly slow and painful. It involved painstakingly reviewing bank statements, credit card bills, and even old receipts. I started using budgeting apps like Mint and Personal Capital to track my spending more closely – a crucial step for anyone struggling with financial transparency. (Learn more about budgeting apps here: [Link to a relevant article about budgeting apps]).

What I discovered was deeply disturbing. I wasn't just slightly overspending; I was maintaining a second, parallel existence, financially supporting another household, though it wasn't a second family. The expenses were a mixture of unintentional overspending and a subconscious effort to maintain a separate, perhaps idealized, version of myself.

- Hidden subscriptions: Multiple streaming services, unused gym memberships, and forgotten online shopping accounts added up to a significant drain on my finances.

- Duplicate purchases: Groceries, household goods, and even clothes were being bought twice, for two separate locations.

- Unacknowledged debts: Small, easily overlooked debts had piled up, adding significant stress and compounding the problem.

The Emotional Toll of Dual Households

The financial implications were devastating, but the emotional toll was even greater. The realization sparked a deep sense of self-doubt and a painful examination of my own spending habits and emotional well-being. This experience highlighted a critical need for self-awareness and honest introspection. I was hiding from a part of myself, and that evasion manifested in my financial mismanagement.

This journey forced me to confront some uncomfortable truths about my lifestyle, my priorities, and my overall mental health. It also highlighted the importance of open communication with those close to me. Talking to a trusted friend, family member, or therapist is crucial for navigating challenging financial situations and working through the emotional fallout. Consider seeking professional help from a financial advisor or therapist specializing in financial anxiety. ([Link to a relevant resource about financial therapy]).

The Path to Recovery: Rebuilding Financial Stability

Recovering from this experience has been a long, arduous process. It requires a multi-faceted approach that encompasses:

- Honest self-assessment: Understanding the root causes of the overspending is critical for long-term success.

- Budgeting and financial planning: Creating and sticking to a realistic budget is paramount.

- Debt management: Developing a strategy to tackle existing debts is essential.

- Seeking professional help: Don't hesitate to seek guidance from a financial advisor or therapist.

This experience was profoundly humbling and painful, but it ultimately led to a greater understanding of myself and my finances. It’s a stark reminder that even seemingly small financial discrepancies can snowball into significant problems if left unaddressed. The journey to financial stability is challenging, but with self-awareness, honest reflection, and professional support, it's possible to overcome. It's a difficult truth, but one that ultimately led to a healthier, more sustainable life.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on I Slowly Realized I Was Running Two Households: A Difficult Truth. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Guilty Verdict Wisconsin Man Kills And Dismembers 19 Year Old

