IBM Stock Market Underperformance: Causes And Potential Recovery

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

IBM Stock Market Underperformance: Causes and Potential Recovery

IBM, a tech giant with a storied history, has recently faced headwinds in the stock market, underperforming compared to its tech peers. While the company remains a significant player in various sectors, understanding the reasons behind this underperformance is crucial for investors. This article delves into the key factors contributing to IBM's lagging stock price and explores potential avenues for recovery.

H2: Declining Revenue and Shifting Market Dynamics

One of the primary reasons for IBM's underperformance is the decline in its traditional hardware and software revenue streams. The shift towards cloud computing, spearheaded by companies like Amazon Web Services (AWS) and Microsoft Azure, has significantly impacted IBM's market share. While IBM has invested heavily in its hybrid cloud offerings, Red Hat's acquisition notwithstanding, it hasn't fully captured the market dominance enjoyed by its competitors. This intense competition within the cloud computing market is a major factor contributing to the slower revenue growth.

Furthermore, the global economic slowdown has further dampened demand for IBM's enterprise solutions, adding pressure to its bottom line. This economic uncertainty makes investors hesitant, leading to a lower valuation for the stock.

H2: The Hybrid Cloud Strategy: A Double-Edged Sword

IBM's strategic pivot towards hybrid cloud solutions represents a significant effort to adapt to changing market dynamics. While this strategy holds long-term potential, its immediate impact on the stock price has been muted. Integrating Red Hat's open-source technologies into IBM's existing infrastructure is a complex undertaking, requiring significant investment and time to yield substantial returns. The transition period inevitably leads to short-term challenges, influencing investor sentiment negatively.

Moreover, the competitive landscape within the hybrid cloud space is equally fierce, making it difficult for IBM to establish a clear leadership position. Successfully navigating this complexity and demonstrating clear market share gains will be crucial for future stock price appreciation.

H2: Potential Catalysts for Recovery

Despite the current challenges, several factors could potentially drive IBM's stock price recovery:

- Increased Adoption of Hybrid Cloud Solutions: As businesses increasingly adopt hybrid cloud strategies, IBM's comprehensive offerings could gain traction, leading to increased revenue and market share.

- Successful Integration of Red Hat: A successful integration of Red Hat's technologies into IBM's ecosystem will streamline operations, enhance offerings, and boost efficiency, positively impacting profitability.

- Focus on High-Growth Areas: Concentrating resources and investments on high-growth areas within AI, quantum computing, and cybersecurity could generate significant revenue streams and attract investor interest.

- Improved Operational Efficiency: Streamlining internal processes and reducing operational costs will enhance profitability and improve investor confidence.

- Stronger Guidance from Management: Clear and realistic financial guidance from management can reassure investors about IBM's future prospects.

H2: Investor Outlook and Conclusion

IBM's stock market underperformance is multifaceted, stemming from intense competition, economic headwinds, and the challenges of transitioning to a hybrid cloud model. However, the company's significant investments in strategic areas and its potential to capitalize on long-term industry trends offer a path toward recovery. Investors should carefully monitor IBM's progress in executing its strategic plan, particularly its hybrid cloud strategy and its performance in key growth sectors. While the near-term outlook might remain uncertain, the long-term prospects of this tech giant remain a subject of considerable debate and analysis amongst market experts. Ultimately, the success of IBM's recovery hinges on its ability to adapt to evolving market demands and effectively leverage its technological capabilities. Further research and analysis are recommended before making any investment decisions.

Disclaimer: This article is for informational purposes only and should not be considered financial advice. Consult with a financial advisor before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on IBM Stock Market Underperformance: Causes And Potential Recovery. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

White Lotus Stars Address Rumors Goggins And Wood On Instagram Unfollow And Cut Scenes

Jun 06, 2025

White Lotus Stars Address Rumors Goggins And Wood On Instagram Unfollow And Cut Scenes

