Investing In Gold & Precious Metals For Retirement: A Self-Directed IRA Analysis

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Investing in Gold & Precious Metals for Retirement: A Self-Directed IRA Analysis

Are you looking for ways to diversify your retirement portfolio and potentially protect your savings from market volatility? Investing in gold and precious metals within a Self-Directed IRA (SDIRA) might be a strategy worth exploring. While not without risk, precious metals can offer a hedge against inflation and economic uncertainty, making them an attractive addition to a well-rounded retirement plan. This article provides a comprehensive analysis of this investment strategy.

Understanding Self-Directed IRAs

Before diving into the specifics of precious metal investments, let's clarify what a Self-Directed IRA is. Unlike traditional IRAs, which typically offer limited investment options, a SDIRA provides greater control over your retirement funds. This means you can invest in a broader range of assets, including gold, silver, platinum, palladium, and other alternative investments that are typically unavailable in traditional retirement accounts. [Link to reputable source explaining SDIRAs]

Why Consider Gold and Precious Metals for Retirement?

- Inflation Hedge: Historically, precious metals have served as a hedge against inflation. When the value of fiat currencies declines, the price of gold and other precious metals often rises, preserving your purchasing power.

- Portfolio Diversification: Diversification is key to a successful investment strategy. Adding precious metals to a portfolio dominated by stocks and bonds can reduce overall risk and potentially improve returns.

- Safe Haven Asset: During times of economic uncertainty or geopolitical instability, investors often flock to gold and other precious metals, viewing them as a safe haven asset. This can lead to increased demand and price appreciation.

- Tangible Asset: Unlike stocks or bonds, which are intangible assets, precious metals are tangible. This offers a sense of security to some investors.

Investing in Precious Metals through a SDIRA: A Step-by-Step Guide

- Choose a Reputable Custodian: Selecting a qualified custodian is crucial. They will hold your assets and ensure compliance with IRA rules and regulations. [Link to comparison of reputable custodians - avoid direct promotion]

- Select Your Precious Metals: Decide which metals to invest in (gold, silver, platinum, palladium) based on your risk tolerance and investment goals. Consider the potential for price fluctuations of each metal.

- Purchase and Storage: Your custodian will facilitate the purchase of your chosen precious metals. They may offer storage options, or you may need to arrange for secure storage yourself. Remember to carefully consider insurance and security implications.

- Ongoing Monitoring: Regularly monitor your investment's performance and adjust your strategy as needed. Economic conditions and market trends can significantly impact precious metal prices.

Potential Risks and Considerations:

- Price Volatility: Precious metal prices can fluctuate significantly, leading to potential losses.

- Storage Costs: Secure storage of physical precious metals can incur fees.

- Liquidity: Selling precious metals might take longer compared to selling stocks or bonds.

- Regulatory Compliance: Strict adherence to IRA rules and regulations is crucial to avoid penalties.

Conclusion: A Strategic Addition to Your Retirement Plan?

Investing in gold and precious metals through a Self-Directed IRA can be a valuable strategy for diversifying your retirement portfolio and potentially protecting your savings from inflation and market downturns. However, it's essential to understand the inherent risks and conduct thorough research before making any investment decisions. Consulting with a qualified financial advisor is recommended before implementing this strategy. Remember, this is not financial advice, and individual circumstances should always be considered. Do your own due diligence before investing in any asset class.

Call to Action: Learn more about Self-Directed IRAs and explore the potential benefits of precious metal investments for your retirement planning by contacting a qualified financial advisor today. [Link to general financial planning resources - avoid direct promotion]

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Investing In Gold & Precious Metals For Retirement: A Self-Directed IRA Analysis. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

April Jobs Report Unexpected Increase Signals Resilient Labor Market

Jun 05, 2025

April Jobs Report Unexpected Increase Signals Resilient Labor Market

Jun 05, 2025 -

Biosecurity Breach Smuggling Charges Filed Against Chinese Researchers In Michigan

Jun 05, 2025

Biosecurity Breach Smuggling Charges Filed Against Chinese Researchers In Michigan

Jun 05, 2025 -

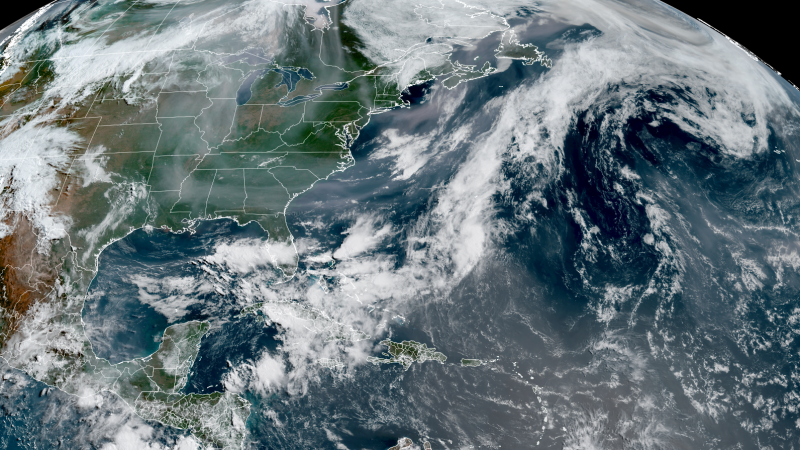

Weather Forecast Imminent Collision Of Canadian Smoke And African Dust Over Southern Regions

Jun 05, 2025

Weather Forecast Imminent Collision Of Canadian Smoke And African Dust Over Southern Regions

Jun 05, 2025 -

Pittsburgh Penguins Add David Quinn To Coaching Staff

Jun 05, 2025

Pittsburgh Penguins Add David Quinn To Coaching Staff

Jun 05, 2025 -

Singer Jessie J Shares Her Breast Cancer Diagnosis And Treatment Plan

Jun 05, 2025

Singer Jessie J Shares Her Breast Cancer Diagnosis And Treatment Plan

Jun 05, 2025

Latest Posts

-

Indian Clinical Trials Examining The Impact Of Mangoes On Blood Sugar Levels

Aug 17, 2025

Indian Clinical Trials Examining The Impact Of Mangoes On Blood Sugar Levels

Aug 17, 2025 -

Hong Kong Media And The Intensifying Us China Power Struggle

Aug 17, 2025

Hong Kong Media And The Intensifying Us China Power Struggle

Aug 17, 2025 -

The Ukrainian Peoples Struggle For Peace And Sovereignty

Aug 17, 2025

The Ukrainian Peoples Struggle For Peace And Sovereignty

Aug 17, 2025 -

Can Topshop Reclaim Its Place As A High Street Fashion Icon

Aug 17, 2025

Can Topshop Reclaim Its Place As A High Street Fashion Icon

Aug 17, 2025 -

Battlefield 6 Beta Review A Deep Dive Into Multiplayer Gameplay

Aug 17, 2025

Battlefield 6 Beta Review A Deep Dive Into Multiplayer Gameplay

Aug 17, 2025