Is Coinbase's Bitcoin Premium Sustainable? A 60-Day Analysis

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Is Coinbase's Bitcoin Premium Sustainable? A 60-Day Analysis

Coinbase's premium over the spot price of Bitcoin has been a fascinating market phenomenon. For weeks, buying Bitcoin on Coinbase often cost more than purchasing it on other exchanges. But is this premium sustainable? Our 60-day analysis delves into the factors driving this price discrepancy and explores its long-term viability.

The cryptocurrency market is known for its volatility, but recently, a specific trend has captured the attention of investors and analysts: Coinbase's consistent premium on Bitcoin. For a significant period, purchasing BTC on Coinbase frequently resulted in a higher price than on competing exchanges like Binance or Kraken. This begs the question: is this premium a fleeting anomaly or a sustainable market feature?

Over the past 60 days, we've tracked the price difference between Coinbase and other major exchanges, factoring in various market conditions. Our analysis reveals a complex interplay of factors contributing to this price discrepancy.

Factors Contributing to Coinbase's Bitcoin Premium:

-

Liquidity: Coinbase, while a major player, may experience periods of lower liquidity compared to larger, more global exchanges like Binance. Reduced liquidity can lead to higher prices, especially during periods of high trading volume or market instability. Think of it like supply and demand – less available Bitcoin means higher prices.

-

Regulatory Landscape: Coinbase operates under a stricter regulatory environment in the US compared to some of its international counterparts. This added regulatory compliance can influence operational costs, which might indirectly translate into a higher price for Bitcoin.

-

Customer Base: Coinbase attracts a large number of first-time crypto investors. These users may be less price-sensitive and more willing to pay a premium for the perceived security and user-friendliness of the platform. This demographic plays a significant role in shaping market dynamics.

-

Transaction Fees and Spread: While not the sole factor, Coinbase's fees and bid-ask spreads can contribute to the observed premium. These costs are added on top of the already higher Bitcoin price, further exacerbating the difference.

-

Market Sentiment and Speculation: Positive market sentiment and news surrounding Coinbase itself can influence the premium. Speculative trading based on anticipated future performance might also drive up the price on the platform.

Sustainability Concerns:

While the premium has persisted for a period, its long-term sustainability remains questionable. Several factors threaten its continuation:

-

Arbitrage Opportunities: The existence of a significant premium creates lucrative arbitrage opportunities for sophisticated traders. These traders can buy Bitcoin at a lower price on other exchanges and sell it on Coinbase, thereby reducing the premium.

-

Increased Competition: The cryptocurrency exchange landscape is highly competitive. The emergence of new exchanges with potentially lower fees and better liquidity could further erode Coinbase's premium.

-

Regulatory Changes: Future regulatory developments could impact Coinbase's operations and potentially reduce the premium. A more streamlined regulatory framework might level the playing field.

Conclusion:

Our 60-day analysis suggests that while Coinbase's Bitcoin premium is a demonstrable phenomenon, its long-term sustainability is doubtful. The interplay of liquidity, regulatory factors, customer base, and market sentiment creates a complex dynamic. However, arbitrage opportunities and increasing competition are likely to exert downward pressure on the premium. While the premium might fluctuate, it's unlikely to remain consistently high over the long term. Further monitoring of market conditions and regulatory developments is crucial to fully understand the future trajectory of Coinbase's Bitcoin pricing.

Disclaimer: This article is for informational purposes only and should not be considered financial advice. Investing in cryptocurrencies involves significant risks, and you should conduct your own thorough research before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Is Coinbase's Bitcoin Premium Sustainable? A 60-Day Analysis. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Phat Bieu Cua Powell Ap Luc Len Gia Vang Kha Nang Cat Giam Lai Suat Thang 9 Giam

