Investing In SiriusXM: Weighing The Risks And Rewards

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Investing in SiriusXM: Weighing the Risks and Rewards

Satellite radio giant SiriusXM (SIRI) has captivated investors for years, offering a blend of potential rewards and inherent risks. Is now the right time to invest? This in-depth analysis explores the factors you should consider before adding SiriusXM to your portfolio.

SiriusXM: A Deep Dive into the Satellite Radio Landscape

SiriusXM Holdings Inc. dominates the satellite radio market in North America, boasting millions of subscribers. Their success is built on a foundation of exclusive programming, including popular talk radio shows, commercial-free music channels, and sports coverage. This broad appeal contributes to a relatively stable subscriber base, a key factor for investors. However, the landscape is evolving, and competition from streaming services presents a significant challenge.

The Allure of SiriusXM: Potential Rewards for Investors

Several factors contribute to SiriusXM's attractiveness as an investment:

- Recurring Revenue Streams: The subscription-based nature of the business model provides predictable revenue streams, crucial for long-term stability. This consistent cash flow is a major draw for investors seeking lower-risk opportunities.

- Strong Brand Recognition: SiriusXM enjoys significant brand recognition and loyalty among its subscribers. This established brand presence provides a solid competitive advantage.

- Potential for Growth: While facing competition, SiriusXM continues to explore avenues for growth, including partnerships with automakers for factory-installed radios and expansion into new audio content formats. This forward-looking approach offers potential for future gains.

- Dividend Potential: For income-focused investors, SiriusXM's history of dividend payments can be a compelling incentive. However, always remember that dividends are not guaranteed and can be affected by company performance.

Navigating the Risks: Challenges Facing SiriusXM Investors

Despite its strengths, SiriusXM isn't without its challenges:

- Competition from Streaming Services: The rise of streaming music and podcast platforms like Spotify and Apple Music poses a significant threat to SiriusXM's subscriber base. These services often offer more affordable and diverse content options.

- Technological Advancements: The industry is constantly evolving. Changes in technology and consumer preferences could impact the demand for satellite radio.

- Economic Sensitivity: Subscription services can be vulnerable to economic downturns. During periods of economic uncertainty, consumers might be more likely to cut back on non-essential services like satellite radio.

- Debt Levels: Like many companies, SiriusXM carries a significant amount of debt. High debt levels can increase financial risk and vulnerability during economic instability.

Analyzing the Investment Landscape: Is SiriusXM Right for You?

Before investing in SiriusXM, consider your individual investment goals and risk tolerance. Consult with a financial advisor to determine if this investment aligns with your overall financial strategy.

Factors to Consider:

- Your Risk Tolerance: Are you comfortable with the inherent risks associated with investing in a company facing competitive pressures?

- Long-Term vs. Short-Term Goals: Are you investing for long-term growth or seeking short-term gains? SiriusXM's value proposition might be better suited for long-term investors.

- Diversification: Remember the importance of diversification within your investment portfolio. Don't put all your eggs in one basket!

Conclusion: A Measured Approach to SiriusXM

Investing in SiriusXM presents a compelling opportunity, but it's crucial to approach it with a balanced perspective. While the company's strong brand and recurring revenue streams offer stability, the competitive landscape and economic sensitivities warrant careful consideration. Thorough research and consultation with a financial professional are essential before making any investment decision. Remember to always conduct your own due diligence before investing in any stock.

Disclaimer: This article provides general information and should not be considered financial advice. Investing involves risk, and you could lose money.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Investing In SiriusXM: Weighing The Risks And Rewards. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Brigitte Macron Shoving Incident Macrons Official Response

