Investment Update: Perpetual Equity Reports Strong NTA Backing

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Investment Update: Perpetual Equity Reports Strong NTA Backing

Perpetual Equity's latest results showcase robust net tangible asset (NTA) backing, bolstering investor confidence. The fund manager has announced impressive figures, highlighting a strong underlying position and reinforcing its commitment to delivering sustainable returns for investors. This news comes as a welcome boost amidst ongoing market volatility.

Perpetual, a well-established name in the Australian investment landscape, has consistently demonstrated a commitment to responsible investing and long-term value creation. This latest NTA update further solidifies their position as a reliable and dependable investment option. For those unfamiliar with NTA, it's a crucial metric reflecting the net asset value of a company or fund, representing the value of assets minus liabilities. A strong NTA suggests a healthy financial foundation and indicates the underlying value of the investments held.

What does this mean for investors?

A robust NTA backing, as reported by Perpetual Equity, offers several key benefits to investors:

- Increased Confidence: The strong NTA provides reassurance, particularly during periods of market uncertainty. Investors can feel more confident in their investment's underlying value.

- Potential for Growth: A healthy NTA often serves as a foundation for future growth and potential capital appreciation. This positive indicator suggests ongoing potential for returns.

- Reduced Risk: While no investment is entirely without risk, a strong NTA generally translates to a lower risk profile, offering investors more stability.

Deeper Dive into Perpetual Equity's Performance

Perpetual's success can be attributed to several factors, including:

- Experienced Investment Team: Their team boasts years of experience and expertise in navigating complex market conditions. This skilled management is crucial for consistent performance.

- Strategic Investment Approach: Perpetual employs a well-defined investment strategy focused on long-term value creation, rather than short-term gains. This approach minimizes volatility and maximizes long-term returns.

- Focus on Sustainable Investing: Increasingly, investors prioritize environmentally and socially responsible investments (ESG). Perpetual’s commitment to sustainable investing aligns with this growing trend, attracting a wider investor base.

Looking Ahead: Opportunities and Challenges

While the current NTA figures are positive, investors should always remain aware of potential market risks. Geopolitical events, economic fluctuations, and unforeseen circumstances can all impact investment performance. However, Perpetual's strong NTA backing provides a significant buffer against potential market downturns.

Further Research: For a more in-depth understanding of Perpetual Equity’s performance and investment strategy, we recommend visiting their official website [insert link to Perpetual Equity website here]. You can also consult with a qualified financial advisor to discuss whether this investment aligns with your individual risk tolerance and financial goals.

Conclusion: A Positive Sign for Investors

Perpetual Equity's strong NTA backing is undoubtedly positive news for existing and prospective investors. It reinforces the fund's financial health and suggests a promising outlook for future returns. This update underscores the importance of due diligence and the need to consider long-term investment strategies. While past performance is not indicative of future results, the strong NTA provides a significant level of comfort for those considering investing in Perpetual Equity or similar funds. Remember to always conduct thorough research and seek professional advice before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Investment Update: Perpetual Equity Reports Strong NTA Backing. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

