Is Boeing Stock's 2025 Success A Fleeting Trend?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Is Boeing Stock's 2025 Success a Fleeting Trend? Navigating the Aerospace Giant's Future

Boeing (BA) has experienced a resurgence in 2025, sending ripples of excitement through the investment community. But is this a sustainable climb, or just a fleeting moment of good fortune before the next headwind hits? Let's delve into the factors contributing to Boeing's current success and analyze the potential for long-term growth.

The 2025 Resurgence: A Closer Look

Several key factors have propelled Boeing's stock price in 2025. These include:

- Increased 737 MAX Deliveries: The grounding and subsequent return of the 737 MAX, while a tumultuous chapter, has finally led to a significant increase in deliveries. This translates directly to increased revenue and improved investor confidence. [Link to a relevant Boeing news release about 737 MAX deliveries]

- Strong Commercial Aircraft Demand: The global demand for air travel is recovering strongly, leading to increased orders for new aircraft. Boeing is well-positioned to capitalize on this growth, particularly with its updated 737 MAX and the highly anticipated 777X.

- Defense Sector Strength: Boeing's defense division continues to perform well, securing significant government contracts and contributing a stable revenue stream. This diversification helps mitigate risk associated with the commercial aircraft market's inherent volatility. [Link to a relevant article about Boeing's defense contracts]

- Improved Supply Chain Management: Past supply chain disruptions significantly hampered Boeing's production. Recent improvements in this area have helped streamline operations and reduce delays, contributing to more consistent deliveries.

Challenges Remain on the Horizon

While the current outlook appears positive, several challenges could potentially derail Boeing's progress:

- Geopolitical Instability: Global events, including ongoing conflicts and trade tensions, can significantly impact air travel demand and Boeing's international sales.

- Inflationary Pressures: Rising costs for raw materials and labor could impact profitability and squeeze margins.

- Competition: Boeing faces stiff competition from Airbus, a persistent rival in the commercial aircraft market. Airbus's own successes and innovations could put pressure on Boeing's market share.

- Sustainability Concerns: The aviation industry is under increasing pressure to reduce its carbon footprint. Boeing's ability to innovate and deliver sustainable aircraft will be crucial for long-term success.

Is it a Fleeting Trend or Sustainable Growth?

Determining whether Boeing's 2025 success is a fleeting trend or sustainable growth requires a nuanced perspective. While the current positive indicators are encouraging, the challenges outlined above remain significant.

The Verdict: Boeing's success in 2025 is likely a combination of overcoming past hurdles and capitalizing on favorable market conditions. However, its long-term success hinges on its ability to navigate geopolitical risks, manage costs effectively, maintain a competitive edge against Airbus, and embrace sustainable aviation practices. Investors should carefully consider these factors before making any investment decisions.

Further Research:

For a more in-depth analysis, consider reviewing Boeing's official financial reports and investor presentations. Independent analyst reports can also offer valuable insights.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Always consult with a qualified financial advisor before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Is Boeing Stock's 2025 Success A Fleeting Trend?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