Jun 06, 2025 -

After Ketemas Casting Exploring Ryan Gosling As A White Black Panther In The Mcu

Jun 06, 2025

After Ketemas Casting Exploring Ryan Gosling As A White Black Panther In The Mcu

Jun 06, 2025 -

Ai Ceo Reveals Terrifying New Ai Behaviors

Jun 06, 2025

Ai Ceo Reveals Terrifying New Ai Behaviors

Jun 06, 2025 -

Darts Star Rob Cross Banned As Director Due To Tax Issues

Jun 06, 2025

Darts Star Rob Cross Banned As Director Due To Tax Issues

Jun 06, 2025 -

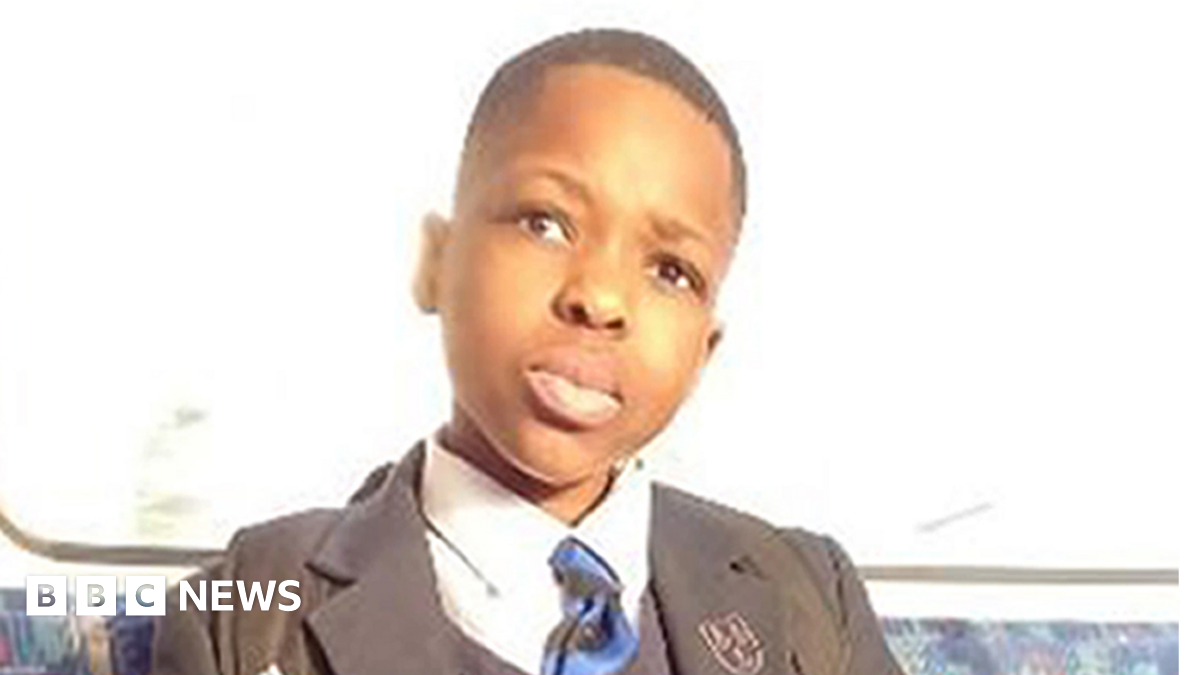

Murder Accused Marcus Monzos Alleged Plot Against Daniel Anjorin

Jun 06, 2025

Murder Accused Marcus Monzos Alleged Plot Against Daniel Anjorin

Jun 06, 2025

Latest Posts

-

Apld Secures 5 Billion For Accelerated Hyperscale Data Center Growth

Jun 07, 2025

Apld Secures 5 Billion For Accelerated Hyperscale Data Center Growth

Jun 07, 2025 -

Steve Guttenberg Takes On Dark Role In Upcoming Lifetime Film

Jun 07, 2025

Steve Guttenberg Takes On Dark Role In Upcoming Lifetime Film

Jun 07, 2025 -

Playoff Failure Costs Peter De Boer His Job With The San Jose Sharks

Jun 07, 2025

Playoff Failure Costs Peter De Boer His Job With The San Jose Sharks

Jun 07, 2025 -

From Comedy To Crime Steve Guttenbergs Shocking Transformation In Lifetime Movie

Jun 07, 2025

From Comedy To Crime Steve Guttenbergs Shocking Transformation In Lifetime Movie

Jun 07, 2025 -

Bidens Autopen Use And Recent Actions Trump Orders Investigation Citing Cognitive Concerns

Jun 07, 2025

Bidens Autopen Use And Recent Actions Trump Orders Investigation Citing Cognitive Concerns

Jun 07, 2025