Is Amazon (AMZN) A Strong Buy? Momentum Investing Explained

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Is Amazon (AMZN) a Strong Buy? Understanding Momentum Investing

Amazon (AMZN). The name conjures images of ubiquitous online shopping, cloud computing dominance, and innovative technological advancements. But for investors, the burning question remains: is AMZN a strong buy right now? The answer, as with most investment decisions, isn't simple. It requires understanding not just Amazon's fundamentals, but also the investment strategy driving the decision – in this case, momentum investing.

This article delves into the current state of Amazon, exploring its financial performance, future prospects, and how momentum investing strategies might inform your investment decision. We'll also unpack what momentum investing actually entails and its potential risks.

Amazon's Recent Performance and Future Outlook:

Amazon's recent financial reports have been a mixed bag. While its cloud computing division, Amazon Web Services (AWS), continues to be a powerhouse, generating significant revenue and profits, other segments have faced headwinds. The company's advertising revenue is strong, but its e-commerce business, while still massive, has seen slower growth compared to previous years. This slowing growth, coupled with ongoing economic uncertainty, has created volatility in AMZN's stock price.

Several factors contribute to the complexity of predicting Amazon's future:

- E-commerce Competition: Amazon faces intense competition from other e-commerce giants like Walmart and increasingly sophisticated online marketplaces.

- Inflation and Consumer Spending: Changes in consumer spending habits due to inflation directly impact Amazon's sales.

- AWS Growth Potential: While AWS remains a significant driver of profit, the cloud computing market is becoming increasingly competitive, posing challenges for future growth.

- Technological Innovation: Amazon's continued investment in innovative technologies, including artificial intelligence and robotics, presents both opportunities and risks.

Understanding Momentum Investing:

Momentum investing focuses on identifying stocks that have demonstrated strong price appreciation over a specific period. The core belief is that a stock's upward momentum will continue. This isn't about fundamental analysis (examining a company's financials); it's about riding the wave of a stock's price trend.

How Does Momentum Investing Apply to Amazon?

AMZN's stock price has experienced significant fluctuations recently. A momentum investor might look at periods of strong upward movement and consider buying during those "momentum" phases. However, it's crucial to understand the risks:

- High Volatility: Momentum investing inherently involves higher risk due to the reliance on price trends, which can reverse quickly.

- Market Corrections: Even strong momentum stocks are susceptible to market corrections, potentially leading to significant losses.

- False Signals: Short-term price fluctuations can give false signals, leading to incorrect investment decisions.

Is AMZN a Strong Buy Based on Momentum Investing?

The decision to buy AMZN based on momentum investing depends entirely on the current market conditions and the specific timeframe considered. Analyzing recent price trends, evaluating the overall market sentiment, and understanding the risks associated with momentum investing are crucial. There's no simple yes or no answer.

Beyond Momentum: Fundamental Analysis Matters

While momentum can be a factor, solely relying on it is risky. A thorough fundamental analysis of Amazon's financial health, competitive landscape, and future prospects is essential before making any investment decision. Consider researching Amazon's financial statements, reviewing analyst reports, and understanding the overall economic climate.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Always conduct thorough research and consider consulting a financial advisor before making any investment decisions. The information provided here is based on publicly available data and may not reflect the most current information.

Call to Action: Learn more about fundamental analysis techniques by exploring resources like [link to a reputable financial education website]. Understanding both momentum and fundamental analysis will empower you to make more informed investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Is Amazon (AMZN) A Strong Buy? Momentum Investing Explained. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Kfc Announces 7 000 Job Creation In Uk And Ireland Expansion

