I Slowly Realized I Was Running Two Households: A Financial And Emotional Toll

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

I Slowly Realized I Was Running Two Households: A Financial and Emotional Toll

The quiet hum of the washing machine, the gentle clinking of dishes – sounds of domesticity that, for many, represent comfort and stability. But for me, these once-soothing sounds became a soundtrack to a burgeoning crisis: I was unknowingly running two households, a situation that took a devastating financial and emotional toll. This isn't a tale of deliberate deception, but a slow, insidious creep of responsibility that left me reeling.

This article explores the hidden struggles of maintaining separate homes, the financial implications, and the significant emotional burden it places on individuals. It's a story of realization, recovery, and the importance of open communication.

The Gradual Erosion of Finances

It began subtly. A few extra grocery trips, additional utility bills, and the creeping cost of maintaining two separate properties. Initially, these expenses seemed manageable, easily explained away as "unexpected costs" or "temporary inconveniences." But the truth is, I was juggling two mortgages (or rents), two sets of insurance, and double the expenses associated with daily living. The financial strain wasn't immediately apparent; it was a slow, insidious erosion of my savings and my peace of mind. I found myself constantly stressed, juggling bank accounts and frantically trying to make ends meet. Looking back, I should have seen the warning signs sooner. Ignoring the mounting debt and the growing sense of panic only exacerbated the problem. This is a common experience for those navigating complex family situations or unexpected life changes.

The Emotional Weight of Dual Responsibilities

Beyond the financial strain, the emotional toll was immense. The constant juggling act left me feeling perpetually exhausted and overwhelmed. There was little time for self-care, for friends, or for the simple joys of life. The guilt and anxiety were crippling. I was constantly worried about letting someone down, about not being able to meet the demands of both households. This emotional burden led to increased stress, impacting my sleep, my appetite, and my overall well-being. Seeking professional help, such as therapy or financial counseling, is crucial in navigating these overwhelming emotions. [Link to Mental Health Resource Website]

Recognizing the Problem and Finding a Solution

The turning point came when I finally sat down and meticulously tracked every expense. The stark reality of my dual household costs hit me like a ton of bricks. This forced honesty was painful, but it was the first step towards recovery. Honest communication with those involved was essential. This isn't always easy, but it's vital for finding a sustainable solution. In my case, it involved difficult conversations, compromises, and a reassessment of priorities. This journey was about more than just finances; it was about regaining control of my life and my well-being.

Avoiding the Trap: Tips for Financial Wellbeing

- Track your expenses meticulously: Use budgeting apps or spreadsheets to monitor your spending and identify areas where you can cut back.

- Communicate openly: Honest conversations are crucial, even if they are difficult.

- Seek professional help: Don't hesitate to reach out to financial advisors or therapists for support.

- Prioritize your well-being: Make time for self-care – it's essential for managing stress.

- Re-evaluate your lifestyle: Consider making adjustments to your spending habits and lifestyle to align with your financial capabilities.

Running two households is a challenging and often hidden struggle. Recognizing the problem, seeking help, and prioritizing open communication are essential steps towards reclaiming financial stability and emotional well-being. If you're struggling, please know you're not alone, and help is available. Remember, taking that first step is crucial.

Call to Action: Share your experiences in the comments below. Your story could help others facing similar challenges.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on I Slowly Realized I Was Running Two Households: A Financial And Emotional Toll. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Meet The New Black Panther Marvels Shocking Announcement And Fan Backlash

