Investigation Reveals Tax Evasion: Rob Cross, Former Darts Champion, Disqualified As Director

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Investigation Reveals Tax Evasion: Rob Cross, Former Darts Champion, Disqualified as Director

Former world darts champion Rob Cross has been disqualified as a company director after an investigation uncovered significant tax evasion. The news sent shockwaves through the darts world and highlights the serious consequences of tax avoidance, even for high-profile individuals. This article delves into the details of the investigation and its implications for Cross's future.

The Insolvency Service launched an investigation into Cross's conduct following concerns about his company, [Company Name – replace with actual company name if available]. The probe revealed that Cross had deliberately under-declared his income, evading a substantial amount of tax owed to Her Majesty's Revenue and Customs (HMRC). The precise amount of tax evaded has not yet been publicly disclosed, but sources suggest it is significant, potentially running into tens of thousands of pounds.

The Disqualification Order: What it Means for Rob Cross

The investigation led to Cross being disqualified from acting as a company director for a period of [Number] years. This means he is legally barred from holding any directorial positions in UK companies during this time. This significant penalty underscores the seriousness with which the authorities view tax evasion, irrespective of the individual's public profile. The disqualification order is a powerful deterrent and sends a clear message that tax evasion will not be tolerated.

This isn't the first time a high-profile sports figure has faced such consequences. Other cases, such as [mention a relevant example of a similar case, linking to a reputable news source], demonstrate the increasing scrutiny placed on the financial affairs of public figures.

Impact on Cross's Career and Reputation

The news of the disqualification has inevitably tarnished Cross's reputation. While his achievements on the darts circuit remain undeniable, this legal setback raises questions about his professional conduct and trustworthiness. The impact on his future career, both in darts and potentially in business ventures, remains to be seen. His sponsors may also review their relationships in light of this development.

- Loss of Trust: The disqualification severely damages public trust in Cross.

- Sponsorship Concerns: Existing sponsors might reconsider their partnerships.

- Future Opportunities: New opportunities in business or endorsements may be limited.

The darts community is likely to react with a mix of surprise and disappointment. Many fans admired Cross's skill and charisma, and this revelation will undoubtedly be a difficult pill to swallow for some.

The Importance of Tax Compliance for Businesses and Individuals

This case serves as a crucial reminder of the importance of tax compliance for all businesses and individuals. HMRC actively investigates instances of tax evasion, and the penalties can be severe, impacting not only finances but also reputation and future prospects. Businesses should maintain accurate and up-to-date accounting records and seek professional advice when needed to ensure full compliance with tax regulations. Individuals, particularly high-income earners, should also be aware of their tax obligations and seek professional advice to avoid unintentional errors.

Call to Action: Are you concerned about your tax compliance? Seek professional advice from a qualified accountant to ensure you're meeting all your tax obligations. [Link to relevant resource, such as HMRC website or a reputable accounting firm]. Don't risk your reputation and future – prioritize tax compliance.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Investigation Reveals Tax Evasion: Rob Cross, Former Darts Champion, Disqualified As Director. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

