Investing In Coca-Cola (KO): A Comprehensive Guide

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Investing in Coca-Cola (KO): A Comprehensive Guide

The iconic red and white logo is instantly recognizable globally, but is Coca-Cola (KO) a smart investment for your portfolio? This comprehensive guide delves into the pros and cons of investing in this beverage giant, offering insights to help you make an informed decision. From its dividend history to its future prospects, we'll explore everything you need to know before adding KO to your holdings.

Why Consider Investing in Coca-Cola (KO)?

Coca-Cola boasts a compelling investment case built on several key pillars:

-

Strong Brand Recognition and Global Reach: Coca-Cola's brand recognition is arguably unmatched. This global presence translates to consistent revenue streams, even amidst economic fluctuations. The company's diverse portfolio of brands, including Sprite, Fanta, and Minute Maid, further mitigates risk.

-

Consistent Dividend Payments: For income-seeking investors, Coca-Cola's dividend history is particularly attractive. It's a Dividend Aristocrat, meaning it has increased its dividend annually for over 25 years, demonstrating a strong commitment to shareholder returns. This makes it a popular choice for long-term investors building passive income streams. Learn more about .

-

Adaptability and Innovation: While primarily known for its sugary drinks, Coca-Cola has actively diversified its product portfolio to include healthier options and adapt to changing consumer preferences. This includes investing in sparkling water brands and expanding into plant-based beverages.

-

Resilience During Economic Downturns: Coca-Cola's products are considered relatively recession-resistant. Even during economic hardship, consumers tend to continue purchasing these beverages, providing a degree of stability to the company's earnings.

Potential Risks Associated with KO Stock

Despite its strengths, potential investors should consider these risks:

-

Health Concerns and Shifting Consumer Preferences: Growing awareness of health and wellness has led to decreased consumption of sugary drinks. Coca-Cola's response to these changing preferences will be crucial for its long-term success.

-

Competition and Market Saturation: The beverage industry is highly competitive. Coca-Cola faces strong competition from PepsiCo and other emerging beverage brands.

-

Geopolitical Risks: As a global company, Coca-Cola is exposed to geopolitical risks and fluctuations in foreign exchange rates. These factors can impact profitability and revenue.

Analyzing Coca-Cola's Financial Performance:

Before making any investment decision, it's crucial to analyze Coca-Cola's financial statements, including its revenue, earnings per share (EPS), and debt levels. Reliable financial data can be accessed through reputable sources like or . Look for trends in revenue growth, profitability, and debt management to gauge the company's overall financial health.

Is Coca-Cola (KO) Right for You?

Ultimately, whether or not Coca-Cola is a suitable investment depends on your individual investment goals and risk tolerance. If you're seeking a relatively stable, dividend-paying stock with a strong brand reputation, Coca-Cola could be a good fit. However, be aware of the potential risks associated with the company and the beverage industry as a whole. Consider diversifying your portfolio to mitigate risk and consult with a qualified financial advisor before making any investment decisions.

Call to Action: Conduct thorough research and consider your personal financial situation before investing in any stock. This article is for informational purposes only and does not constitute financial advice.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Investing In Coca-Cola (KO): A Comprehensive Guide. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Confirmed Paige De Sorbo Wont Return For Summer House Season 8

