Is Limbach (LMB) Today's Top Stock Pick?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Is Limbach Holdings (LMB) Today's Top Stock Pick? A Deep Dive into the HVAC Giant

Limbach Holdings (LMB), a leading provider of mechanical, electrical, and plumbing (MEP) services, has seen its stock fluctuate recently. But is now the time to invest? This in-depth analysis explores Limbach's current market position, financial performance, and future prospects to help you determine if LMB is a smart addition to your portfolio.

Limbach Holdings: A Quick Overview

Limbach Holdings, Inc. operates primarily in the United States, offering a comprehensive suite of services across the HVAC, plumbing, and electrical sectors. They cater to a diverse range of clients, including commercial, industrial, and institutional entities. The company boasts a strong reputation for quality workmanship and project delivery, built over many years of experience.

Recent Market Performance and Stock Volatility:

LMB's stock price has shown some volatility in recent months, prompting investors to question its long-term potential. Understanding the reasons behind this volatility is crucial before making any investment decisions. Factors to consider include the overall market sentiment, sector-specific challenges, and Limbach's own financial reporting. News regarding contract wins and losses, as well as broader economic indicators, can significantly impact LMB's stock price. Analyzing recent earnings reports and investor calls is vital for a comprehensive understanding of the current situation.

Analyzing Limbach's Financials: Key Metrics to Watch

Before considering LMB as a top stock pick, a thorough analysis of its key financial metrics is essential. Investors should pay close attention to:

- Revenue Growth: Consistent year-over-year revenue growth indicates a healthy and expanding business.

- Profit Margins: Strong profit margins point to efficient operations and pricing strategies.

- Debt Levels: High levels of debt can pose a significant risk, so it's crucial to monitor Limbach's debt-to-equity ratio.

- Cash Flow: Positive cash flow is vital for sustainable growth and dividend payouts.

Future Growth Prospects: Industry Trends and Limbach's Positioning

The HVAC industry is undergoing significant changes, driven by factors such as increasing energy efficiency regulations, the growth of sustainable building practices, and technological advancements. Limbach's ability to adapt to these trends and capitalize on emerging opportunities will be critical for its future success. Their commitment to innovation and sustainability will be a key factor determining their long-term competitiveness.

Key Risks and Considerations:

Like any investment, LMB stock carries inherent risks. These include:

- Competition: The MEP industry is competitive, with both large national firms and smaller regional players vying for market share.

- Economic Conditions: Recessions or economic downturns can significantly impact demand for construction and renovation services.

- Supply Chain Disruptions: The availability and cost of materials can affect project profitability.

Is Limbach Holdings a Top Stock Pick? The Verdict

Whether Limbach Holdings (LMB) is the right stock pick for you depends entirely on your individual investment goals, risk tolerance, and overall portfolio strategy. While the company holds a strong position in the MEP sector and has potential for future growth, investors should carefully weigh the risks and conduct thorough due diligence before making any investment decisions. Consulting with a qualified financial advisor is always recommended.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Investing in the stock market involves risk, and you could lose money. Always conduct thorough research and consult with a financial professional before making any investment decisions. This article contains external links for informational purposes only; we are not responsible for the content of external websites.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Is Limbach (LMB) Today's Top Stock Pick?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Endividamento Americano Fuga De Investimentos Em Titulos Sobe

