IBM Stock Performance: Current Status And Investment Implications

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

IBM Stock Performance: Current Status and Investment Implications

IBM, a tech giant with a storied history, has seen its stock performance fluctuate significantly in recent years. Understanding its current status and the implications for investors is crucial for anyone considering adding IBM to their portfolio or already holding shares. This article delves into the current market position of IBM stock, analyzing its recent performance and exploring the factors influencing its future trajectory.

Current Market Status of IBM Stock:

As of [Insert Today's Date], IBM's stock price is [Insert Current Stock Price]. This represents a [Insert Percentage Change] change compared to [Insert Timeframe, e.g., the previous year, the past month]. This fluctuation reflects a complex interplay of factors, including its ongoing hybrid cloud strategy, the performance of its various business segments, and broader macroeconomic conditions.

Recent Performance and Key Drivers:

IBM's recent performance has been a mixed bag. While the company has shown consistent revenue growth driven by its robust hybrid cloud offerings, profit margins remain under pressure. Several key factors are influencing this:

-

Hybrid Cloud Growth: IBM's strategic shift towards hybrid cloud solutions, leveraging Red Hat's open-source technology, has been a significant driver of revenue growth. This segment is expected to continue its expansion, providing a key pillar of future growth. However, competition in the cloud market remains fierce, with players like AWS, Microsoft Azure, and Google Cloud Platform vying for market share.

-

Spin-off of Kyndryl: The 2021 spin-off of Kyndryl, IBM's managed infrastructure services business, significantly reshaped the company's structure and financial profile. This move allowed IBM to focus more sharply on its higher-growth areas, such as artificial intelligence and hybrid cloud.

-

Investment in AI: IBM's significant investment in artificial intelligence, particularly through its Watson platform, presents both opportunities and challenges. While AI is seen as a future growth driver, the market is still developing, and competition is intense. The success of IBM's AI initiatives will be crucial for its long-term prospects.

-

Macroeconomic Factors: Global economic conditions, including inflation and interest rate hikes, are also affecting IBM's stock performance. These macroeconomic uncertainties create volatility in the market, impacting the performance of even established companies like IBM.

Investment Implications:

For investors, the current picture presents both risks and rewards. IBM's focus on high-growth sectors like hybrid cloud and AI offers significant long-term potential. However, competition and macroeconomic headwinds pose challenges.

Considering an investment in IBM requires careful consideration of:

-

Risk Tolerance: IBM's stock is generally considered a moderately stable investment, but it's not without risk. Investors should assess their own risk tolerance before making a decision.

-

Long-Term Perspective: IBM's transformation is a long-term project. Investors need to have a long-term perspective to reap the potential benefits of its strategic initiatives.

-

Diversification: Diversifying your investment portfolio is always recommended. Don't put all your eggs in one basket, even a seemingly stable one like IBM.

-

Fundamental Analysis: Conducting thorough fundamental analysis, including examining IBM's financial statements and future projections, is crucial before making an investment decision.

Conclusion:

IBM's stock performance is a dynamic reflection of its ongoing transformation and the broader market landscape. While challenges exist, the company's strategic focus on hybrid cloud and AI positions it for future growth. Investors should conduct thorough research and carefully consider their own risk tolerance before making any investment decisions. Staying informed about market trends and IBM's financial performance is essential for making well-informed investment choices. Consult with a qualified financial advisor before making any investment decisions.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Investing in the stock market involves risk, and you could lose money.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on IBM Stock Performance: Current Status And Investment Implications. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Playoff Failure Costs De Boer His Job Dallas Stars Announce Coaching Change