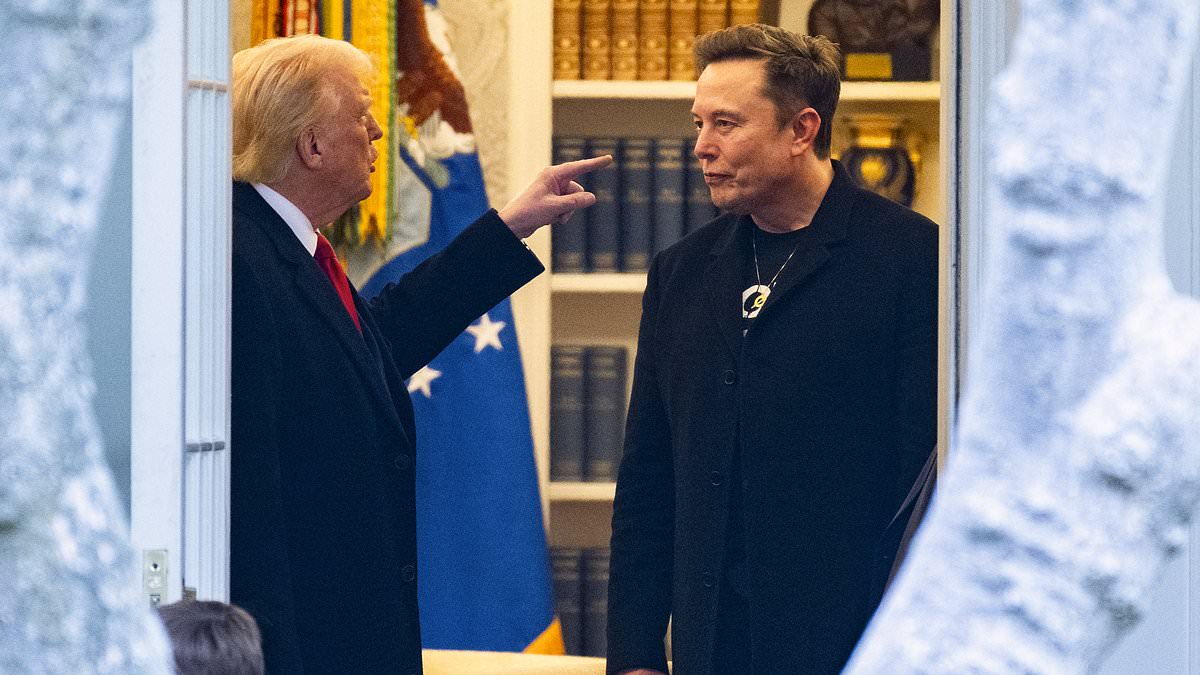

Key Trump Advisor Architect Of The Presidents Musk Split

Jun 07, 2025

Key Trump Advisor Architect Of The Presidents Musk Split

Jun 07, 2025 -

Police Dog Pension Should Our K9 Heroes Receive Retirement Benefits

Jun 07, 2025

Police Dog Pension Should Our K9 Heroes Receive Retirement Benefits

Jun 07, 2025 -

Ver Andorra Vs Inglaterra En Vivo Guia Completa De Canales Para Las Eliminatorias Uefa

Jun 07, 2025

Ver Andorra Vs Inglaterra En Vivo Guia Completa De Canales Para Las Eliminatorias Uefa

Jun 07, 2025 -

Gaza Aid Site Shooting Evidence Points To Israeli Gunfire

Jun 07, 2025

Gaza Aid Site Shooting Evidence Points To Israeli Gunfire

Jun 07, 2025 -

Is Ibms Innovation Pipeline Reigniting Its Cool Factor

Jun 07, 2025

Is Ibms Innovation Pipeline Reigniting Its Cool Factor

Jun 07, 2025

Latest Posts

-

Nfl Star Chris Conleys Post Football Career A Focus On Film

Jun 07, 2025

Nfl Star Chris Conleys Post Football Career A Focus On Film

Jun 07, 2025 -

Demonstrators Block Ice After Controversial San Diego Restaurant Raid

Jun 07, 2025

Demonstrators Block Ice After Controversial San Diego Restaurant Raid

Jun 07, 2025 -

Hamilton By Election Results What Reforms Strong Showing Means

Jun 07, 2025

Hamilton By Election Results What Reforms Strong Showing Means

Jun 07, 2025 -

Kepa Arrizabalaga To Arsenal Deal Imminent Sources Say

Jun 07, 2025

Kepa Arrizabalaga To Arsenal Deal Imminent Sources Say

Jun 07, 2025 -

Israel Confirms Arming Hamas Rivals Amidst Growing Opposition Backlash

Jun 07, 2025

Israel Confirms Arming Hamas Rivals Amidst Growing Opposition Backlash

Jun 07, 2025