Institutional Investment: Two Sigma Takes Large Position In Bank Of America

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Two Sigma's Big Bet: A Deep Dive into the Bank of America Investment

Wall Street is buzzing after quantitative investment firm Two Sigma revealed a significant increase in its Bank of America (BAC) holdings. This bold move has sparked considerable interest and speculation amongst analysts and investors alike, prompting questions about Two Sigma's investment strategy and the future outlook for Bank of America. This article delves into the implications of this substantial investment, examining the factors that might have driven Two Sigma's decision and what it could mean for both the bank and the broader financial market.

Two Sigma's Strategic Positioning: More Than Just a Numbers Game

Two Sigma, renowned for its data-driven, quantitative approach to investing, isn't known for impulsive decisions. Their significant stake in Bank of America suggests a calculated assessment of the bank's long-term potential. While the exact details of their investment strategy remain undisclosed, several factors could explain this strategic move:

-

BAC's Robust Financial Performance: Bank of America has consistently demonstrated strong financial performance in recent quarters, exceeding analyst expectations on several key metrics. This includes healthy loan growth, improved net interest margins, and effective cost management. These positive indicators likely contributed to Two Sigma's confidence in BAC's future prospects.

-

Undervalued Asset Potential: Some market analysts believe that Bank of America's stock might be currently undervalued, presenting a compelling opportunity for long-term investors. Two Sigma's investment could be a bet on a future price appreciation driven by market corrections or improved investor sentiment.

-

Diversification within a Stable Sector: The financial sector, while volatile at times, offers a degree of stability compared to other, more speculative markets. For a firm like Two Sigma, which manages diverse portfolios, a substantial investment in a major player like Bank of America could serve as a significant component of a balanced, risk-managed strategy.

Implications for Bank of America and the Market

Two Sigma's large position in Bank of America carries several implications:

-

Increased Investor Confidence: The investment by a sophisticated quantitative firm like Two Sigma could boost investor confidence in Bank of America, potentially attracting further institutional investment and driving up the stock price.

-

Market Sentiment Shift: This move might influence market sentiment, prompting other investors to reassess their own positions in BAC and the broader financial sector.

-

Long-Term Growth Strategy: Two Sigma's significant investment suggests a belief in Bank of America's long-term growth potential, potentially impacting the bank's strategic planning and future initiatives.

What to Watch For:

Investors and analysts will be closely watching Bank of America's performance in the coming quarters. Any significant deviation from projected growth could impact the value of Two Sigma's investment and influence the broader market's perception of BAC. Furthermore, any further announcements from Two Sigma regarding their investment strategy will be closely scrutinized.

Conclusion:

Two Sigma's substantial investment in Bank of America is a significant development in the financial world. While the specific reasoning behind the move remains partially opaque, the investment signals strong confidence in Bank of America's future performance and potential for growth. The impact of this decision on Bank of America's stock price and the overall market remains to be seen, but it undoubtedly marks a compelling event to watch closely. This situation highlights the ever-evolving dynamics of institutional investing and its profound influence on the financial landscape. Stay tuned for further updates as this story unfolds.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Institutional Investment: Two Sigma Takes Large Position In Bank Of America. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Best Sites To Watch Sramkova Vs Swiatek Tennis Match Online For Free

May 27, 2025

Best Sites To Watch Sramkova Vs Swiatek Tennis Match Online For Free

May 27, 2025 -

Ncaa Lacrosse Championship 2025 Bracket Predictions Schedule And Game Results

May 27, 2025

Ncaa Lacrosse Championship 2025 Bracket Predictions Schedule And Game Results

May 27, 2025 -

Kings Solidarity With Canada Navigating The Complexities With The Us

May 27, 2025

Kings Solidarity With Canada Navigating The Complexities With The Us

May 27, 2025 -

Giancarlo Stanton To Seattle Mariners Reportedly Eyeing Slugger

May 27, 2025

Giancarlo Stanton To Seattle Mariners Reportedly Eyeing Slugger

May 27, 2025 -

Understanding The Social Security Payment Schedule June 2025 For The United States

May 27, 2025

Understanding The Social Security Payment Schedule June 2025 For The United States

