Impact Of Fed's 2025 Rate Cut Prediction On US Treasury Yields

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Fed's 2025 Rate Cut Prediction Sends Ripples Through US Treasury Yields

The Federal Reserve's recent projection of interest rate cuts in 2025 has sent shockwaves through the financial markets, significantly impacting US Treasury yields. This unexpected shift in the Fed's outlook has created considerable uncertainty and sparked debate among economists and investors alike. Understanding this impact is crucial for anyone invested in or impacted by the US economy.

The Fed's 2025 Pivot: A Surprise Announcement

The Federal Open Market Committee (FOMC) surprised many by including projections for rate cuts in 2025 within their latest economic forecasts. This prediction, coming after months of aggressive rate hikes aimed at combating inflation, signals a potential shift in the Fed's monetary policy strategy. While the timing and magnitude of these potential cuts remain uncertain, the mere suggestion has had a noticeable effect on Treasury yields.

Impact on US Treasury Yields: A Detailed Look

The anticipation of future rate cuts has led to a decline in US Treasury yields. This is because lower interest rates generally make existing bonds with higher yields more attractive, thereby pushing up their prices and lowering their yields. This inverse relationship between bond prices and yields is a fundamental principle of fixed-income investing.

- Short-term yields: These have been particularly sensitive to the Fed's projections, showing a more pronounced decrease. Investors are adjusting their expectations for future short-term interest rates, anticipating the easing of monetary policy.

- Long-term yields: While also impacted, long-term yields have demonstrated a less dramatic response. This is likely due to the uncertainty surrounding the economic outlook and the longer time horizon involved.

Why the Shift in Fed's Stance?

The Fed's revised outlook is likely influenced by several factors, including:

- Easing inflation: While inflation remains above the Fed's target, recent data suggests a potential cooling-off period. This allows the central bank to consider a less aggressive approach.

- Economic slowdown: Concerns about a potential economic recession are growing, prompting the Fed to prepare for a scenario requiring stimulative monetary policy.

- Global economic factors: International economic conditions, including geopolitical uncertainties, also play a significant role in the Fed's decision-making process.

What Lies Ahead for US Treasury Yields?

Predicting the future trajectory of US Treasury yields is inherently challenging. However, several factors will likely influence their movement:

- Inflation data: Continued downward pressure on inflation will support the Fed's projected rate cuts and potentially further reduce yields.

- Economic growth: The pace of economic growth will significantly influence the Fed's policy decisions and, consequently, Treasury yields. A stronger-than-expected recovery could lead to higher yields.

- Geopolitical events: Unexpected global events could easily disrupt the current market outlook and trigger significant volatility in Treasury yields.

Investing in the Current Climate: Navigating Uncertainty

The current environment presents both challenges and opportunities for investors. Diversification and a well-defined investment strategy are crucial for navigating the uncertainty surrounding US Treasury yields. Seeking advice from a qualified financial advisor can help investors make informed decisions based on their individual risk tolerance and financial goals.

Conclusion:

The Fed's prediction of rate cuts in 2025 has significantly impacted US Treasury yields, creating a complex and dynamic market. While the exact future remains uncertain, understanding the interplay between the Fed's policy decisions, economic indicators, and geopolitical factors is essential for making informed investment choices. Stay updated on economic news and consult with financial professionals to effectively navigate this evolving landscape. For more in-depth analysis on monetary policy, you might find [link to relevant Federal Reserve website] helpful.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Impact Of Fed's 2025 Rate Cut Prediction On US Treasury Yields. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

