Investing In SiriusXM Holdings: Weighing The Potential For Future Gains.

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Investing in SiriusXM Holdings: Weighing the Potential for Future Gains

SiriusXM Holdings Inc. (SIRI) has carved a niche as a dominant player in the satellite radio industry. But is it a smart investment for your portfolio? This in-depth analysis explores the potential for future gains, examining the company's strengths, weaknesses, and the overall market landscape. We'll delve into the factors you need to consider before adding SIRI to your watchlist or making a purchase.

SiriusXM's Strengths: A Solid Foundation for Growth?

SiriusXM boasts a substantial subscriber base, a key indicator of its market dominance. This loyal customer base provides a stable revenue stream, crucial for long-term growth. The company's diverse content offerings, including ad-free music, sports, news, and talk radio, cater to a wide range of listeners. This diversification helps mitigate risk associated with relying on a single content type.

Furthermore, SiriusXM's strategic partnerships and acquisitions have broadened its reach and content library, strengthening its competitive position. Their foray into podcasting, for example, taps into a rapidly expanding segment of the audio entertainment market. This proactive approach to innovation is crucial in a constantly evolving media landscape.

- Strong Subscriber Base: A large and relatively stable subscriber count provides a reliable revenue stream.

- Diverse Content Portfolio: Catering to diverse interests minimizes reliance on single content types.

- Strategic Partnerships & Acquisitions: Expand reach and content library, enhancing competitive advantage.

- Podcasting Expansion: Taps into a burgeoning and lucrative market segment.

Challenges and Risks: Navigating the Road Ahead

While SiriusXM presents a compelling investment case, it's vital to acknowledge potential challenges. The increasing popularity of streaming services poses a significant threat. Platforms like Spotify and Apple Music offer similar audio content, often at a lower price point. This competitive pressure necessitates continuous innovation and strategic adaptation from SiriusXM to maintain its market share.

Furthermore, economic downturns can impact consumer spending, potentially leading to subscriber churn. The automotive industry, a significant driver of SiriusXM subscriptions, is also sensitive to economic fluctuations. Therefore, understanding these macroeconomic factors is crucial for assessing investment risk.

- Competition from Streaming Services: The rise of streaming platforms presents a substantial challenge.

- Economic Sensitivity: Recessions can impact subscriber numbers and overall revenue.

- Dependence on the Automotive Industry: Fluctuations in the auto market can affect subscription growth.

Analyzing the Financial Performance: A Key Indicator

Before investing in any stock, it's crucial to analyze its financial performance. Review SiriusXM's financial statements, paying close attention to key metrics like revenue growth, profit margins, and debt levels. Compare its performance to industry peers and consider long-term trends. [Link to SiriusXM Investor Relations]. Understanding these financial indicators will provide a clearer picture of the company's health and potential for future profitability.

Conclusion: Is SiriusXM a Buy?

Investing in SiriusXM involves weighing its inherent strengths against the considerable competitive pressures and macroeconomic risks. The company's strong subscriber base and diverse content offer a solid foundation. However, its vulnerability to streaming services and economic downturns necessitates careful consideration. Thorough due diligence, including a comprehensive analysis of financial statements and industry trends, is crucial before making any investment decision. Consult with a financial advisor to determine if SiriusXM aligns with your individual investment goals and risk tolerance. Remember, this analysis is for informational purposes and does not constitute financial advice.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Investing In SiriusXM Holdings: Weighing The Potential For Future Gains.. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

