Investing In Robinhood: A Look At The Stock's Potential

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Investing in Robinhood: A Look at the Stock's Potential

The meteoric rise and subsequent fall of Robinhood Markets, Inc. (HOOD) has captivated investors. Once a darling of the millennial investing world, its stock price has experienced significant volatility. But is now the time to consider investing in Robinhood? This in-depth analysis explores the company's potential, risks, and what investors should consider before taking the plunge.

Robinhood's Rise and Fall:

Robinhood revolutionized investing with its commission-free trading platform, attracting millions of new users. Its user-friendly interface and gamified approach democratized access to the stock market. However, this rapid growth wasn't without its challenges. Regulatory scrutiny, increased competition, and a shift in market sentiment led to a sharp decline in its stock price. The company faced significant criticism following the GameStop saga and continues to navigate a complex regulatory landscape.

Analyzing Robinhood's Current State:

Despite the challenges, Robinhood retains a substantial user base and is actively developing new features and services. These include expanding its offerings beyond stock trading to include cryptocurrencies, options, and other investment products. The company is also working to diversify its revenue streams, reducing its reliance on transaction-based revenue.

Key Factors to Consider:

- Revenue Diversification: Robinhood's ability to diversify its revenue streams beyond trading commissions is crucial for long-term success. The development of new products and services will be key to attracting and retaining users.

- Regulatory Landscape: Navigating the ever-changing regulatory environment will be a significant challenge for Robinhood. Any major regulatory changes could significantly impact its business model.

- Competition: The online brokerage industry is highly competitive, with established players like Fidelity and Charles Schwab constantly innovating. Robinhood needs to maintain its competitive edge to attract and retain users.

- Market Sentiment: Investor sentiment towards Robinhood remains volatile. News and market events can significantly impact its stock price.

Potential Growth Areas:

While risks are present, several potential growth areas exist for Robinhood:

- International Expansion: Expanding into new international markets could significantly increase its user base and revenue.

- Enhanced Features and Services: Continuing to develop and improve its platform with new features and services will attract and retain users.

- Financial Education Initiatives: Investing in financial education initiatives could help improve user engagement and retention.

Is it a Buy, Sell, or Hold?

The decision to invest in Robinhood is a complex one, depending heavily on your risk tolerance and investment strategy. The stock carries significant risk, but the potential for growth is also considerable. Before investing, it's crucial to conduct thorough due diligence, considering the factors outlined above. Consulting with a financial advisor is recommended, especially for those new to investing.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Investing in the stock market involves risk, and you could lose money.

Further Research: For more detailed information on Robinhood's financial performance, visit the company's investor relations website and review recent SEC filings. You can also research analyst reports and articles from reputable financial news sources. Remember to always diversify your portfolio and invest responsibly.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Investing In Robinhood: A Look At The Stock's Potential. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Rangers Coaching Staff Bolstered By Quinn And Sacco Additions

