Insufficient Retirement Savings: A Pension Commission Review Of Causes And Solutions

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Insufficient Retirement Savings: A Pension Commission Review of Causes and Solutions

Are you worried about having enough money for retirement? You're not alone. A recent review by the Pension Commission highlights a growing crisis: insufficient retirement savings among a significant portion of the population. This article delves into the key findings of the report, exploring the underlying causes and examining the proposed solutions to secure a financially comfortable retirement for all.

The Stark Reality: A Nation Under-Saving for Retirement

The Pension Commission's comprehensive review paints a concerning picture. Millions are facing the daunting prospect of a retirement marked by financial insecurity, jeopardizing their quality of life and well-being in their later years. The report cites a worrying trend of declining savings rates, particularly among younger generations, coupled with increased longevity and rising healthcare costs. This perfect storm threatens to overwhelm individuals and place a significant strain on social security systems.

Unveiling the Root Causes: Why Are We Falling Short?

The Commission's findings pinpoint several key factors contributing to this alarming trend:

- Low wages and income inequality: Stagnant wages and a widening gap between the rich and poor leave many struggling to meet current expenses, let alone save for retirement. [Link to relevant article on income inequality]

- Rising cost of living: Inflation, particularly in housing and healthcare, eats away at disposable income, leaving less available for savings. [Link to relevant article on inflation]

- Lack of financial literacy: Many individuals lack the understanding and knowledge necessary to effectively plan for retirement, leading to poor financial decisions. [Link to resource on financial literacy]

- Debt burdens: High levels of student loan debt, credit card debt, and other forms of borrowing hinder saving potential. [Link to article on student loan debt]

- Inadequate employer-sponsored retirement plans: The availability and generosity of employer-sponsored retirement plans vary significantly, leaving many workers without adequate support. [Link to article on employer-sponsored retirement plans]

Pathways to a Secure Retirement: The Commission's Recommendations

The Pension Commission's report outlines a multi-pronged approach to address this critical issue. Key recommendations include:

- Increasing employer contributions: Mandating higher employer contributions to retirement plans would significantly boost savings rates for many employees.

- Improving financial literacy education: Investing in comprehensive financial literacy programs, beginning in schools, is crucial to equip individuals with the knowledge to make informed financial decisions.

- Auto-enrollment in retirement plans: Automatically enrolling employees in retirement plans with the option to opt out, rather than requiring active enrollment, significantly increases participation rates.

- Government incentives for retirement savings: Tax incentives and matching contributions from the government can incentivize greater saving.

- Addressing income inequality: Implementing policies to reduce income inequality and raise minimum wages will leave more disposable income for savings.

The Road Ahead: Collective Action is Crucial

The findings of the Pension Commission's review highlight the urgent need for collective action. Individuals, employers, and governments all have a role to play in ensuring a secure retirement for future generations. Ignoring this issue will not only have profound consequences for individual well-being but also place an unsustainable burden on social security systems.

Call to Action: Learn more about your retirement savings options. Seek professional financial advice to create a personalized retirement plan. Engage in the public conversation about retirement security and advocate for policies that promote financial well-being for all. Your future self will thank you.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Insufficient Retirement Savings: A Pension Commission Review Of Causes And Solutions. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Los Angeles Home Over 400 Guinea Pigs Discovered In Dire Conditions

Jul 23, 2025

Los Angeles Home Over 400 Guinea Pigs Discovered In Dire Conditions

Jul 23, 2025 -

Power Outage Hits South Omaha Due To Equipment Malfunction Says Oppd

Jul 23, 2025

Power Outage Hits South Omaha Due To Equipment Malfunction Says Oppd

Jul 23, 2025 -

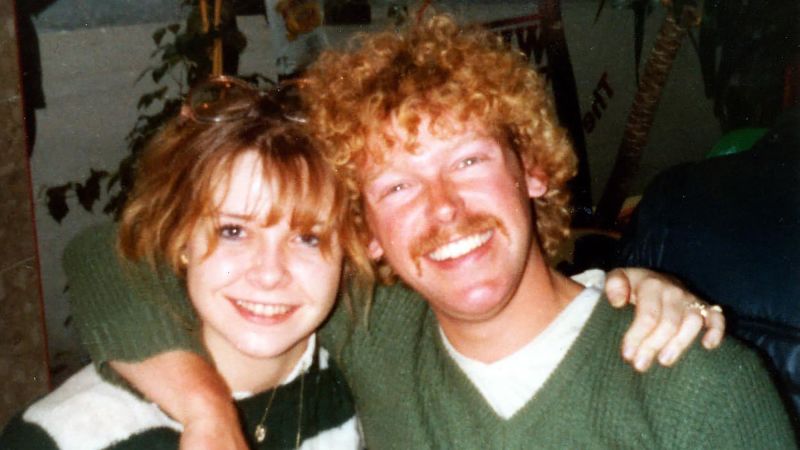

Chance Encounter 40 Years Of Marriage Began On A Plane

Jul 23, 2025

Chance Encounter 40 Years Of Marriage Began On A Plane

Jul 23, 2025 -

Girlguidings Expanded Badge Program 72 New Badges Added

Jul 23, 2025

Girlguidings Expanded Badge Program 72 New Badges Added

Jul 23, 2025 -

F 35 B Lightning Ii Technical Snag Delays Uk Jets Departure From Kerala

Jul 23, 2025

F 35 B Lightning Ii Technical Snag Delays Uk Jets Departure From Kerala

Jul 23, 2025

Californias Vandenberg Air Force Base Key To Space Xs Starlink Satellite Deployments

Californias Vandenberg Air Force Base Key To Space Xs Starlink Satellite Deployments

American Dream Fulfilled Normandy Adventure For Two

American Dream Fulfilled Normandy Adventure For Two