End Of The Line For I Os 18 4 1 Apple Prevents Downgrades And Restores

May 27, 2025

End Of The Line For I Os 18 4 1 Apple Prevents Downgrades And Restores

May 27, 2025 -

Legal Battle Brews Texas Woman Fights For 83 5 Million Lottery Jackpot

May 27, 2025

Legal Battle Brews Texas Woman Fights For 83 5 Million Lottery Jackpot

May 27, 2025 -

I Os 18 4 1 Potential Bugs And Performance Issues

May 27, 2025

I Os 18 4 1 Potential Bugs And Performance Issues

May 27, 2025 -

Sirius Xm Is This Stock Still A Millionaire Maker A Deep Dive

May 27, 2025

Sirius Xm Is This Stock Still A Millionaire Maker A Deep Dive

May 27, 2025 -

Yankees Star Giancarlo Stanton A Disappointing Injury Report

May 27, 2025

Yankees Star Giancarlo Stanton A Disappointing Injury Report

May 27, 2025

Latest Posts

-

Beyond Gates And Buffett Analyzing The 600 Billion Commitment To Charity

May 28, 2025

Beyond Gates And Buffett Analyzing The 600 Billion Commitment To Charity

May 28, 2025 -

Did You Receive A Fraudulent Text From The Ga Dds Heres What To Do

May 28, 2025

Did You Receive A Fraudulent Text From The Ga Dds Heres What To Do

May 28, 2025 -

Liverpools Championship Parade Understanding The Recent Incident

May 28, 2025

Liverpools Championship Parade Understanding The Recent Incident

May 28, 2025 -

Harvards Elitism A Convenient Target For Trumps Rhetoric

May 28, 2025

Harvards Elitism A Convenient Target For Trumps Rhetoric

May 28, 2025 -

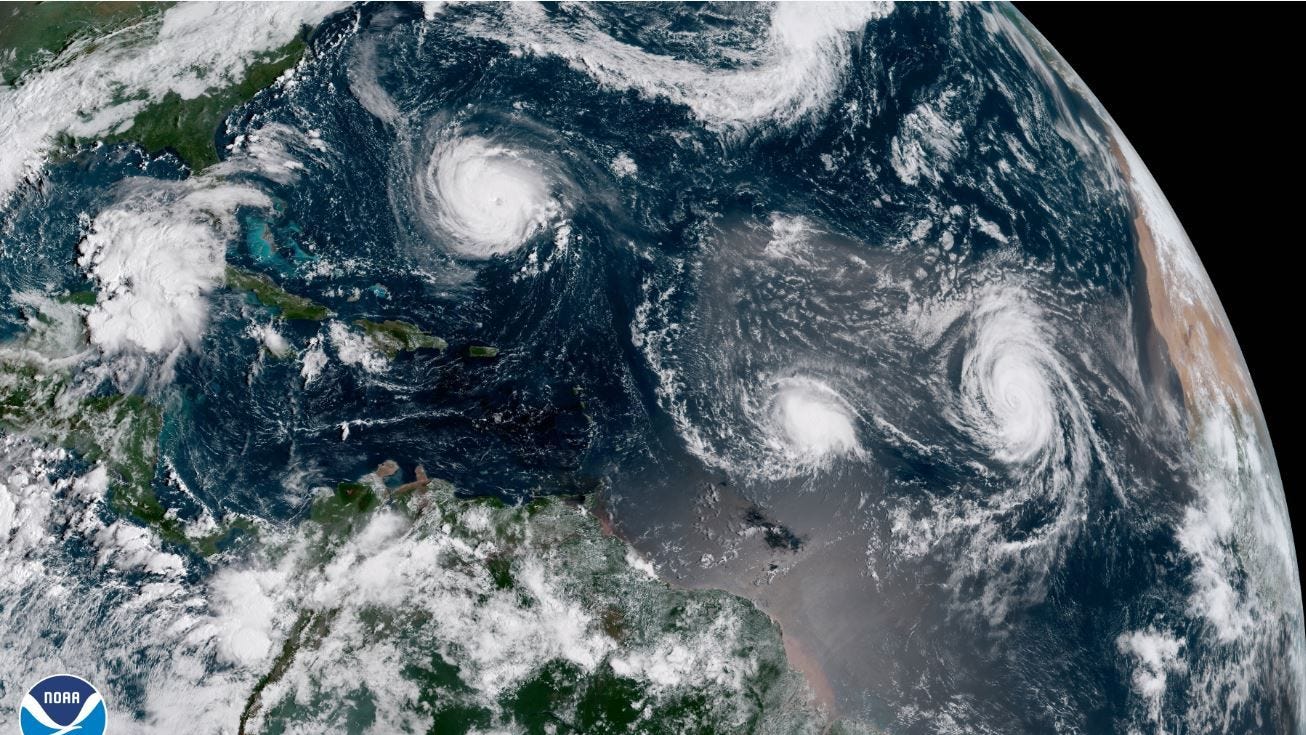

Frequently Asked Questions About The 2025 Atlantic Hurricane Season

May 28, 2025

Frequently Asked Questions About The 2025 Atlantic Hurricane Season

May 28, 2025