May 28, 2025

Brigitte Macron Shoving Incident Macrons Official Response

May 28, 2025 -

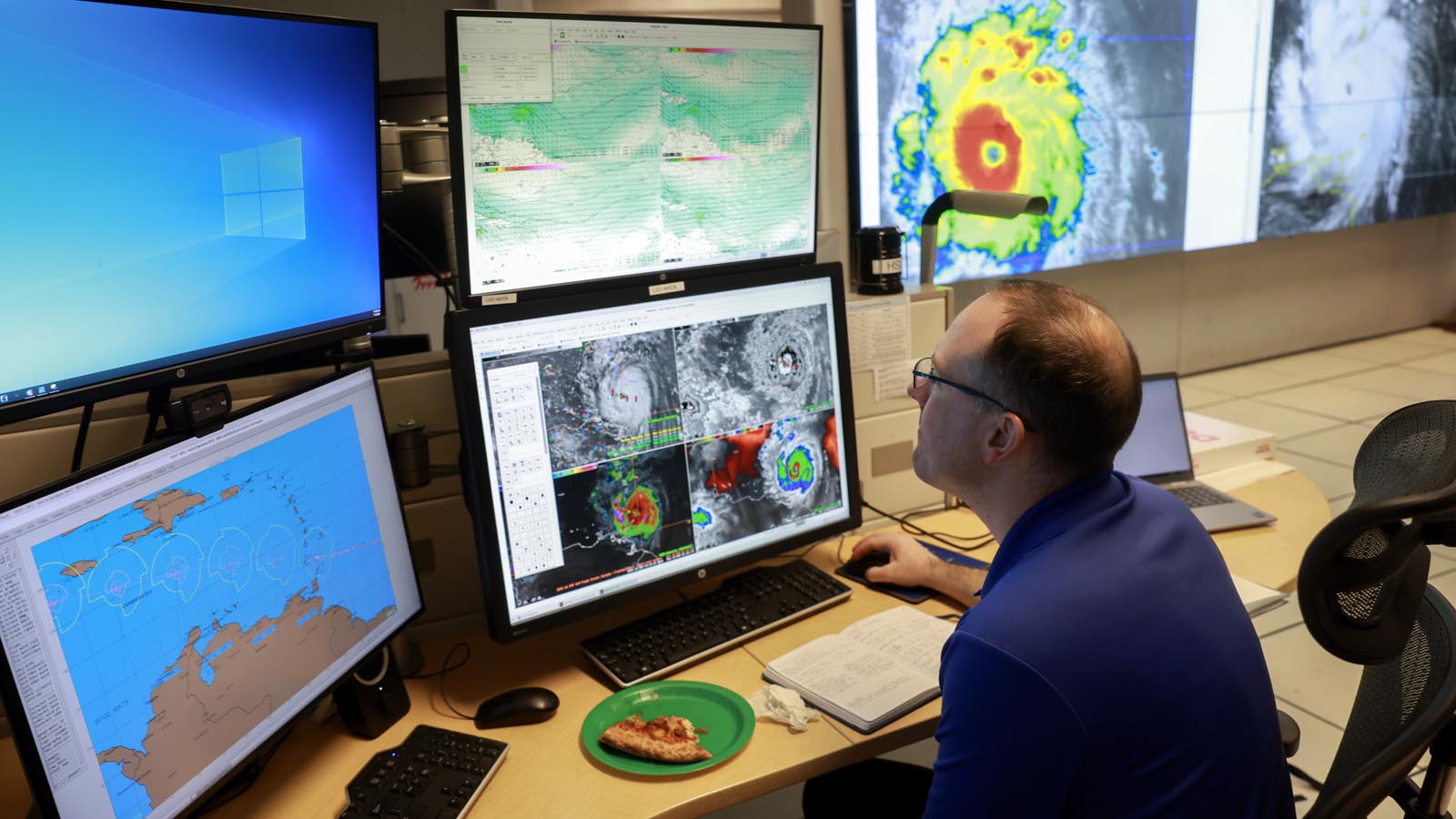

Evaluating Hurricane Models A 2025 Forecast Accuracy Comparison

May 28, 2025

Evaluating Hurricane Models A 2025 Forecast Accuracy Comparison

May 28, 2025 -

The Ups And Downs Of Michelle Mone A Business Biography

May 28, 2025

The Ups And Downs Of Michelle Mone A Business Biography

May 28, 2025 -

73 Arrests Stabbings Mark Chaotic Memorial Day Weekend In Beach Town

May 28, 2025

73 Arrests Stabbings Mark Chaotic Memorial Day Weekend In Beach Town

May 28, 2025 -

Uk And Ireland To See 7 000 New Kfc Jobs In Expansion Drive

May 28, 2025

Uk And Ireland To See 7 000 New Kfc Jobs In Expansion Drive

May 28, 2025

Latest Posts

-

Confirmation Elon Musk Steps Down From Trump Administration Position

May 30, 2025

Confirmation Elon Musk Steps Down From Trump Administration Position

May 30, 2025 -

Facing Imminent Attack Ukraines Ambitious Drone Defense Strategy

May 30, 2025

Facing Imminent Attack Ukraines Ambitious Drone Defense Strategy

May 30, 2025 -

Today Show Co Host Sheinelle Jones Mourns The Loss Of Her Husband

May 30, 2025

Today Show Co Host Sheinelle Jones Mourns The Loss Of Her Husband

May 30, 2025 -

The Housing Market Imbalance A 12 Year High In Seller Dominance

May 30, 2025

The Housing Market Imbalance A 12 Year High In Seller Dominance

May 30, 2025 -

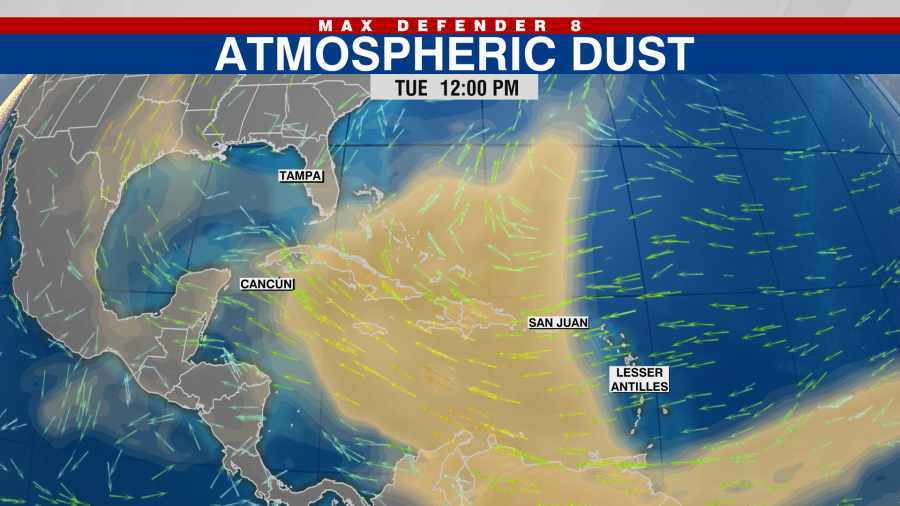

Saharan Dust Storm Understanding The Florida Forecast And Health Impacts

May 30, 2025

Saharan Dust Storm Understanding The Florida Forecast And Health Impacts

May 30, 2025