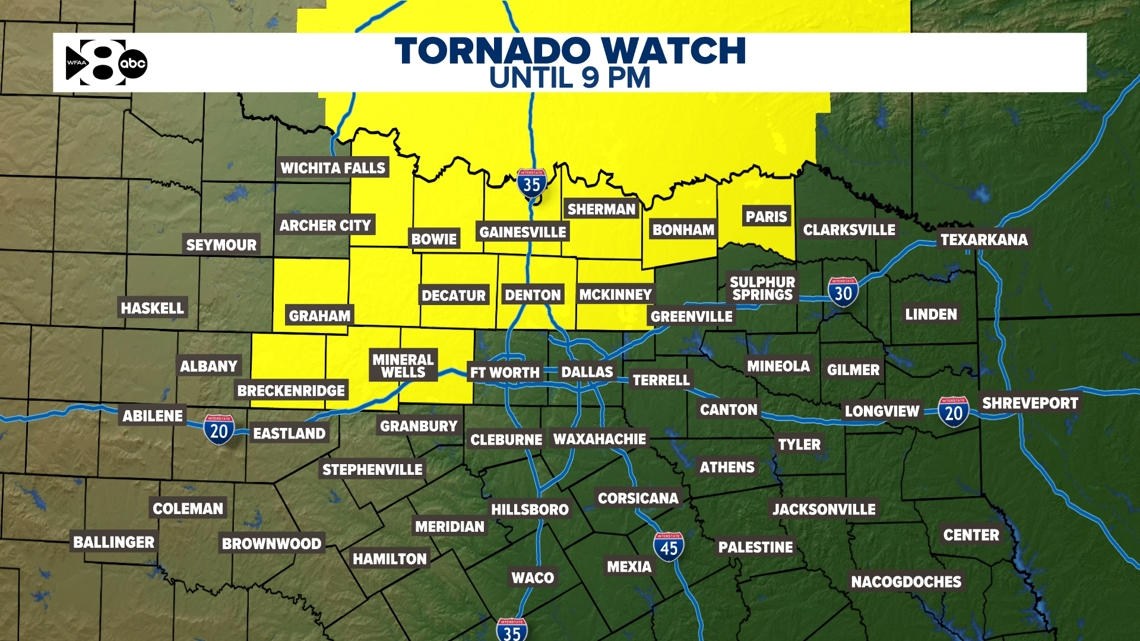

Dfw Area Severe Weather Passes Cold Front Incoming

May 20, 2025

Dfw Area Severe Weather Passes Cold Front Incoming

May 20, 2025 -

Eu Uk Brexit Talks A Delicate Balance Between Compromise And Accusation

May 20, 2025

Eu Uk Brexit Talks A Delicate Balance Between Compromise And Accusation

May 20, 2025 -

Billionaires Brilliance How She Generates Groundbreaking Ideas

May 20, 2025

Billionaires Brilliance How She Generates Groundbreaking Ideas

May 20, 2025 -

Davao Mayor Duterte Election Win And The Hagues Shadow

May 20, 2025

Davao Mayor Duterte Election Win And The Hagues Shadow

May 20, 2025 -

Elite Athletes Struggle Olympic Gold Tarnished By Coaching Abuse

May 20, 2025

Elite Athletes Struggle Olympic Gold Tarnished By Coaching Abuse

May 20, 2025

Latest Posts

-

Pectra Upgrade Drives 200 M Ethereum Investment Boom

May 21, 2025

Pectra Upgrade Drives 200 M Ethereum Investment Boom

May 21, 2025 -

Misbehaving Tourists Beware Bali Introduces Stricter Regulations

May 21, 2025

Misbehaving Tourists Beware Bali Introduces Stricter Regulations

May 21, 2025 -

Bbc And Gary Lineker Part Ways Impact On Match Of The Day

May 21, 2025

Bbc And Gary Lineker Part Ways Impact On Match Of The Day

May 21, 2025 -

Buy Now Pay Later Understanding The Changes In Consumer Protection Laws

May 21, 2025

Buy Now Pay Later Understanding The Changes In Consumer Protection Laws

May 21, 2025 -

International Support Urged For Balis Tourist Safety And Conduct

May 21, 2025

International Support Urged For Balis Tourist Safety And Conduct

May 21, 2025