Investigating The 1000% Increase In SBET Stock Price: A Comprehensive Analysis

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Investigating the 1000% Increase in SBET Stock Price: A Comprehensive Analysis

The stock market can be a wild ride, and few examples illustrate this better than the astronomical rise of SBET (hypothetical stock ticker) stock. In recent months, SBET has experienced a staggering 1000% increase in its share price, leaving investors both bewildered and elated. This unprecedented surge demands a closer look at the underlying factors driving this phenomenal growth and whether this trend is sustainable. This in-depth analysis delves into the possible causes, highlighting both the potential benefits and the inherent risks associated with such dramatic price fluctuations.

The Meteoric Rise: Unpacking the 1000% Increase

Several interconnected factors likely contributed to SBET's remarkable surge. It's crucial to analyze these elements to understand the full picture and assess the future trajectory of the stock.

1. Positive Financial Performance: A key driver behind any significant stock price increase is strong financial performance. Did SBET release unexpectedly positive earnings reports? Have they announced significant revenue growth or new partnerships that justify this level of investor confidence? Investigating these financial fundamentals is paramount. Analyzing quarterly reports and SEC filings is crucial in uncovering the underlying reasons for this growth. [Link to hypothetical SEC filing - replace with real resource if available].

2. Market Sentiment and Hype: Beyond concrete financial data, market sentiment plays a significant role. Did SBET benefit from positive media coverage, social media buzz, or a general increase in investor enthusiasm for the sector? The power of social media in influencing stock prices cannot be overlooked. A viral trend or a positive mention by a prominent influencer can have a dramatic impact, even without strong fundamental support. [Link to article about social media impact on stock market - replace with real resource].

3. Industry Trends and Technological Advancements: Is SBET operating in a rapidly growing sector experiencing significant technological breakthroughs? Innovation often fuels explosive growth in the stock market. A groundbreaking new product, service, or technology could easily explain the dramatic increase in SBET's valuation. Understanding the broader industry context is key to comprehending the stock's performance.

4. Short Squeeze: A less common but potent factor is a short squeeze. If a substantial number of investors were betting against SBET (short selling), a sudden surge in demand could force these investors to buy back shares to limit their losses, further driving up the price. This can create a self-perpetuating cycle of rapid price increases.

5. Speculative Investing: The dramatic increase in SBET's stock price could simply be attributed to speculation. Investors might be anticipating future growth, driven by hype and hope rather than concrete financial data. This is particularly risky, as speculative bubbles can burst rapidly, leading to significant losses.

Assessing the Sustainability: Risks and Potential Downsides

While the 1000% increase is undeniably impressive, investors need to approach it with caution. Such dramatic growth often raises concerns about a potential market correction.

- Overvaluation: The current stock price might be significantly inflated compared to its intrinsic value, making it vulnerable to a sharp decline.

- Lack of Fundamental Support: If the price surge isn't backed by strong financial performance, the upward trend may not be sustainable.

- Market Volatility: The stock market is inherently volatile, and unexpected events can trigger significant price swings.

Conclusion: A Cautious Approach

The 1000% increase in SBET's stock price presents a fascinating case study in market dynamics. While the underlying reasons are multifaceted and require careful investigation, investors should prioritize thorough due diligence before making any investment decisions. Understanding the balance between fundamental strength and market speculation is crucial for navigating such volatile situations. Proceed with caution and consult with a financial advisor before investing in any highly volatile stock. Remember, past performance is not indicative of future results.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Always conduct your own thorough research and consult with a qualified financial advisor before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Investigating The 1000% Increase In SBET Stock Price: A Comprehensive Analysis. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Us Visa Crackdown Impact On Chinese Students And Educational Exchange

May 31, 2025

Us Visa Crackdown Impact On Chinese Students And Educational Exchange

May 31, 2025 -

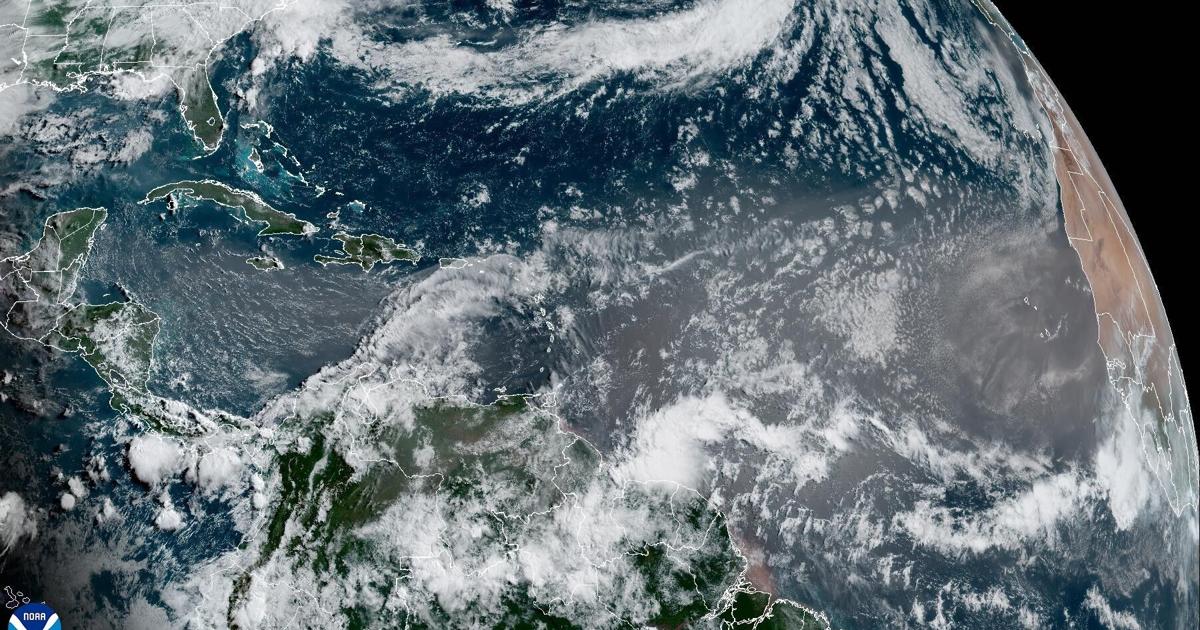

Saharan Dust Clouds Impact Louisiana Sunset Predictions

May 31, 2025

Saharan Dust Clouds Impact Louisiana Sunset Predictions

May 31, 2025 -

Court Case Update Russell Brands Plea In Rape And Assault Case

May 31, 2025

Court Case Update Russell Brands Plea In Rape And Assault Case

May 31, 2025 -

Longtime Rivals Suge Knight Asks Diddy To Take The Stand Humanize Public Persona

May 31, 2025

Longtime Rivals Suge Knight Asks Diddy To Take The Stand Humanize Public Persona

May 31, 2025 -

Man Charged After Deliberate Car Ramming In Liverpool City Centre

May 31, 2025

Man Charged After Deliberate Car Ramming In Liverpool City Centre

May 31, 2025

Walmarts E Commerce Dominance How Target Fell Behind In The Online Retail War

Walmarts E Commerce Dominance How Target Fell Behind In The Online Retail War