Jun 06, 2025

Meet The New Black Panther Marvels Shocking Announcement And Fan Backlash

Jun 06, 2025 -

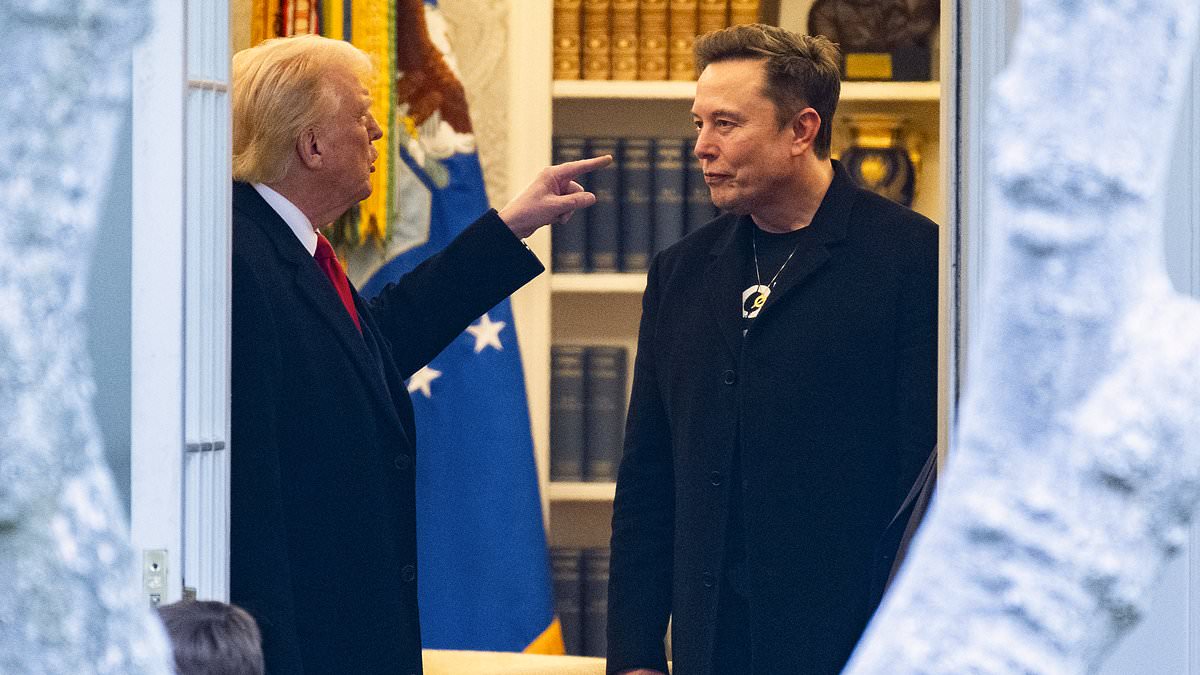

The Advisor Who Drove A Wedge Between Trump And Musk

Jun 06, 2025

The Advisor Who Drove A Wedge Between Trump And Musk

Jun 06, 2025 -

Federal Charges Two Chinese Researchers Accused Of Biological Pathogen Smuggling In Michigan

Jun 06, 2025

Federal Charges Two Chinese Researchers Accused Of Biological Pathogen Smuggling In Michigan

Jun 06, 2025 -

Core Weaves Potential Could Nvidias Venture Be A Us Profit Leader

Jun 06, 2025

Core Weaves Potential Could Nvidias Venture Be A Us Profit Leader

Jun 06, 2025 -

Joe Saccos Next Move Leaving Bruins For A New Coaching Role

Jun 06, 2025

Joe Saccos Next Move Leaving Bruins For A New Coaching Role

Jun 06, 2025

Latest Posts

-

Significant Shift For Dallas Stars Details On The Coaching Change Unveiled

Jun 07, 2025

Significant Shift For Dallas Stars Details On The Coaching Change Unveiled

Jun 07, 2025 -

Is Ibm Stock A Buy Or Sell Analyzing Recent Market Trends

Jun 07, 2025

Is Ibm Stock A Buy Or Sell Analyzing Recent Market Trends

Jun 07, 2025 -

Walton Goggins And Aimee Lou Wood Clear The Air On White Lotus Drama

Jun 07, 2025

Walton Goggins And Aimee Lou Wood Clear The Air On White Lotus Drama

Jun 07, 2025 -

Shopping Guide Finding The Nike Air Max 95 Og Bright Mandarin Sneakers

Jun 07, 2025

Shopping Guide Finding The Nike Air Max 95 Og Bright Mandarin Sneakers

Jun 07, 2025 -

Ibms Stock Price Factors Contributing To Underperformance

Jun 07, 2025

Ibms Stock Price Factors Contributing To Underperformance

Jun 07, 2025