Is A Recession Coming? Jamie Dimon's Sobering Economic Outlook

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Is a Recession Coming? Jamie Dimon's Sobering Economic Outlook Sparks Debate

The American economy is facing a storm, and JPMorgan Chase CEO Jamie Dimon's recent warnings about a potential recession are fueling anxieties across Wall Street and Main Street alike. Dimon, known for his candid assessments of the economic landscape, painted a picture far from rosy, prompting widespread discussion about the likelihood of an impending downturn. But what exactly did Dimon say, and how credible are his predictions? Let's delve into the details.

Dimon's Dire Predictions: More Than Just a "Hurricane"

While Dimon famously likened the brewing economic storm to a "hurricane" earlier this year, his recent comments suggest the brewing tempest may be even more severe. He emphasized several key factors contributing to his pessimistic outlook:

-

Inflationary Pressures: Persistently high inflation continues to erode consumer purchasing power and stifle economic growth. The Federal Reserve's aggressive interest rate hikes, while aimed at curbing inflation, risk triggering a recession by slowing economic activity too sharply. This delicate balancing act is a central concern for economists worldwide. Learn more about the .

-

Geopolitical Uncertainty: The ongoing war in Ukraine, coupled with escalating global tensions, is creating significant uncertainty and disrupting supply chains. This uncertainty makes it difficult for businesses to plan for the future and invest in growth, further contributing to economic instability. Understanding the is crucial in navigating these uncertain times.

-

Consumer Spending Slowdown: While consumer spending remains a significant driver of the US economy, recent data suggests a potential slowdown. Rising interest rates, coupled with inflation, are impacting consumer confidence and reducing disposable income, leading to decreased spending. This decreased spending could trigger a domino effect throughout the economy.

What Does This Mean for the Average American?

Dimon's warnings aren't just abstract economic forecasts; they have real-world implications for everyday Americans. A recession could lead to:

- Increased Unemployment: Companies may be forced to cut jobs to reduce costs in a downturn, leading to higher unemployment rates.

- Reduced Wages: Wage growth may stagnate or even decline as businesses struggle to maintain profitability.

- Higher Interest Rates: Borrowing money becomes more expensive, impacting everything from mortgages and auto loans to business investments.

Is a Recession Inevitable? The Debate Rages On.

While Dimon's warnings are certainly cause for concern, it's important to remember that a recession isn't guaranteed. Many economists hold differing opinions, with some arguing that the economy is resilient enough to weather the storm. The ultimate outcome will depend on several factors, including the effectiveness of Federal Reserve policies and the evolution of geopolitical events.

Staying Informed is Key:

The economic landscape is constantly shifting. Staying informed about key economic indicators, such as inflation rates, unemployment figures, and consumer confidence indices, is crucial for making informed financial decisions. Regularly consulting reputable financial news sources and seeking advice from financial professionals can help you navigate these uncertain times effectively.

Call to Action: What steps are you taking to prepare for potential economic uncertainty? Share your thoughts in the comments below.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Is A Recession Coming? Jamie Dimon's Sobering Economic Outlook. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Investigation Launched After Austrias Tragic Mass Shooting

Jun 13, 2025

Investigation Launched After Austrias Tragic Mass Shooting

Jun 13, 2025 -

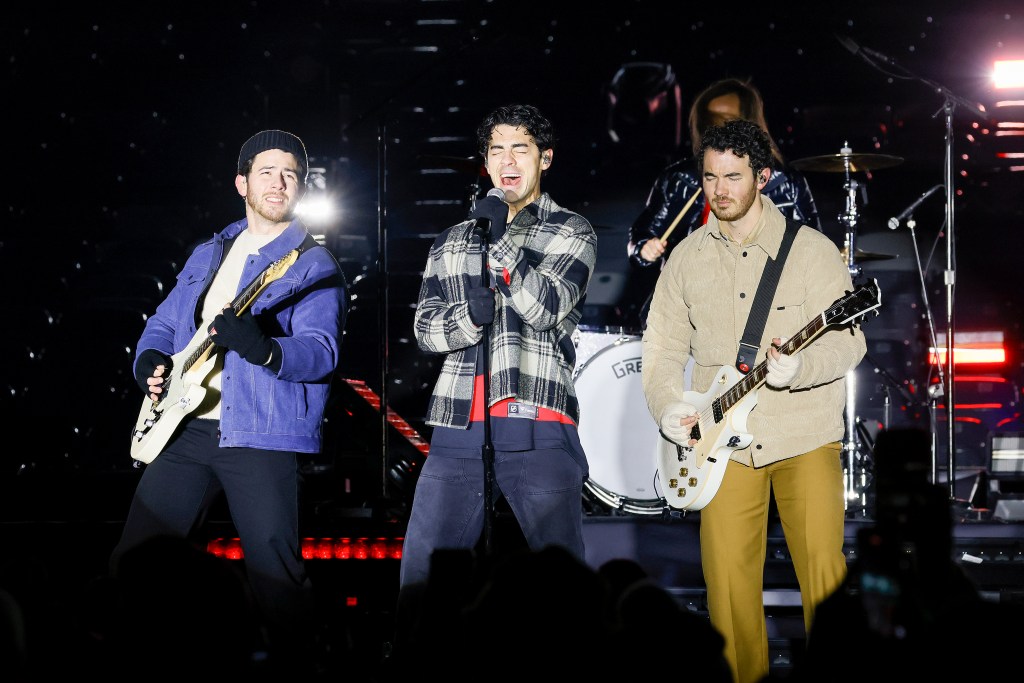

Jonas Brothers J Hope And Other Must Hear Tracks New Music Friday

Jun 13, 2025

Jonas Brothers J Hope And Other Must Hear Tracks New Music Friday

Jun 13, 2025 -

The Ballymena Protest An Analysis Of The Escalation To Violence

Jun 13, 2025

The Ballymena Protest An Analysis Of The Escalation To Violence

Jun 13, 2025 -

Khaby Lames Experience Ice Detention And Subsequent Us Exit

Jun 13, 2025

Khaby Lames Experience Ice Detention And Subsequent Us Exit

Jun 13, 2025 -

2024s Dirty Dozen List Why You Should Carefully Wash Your Spinach And Strawberries

Jun 13, 2025

2024s Dirty Dozen List Why You Should Carefully Wash Your Spinach And Strawberries

Jun 13, 2025

Latest Posts

-

Beeline Highway Closed Large Brush Fire Near Payson Arizona

Jun 14, 2025

Beeline Highway Closed Large Brush Fire Near Payson Arizona

Jun 14, 2025 -

The Path To Pro Following Jackson Buchanan And Sam Haynes

Jun 14, 2025

The Path To Pro Following Jackson Buchanan And Sam Haynes

Jun 14, 2025 -

Love Island Usa Checking Tonights Episode Status June 11

Jun 14, 2025

Love Island Usa Checking Tonights Episode Status June 11

Jun 14, 2025 -

Official Announcement Jonas Brothers Postpone Multiple Concerts

Jun 14, 2025

Official Announcement Jonas Brothers Postpone Multiple Concerts

Jun 14, 2025 -

Eastern Carlsbad Claro Fire 45 Acre Wildfire Under Control

Jun 14, 2025

Eastern Carlsbad Claro Fire 45 Acre Wildfire Under Control

Jun 14, 2025