IBM Stock Price Dip: Reasons For The Decline And Potential Recovery

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

IBM Stock Price Dip: Reasons for the Decline and Potential for Recovery

IBM, a tech giant with a storied history, has recently experienced a dip in its stock price. This fluctuation has left investors wondering about the underlying causes and the potential for a future rebound. This article delves into the key factors contributing to the decline and explores the prospects for recovery, providing valuable insights for investors navigating this dynamic market.

Reasons Behind the IBM Stock Price Dip:

Several factors have contributed to the recent downturn in IBM's stock price. Understanding these complexities is crucial for assessing the company's future trajectory.

1. Shifting Market Landscape: The technology sector is notoriously volatile, characterized by rapid innovation and intense competition. IBM, while a dominant force for decades, faces challenges from nimbler, more specialized tech companies in cloud computing, AI, and cybersecurity. This competitive pressure impacts market share and profitability, influencing investor sentiment.

2. Revenue Growth Concerns: While IBM has been actively diversifying its portfolio, particularly into hybrid cloud solutions and AI, revenue growth hasn't always met analyst expectations. Concerns about consistent, substantial revenue growth often translate to stock price fluctuations. Recent quarterly reports have likely played a significant role in shaping the current market perception.

3. Macroeconomic Factors: The broader economic climate also significantly impacts stock performance. Global inflation, rising interest rates, and potential recessionary pressures create uncertainty, leading investors to reassess their holdings, including IBM stock. These macroeconomic headwinds affect all sectors, and technology is not immune.

4. Increased Investment in R&D: IBM's commitment to research and development, though vital for long-term growth, can impact short-term profitability. Significant investments in areas like quantum computing and AI, while promising, may not immediately yield substantial returns, leading to temporary dips in earnings.

Potential for Recovery: A Look Ahead

Despite the recent dip, several factors suggest potential for an IBM stock price recovery:

- Strong Hybrid Cloud Strategy: IBM's focus on hybrid cloud solutions positions it well in a market demanding flexible and secure cloud infrastructure. This strategic move could yield significant long-term returns.

- AI Leadership: IBM is a recognized leader in artificial intelligence, with a robust portfolio of AI solutions. The burgeoning AI market presents considerable growth opportunities, potentially driving future stock appreciation.

- Cost-Cutting Measures: IBM has implemented various cost-cutting measures to enhance efficiency and profitability. These measures, if successful, could positively impact the company's financial performance and investor confidence.

- Long-Term Value Proposition: Despite the short-term fluctuations, IBM maintains a strong foundation built on decades of innovation and a diverse portfolio of products and services. Its long-term value proposition remains attractive to many investors.

Analyzing Investor Sentiment and Future Outlook:

It's crucial to monitor analyst ratings, financial news, and market trends to gauge the evolving investor sentiment towards IBM. While short-term price fluctuations are inevitable, a long-term perspective is often beneficial when evaluating investment opportunities in established companies like IBM. Consider consulting with a financial advisor for personalized guidance tailored to your risk tolerance and investment goals.

Disclaimer: This article provides general information and should not be considered financial advice. Investing in the stock market involves risk, and past performance is not indicative of future results. Always conduct thorough research and seek professional advice before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on IBM Stock Price Dip: Reasons For The Decline And Potential Recovery. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Statement On Villanova Wildcats Transition From Caa Football

Jun 06, 2025

Statement On Villanova Wildcats Transition From Caa Football

Jun 06, 2025 -

Daniel Anjorin Murder Prosecution Presents Case Against Marcus Monzo

Jun 06, 2025

Daniel Anjorin Murder Prosecution Presents Case Against Marcus Monzo

Jun 06, 2025 -

18 Years On Is The Madeleine Mc Cann Search Still Viable

Jun 06, 2025

18 Years On Is The Madeleine Mc Cann Search Still Viable

Jun 06, 2025 -

David Quinns Return To The Rangers Details On His Role Under Sullivan

Jun 06, 2025

David Quinns Return To The Rangers Details On His Role Under Sullivan

Jun 06, 2025 -

Large Scale Evacuation In Cologne Due To Wwii Bomb Threat

Jun 06, 2025

Large Scale Evacuation In Cologne Due To Wwii Bomb Threat

Jun 06, 2025

Latest Posts

-

June 6th 2024 Maxwell Anderson Faces Trial For Sade Robinsons Death

Jun 07, 2025

June 6th 2024 Maxwell Anderson Faces Trial For Sade Robinsons Death

Jun 07, 2025 -

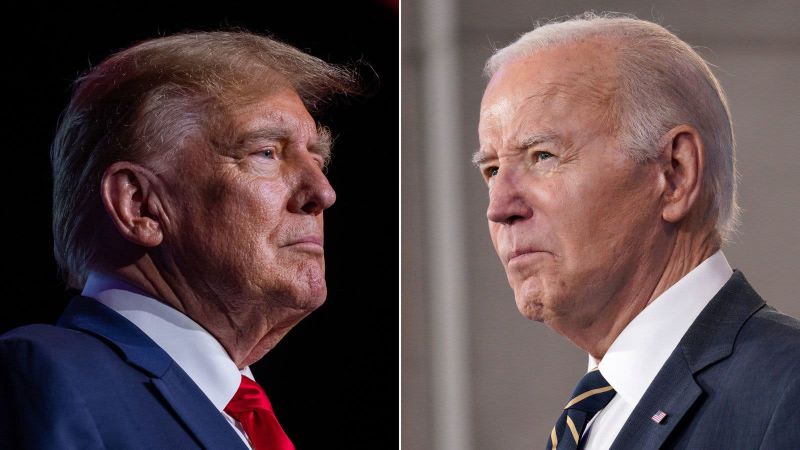

Cognitive Decline Allegations Fuel Trumps Investigation Into Biden

Jun 07, 2025

Cognitive Decline Allegations Fuel Trumps Investigation Into Biden

Jun 07, 2025 -

Maxwell Anderson Trial Begins Remembering Sade Robinson

Jun 07, 2025

Maxwell Anderson Trial Begins Remembering Sade Robinson

Jun 07, 2025 -

Preventing Hospitalization The Role Of The Infant Microbiome

Jun 07, 2025

Preventing Hospitalization The Role Of The Infant Microbiome

Jun 07, 2025 -

Longtime Friend Of Cassie Ventura To Testify Day Two In Combs Case

Jun 07, 2025

Longtime Friend Of Cassie Ventura To Testify Day Two In Combs Case

Jun 07, 2025