Jun 06, 2025

Confirmed Paige De Sorbo Wont Return For Summer House Season 8

Jun 06, 2025 -

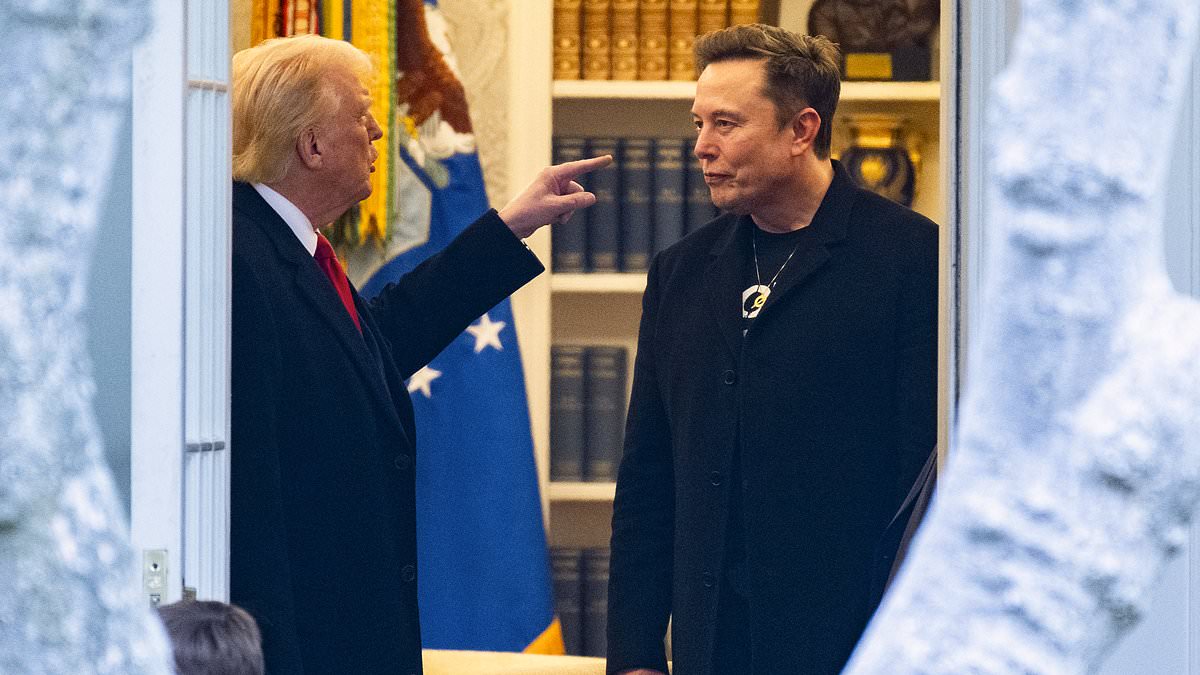

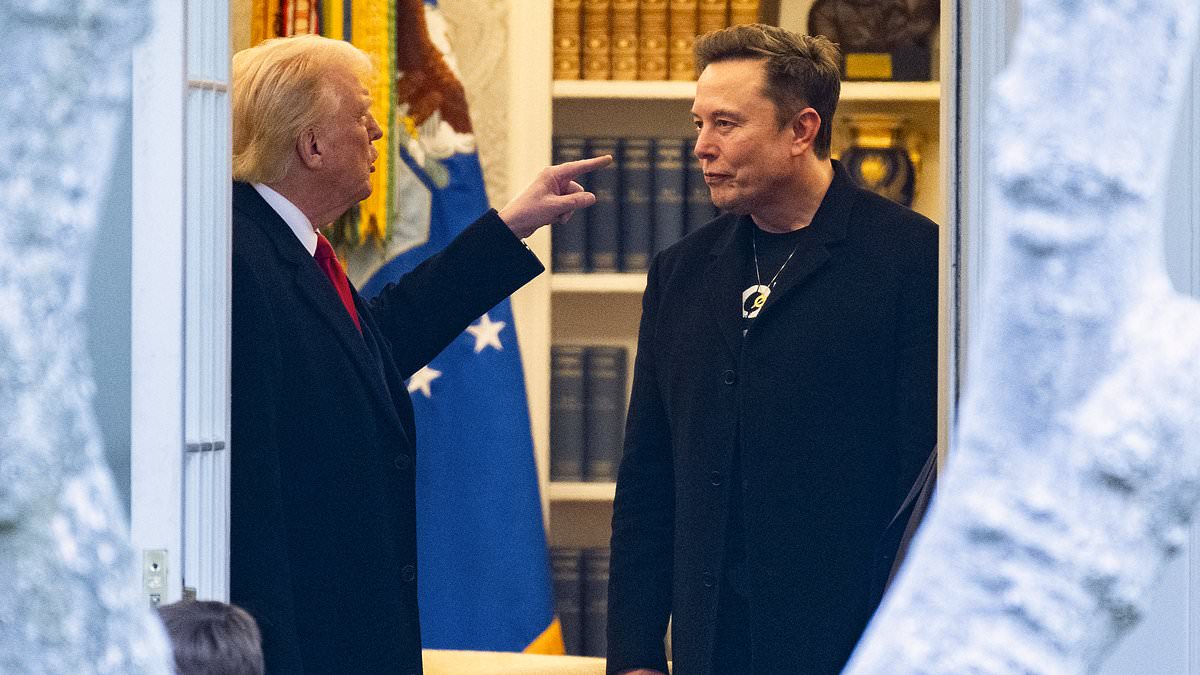

The Untold Story How A Trump Advisor Sparked The Musk Feud

Jun 06, 2025

The Untold Story How A Trump Advisor Sparked The Musk Feud

Jun 06, 2025 -

Celebrating Lilibet Meghan Releases Birthday Photos Of Her Young Daughter

Jun 06, 2025

Celebrating Lilibet Meghan Releases Birthday Photos Of Her Young Daughter

Jun 06, 2025 -

6 Million Nhs Scotland Fraud Four Receive Prison Sentences

Jun 06, 2025

6 Million Nhs Scotland Fraud Four Receive Prison Sentences

Jun 06, 2025 -

Microbiomes Role In Preventing Hospital Readmissions

Jun 06, 2025

Microbiomes Role In Preventing Hospital Readmissions

Jun 06, 2025

Latest Posts

-

Camila Cabellos Former Boyfriend Matthew Hussey To Become A Father

Jun 06, 2025

Camila Cabellos Former Boyfriend Matthew Hussey To Become A Father

Jun 06, 2025 -

Lifetimes Latest Thriller Steve Guttenberg Plays A Serial Killer

Jun 06, 2025

Lifetimes Latest Thriller Steve Guttenberg Plays A Serial Killer

Jun 06, 2025 -

Is Ibm Relevant In 2024 A Critical Analysis Of Its Comeback

Jun 06, 2025

Is Ibm Relevant In 2024 A Critical Analysis Of Its Comeback

Jun 06, 2025 -

Sade Robinson Death Updates On The Maxwell Anderson Trial Proceedings

Jun 06, 2025

Sade Robinson Death Updates On The Maxwell Anderson Trial Proceedings

Jun 06, 2025 -

Key Trump Advisor At Center Of Musk Trump Feud

Jun 06, 2025

Key Trump Advisor At Center Of Musk Trump Feud

Jun 06, 2025