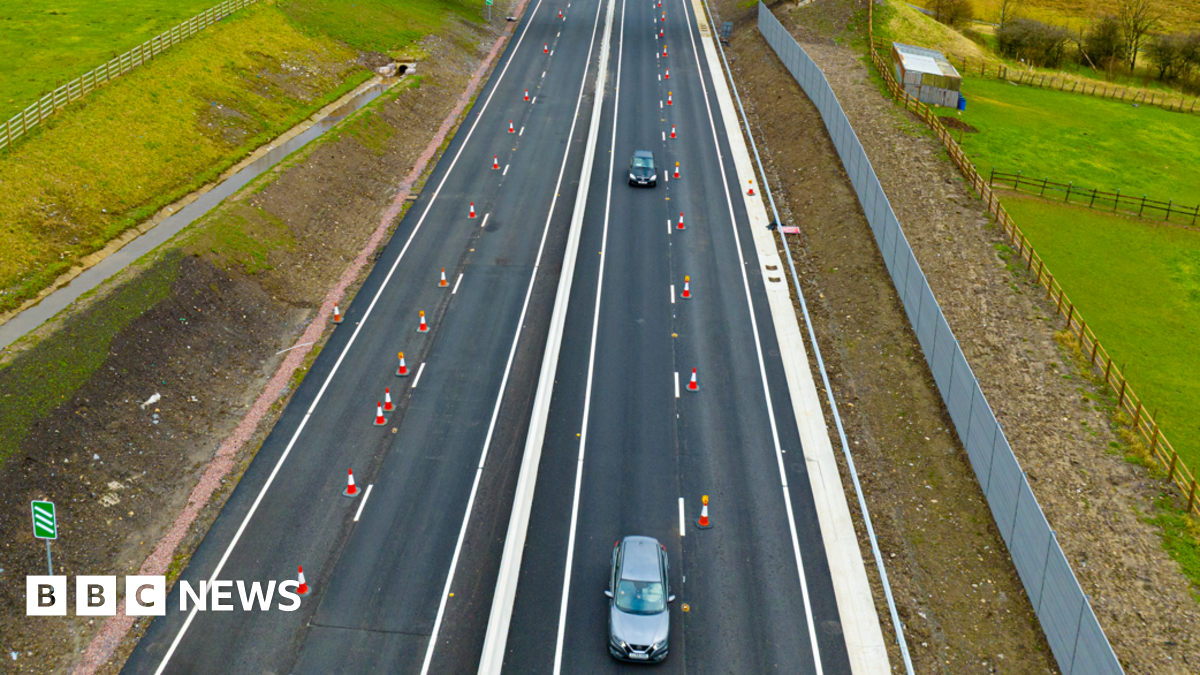

Heads Of The Valleys Road A465 Fully Operational After Extensive 23 Year Project

Jun 02, 2025

Heads Of The Valleys Road A465 Fully Operational After Extensive 23 Year Project

Jun 02, 2025 -

The R Words Resurgence Examining The Normalization Of A Harmful Disability Term

Jun 02, 2025

The R Words Resurgence Examining The Normalization Of A Harmful Disability Term

Jun 02, 2025 -

A Visit To The Spanish Grand Prix Tuchel And The England Squad

Jun 02, 2025

A Visit To The Spanish Grand Prix Tuchel And The England Squad

Jun 02, 2025 -

Time Craftsmanship And Cost Understanding The Price Of Sustainable Furniture

Jun 02, 2025

Time Craftsmanship And Cost Understanding The Price Of Sustainable Furniture

Jun 02, 2025 -

Fight For Asian American Vote Mamdani Gains Key Endorsement In Nyc Mayor Race

Jun 02, 2025

Fight For Asian American Vote Mamdani Gains Key Endorsement In Nyc Mayor Race

Jun 02, 2025

Latest Posts

-

Russia Launches Massive Air Strikes On Ukraine Poland Deploys Fighter Jets

Sep 22, 2025

Russia Launches Massive Air Strikes On Ukraine Poland Deploys Fighter Jets

Sep 22, 2025 -

British Couples Son Freed By Taliban Joyful Reunion In Uk

Sep 22, 2025

British Couples Son Freed By Taliban Joyful Reunion In Uk

Sep 22, 2025 -

Dealing With Loose Skin A Common Side Effect Of Weight Loss Drugs

Sep 22, 2025

Dealing With Loose Skin A Common Side Effect Of Weight Loss Drugs

Sep 22, 2025 -

Car And Van Crash On A9 At Slochd Claims Two Lives Couple Named

Sep 22, 2025

Car And Van Crash On A9 At Slochd Claims Two Lives Couple Named

Sep 22, 2025 -

London Fashion Week Romeo Beckhams Runway Walk And Dame Prues Show Stopping Outfit

Sep 22, 2025

London Fashion Week Romeo Beckhams Runway Walk And Dame Prues Show Stopping Outfit

Sep 22, 2025