Investing In Gold: Risks And Rewards In A Booming Market

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Investing in Gold: Risks and Rewards in a Booming Market

Gold. The word itself conjures images of wealth, security, and perhaps a touch of old-world glamour. But in today's volatile market, is investing in gold truly the safe haven many believe it to be? The answer, as with most financial decisions, is nuanced. This article explores the potential rewards and inherent risks of investing in gold during this period of economic uncertainty and market fluctuations.

The Allure of Gold: Why Investors Are Drawn to the Precious Metal

Gold's enduring appeal stems from its perceived stability against inflation and economic downturns. Historically, during times of crisis, investors flock to gold as a safe haven asset, driving up its price. This "flight to safety" is a key driver of gold's value, making it an attractive hedge against portfolio losses in other asset classes like stocks and bonds.

Several factors currently contribute to gold's booming market:

- Inflationary Pressures: High inflation erodes the purchasing power of fiat currencies, making gold, a tangible asset with intrinsic value, a more attractive investment.

- Geopolitical Instability: Global conflicts and economic uncertainties often lead investors to seek the safety and stability of gold.

- Interest Rate Hikes: Rising interest rates can negatively impact bond yields, making gold a more competitive alternative for income-seeking investors.

- Currency Devaluation: Concerns about the weakening of certain currencies can boost demand for gold as a store of value.

Understanding the Risks: Not All That Glitters is Gold

While the potential rewards are significant, investing in gold isn't without its risks:

- Price Volatility: Despite its reputation for stability, gold prices can fluctuate significantly. While it can act as a hedge against inflation, it's not immune to market forces. Sharp price drops are possible, leading to potential losses.

- Lack of Income Generation: Unlike dividend-paying stocks or interest-bearing bonds, gold itself doesn't generate income. Your returns rely solely on price appreciation.

- Storage and Security Costs: Physically storing gold requires secure facilities and insurance, adding to the overall cost of investment.

- Liquidity Concerns: While generally liquid, selling large quantities of gold might take time and require finding a buyer willing to pay the current market price.

Different Ways to Invest in Gold:

There are several ways to gain exposure to gold, each with its own set of advantages and disadvantages:

- Physical Gold: Buying gold bars or coins offers tangible ownership but carries storage and security risks.

- Gold ETFs (Exchange-Traded Funds): ETFs track the price of gold, providing a convenient and cost-effective way to invest. Examples include GLD (SPDR Gold Shares).

- Gold Mining Stocks: Investing in companies that mine gold offers potential leverage, but also carries higher risk due to the volatility of the mining industry.

Conclusion: A Strategic Part of a Diversified Portfolio

Investing in gold can be a valuable part of a diversified investment portfolio, particularly during times of economic uncertainty. However, it's crucial to understand the inherent risks and consider your personal risk tolerance before making any investment decisions. Gold should be viewed as a strategic component of a broader investment strategy, not a get-rich-quick scheme. Remember to consult with a qualified financial advisor before making any significant investment choices. They can help you assess your risk tolerance and determine the appropriate allocation of gold in your portfolio. Don't forget to conduct thorough research and stay updated on market trends to make informed decisions.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Investing in gold carries risk, and you could lose money.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Investing In Gold: Risks And Rewards In A Booming Market. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Labour Leaders Sharp Criticism Of Immigration Policies

May 15, 2025

Labour Leaders Sharp Criticism Of Immigration Policies

May 15, 2025 -

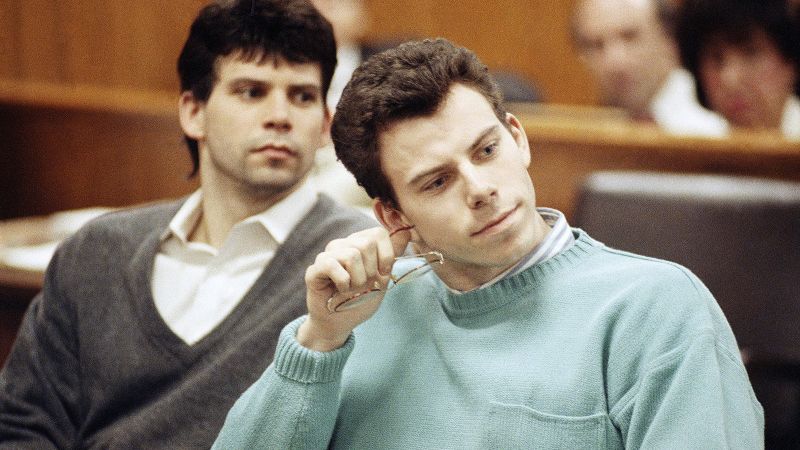

Erik And Lyle Menendez Could Face New Sentences

May 15, 2025

Erik And Lyle Menendez Could Face New Sentences

May 15, 2025 -

38 Years Behind Bars One Mans Journey And The Promise Of New Weight Loss Drugs

May 15, 2025

38 Years Behind Bars One Mans Journey And The Promise Of New Weight Loss Drugs

May 15, 2025 -

May 14th Mlb Matchup Pirates Vs Mets Game Odds And Predictions

May 15, 2025

May 14th Mlb Matchup Pirates Vs Mets Game Odds And Predictions

May 15, 2025 -

Bbc Cameramans Trauma Gaza Children And The Aftermath Of Israeli Airstrikes

May 15, 2025

Bbc Cameramans Trauma Gaza Children And The Aftermath Of Israeli Airstrikes

May 15, 2025

Latest Posts

-

Tsmc Q2 Profit Jumps 61 Exceeding Expectations Amidst Robust Ai Chip Demand

Jul 17, 2025

Tsmc Q2 Profit Jumps 61 Exceeding Expectations Amidst Robust Ai Chip Demand

Jul 17, 2025 -

Nvidias Ai Chip Sales To China A Reversal Of Us Export Controls

Jul 17, 2025

Nvidias Ai Chip Sales To China A Reversal Of Us Export Controls

Jul 17, 2025 -

Love Island Usas Amaya And Bryan Post Show Relationship Update

Jul 17, 2025

Love Island Usas Amaya And Bryan Post Show Relationship Update

Jul 17, 2025 -

Ynw Melly Double Murder Case Retrial Set For September Following Mistrial

Jul 17, 2025

Ynw Melly Double Murder Case Retrial Set For September Following Mistrial

Jul 17, 2025 -

De Chambeau Explains Why Public Courses Present Unexpected Challenges

Jul 17, 2025

De Chambeau Explains Why Public Courses Present Unexpected Challenges

Jul 17, 2025