Investing In Lockheed Martin: A 20-Year Retrospective On Stock Returns

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Investing in Lockheed Martin: A 20-Year Retrospective on Stock Returns

Lockheed Martin (LMT), a titan in the aerospace and defense industry, has long been a consideration for long-term investors. But how has a two-decade investment in LMT actually performed? This in-depth analysis explores the stock's returns over the past 20 years, considering factors like dividends, market volatility, and the company's strategic position within the global defense landscape. Understanding this historical performance can offer valuable insights for potential future investors.

Two Decades of Growth: Navigating Market Tides

Analyzing Lockheed Martin's stock performance over the past 20 years requires a nuanced approach. While the stock market is inherently volatile, LMT has generally demonstrated resilience, even during periods of economic downturn. Let's examine some key periods:

2003-2008: The Post-9/11 Boom and Subsequent Recession: The period following the September 11th attacks saw a surge in defense spending, benefiting Lockheed Martin significantly. However, the 2008 financial crisis tested the market, and LMT wasn't immune to the downturn. Despite the volatility, long-term investors who held through this period likely experienced positive returns, albeit with fluctuations.

2009-2019: Steady Growth and Diversification: The decade following the 2008 crisis saw more stable growth for Lockheed Martin. The company's strategic diversification into various sectors within the aerospace and defense industry helped to mitigate risks associated with dependence on any single program or contract. This period highlighted the importance of long-term investment strategies.

2020-Present: Pandemic and Geopolitical Shifts: The COVID-19 pandemic initially impacted the global economy, yet Lockheed Martin, as a crucial defense contractor, experienced relatively less disruption than many other sectors. The ongoing geopolitical instability and increased global defense spending have further boosted the company's performance in recent years. This underscores the significance of understanding macroeconomic trends when evaluating defense stocks.

H2: Key Factors Influencing Lockheed Martin's Stock Performance

Several factors have contributed to Lockheed Martin's long-term stock performance:

- Government Contracts: The company's reliance on government contracts is a double-edged sword. While it provides significant revenue stability, it also makes the company vulnerable to changes in government spending priorities.

- Technological Innovation: Lockheed Martin's consistent investment in research and development is crucial for maintaining a competitive edge and securing future contracts. This continuous innovation is a key driver of long-term growth.

- Dividend Payments: LMT has a history of paying consistent dividends, which can significantly enhance overall returns for long-term investors. This steady income stream is attractive to many investors seeking reliable income.

- Geopolitical Landscape: Global political instability and increasing defense budgets worldwide are often positive catalysts for Lockheed Martin's growth.

H2: Analyzing Total Returns (Including Dividends)

To accurately assess the performance of a long-term investment in Lockheed Martin, one must consider both capital appreciation and dividend reinvestment. While precise figures require access to historical stock data and dividend records, a general observation is that total returns over 20 years likely exceeded those of many broader market indices. However, past performance is not indicative of future results.

H2: What Does the Future Hold for LMT Investors?

Predicting future stock performance is always challenging. However, Lockheed Martin's strong financial position, consistent innovation, and the current geopolitical environment suggest a continued positive outlook for the company. However, investors should always conduct thorough due diligence and consider their personal risk tolerance before investing in any stock.

H3: Disclaimer: This article is for informational purposes only and does not constitute financial advice. Consult with a qualified financial advisor before making any investment decisions.

H2: Learn More:

To delve deeper into Lockheed Martin's financial performance, consult their official investor relations website. You can also research market analysis reports from reputable financial institutions for further insights.

By understanding the complexities of investing in Lockheed Martin and considering historical data, potential investors can make more informed decisions about incorporating LMT into their long-term investment portfolios. Remember to always prioritize thorough research and diversification as key elements of a sound investment strategy.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Investing In Lockheed Martin: A 20-Year Retrospective On Stock Returns. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Jaws At 50 How Spielbergs Masterpiece Redefined Shark Movies And Pop Culture

