Investing In Gold & Precious Metals For Retirement: A Self-Directed IRA Report

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Investing in Gold & Precious Metals for Retirement: A Self-Directed IRA Report

Are you looking for a safe haven for your retirement savings? Consider diversifying your portfolio with gold and precious metals within a Self-Directed IRA (SDIRA). This report explores the potential benefits and considerations of this investment strategy. The recent market volatility has many investors seeking alternative assets, and precious metals are increasingly gaining attention.

The allure of gold and other precious metals as a retirement investment lies in their perceived stability and hedge against inflation. Unlike stocks and bonds, which can fluctuate dramatically, precious metals often hold their value, even during economic downturns. This makes them an attractive option for those seeking to preserve their retirement nest egg.

Why Choose a Self-Directed IRA for Precious Metals?

A Self-Directed IRA offers unparalleled flexibility compared to traditional retirement accounts. While most traditional IRAs restrict investments to stocks, bonds, and mutual funds, an SDIRA allows you to invest in a wider range of assets, including:

- Gold: The most popular precious metal investment, gold is known for its stability and historical value.

- Silver: Often used in industrial applications, silver can offer potential for both price appreciation and diversification.

- Platinum: A rarer and more expensive metal than gold, platinum can be a high-growth, high-risk investment.

- Palladium: Primarily used in catalytic converters, palladium's price is often tied to the automotive industry.

Key benefits of using a Self-Directed IRA for precious metals include:

- Tax advantages: Contributions to a Self-Directed IRA may be tax-deductible, and earnings grow tax-deferred until retirement.

- Control and flexibility: You have complete control over your investments, choosing when and how to buy and sell precious metals.

- Diversification: Adding precious metals to your portfolio can diversify your holdings and reduce overall risk.

Understanding the Risks

While investing in precious metals through an SDIRA offers potential benefits, it’s crucial to acknowledge the inherent risks:

- Price volatility: While generally considered a safe haven, precious metal prices can fluctuate significantly, leading to potential losses.

- Storage costs: Secure storage of physical precious metals can incur additional expenses. Reputable custodians specializing in SDIRA precious metal storage are essential.

- Liquidity: Selling precious metals might take longer compared to selling stocks or bonds, impacting your access to funds.

Choosing a Custodian: A Critical Step

Selecting the right custodian for your Self-Directed IRA is paramount. A reputable custodian will:

- Provide secure storage: Your precious metals must be stored in a safe and insured facility.

- Handle transactions: They facilitate the buying and selling of precious metals on your behalf.

- Maintain compliance: They ensure your SDIRA remains compliant with IRS regulations.

Before investing in precious metals within your SDIRA, consider:

- Your risk tolerance: Precious metals investments carry inherent risks. Assess your comfort level with potential price fluctuations.

- Your investment goals: Determine how precious metals fit into your overall retirement plan.

- Consult a financial advisor: Seeking professional advice is recommended before making significant investment decisions.

Investing in gold and precious metals through a Self-Directed IRA can be a valuable strategy for diversifying your retirement portfolio. However, thorough research, careful planning, and professional guidance are crucial for maximizing potential returns while minimizing risks. Learn more about . Remember to always consult with a qualified financial advisor before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Investing In Gold & Precious Metals For Retirement: A Self-Directed IRA Report. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Double Threat Canadian Smoke And African Dust Cloud To Impact Southern Us Air Quality

Jun 04, 2025

Double Threat Canadian Smoke And African Dust Cloud To Impact Southern Us Air Quality

