IBM Lags Behind Market: Understanding The Recent Stock Decline

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

IBM Lags Behind Market: Understanding the Recent Stock Decline

IBM, a tech giant once synonymous with innovation, has recently seen its stock price underperform the broader market. This decline raises important questions about the company's future and its ability to compete in the rapidly evolving tech landscape. While IBM remains a powerful player, understanding the factors contributing to its lagging performance is crucial for investors and industry observers alike.

The Current Market Situation:

IBM's stock has experienced a noticeable downturn in recent months, trailing behind the growth witnessed in other major tech companies. This underperformance isn't a sudden event but rather a culmination of several interconnected challenges the company faces. Many analysts point to a combination of factors contributing to this situation, including slower-than-expected growth in key sectors and increased competition.

Key Factors Contributing to IBM's Underperformance:

-

Shifting Market Dynamics: The technology sector is characterized by rapid innovation and disruptive technologies. IBM's traditional strengths, while still valuable, are facing increased competition from agile startups and more rapidly adapting tech giants. The shift towards cloud computing and AI, while areas IBM operates in, has seen competitors gain a larger market share.

-

Hybrid Cloud Strategy: While IBM’s hybrid cloud strategy is a significant component of its future plans, its implementation and market penetration haven't yielded the expected returns as quickly as some hoped. The complexities of integrating on-premise infrastructure with cloud services present challenges that are taking longer to overcome than initially anticipated. [Link to IBM's Hybrid Cloud offerings]

-

Competition from Cloud Giants: The dominance of cloud computing providers like Amazon Web Services (AWS), Microsoft Azure, and Google Cloud Platform (GCP) presents a significant hurdle for IBM. These companies possess considerable scale and established ecosystems, making it difficult for IBM to gain significant market share in this highly competitive arena.

-

Investment in AI and Hybrid Cloud: While crucial for long-term growth, IBM's significant investments in AI and hybrid cloud solutions haven't yet translated into immediate, substantial returns. These investments represent a long-term strategy, and the payoff may take time to fully materialize. This has led to short-term concerns among some investors.

-

Financial Performance: Quarterly earnings reports have played a role in influencing investor sentiment. While IBM continues to generate revenue, the rate of growth has not met some analysts' projections, contributing to the stock's decline. [Link to IBM's latest financial reports]

Looking Ahead: IBM's Potential for Recovery:

Despite the recent setbacks, IBM retains significant assets and expertise. Its robust infrastructure, strong client base, and ongoing investments in emerging technologies offer potential for future growth. The company's focus on hybrid cloud solutions addresses a real market need, and its AI capabilities remain valuable. The success of its long-term strategy will ultimately determine whether IBM can overcome its current challenges and regain market momentum.

Investor Sentiment and the Future:

Investor sentiment plays a crucial role in shaping stock prices. The current negative sentiment surrounding IBM's stock performance reflects concerns about its ability to compete effectively in the evolving tech landscape. However, the company's long-term strategy and its substantial resources suggest that a turnaround is possible. The key will be effective execution and demonstrating tangible results from its investments in AI and hybrid cloud technologies.

Conclusion:

IBM's recent stock decline is a complex issue stemming from a combination of factors, including increased competition, slower-than-expected growth in key sectors, and the complexities of its hybrid cloud strategy. While challenges exist, IBM's considerable resources and strategic investments in promising technologies offer potential for future growth. Only time will tell if IBM can successfully navigate these challenges and return to its former glory. Continued monitoring of its financial performance and strategic initiatives will be crucial for investors and industry watchers alike.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on IBM Lags Behind Market: Understanding The Recent Stock Decline. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Sneaker Frenzy Long Lines For New 110s At Jd Sports

Jun 07, 2025

Sneaker Frenzy Long Lines For New 110s At Jd Sports

Jun 07, 2025 -

Burka Ban Call Reform Party Chair Slams Mps Suggestion

Jun 07, 2025

Burka Ban Call Reform Party Chair Slams Mps Suggestion

Jun 07, 2025 -

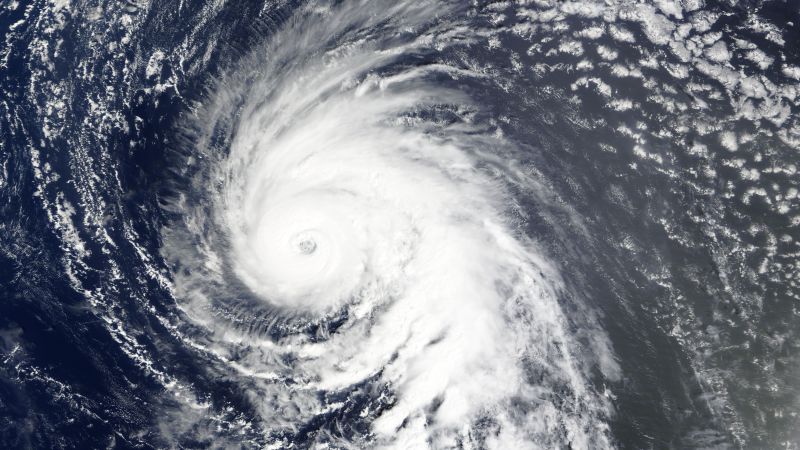

The Potential Of Ghost Hurricanes In Advanced Hurricane Prediction Models

Jun 07, 2025

The Potential Of Ghost Hurricanes In Advanced Hurricane Prediction Models

Jun 07, 2025 -

Bodies Of Two Israeli American Hostages Recovered In Gaza Operation Details

Jun 07, 2025

Bodies Of Two Israeli American Hostages Recovered In Gaza Operation Details

Jun 07, 2025 -

Giving Back To K9 Veterans The Case For Police Dog Pensions

Jun 07, 2025

Giving Back To K9 Veterans The Case For Police Dog Pensions

Jun 07, 2025

Latest Posts

-

Death And Hunger In Gaza Evidence Mounts Against Israel In Aid Site Shooting

Jun 07, 2025

Death And Hunger In Gaza Evidence Mounts Against Israel In Aid Site Shooting

Jun 07, 2025 -

Partido Andorra Inglaterra Hoy Clasificacion Mundial 2026 En Vivo

Jun 07, 2025

Partido Andorra Inglaterra Hoy Clasificacion Mundial 2026 En Vivo

Jun 07, 2025 -

Finfluencers Arrested Regulatory Crackdown Yields Results

Jun 07, 2025

Finfluencers Arrested Regulatory Crackdown Yields Results

Jun 07, 2025 -

Strong Core Bright Future Analyzing Englands Womens Football Team After Retirements

Jun 07, 2025

Strong Core Bright Future Analyzing Englands Womens Football Team After Retirements

Jun 07, 2025 -

Southern England And Wales Brace For Severe Thunderstorms Met Office Warning

Jun 07, 2025

Southern England And Wales Brace For Severe Thunderstorms Met Office Warning

Jun 07, 2025