Jun 07, 2025

Playoff Failure Costs De Boer His Job Dallas Stars Announce Coaching Change

Jun 07, 2025 -

Analysis Why Did Trump Issue A Travel Ban On These 12 Nations

Jun 07, 2025

Analysis Why Did Trump Issue A Travel Ban On These 12 Nations

Jun 07, 2025 -

Juggling Two Households My Story Of Realization And Adjustment

Jun 07, 2025

Juggling Two Households My Story Of Realization And Adjustment

Jun 07, 2025 -

Sneakerheads Line Up For New Air Jordan 11s At Jd Sports

Jun 07, 2025

Sneakerheads Line Up For New Air Jordan 11s At Jd Sports

Jun 07, 2025 -

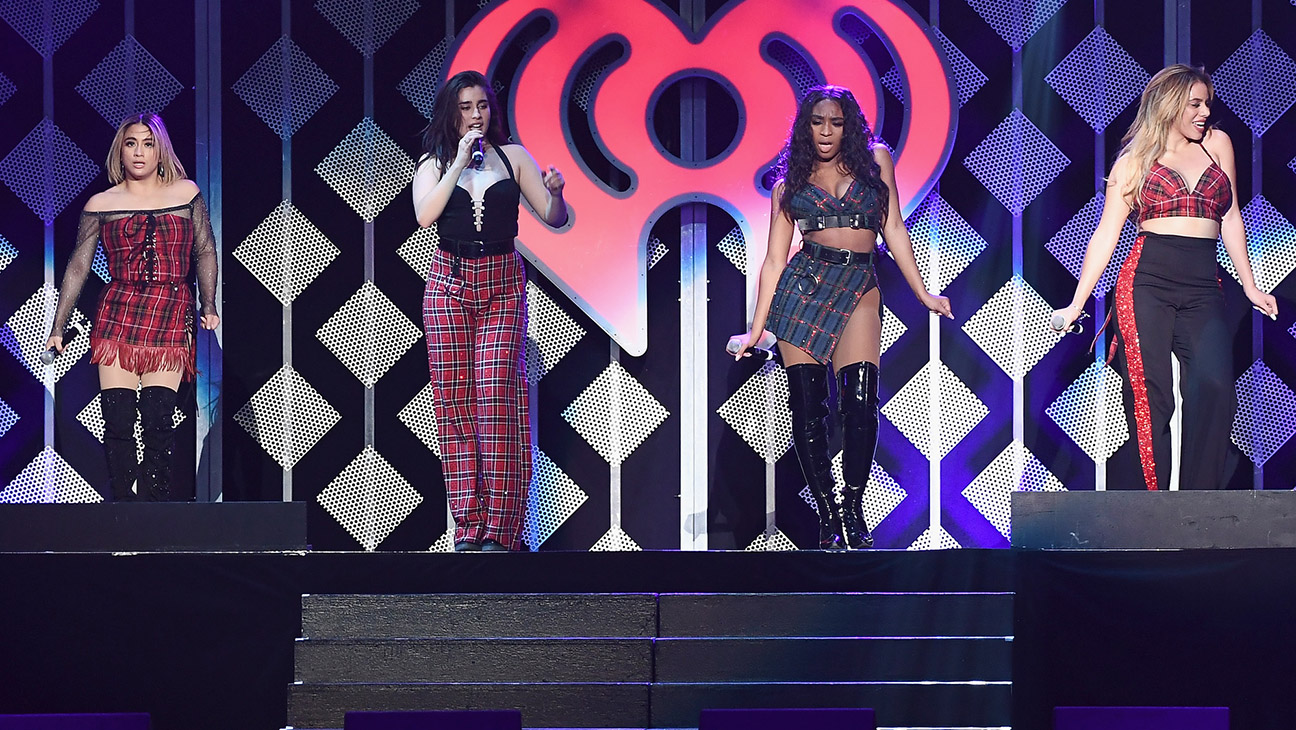

Fifth Harmony Minus Camila Cabello Reunion Talks Underway Exclusive

Jun 07, 2025

Fifth Harmony Minus Camila Cabello Reunion Talks Underway Exclusive

Jun 07, 2025

Latest Posts

-

Renewed Testimony Expected Friend Of Cassie Ventura In Combs Case

Jun 07, 2025

Renewed Testimony Expected Friend Of Cassie Ventura In Combs Case

Jun 07, 2025 -

Record Breaking Ai Lease Propels Applied Digital Shares 48 Higher

Jun 07, 2025

Record Breaking Ai Lease Propels Applied Digital Shares 48 Higher

Jun 07, 2025 -

Steve Guttenbergs Killer Performance In Lifetimes New Thriller

Jun 07, 2025

Steve Guttenbergs Killer Performance In Lifetimes New Thriller

Jun 07, 2025 -

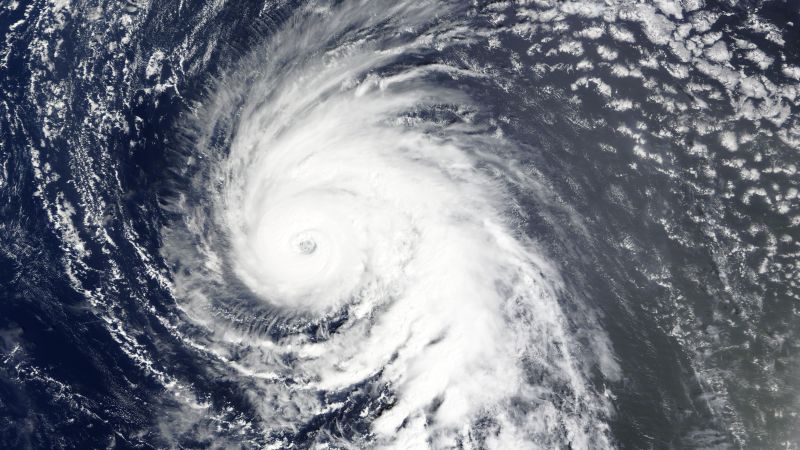

Understanding Ghost Hurricanes A Key To Better Hurricane Forecasting

Jun 07, 2025

Understanding Ghost Hurricanes A Key To Better Hurricane Forecasting

Jun 07, 2025 -

Ibm Stocks Recent Dip Understanding The Market Dynamics

Jun 07, 2025

Ibm Stocks Recent Dip Understanding The Market Dynamics

Jun 07, 2025