Investigation Launched: HS2 Contractors' Use Of Agency Workers Under Tax Scrutiny

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Investigation Launched: HS2 Contractors' Use of Agency Workers Under Tax Scrutiny

High-speed rail project HS2 is facing intense scrutiny as an investigation is launched into the tax implications of its contractors' widespread use of agency workers. The inquiry, spearheaded by [Name of Investigating Body, if known, otherwise replace with "a leading tax authority"], promises to delve deep into the employment practices of firms involved in the multi-billion-pound infrastructure project. Concerns are mounting over potential tax avoidance schemes related to the classification of agency workers and the associated national insurance and income tax liabilities.

The use of agency workers is common in large-scale construction projects like HS2, offering flexibility for contractors. However, the scale of agency worker deployment on the project has raised red flags. Critics argue that some contractors may be misclassifying employees as self-employed or agency workers to reduce their national insurance contributions and corporation tax burdens. This practice, if proven, could represent a significant loss of revenue for the UK government.

The Focus of the Investigation

The investigation is expected to focus on several key areas:

- Worker classification: Determining whether agency workers are correctly classified as self-employed or employed, a crucial factor in determining tax liabilities. Incorrect classification can lead to significant penalties for both contractors and the workers themselves.

- IR35 compliance: Assessing compliance with the IR35 rules, designed to prevent tax avoidance through disguised employment. Non-compliance can result in substantial fines and back taxes.

- Transfer pricing: Examining the arrangements between contractors and agency suppliers to ensure they are at arm's length and do not artificially reduce tax liabilities.

- Transparency and record-keeping: Investigating the transparency of contracting practices and the adequacy of record-keeping to ensure accurate tax declarations.

This investigation follows increasing public and political pressure to address tax avoidance in the UK construction industry. Recent reports have highlighted concerns about the use of complex corporate structures and opaque employment arrangements to minimize tax burdens. The HS2 project, a flagship government initiative, is under particular scrutiny given its substantial budget and reliance on numerous contractors.

Potential Consequences

The outcome of this investigation could have significant consequences. If widespread tax avoidance is uncovered, contractors could face substantial financial penalties, reputational damage, and potential legal action. Furthermore, the government may need to revise its procurement processes to prevent similar issues arising in future large-scale infrastructure projects. For agency workers themselves, the investigation could lead to back payments of taxes and national insurance contributions if they were incorrectly classified.

The investigation is still in its early stages, but its potential implications are far-reaching. Experts predict that the findings could influence future government policy regarding the use of agency workers in large-scale projects and lead to stricter regulations to prevent tax avoidance. This case highlights the ongoing challenge of ensuring tax compliance within complex supply chains, particularly in sectors with a high reliance on temporary and contract workers.

Stay tuned for updates as this crucial investigation unfolds. We will continue to provide in-depth coverage of the developments and their potential impact on the HS2 project and the wider construction industry. [Link to a relevant government website or news source focusing on tax avoidance]. We will keep you informed on the latest developments. Follow us for regular updates.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Investigation Launched: HS2 Contractors' Use Of Agency Workers Under Tax Scrutiny. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

