Institutional Selling And CME Gap Fail To Break Bitcoin's $118K Support

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Institutional Selling and CME Gap Fail to Break Bitcoin's $118K Support: A Bullish Sign?

Bitcoin (BTC) has once again demonstrated resilience, weathering a storm of institutional selling pressure and failing to breach the crucial support level of $118,000. This unexpected strength, coupled with the CME gap's failure to materialize, is sparking renewed optimism among analysts and investors alike. Could this be a significant bullish signal for Bitcoin's future price trajectory?

The cryptocurrency market has experienced considerable volatility in recent weeks. Heavy institutional selling, often cited as a major driver of price corrections, put immense pressure on Bitcoin's price. Many predicted a significant drop below the $118,000 support, a level that has held significance throughout the past few months. This support level represents a confluence of key technical indicators and psychological barriers.

The CME Gap: A Missed Opportunity for Bears?

The unfilled CME gap, a significant technical anomaly often associated with price corrections, added further fuel to the bearish narrative. CME gaps, which occur due to price discrepancies between the CME Bitcoin futures market and the spot market, are frequently filled, usually resulting in a sharp price movement to close the gap. The failure to fill this particular gap, however, suggests a powerful underlying buying pressure preventing a significant price drop.

<h3>Resilience in the Face of Adversity</h3>

Despite the intense selling pressure and the looming CME gap, Bitcoin's price managed to hold above $118,000. This resilience is a strong indication of underlying market strength. Several factors could be contributing to this:

- Accumulation by Long-Term Holders: Data suggests that long-term Bitcoin holders are accumulating, buying the dip and showing unwavering faith in the asset's long-term value.

- Increased Institutional Adoption: Despite the recent selling, the overall trend of institutional adoption continues. Many large corporations and investment firms are still showing interest in Bitcoin as a potential asset class.

- Technological Advancements: Ongoing developments in the Bitcoin network, such as the Lightning Network's increasing adoption, contribute to Bitcoin’s long-term appeal.

What's Next for Bitcoin?

While the recent price action suggests a strong bullish sentiment, it's crucial to remain cautious. The cryptocurrency market is inherently volatile, and unforeseen events could still impact Bitcoin's price. However, the combination of institutional selling failing to break the $118,000 support and the unfilled CME gap presents a compelling case for a potential bullish reversal.

Analysts are closely monitoring key indicators such as trading volume, on-chain metrics, and overall market sentiment to better understand the future price direction. A sustained break above the $120,000 mark could signal a significant upward trend.

Conclusion:

Bitcoin's resilience in the face of institutional selling and the unfilled CME gap has surprised many. While the future remains uncertain, this unexpected strength suggests a strong underlying market demand and could be a significant bullish sign. It remains crucial to stay informed about market developments and conduct thorough research before making any investment decisions. Are you bullish on Bitcoin's future? Share your thoughts in the comments below!

Keywords: Bitcoin, BTC, Cryptocurrency, Institutional Selling, CME Gap, Bitcoin Price, $118,000 Support, Bitcoin Support, Bullish, Bearish, Cryptocurrency Market, Technical Analysis, On-Chain Analysis, Bitcoin Investment, Cryptocurrency News

Related Articles: (Link to relevant articles on your site about Bitcoin price, institutional investment, etc.)

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Institutional Selling And CME Gap Fail To Break Bitcoin's $118K Support. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Endless War Crime Gangs Terrorize High Street Businesses