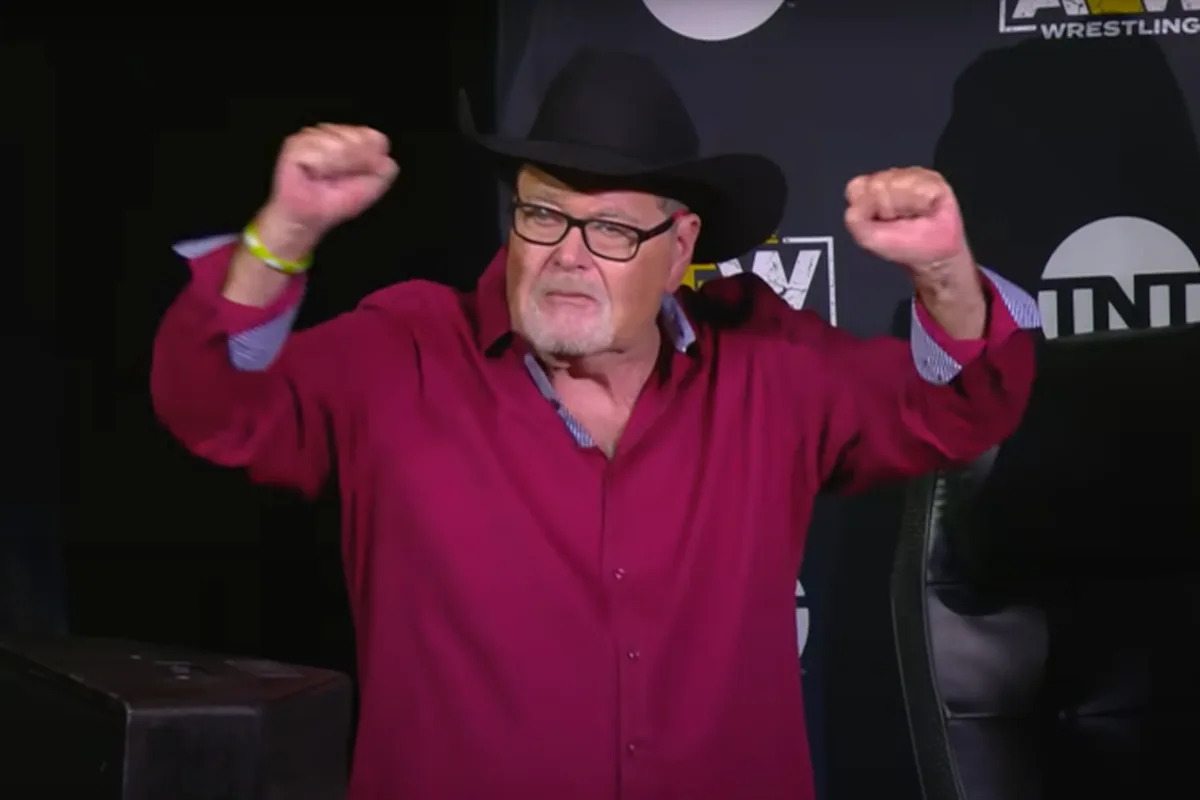

Jim Ross Cancer Free Announces All In Texas Attendance

Jul 08, 2025

Jim Ross Cancer Free Announces All In Texas Attendance

Jul 08, 2025 -

Plan Your Asheville Trip Mountains History And Unforgettable Views

Jul 08, 2025

Plan Your Asheville Trip Mountains History And Unforgettable Views

Jul 08, 2025 -

Perpetual Equity Investment Provides Nta Backing Update

Jul 08, 2025

Perpetual Equity Investment Provides Nta Backing Update

Jul 08, 2025 -

Perpetual Equity Net Tangible Asset Backing Update For July 2025

Jul 08, 2025

Perpetual Equity Net Tangible Asset Backing Update For July 2025

Jul 08, 2025 -

Twenty Years Post 7 7 Assessing The Uks Counter Terrorism Success

Jul 08, 2025

Twenty Years Post 7 7 Assessing The Uks Counter Terrorism Success

Jul 08, 2025

Latest Posts

-

Guest Leaves Baby Shower After Infertility Joke A Story Of Hurt Feelings

Jul 08, 2025

Guest Leaves Baby Shower After Infertility Joke A Story Of Hurt Feelings

Jul 08, 2025 -

Cnn Mounted Volunteers Aid In Locating Missing Individuals

Jul 08, 2025

Cnn Mounted Volunteers Aid In Locating Missing Individuals

Jul 08, 2025 -

Archita Phukans Shocking Confession R25 Lakh Paid To Leave Prostitution

Jul 08, 2025

Archita Phukans Shocking Confession R25 Lakh Paid To Leave Prostitution

Jul 08, 2025 -

Fergie Snubs King Charles Offer Protecting Andrews Feelings

Jul 08, 2025

Fergie Snubs King Charles Offer Protecting Andrews Feelings

Jul 08, 2025 -

Thousands Of Flights Disrupted In The Us Holiday Weekend Travel Aftermath

Jul 08, 2025

Thousands Of Flights Disrupted In The Us Holiday Weekend Travel Aftermath

Jul 08, 2025