Jun 07, 2025

Guilty Verdict Wisconsin Man Kills And Dismembers 19 Year Old

Jun 07, 2025 -

Political Shift Karine Jean Pierre Leaves Democratic Party Becomes Independent

Jun 07, 2025

Political Shift Karine Jean Pierre Leaves Democratic Party Becomes Independent

Jun 07, 2025 -

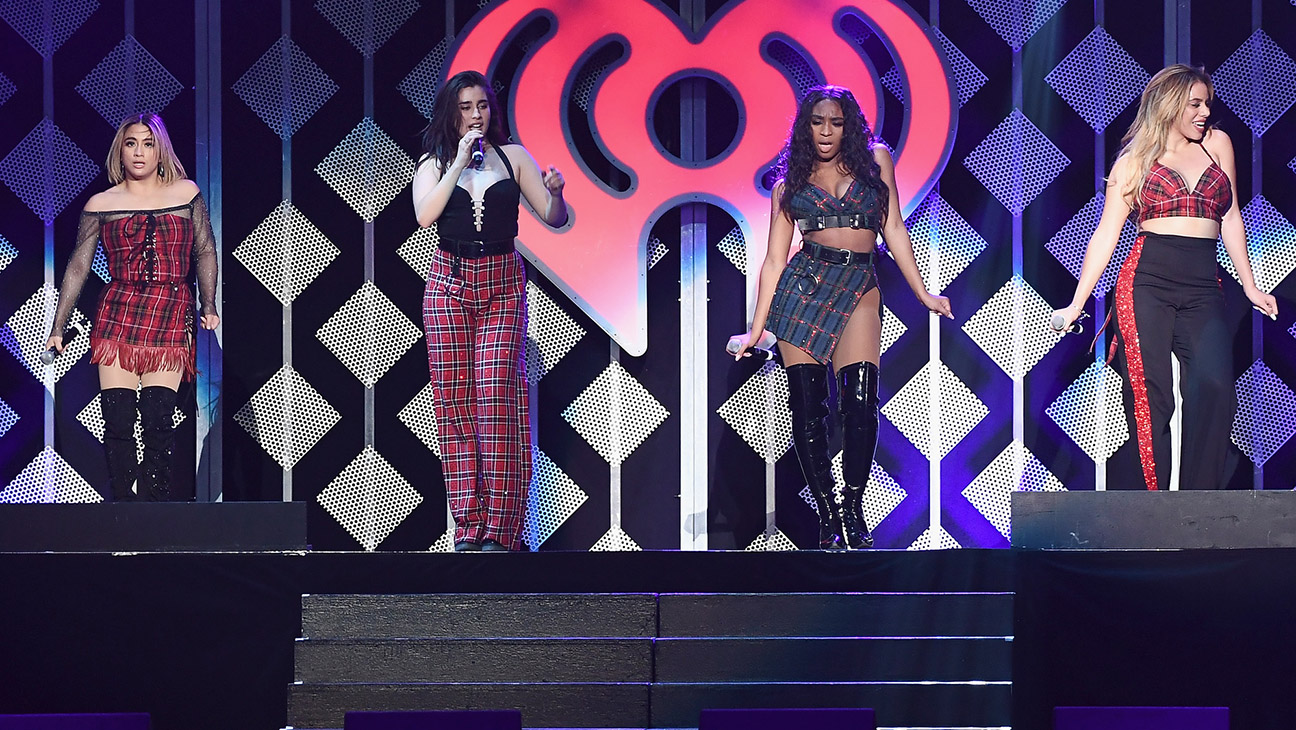

Exclusive Report Fifth Harmonys Future After Camila Cabellos Departure

Jun 07, 2025

Exclusive Report Fifth Harmonys Future After Camila Cabellos Departure

Jun 07, 2025 -

Ibm Stock Performance Current Trends And Potential Recovery

Jun 07, 2025

Ibm Stock Performance Current Trends And Potential Recovery

Jun 07, 2025 -

Atmospheric Rivers And Ghost Hurricanes Unraveling The Link To Improved Hurricane Prediction

Jun 07, 2025

Atmospheric Rivers And Ghost Hurricanes Unraveling The Link To Improved Hurricane Prediction

Jun 07, 2025

Latest Posts

-

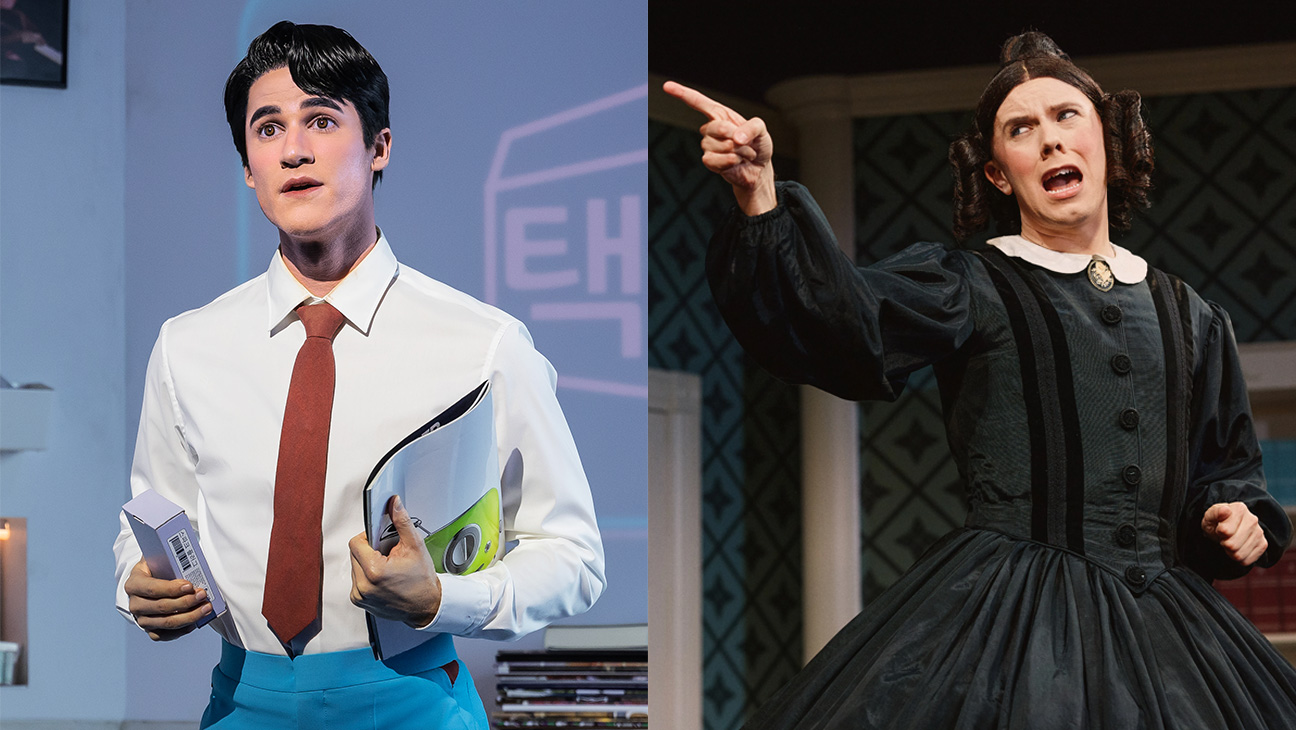

Can Math Predict The Tony Awards Analyzing The Nominees

Jun 07, 2025

Can Math Predict The Tony Awards Analyzing The Nominees

Jun 07, 2025 -

Sweep Of Finfluencer Arrests Highlights Regulatory Scrutiny

Jun 07, 2025

Sweep Of Finfluencer Arrests Highlights Regulatory Scrutiny

Jun 07, 2025 -

The Price Of A Break Cancer Patients And Unaffordable Holidays

Jun 07, 2025

The Price Of A Break Cancer Patients And Unaffordable Holidays

Jun 07, 2025 -

Hamilton By Election Results Reforms Resurgence And What It Means

Jun 07, 2025

Hamilton By Election Results Reforms Resurgence And What It Means

Jun 07, 2025 -

Positive Developments In 5m Chelsea Arsenal Player Transfer Talks

Jun 07, 2025

Positive Developments In 5m Chelsea Arsenal Player Transfer Talks

Jun 07, 2025