Jun 22, 2025

Jaws At 50 How Spielbergs Masterpiece Redefined Shark Movies And Pop Culture

Jun 22, 2025 -

Palestine Actions Future Uncertain Following Illegal Raf Base Entry

Jun 22, 2025

Palestine Actions Future Uncertain Following Illegal Raf Base Entry

Jun 22, 2025 -

Siempre Un Pacificador El Rol De Trump En La Crisis Con Iran

Jun 22, 2025

Siempre Un Pacificador El Rol De Trump En La Crisis Con Iran

Jun 22, 2025 -

Official Name Revealed Megan Fox And Mgks Newborn Daughter

Jun 22, 2025

Official Name Revealed Megan Fox And Mgks Newborn Daughter

Jun 22, 2025 -

Machine Gun Kelly Reveals The Inspiration For Daughter Sagas Name

Jun 22, 2025

Machine Gun Kelly Reveals The Inspiration For Daughter Sagas Name

Jun 22, 2025

Latest Posts

-

Estados Unidos Bombardea Tres Sitios Nucleares En Iran Escalada De La Tension

Jun 22, 2025

Estados Unidos Bombardea Tres Sitios Nucleares En Iran Escalada De La Tension

Jun 22, 2025 -

The Tze Elim Bet Disaster A Consequence Of Mossads Failed Operation Bramble Bush

Jun 22, 2025

The Tze Elim Bet Disaster A Consequence Of Mossads Failed Operation Bramble Bush

Jun 22, 2025 -

Trump Y El Ataque A Iran Por Que Se Pospuso La Accion Militar

Jun 22, 2025

Trump Y El Ataque A Iran Por Que Se Pospuso La Accion Militar

Jun 22, 2025 -

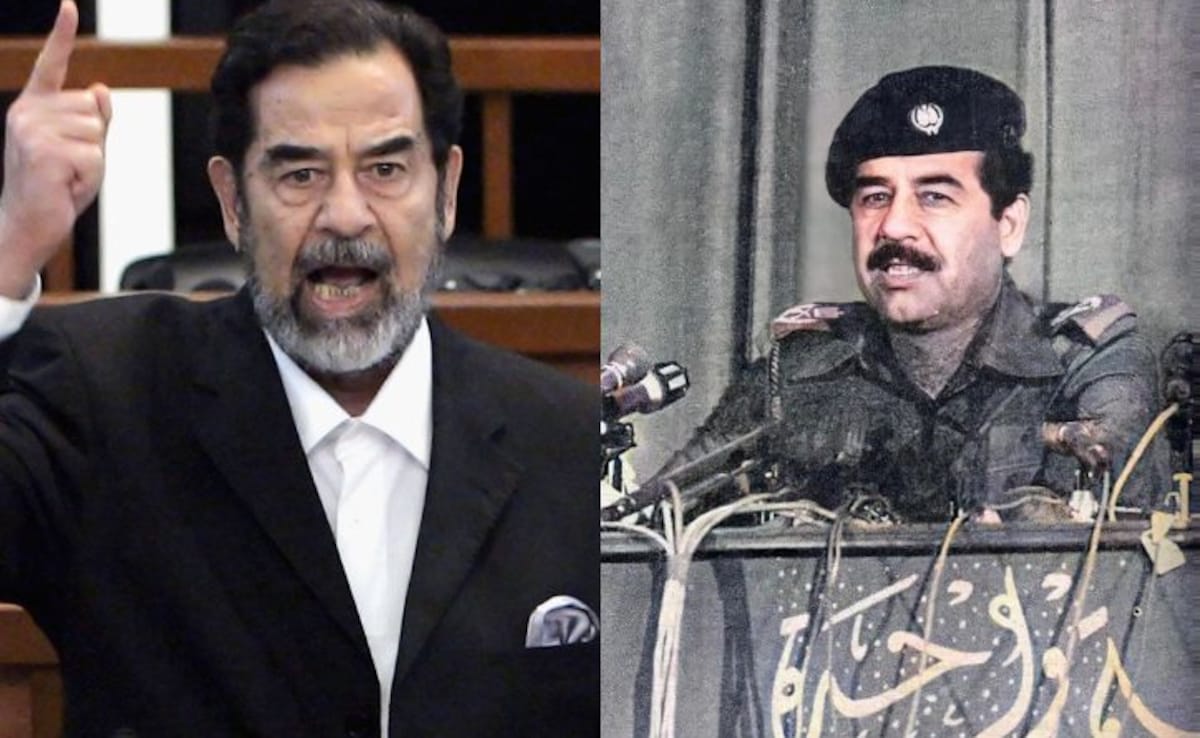

Operation Bramble Bush Examining Mossads Failed Attempt To Eliminate Saddam Hussein

Jun 22, 2025

Operation Bramble Bush Examining Mossads Failed Attempt To Eliminate Saddam Hussein

Jun 22, 2025 -

Tension Internacional Ataque A Instalaciones Nucleares Iranies Ultima Hora

Jun 22, 2025

Tension Internacional Ataque A Instalaciones Nucleares Iranies Ultima Hora

Jun 22, 2025