May 27, 2025

Latest Posts

-

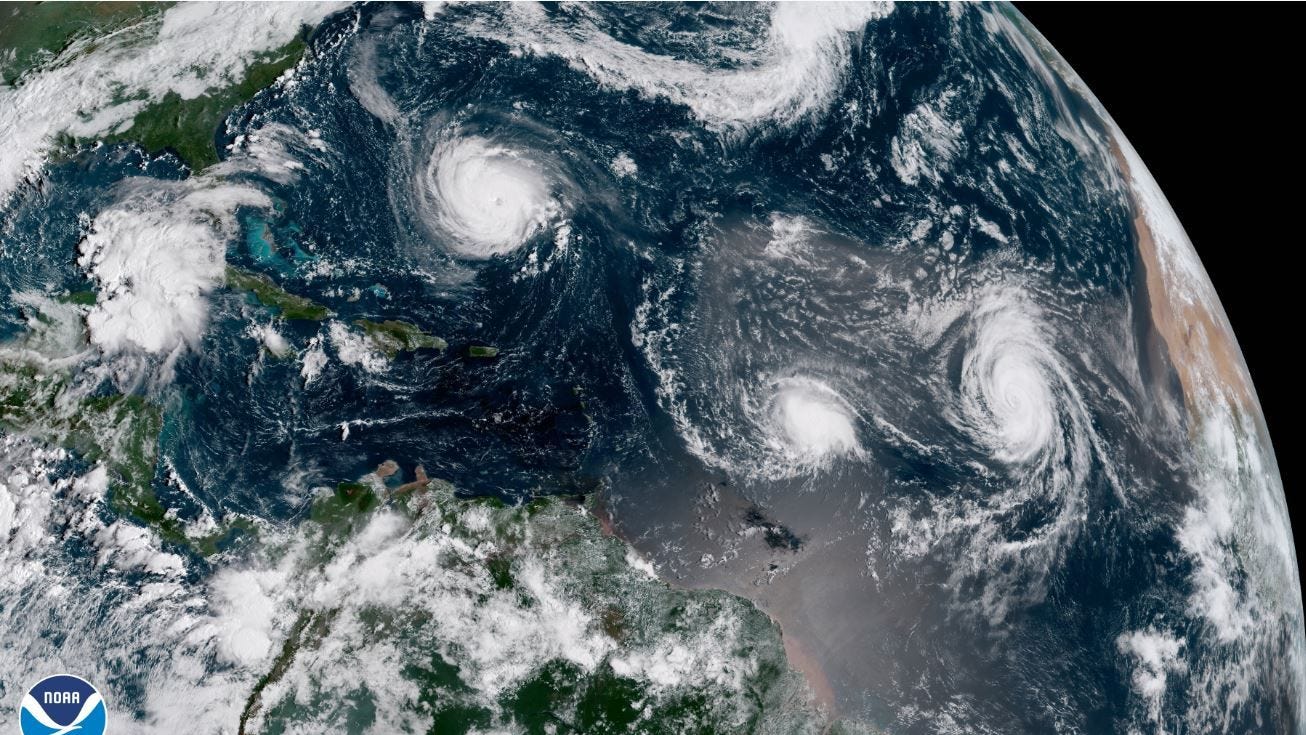

2025 Hurricane Season Outlook Faqs And Preparedness Guide

May 28, 2025

2025 Hurricane Season Outlook Faqs And Preparedness Guide

May 28, 2025 -

See Through Chic Alexandra Daddarios Daring Lace Gown

May 28, 2025

See Through Chic Alexandra Daddarios Daring Lace Gown

May 28, 2025 -

Gaza Receives Aid New Us Supported Group In Action

May 28, 2025

Gaza Receives Aid New Us Supported Group In Action

May 28, 2025 -

Leaked Recording Exposes Police Doubts In High Profile Abortion Case

May 28, 2025

Leaked Recording Exposes Police Doubts In High Profile Abortion Case

May 28, 2025 -

Memorial Tournament 2025 Sleeper Picks Winning Odds And Predictions

May 28, 2025

Memorial Tournament 2025 Sleeper Picks Winning Odds And Predictions

May 28, 2025