Jun 04, 2025 -

Conquer Todays Nyt Spelling Bee Strands June 3rd Guide

Jun 04, 2025

Conquer Todays Nyt Spelling Bee Strands June 3rd Guide

Jun 04, 2025 -

Is This The Next Big Netflix Comedy Fans Obsessed With New Series

Jun 04, 2025

Is This The Next Big Netflix Comedy Fans Obsessed With New Series

Jun 04, 2025 -

Us Open Update Musetti Defeats Rune Tiafoe Makes History Again

Jun 04, 2025

Us Open Update Musetti Defeats Rune Tiafoe Makes History Again

Jun 04, 2025 -

Rising Mortgage Terms First Time Buyers Facing 31 Year Loans

Jun 04, 2025

Rising Mortgage Terms First Time Buyers Facing 31 Year Loans

Jun 04, 2025

Latest Posts

-

De Sorbos Summer House Journey Ends After Seven Successful Seasons

Jun 06, 2025

De Sorbos Summer House Journey Ends After Seven Successful Seasons

Jun 06, 2025 -

Could Ryan Gosling Be Marvels White Black Panther Following Ketemas Reveal

Jun 06, 2025

Could Ryan Gosling Be Marvels White Black Panther Following Ketemas Reveal

Jun 06, 2025 -

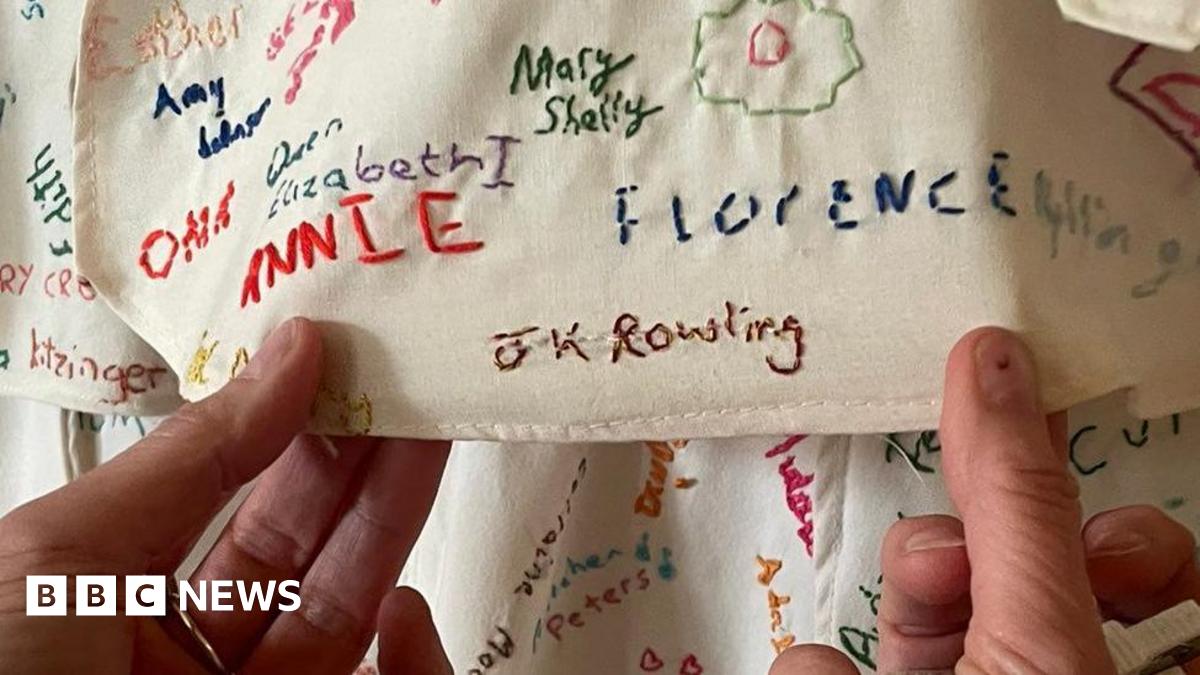

Controversy At Derbyshire National Trust Tampered J K Rowling Artwork Hidden

Jun 06, 2025

Controversy At Derbyshire National Trust Tampered J K Rowling Artwork Hidden

Jun 06, 2025 -

Federal Charges Chinese Scientists Accused Of Biological Material Smuggling To University Of Michigan

Jun 06, 2025

Federal Charges Chinese Scientists Accused Of Biological Material Smuggling To University Of Michigan

Jun 06, 2025 -

Reverse Discrimination Suits Supreme Court Eases Filing Requirements

Jun 06, 2025

Reverse Discrimination Suits Supreme Court Eases Filing Requirements

Jun 06, 2025