Investment Update: Birmingham Capital Management Divests 20,850 Bank Of America Shares

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Investment Update: Birmingham Capital Management Sheds Bank of America Stake

Birmingham, AL – October 26, 2023 – Birmingham Capital Management, a prominent investment firm, announced today a significant divestment from its holdings in Bank of America Corporation (BAC). The firm sold 20,850 shares of BAC, a move that has sparked interest amongst market analysts and investors alike. This strategic decision sheds light on Birmingham Capital Management's evolving investment strategy and potentially indicates shifting market sentiment regarding the financial giant.

The exact reasons behind the divestment remain undisclosed. However, several factors could be contributing to this decision. Industry experts suggest that several macro-economic influences, including rising interest rates and potential recessionary pressures, could be prompting portfolio adjustments across the investment sector. Birmingham Capital Management's decision might reflect a broader trend of reassessing exposure to financial institutions in a period of economic uncertainty.

Analyzing Birmingham Capital Management's Move

Birmingham Capital Management's portfolio adjustments are closely watched within the investment community. Their decisions often serve as a barometer for market trends, influencing other investors and potentially impacting BAC's stock price. This recent divestment, while significant in volume, represents only a portion of their overall holdings. The firm remains a substantial investor in the broader financial sector, highlighting a diversified approach to investment.

The sale of 20,850 shares could indicate several possibilities:

- Portfolio Rebalancing: Birmingham Capital Management may be rebalancing its portfolio to adjust its risk profile or to capitalize on opportunities in other sectors showing stronger growth potential.

- Profit-Taking: The firm might have decided to take profits from its BAC investment given potential price appreciation in recent months.

- Strategic Shift: The divestment could signal a more significant strategic shift in Birmingham Capital Management's investment strategy, potentially favoring other sectors deemed more promising in the current economic climate.

Further details about the rationale behind the sale are expected in the coming weeks. A formal statement from Birmingham Capital Management is anticipated to provide additional clarity.

Implications for Bank of America and the Broader Market

While the impact of this single divestment on Bank of America's stock price might be relatively minor in the grand scheme, it contributes to the ongoing narrative surrounding the financial sector's performance. Analysts will be carefully scrutinizing the broader implications of this move, considering the overall market conditions and the influence of other significant investors.

The sale also highlights the importance of diligent portfolio management in navigating periods of economic uncertainty. For individual investors, this event serves as a reminder to regularly review their investment portfolios and adjust their holdings based on market conditions and personal financial goals. Consult with a financial advisor to ensure your investment strategy aligns with your risk tolerance and long-term financial objectives.

Staying Informed on Market Trends

Keeping abreast of market news and understanding major investment decisions is crucial for both individual and institutional investors. Following financial news sources and staying updated on the activities of major investment firms like Birmingham Capital Management can help investors make informed decisions and navigate the complexities of the investment landscape. [Link to relevant financial news website].

Disclaimer: This article provides general information and does not constitute financial advice. Always consult with a qualified financial advisor before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Investment Update: Birmingham Capital Management Divests 20,850 Bank Of America Shares. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

King Charles Iiis Impactful Canadian Tour A Royal Visit During Political Upheaval

May 28, 2025

King Charles Iiis Impactful Canadian Tour A Royal Visit During Political Upheaval