May 28, 2025

Kfc Announces 7 000 Job Creation In Uk And Ireland Expansion

May 28, 2025 -

Unlocking Value 2025 Memorial Tournament Predictions Odds And Sleepers

May 28, 2025

Unlocking Value 2025 Memorial Tournament Predictions Odds And Sleepers

May 28, 2025 -

Two Sigma Invests Heavily In Bank Of America Bac Stock Implications

May 28, 2025

Two Sigma Invests Heavily In Bank Of America Bac Stock Implications

May 28, 2025 -

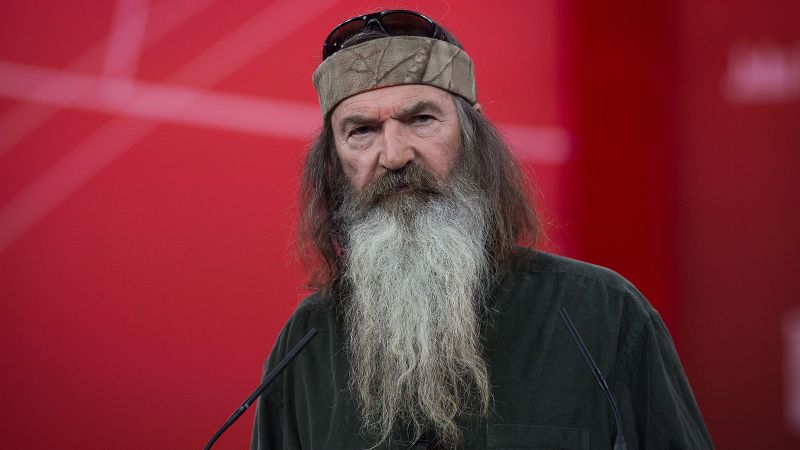

Phil Robertson Dead At 79 Remembering The Duck Dynasty Star

May 28, 2025

Phil Robertson Dead At 79 Remembering The Duck Dynasty Star

May 28, 2025 -

Heightened Tensions In Jerusalem Following Ultra Nationalist Jewish March

May 28, 2025

Heightened Tensions In Jerusalem Following Ultra Nationalist Jewish March

May 28, 2025

Latest Posts

-

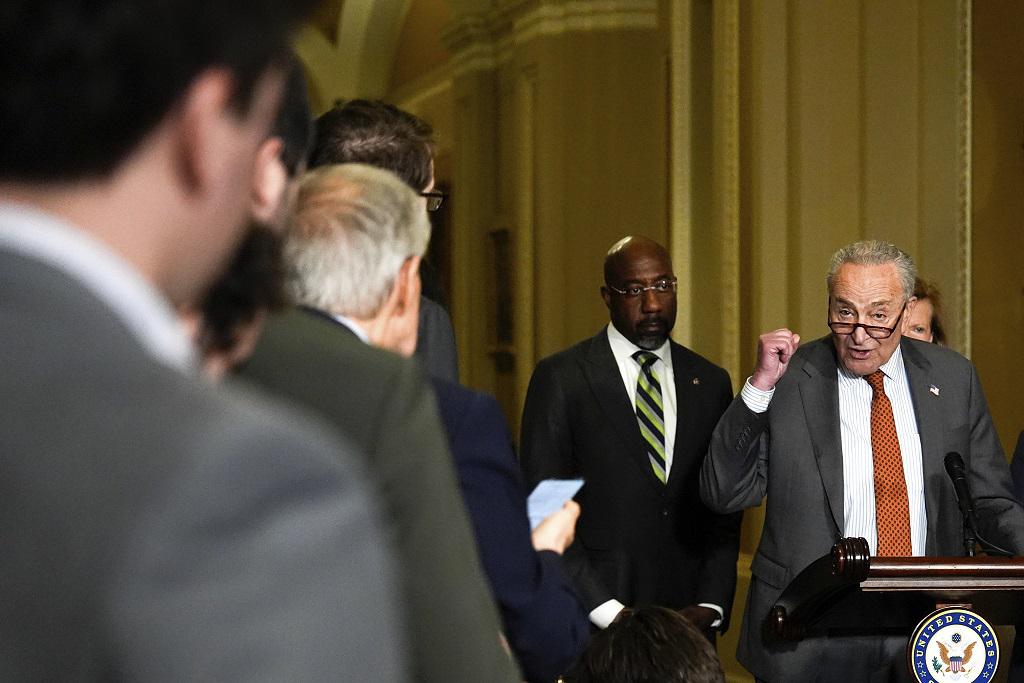

The Big Beautiful Bill Faces Opposition Senate Democrats Strategic Advantage

May 29, 2025

The Big Beautiful Bill Faces Opposition Senate Democrats Strategic Advantage

May 29, 2025 -

French Open Day 5 Follow Djokovic Gauff Sinner And Draper Live

May 29, 2025

French Open Day 5 Follow Djokovic Gauff Sinner And Draper Live

May 29, 2025 -

Male Escorts Apology To Cassie Following Diddys Parties

May 29, 2025

Male Escorts Apology To Cassie Following Diddys Parties

May 29, 2025 -

Sensacional Henrique Rocha Comeca Roland Garros Com Vitoria Inesperada

May 29, 2025

Sensacional Henrique Rocha Comeca Roland Garros Com Vitoria Inesperada

May 29, 2025 -

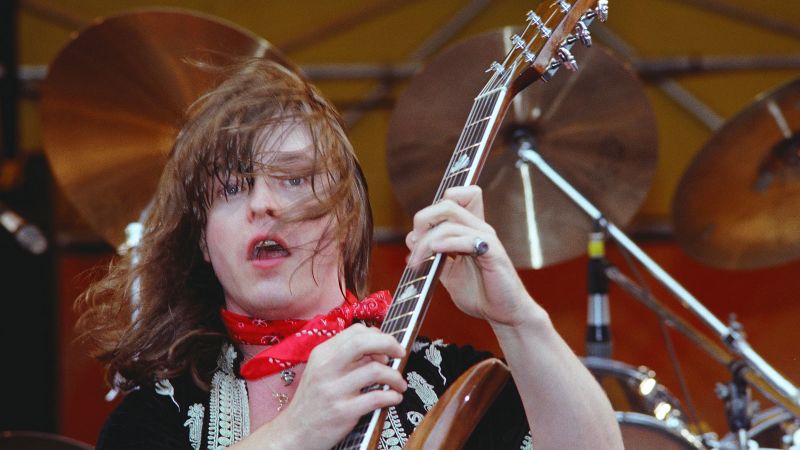

Musician Rick Derringer Collaborator With Weird Al Dies At 77

May 29, 2025

Musician Rick Derringer Collaborator With Weird Al Dies At 77

May 29, 2025