IBM Stock Performance: Reasons For Underperformance In 2024

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

IBM Stock Performance: Why Big Blue Is Underperforming in 2024

IBM, a tech giant with a storied history, has seen its stock performance lag in 2024. While the company continues to innovate and adapt to the ever-changing technological landscape, several factors contribute to its underperformance compared to market expectations and competitor growth. Understanding these reasons is crucial for investors considering adding IBM to their portfolio or those currently holding the stock.

H2: Macroeconomic Headwinds and Sector-Specific Challenges

The current macroeconomic climate plays a significant role. Rising interest rates, persistent inflation, and concerns about a potential recession have dampened investor sentiment across the tech sector, impacting IBM's stock price alongside its competitors. Furthermore, increased competition within the cloud computing market, a sector IBM is heavily invested in, presents an ongoing challenge. Companies like Amazon Web Services (AWS), Microsoft Azure, and Google Cloud Platform continue to dominate market share, putting pressure on IBM's hybrid cloud strategy.

H2: IBM's Transformation and its Impact on Stock Price

IBM's ongoing transformation from a hardware-focused company to a hybrid cloud and AI-centric business is a double-edged sword. While this strategic shift is necessary for long-term growth and competitiveness, it's also created short-term uncertainty. Investors are still assessing the effectiveness and profitability of this transition, leading to a cautious approach towards the stock. The significant investments required for R&D and infrastructure upgrades in AI and hybrid cloud solutions also impact short-term profitability, potentially affecting earnings reports and investor confidence.

H3: Key Areas of Concern:

- Competition in the Cloud: IBM's Red Hat acquisition, while strategically important, hasn't completely solved its competitive challenges in the cloud market. Overcoming the dominance of AWS, Azure, and Google Cloud requires consistent innovation and significant market penetration.

- Profitability and Margins: The shift towards higher-margin services is still underway, and the impact on overall profitability hasn't fully materialized yet. Investors are looking for clear evidence of improved margins and consistent revenue growth.

- Investor Sentiment: Negative sentiment surrounding the tech sector and uncertainty surrounding IBM's transformation have led to lower investor confidence, impacting trading volume and stock price.

H2: Looking Ahead: Potential Catalysts for Future Growth

Despite the current challenges, IBM isn't without potential. Its strong presence in hybrid cloud, its growing AI capabilities (including Watson), and its focus on enterprise solutions offer avenues for future growth. Key areas to watch include:

- Successful execution of its hybrid cloud strategy: Demonstrating significant market share gains and improved profitability in this sector is crucial.

- AI innovation and market adoption: IBM's advancements in AI could be a major catalyst for future growth if they successfully translate into commercially viable products and services.

- Improved operational efficiency: Streamlining operations and focusing on profitability will be crucial for improving investor sentiment.

H2: Conclusion: A Long-Term Perspective

IBM's underperformance in 2024 is a complex issue with multiple contributing factors. While short-term challenges exist, the company's long-term prospects depend heavily on successful execution of its strategic transformation and adapting to the evolving technological landscape. Investors should carefully consider these factors and adopt a long-term perspective before making any investment decisions. Further research into IBM's quarterly earnings reports and analyst forecasts is recommended for a comprehensive understanding. Remember to consult with a financial advisor before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on IBM Stock Performance: Reasons For Underperformance In 2024. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Eliminatorias Uefa Como Ver El Partido Andorra Vs Inglaterra En Directo

Jun 07, 2025

Eliminatorias Uefa Como Ver El Partido Andorra Vs Inglaterra En Directo

Jun 07, 2025 -

Friends Testimony Resumes In Sean Combs Trial Cassie Ventura Case Developments

Jun 07, 2025

Friends Testimony Resumes In Sean Combs Trial Cassie Ventura Case Developments

Jun 07, 2025 -

Secure Your Nike Air Max 95 Og Bright Mandarin A Buyers Guide To Retailers And Resellers

Jun 07, 2025

Secure Your Nike Air Max 95 Og Bright Mandarin A Buyers Guide To Retailers And Resellers

