Increased Car Insurance Premiums: State Farm's California Rate Hike Impact

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Increased Car Insurance Premiums: State Farm's California Rate Hike Impact

California drivers are facing a significant blow to their wallets as State Farm, one of the nation's largest auto insurers, announces substantial premium increases. The move is sparking widespread concern and igniting a debate about the affordability of car insurance in the Golden State. This substantial rate hike isn't an isolated incident; it reflects a broader trend impacting car insurance costs across the country, driven by a complex interplay of factors.

This article delves into the details of State Farm's California rate hike, explores its potential impact on consumers, and examines the underlying causes contributing to the rising cost of car insurance.

State Farm's Justification for the Increase

State Farm cites several reasons for the necessary premium adjustments in California. They claim increased claims costs, particularly those related to severe accidents and vehicle repairs, are the primary driver. The rising cost of auto parts, labor shortages in the repair industry, and the increasing severity of accidents due to factors like distracted driving are all contributing factors. Additionally, inflationary pressures are impacting their operational expenses, leading to the need for higher premiums to maintain financial stability. The company has emphasized that these increases are necessary to ensure they can continue to provide comprehensive coverage to their policyholders.

The Impact on California Drivers

The impact of these increased premiums will vary based on individual factors such as driving history, vehicle type, and location. However, the overall effect is expected to be significant for many Californians. For some, this could mean a considerable increase in their monthly expenses, potentially stretching already tight household budgets. This could force some drivers to reconsider their coverage levels, potentially leading to underinsurance and increased financial vulnerability in the event of an accident.

What this means for you:

- Higher monthly payments: Expect a noticeable increase in your insurance bill.

- Budget adjustments: You may need to re-evaluate your monthly budget to accommodate the higher costs.

- Policy review: Consider reviewing your current coverage to ensure it still meets your needs while staying within your budget. You might explore options like increasing your deductible to lower your premiums, though this increases your out-of-pocket expenses in case of an accident.

The Broader Context of Rising Car Insurance Costs

State Farm's rate hike is not unique. Many other insurance companies across the US are facing similar challenges and implementing premium increases. This reflects a broader trend impacting the insurance industry, fueled by:

- Increased repair costs: The cost of repairing modern vehicles, particularly those with advanced safety features and complex electronics, is significantly higher than in the past.

- Higher healthcare costs: The cost of medical treatment following accidents continues to rise, directly impacting insurance payouts.

- Inflation: Rising inflation impacts all aspects of the insurance business, from administrative costs to claims payouts.

- Increased litigation: Higher legal fees and larger payouts in accident-related lawsuits contribute to increased premiums.

What Can California Drivers Do?

While the situation is challenging, drivers can take steps to mitigate the impact of rising premiums:

- Shop around: Compare rates from different insurance providers to find the best deal. Online comparison tools can make this process easier. [Link to a reputable car insurance comparison website]

- Improve your driving record: Maintaining a clean driving record is the best way to secure lower premiums.

- Consider safety features: Vehicles with advanced safety features may qualify for discounts.

- Bundle your insurance: Bundling auto insurance with other types of insurance (homeowners, renters) can often result in savings.

The rising cost of car insurance in California is a significant concern for many residents. State Farm's rate hike underscores the need for drivers to be proactive in managing their insurance costs and understanding the factors contributing to this nationwide trend. Staying informed and taking the necessary steps to compare rates and manage your driving habits are crucial in navigating this challenging landscape.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Increased Car Insurance Premiums: State Farm's California Rate Hike Impact. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Ben Roberts Smith Loses War Crimes Defamation Appeal Full Decision

May 17, 2025

Ben Roberts Smith Loses War Crimes Defamation Appeal Full Decision

May 17, 2025 -

Friendship Film Soars Into Top Ten Markets Starring Detroits Tim Robinson

May 17, 2025

Friendship Film Soars Into Top Ten Markets Starring Detroits Tim Robinson

May 17, 2025 -

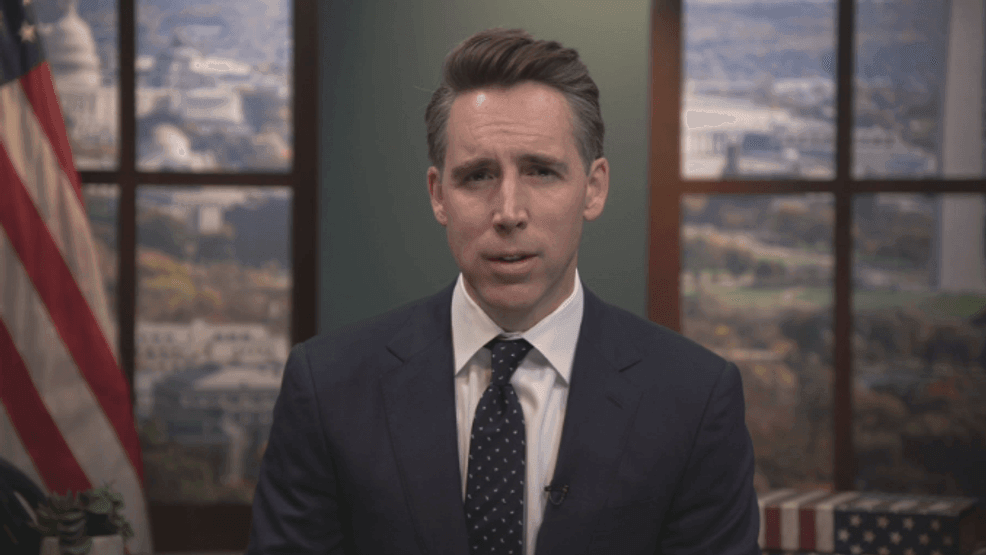

Insurance Giants State Farm And Allstate Testify Before Senator Hawley

May 17, 2025

Insurance Giants State Farm And Allstate Testify Before Senator Hawley

May 17, 2025 -

Mlb Season At The Halfway Point 7 Surprising Statistical Insights

May 17, 2025

Mlb Season At The Halfway Point 7 Surprising Statistical Insights

May 17, 2025 -

Investigation Launched Rome Trip For Regulators Raises Ethical Questions

May 17, 2025

Investigation Launched Rome Trip For Regulators Raises Ethical Questions

May 17, 2025

Latest Posts

-

Minnesota Twins Clinch 13th Straight Victory Shutting Out Opponents

May 18, 2025

Minnesota Twins Clinch 13th Straight Victory Shutting Out Opponents

May 18, 2025 -

Australian Citizen Jailed In Russia 13 Year Term For Ukraine Combat

May 18, 2025

Australian Citizen Jailed In Russia 13 Year Term For Ukraine Combat

May 18, 2025 -

Us East Coast Sea Level Rise Linked To Decelerating Ocean Currents

May 18, 2025

Us East Coast Sea Level Rise Linked To Decelerating Ocean Currents

May 18, 2025 -

Diddy Trial Testimony Analysis Of Cassie Ventura And Dawn Richards Accounts

May 18, 2025

Diddy Trial Testimony Analysis Of Cassie Ventura And Dawn Richards Accounts

May 18, 2025 -

Cassinos Online Com Bonus Descubra Slots Brasileiros E Acompanhe O New York Football Giants

May 18, 2025

Cassinos Online Com Bonus Descubra Slots Brasileiros E Acompanhe O New York Football Giants

May 18, 2025