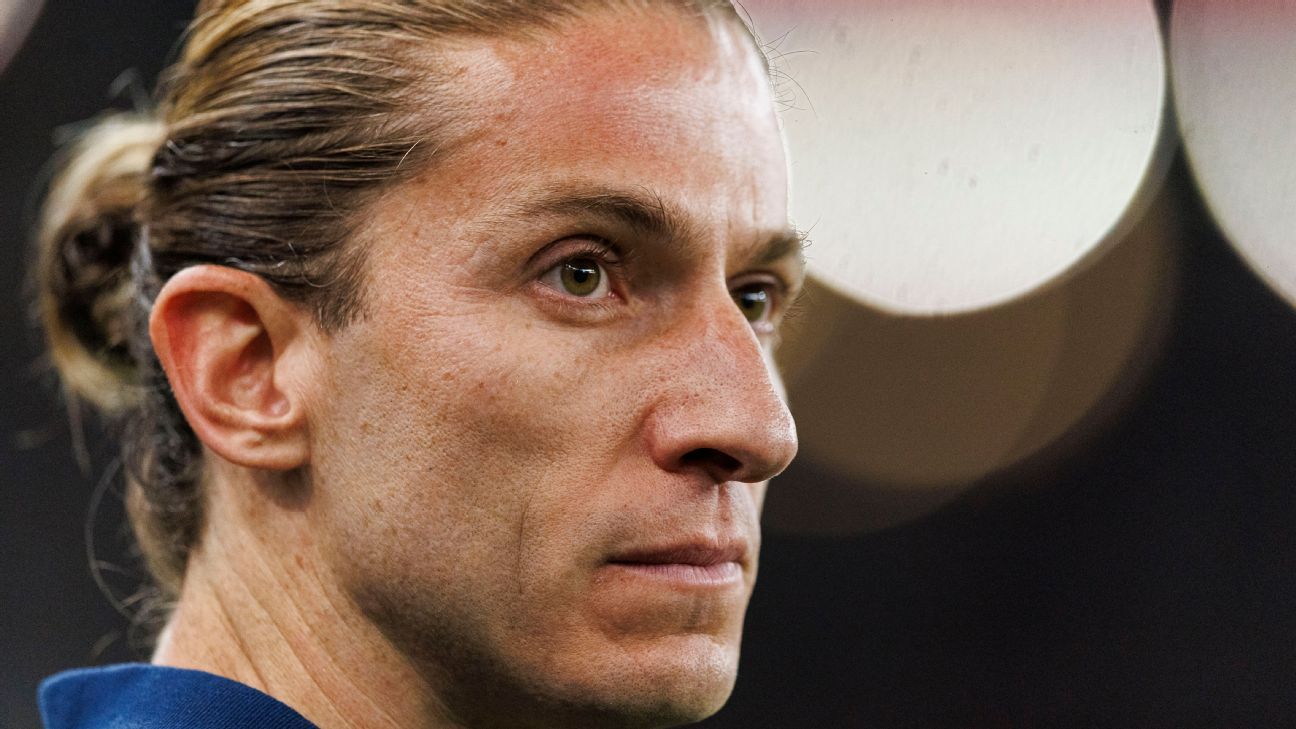

Filipe Luis Assusta Jornal Espanhol Flamengo Na Disputa Pelo Mundial

Jun 17, 2025

Filipe Luis Assusta Jornal Espanhol Flamengo Na Disputa Pelo Mundial

Jun 17, 2025 -

Filipe Luis Preocupa Jornal Espanhol Flamengo Como Azarao No Mundial De Clubes

Jun 17, 2025

Filipe Luis Preocupa Jornal Espanhol Flamengo Como Azarao No Mundial De Clubes

Jun 17, 2025 -

Minnesota Lawmakers Shot Latest Developments In The Investigation

Jun 17, 2025

Minnesota Lawmakers Shot Latest Developments In The Investigation

Jun 17, 2025 -

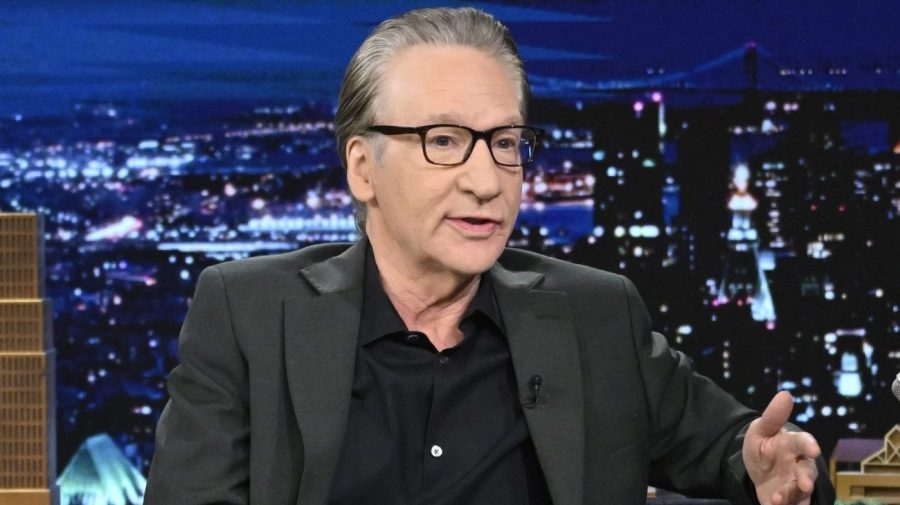

Maher Applauds Trumps Parade But Slams Military Presence On Streets

Jun 17, 2025

Maher Applauds Trumps Parade But Slams Military Presence On Streets

Jun 17, 2025 -

Betting On The Marlins Phillies Series Comprehensive Odds Predictions And Analysis

Jun 17, 2025

Betting On The Marlins Phillies Series Comprehensive Odds Predictions And Analysis

Jun 17, 2025

Latest Posts

-

Millennials Face Triple Risk Of Appendix Cancer Compared To Gen X Parents New Study

Jun 17, 2025

Millennials Face Triple Risk Of Appendix Cancer Compared To Gen X Parents New Study

Jun 17, 2025 -

Ataque Do Rival Do Flamengo Brasileiros E Idolo Vascaino Prometem Duelo

Jun 17, 2025

Ataque Do Rival Do Flamengo Brasileiros E Idolo Vascaino Prometem Duelo

Jun 17, 2025 -

Watch Live F1 Movie Red Carpet Arrivals Stars And Drivers

Jun 17, 2025

Watch Live F1 Movie Red Carpet Arrivals Stars And Drivers

Jun 17, 2025 -

The Human Cost Iranian Perspectives On The Impact Of Israeli Military Action

Jun 17, 2025

The Human Cost Iranian Perspectives On The Impact Of Israeli Military Action

Jun 17, 2025 -

Clarissa Ward On Cnn A Palestinian Israeli Village Recovers From Rocket Attack

Jun 17, 2025

Clarissa Ward On Cnn A Palestinian Israeli Village Recovers From Rocket Attack

Jun 17, 2025