Jul 31, 2025

Phat Bieu Cua Powell Ap Luc Len Gia Vang Kha Nang Cat Giam Lai Suat Thang 9 Giam

Jul 31, 2025 -

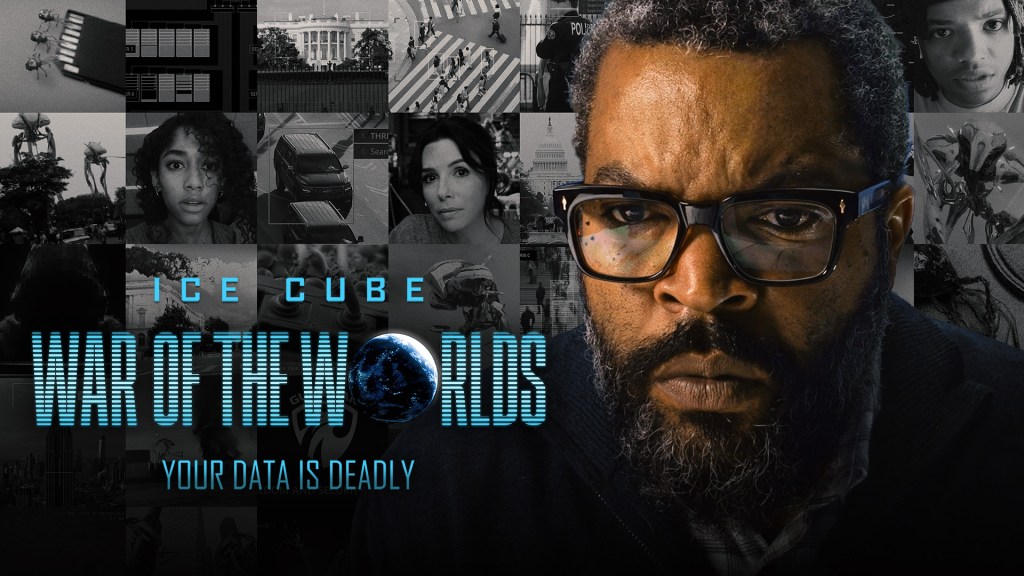

Watch The Trailer Ice Cube And Eva Longorias War Of The Worlds Coming To Prime Video

Jul 31, 2025

Watch The Trailer Ice Cube And Eva Longorias War Of The Worlds Coming To Prime Video

Jul 31, 2025 -

New Sba Advocate Vows Support For Manufacturing And Automation In Small Businesses

Jul 31, 2025

New Sba Advocate Vows Support For Manufacturing And Automation In Small Businesses

Jul 31, 2025 -

Cnn Reports Promising Results In Early Alzheimers Treatment Through Lifestyle Intervention

Jul 31, 2025

Cnn Reports Promising Results In Early Alzheimers Treatment Through Lifestyle Intervention

Jul 31, 2025 -

Russian Soldiers Face Brutal Punishment For Defying Putins Orders

Jul 31, 2025

Russian Soldiers Face Brutal Punishment For Defying Putins Orders

Jul 31, 2025

Latest Posts

-

Brazilian Government Actions Potential Threats To Us National Interests

Aug 01, 2025

Brazilian Government Actions Potential Threats To Us National Interests

Aug 01, 2025 -

Oyster Bay Womans 30 Million Fraud Scheme A Guilty Plea And Political Connections

Aug 01, 2025

Oyster Bay Womans 30 Million Fraud Scheme A Guilty Plea And Political Connections

Aug 01, 2025 -

Cnn Politics Examining The Maga Medias Rally Around Trump On Epstein Allegations

Aug 01, 2025

Cnn Politics Examining The Maga Medias Rally Around Trump On Epstein Allegations

Aug 01, 2025 -

Market Movers Apples Earnings Surprise Amazons Stock Slip Reddits Rally

Aug 01, 2025

Market Movers Apples Earnings Surprise Amazons Stock Slip Reddits Rally

Aug 01, 2025 -

Pop Cap Reimagines Plants Vs Zombies Replanted As Franchise Cornerstone

Aug 01, 2025

Pop Cap Reimagines Plants Vs Zombies Replanted As Franchise Cornerstone

Aug 01, 2025