May 28, 2025 -

Hunger In Gaza Bbc Focuses On Infant Affected By Blockade

May 28, 2025

Hunger In Gaza Bbc Focuses On Infant Affected By Blockade

May 28, 2025 -

Anson Mount Discusses His Most Challenging Star Trek Strange New Worlds Moment

May 28, 2025

Anson Mount Discusses His Most Challenging Star Trek Strange New Worlds Moment

May 28, 2025 -

Long Awaited Return Four Wwii Bomber Crew Members Coming Home

May 28, 2025

Long Awaited Return Four Wwii Bomber Crew Members Coming Home

May 28, 2025 -

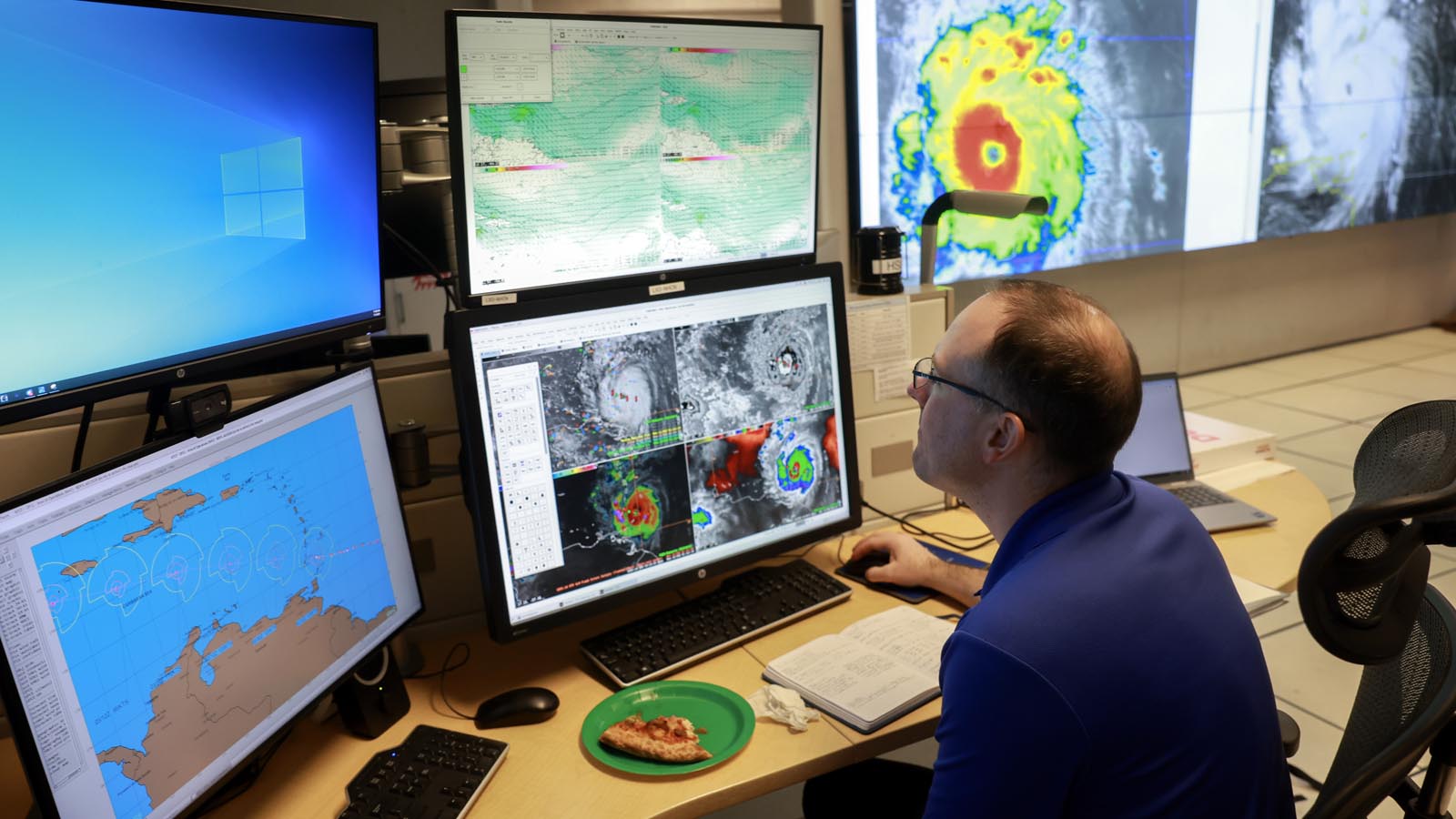

Understanding Hurricane Model Reliability In 2025

May 28, 2025

Understanding Hurricane Model Reliability In 2025

May 28, 2025

Latest Posts

-

Kidnapped And Sold Joshlin Smiths Mother Receives Jail Sentence In South Africa

May 31, 2025

Kidnapped And Sold Joshlin Smiths Mother Receives Jail Sentence In South Africa

May 31, 2025 -

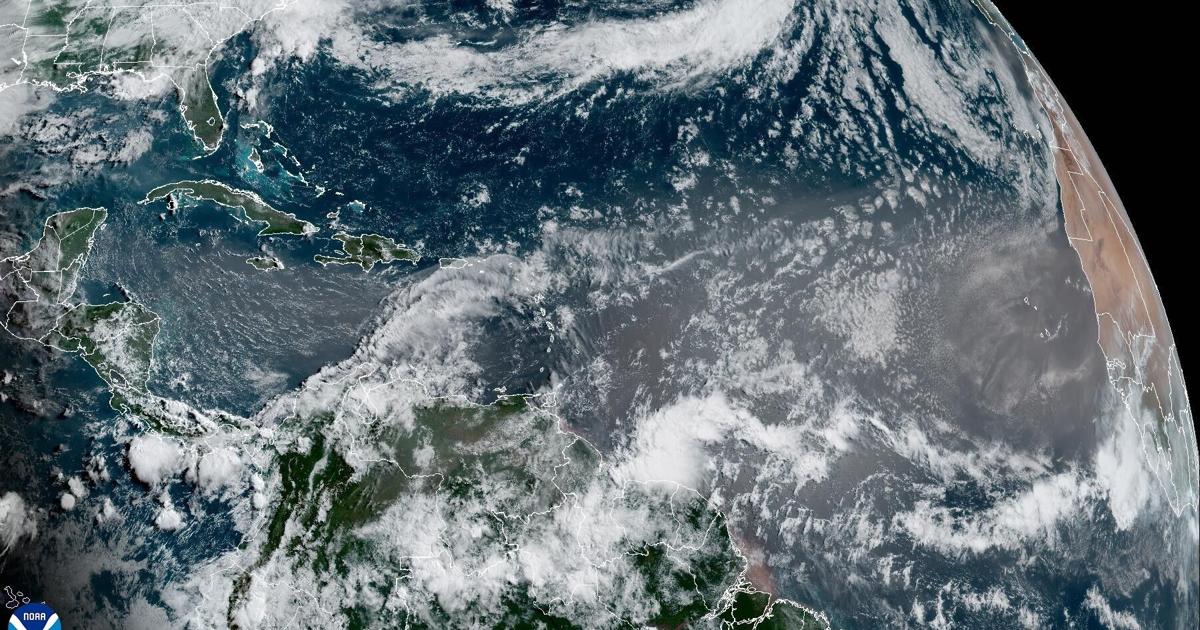

Dramatic Louisiana Sunsets Predicted Saharan Dust Plume On The Way

May 31, 2025

Dramatic Louisiana Sunsets Predicted Saharan Dust Plume On The Way

May 31, 2025 -

Air Traffic Control Crisis At Newark Airport A Proposed Solution

May 31, 2025

Air Traffic Control Crisis At Newark Airport A Proposed Solution

May 31, 2025 -

Holger Runes Third Round Berth At French Open A Dominant Display

May 31, 2025

Holger Runes Third Round Berth At French Open A Dominant Display

May 31, 2025 -

Joshlin Smith Kidnapping Mother Kelly Jailed In South Africa

May 31, 2025

Joshlin Smith Kidnapping Mother Kelly Jailed In South Africa

May 31, 2025