Jun 05, 2025

Rangers Coaching Staff Bolstered By Quinn And Sacco Additions

Jun 05, 2025 -

Supreme Court Weighs In On Reverse Discrimination A Case Of Gender Bias

Jun 05, 2025

Supreme Court Weighs In On Reverse Discrimination A Case Of Gender Bias

Jun 05, 2025 -

Understanding The Potential 420 000 Retirement Cut In The Gops New Plan

Jun 05, 2025

Understanding The Potential 420 000 Retirement Cut In The Gops New Plan

Jun 05, 2025 -

Netherlands Government Crumbles Wilders Party Exit Triggers Coalition Collapse

Jun 05, 2025

Netherlands Government Crumbles Wilders Party Exit Triggers Coalition Collapse

Jun 05, 2025 -

Buffetts Recent Us Investment Sell Off A Shift In Strategy

Jun 05, 2025

Buffetts Recent Us Investment Sell Off A Shift In Strategy

Jun 05, 2025

Latest Posts

-

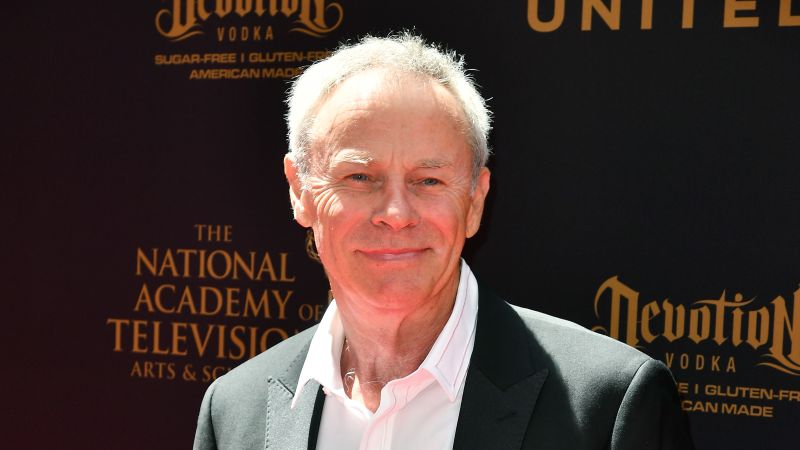

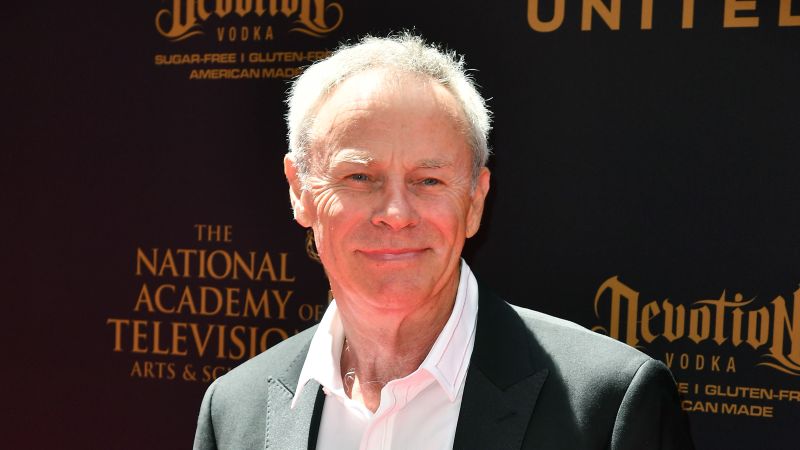

Tristan Rogers Dead At 79 Remembering Robert Scorpio Of General Hospital

Aug 17, 2025

Tristan Rogers Dead At 79 Remembering Robert Scorpio Of General Hospital

Aug 17, 2025 -

Keita Nakagawas Game Tying Home Run Fuels Orix Comeback

Aug 17, 2025

Keita Nakagawas Game Tying Home Run Fuels Orix Comeback

Aug 17, 2025 -

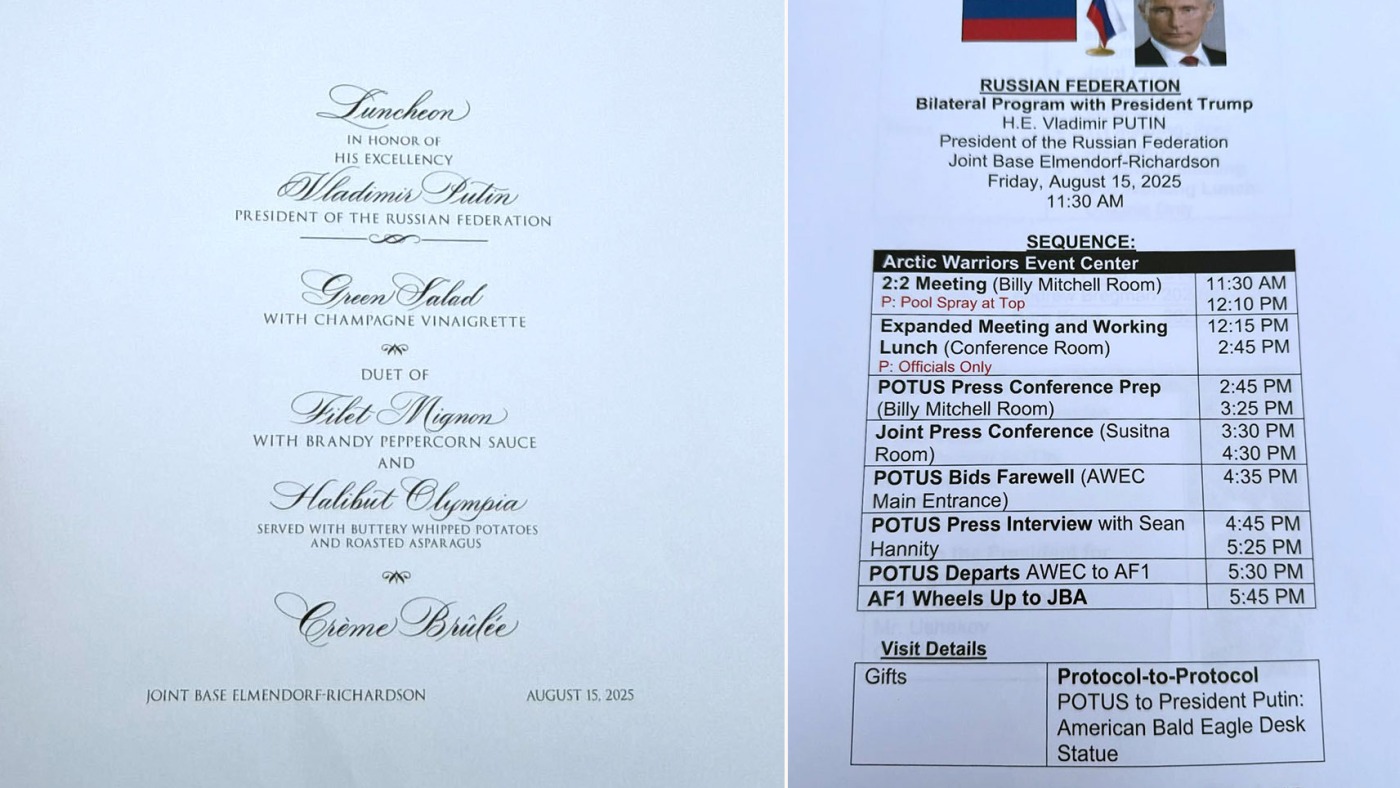

Newly Found Documents Shed Light On Trump Putin Meeting In Alaska

Aug 17, 2025

Newly Found Documents Shed Light On Trump Putin Meeting In Alaska

Aug 17, 2025 -

Actor Tristan Rogers Iconic General Hospital Star Passes Away At 79

Aug 17, 2025

Actor Tristan Rogers Iconic General Hospital Star Passes Away At 79

Aug 17, 2025 -

Premier League Racism Antoine Semenyo Details Abuse During Liverpool Game

Aug 17, 2025

Premier League Racism Antoine Semenyo Details Abuse During Liverpool Game

Aug 17, 2025