Jun 07, 2025 -

Regulatory Action Targets Finfluencers Multiple Arrests Made

Jun 07, 2025

Regulatory Action Targets Finfluencers Multiple Arrests Made

Jun 07, 2025 -

Ais Evolving Behavior Concerns From An Industry Leader

Jun 07, 2025

Ais Evolving Behavior Concerns From An Industry Leader

Jun 07, 2025

Latest Posts

-

Gaza Aid Site Shooting Videos And Witness Accounts Implicate Israeli Fire

Jun 07, 2025

Gaza Aid Site Shooting Videos And Witness Accounts Implicate Israeli Fire

Jun 07, 2025 -

Recuerdas A Koldo Alvarez Su Brillantez Ante Beckham Lampard Y Gerrard En Montjuic

Jun 07, 2025

Recuerdas A Koldo Alvarez Su Brillantez Ante Beckham Lampard Y Gerrard En Montjuic

Jun 07, 2025 -

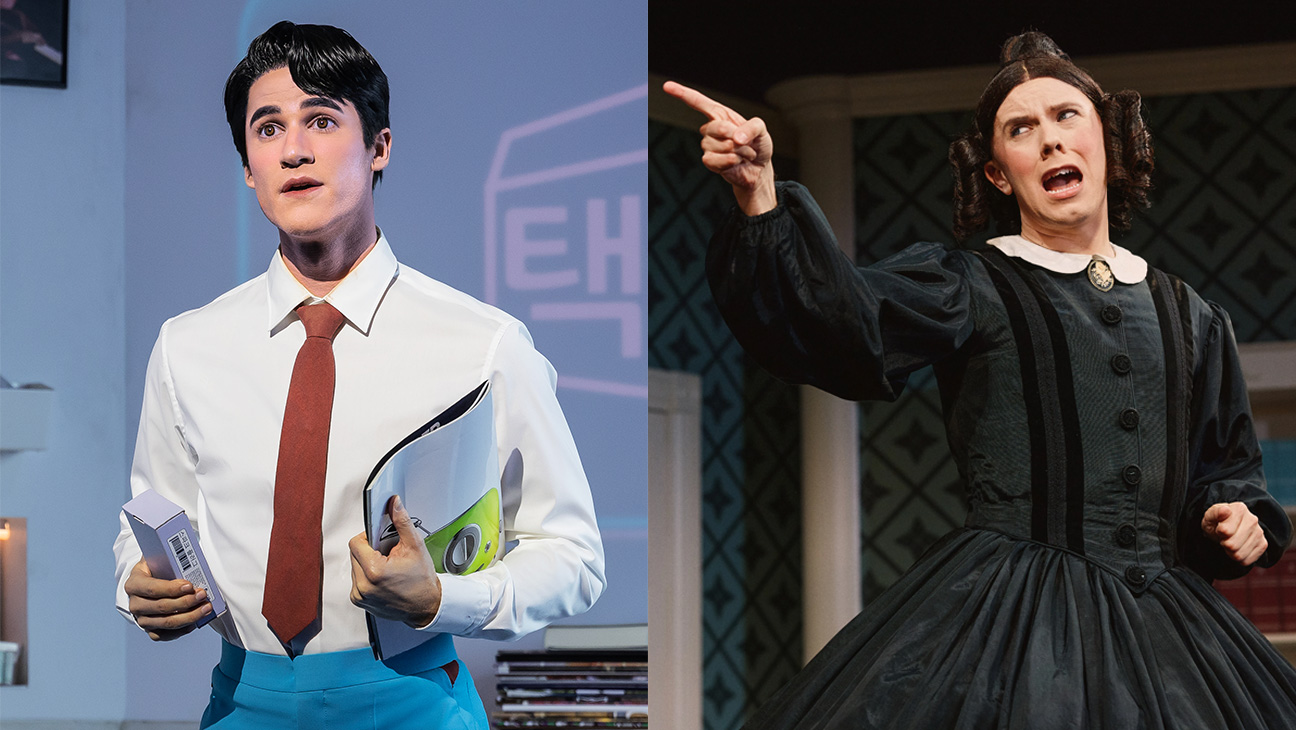

Predicting Tony Award Winners A Data Driven Approach

Jun 07, 2025

Predicting Tony Award Winners A Data Driven Approach

Jun 07, 2025 -

El Dia Que Koldo Alvarez Deslumbro A Beckham Lampard Y Gerrard En Montjuic

Jun 07, 2025

El Dia Que Koldo Alvarez Deslumbro A Beckham Lampard Y Gerrard En Montjuic

Jun 07, 2025 -

Chelsea And Arsenal In 5m Transfer Talks Progress Reported

Jun 07, 2025

Chelsea And Arsenal In 5m Transfer Talks Progress Reported

Jun 07, 2025