Investigating PG&E's Nuclear Plant Fee: A Slush Fund Inquiry

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Investigating PG&E's Nuclear Plant Fee: A Slush Fund Inquiry?

California's largest utility, Pacific Gas and Electric (PG&E), is facing intense scrutiny over its controversial nuclear decommissioning fee. For years, ratepayers have been charged a significant amount annually to cover the eventual dismantling of Diablo Canyon Power Plant. However, recent investigations are raising serious questions about how these funds are being managed, leading to accusations of a potential "slush fund." This article delves into the ongoing inquiry and the implications for California consumers.

The Decommissioning Fee: A Necessary Evil or a Cash Cow?

The Diablo Canyon Power Plant, located on the California coast, is slated for decommissioning in the coming years. This process is incredibly complex and expensive, requiring specialized equipment, skilled labor, and meticulous planning to ensure environmental safety. To cover these substantial costs, PG&E charges its customers a dedicated decommissioning fee, added directly to their monthly bills.

While the necessity of funding decommissioning is widely accepted, the specific allocation and management of these funds are now under the microscope. Critics argue that the fee is excessively high, potentially exceeding the actual costs required for the decommissioning process. This surplus, they claim, could be inappropriately used, leading to the "slush fund" allegations.

The Investigation: Uncovering Potential Mismanagement

Several investigations are currently underway, scrutinizing PG&E's handling of the nuclear decommissioning fund. These inquiries are examining various aspects, including:

- Transparency of spending: Critics argue that PG&E lacks sufficient transparency regarding how the funds are being utilized. Detailed breakdowns of expenses and independent audits are being demanded to ensure accountability.

- Potential cost overruns: Investigations are assessing whether PG&E is inflating costs, potentially leading to unnecessary profit from the decommissioning fund.

- Compliance with regulations: Regulatory bodies are reviewing PG&E's compliance with all relevant laws and regulations concerning the management of the decommissioning fund.

These investigations involve various agencies, including the California Public Utilities Commission (CPUC) and potentially federal oversight bodies. The outcome could have significant implications for PG&E and its relationship with its customers.

What Happens Next? The Implications for Ratepayers

The ongoing investigations could lead to several potential outcomes, each with significant implications for California ratepayers:

- Rate reductions: If the investigations reveal overcharging or mismanagement, the CPUC could order PG&E to reduce rates, returning excess funds to consumers.

- Fines and penalties: PG&E could face substantial fines and penalties if found to be in violation of regulations.

- Increased regulatory oversight: The controversy could lead to increased scrutiny and tighter regulations regarding the management of nuclear decommissioning funds for all utilities.

The outcome of these investigations is crucial for ensuring transparency and accountability in the management of public funds. Ratepayers deserve to know that their money is being used responsibly and efficiently.

Staying Informed: Resources and Calls to Action

Stay informed about the progress of these investigations by regularly checking updates from the CPUC and other relevant regulatory bodies. You can also participate in public comment periods and advocate for greater transparency and accountability in the management of utility funds. Your voice matters in ensuring fair and responsible energy practices in California. [Link to CPUC website]

This ongoing saga highlights the importance of vigilant oversight of public utilities and underscores the need for greater transparency in the management of large-scale infrastructure projects. The future of the Diablo Canyon decommissioning fund, and the broader implications for consumer protection, remain to be seen.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Investigating PG&E's Nuclear Plant Fee: A Slush Fund Inquiry. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

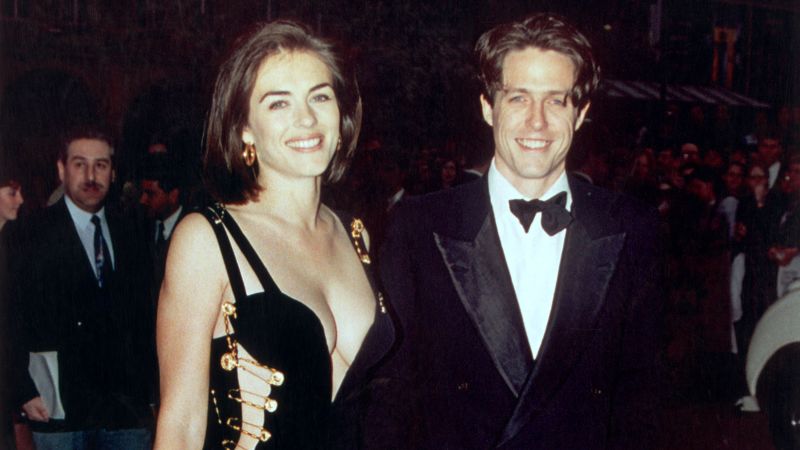

Remembering Liz Hurleys Iconic Safety Pin Dress

Jun 10, 2025

Remembering Liz Hurleys Iconic Safety Pin Dress

Jun 10, 2025 -

Against All Odds Paralysed Brides Touching Hospital Wedding

Jun 10, 2025

Against All Odds Paralysed Brides Touching Hospital Wedding

Jun 10, 2025 -

New Harry Potter Cast Members Announced For Hbo Series Draco Malfoy Among Them

Jun 10, 2025

New Harry Potter Cast Members Announced For Hbo Series Draco Malfoy Among Them

Jun 10, 2025 -

Murder Charges Filed In Sheffield Following Fatal Car Accident Involving Child

Jun 10, 2025

Murder Charges Filed In Sheffield Following Fatal Car Accident Involving Child

Jun 10, 2025 -

Petunia And Vernon Dursley Found Hbos Harry Potter Series Announces Key Cast Additions

Jun 10, 2025

Petunia And Vernon Dursley Found Hbos Harry Potter Series Announces Key Cast Additions

Jun 10, 2025

Latest Posts

-

From Concept To Screen Creating A Documentary On A Limited Budget

Jun 12, 2025

From Concept To Screen Creating A Documentary On A Limited Budget

Jun 12, 2025 -

Diy Documentary A Ken Burns And Motor Week Inspired Film

Jun 12, 2025

Diy Documentary A Ken Burns And Motor Week Inspired Film

Jun 12, 2025 -

Gaza Comments Spark Uk Sanctions Against Israeli Ministers

Jun 12, 2025

Gaza Comments Spark Uk Sanctions Against Israeli Ministers

Jun 12, 2025 -

Queens 2025 Kartals Singles Loss Boulter And Raducanus Doubles Exit

Jun 12, 2025

Queens 2025 Kartals Singles Loss Boulter And Raducanus Doubles Exit

Jun 12, 2025 -

Australian Ultrarun Will Goodge Conquers 2 387 Miles Despite Hallucinations And Sleep Deprivation

Jun 12, 2025

Australian Ultrarun Will Goodge Conquers 2 387 Miles Despite Hallucinations And Sleep Deprivation

Jun 12, 2025