Aug 02, 2025

Endless War Crime Gangs Terrorize High Street Businesses

Aug 02, 2025 -

Marvels Eyes Of Wakanda A Conversation With Showrunner Todd Harris

Aug 02, 2025

Marvels Eyes Of Wakanda A Conversation With Showrunner Todd Harris

Aug 02, 2025 -

Alleged Poisoning Investigating The Death Of A Mother And The Husbands Role

Aug 02, 2025

Alleged Poisoning Investigating The Death Of A Mother And The Husbands Role

Aug 02, 2025 -

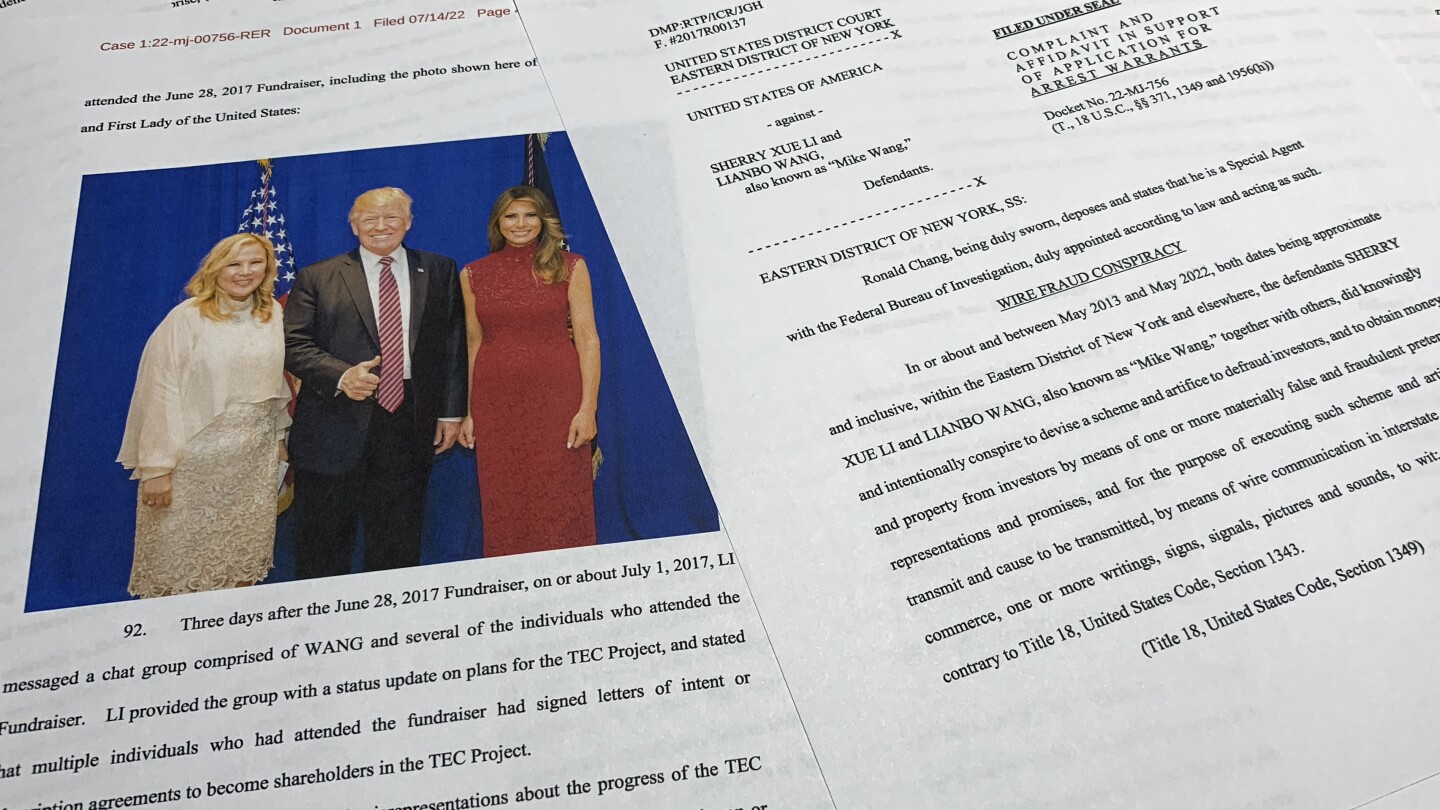

Trump Fundraiser Recipient Ny Investor Scamster Admits Guilt

Aug 02, 2025

Trump Fundraiser Recipient Ny Investor Scamster Admits Guilt

Aug 02, 2025 -

Pop Cap Revives Plants Vs Zombies Replanted Focusing On Franchise Roots

Aug 02, 2025

Pop Cap Revives Plants Vs Zombies Replanted Focusing On Franchise Roots

Aug 02, 2025

Latest Posts

-

White House Ballroom Renovation 200 Million Project Begins This September

Aug 03, 2025

White House Ballroom Renovation 200 Million Project Begins This September

Aug 03, 2025 -

X Qc Vs Kai Cenat Who Reigns Supreme In Streaming Net Worth

Aug 03, 2025

X Qc Vs Kai Cenat Who Reigns Supreme In Streaming Net Worth

Aug 03, 2025 -

Backlash Against Bbc Master Chef Faces Cancellation After Judge Sackings

Aug 03, 2025

Backlash Against Bbc Master Chef Faces Cancellation After Judge Sackings

Aug 03, 2025 -

Mr Beasts Challenge Cenat Vs X Qcs Streaming Empire Compared

Aug 03, 2025

Mr Beasts Challenge Cenat Vs X Qcs Streaming Empire Compared

Aug 03, 2025 -

New Policy Only Working Class Individuals Eligible For Civil Service Internships

Aug 03, 2025

New Policy Only Working Class Individuals Eligible For Civil Service Internships

Aug 03, 2025