Jun 28, 2025

Endividamento Americano Fuga De Investimentos Em Titulos Sobe

Jun 28, 2025 -

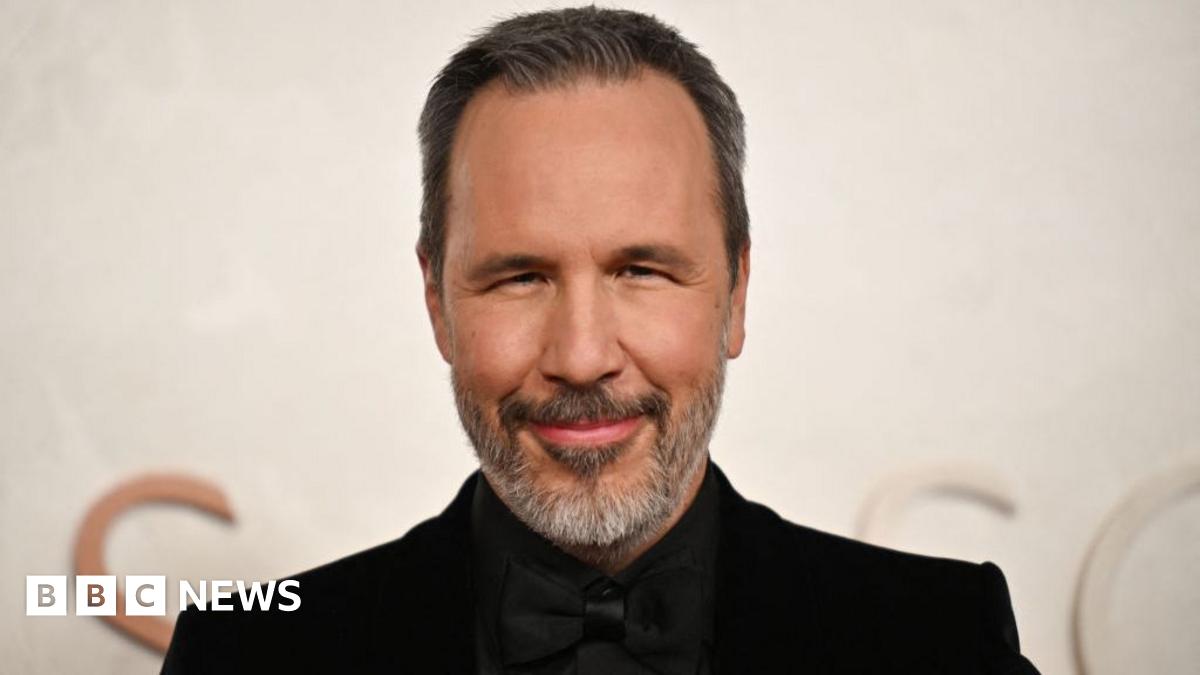

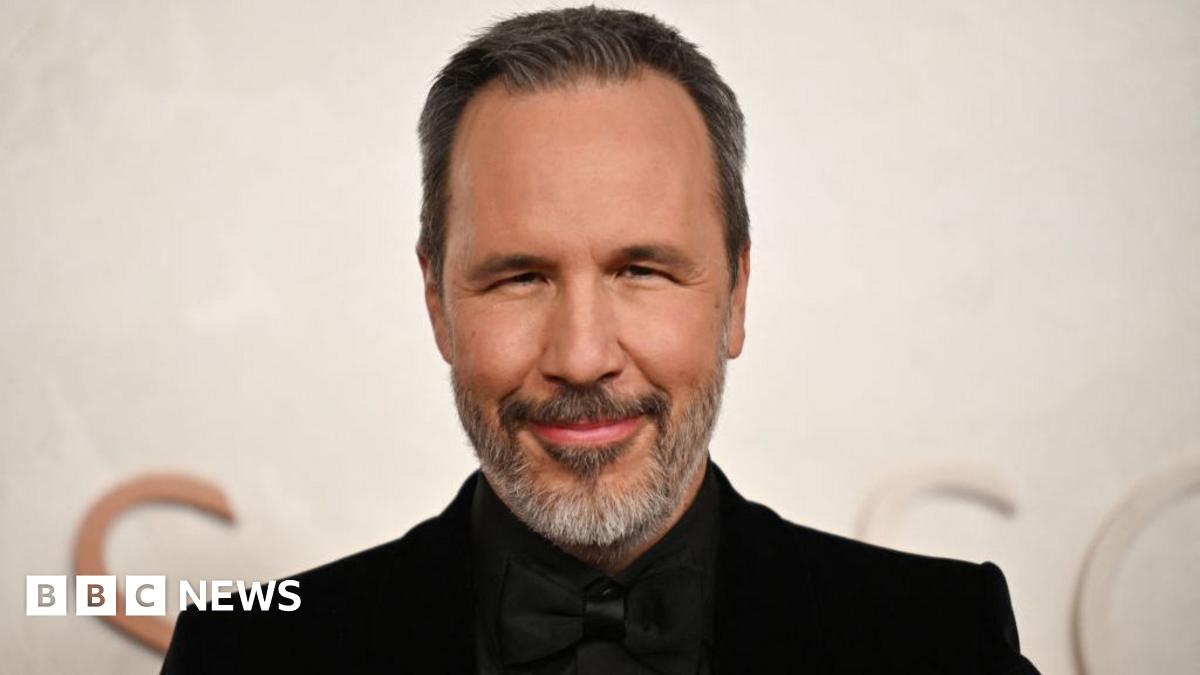

Could Denis Villeneuve Be The Next James Bond Director

Jun 28, 2025

Could Denis Villeneuve Be The Next James Bond Director

Jun 28, 2025 -

Limbach Lmb Todays Bull Market Stock Pick

Jun 28, 2025

Limbach Lmb Todays Bull Market Stock Pick

Jun 28, 2025 -

Could Denis Villeneuve Direct The Next James Bond Movie

Jun 28, 2025

Could Denis Villeneuve Direct The Next James Bond Movie

Jun 28, 2025 -

New Leak Hints At All Black I Phone 17 Pro And I Phone 17 Air

Jun 28, 2025

New Leak Hints At All Black I Phone 17 Pro And I Phone 17 Air

Jun 28, 2025

Latest Posts

-

Man City Vs Chelsea Comparing Fifa Club World Cup Winnings

Jun 30, 2025

Man City Vs Chelsea Comparing Fifa Club World Cup Winnings

Jun 30, 2025 -

Despite Legal Warnings Budapest Pride Holds Event

Jun 30, 2025

Despite Legal Warnings Budapest Pride Holds Event

Jun 30, 2025 -

Your Guide To The 2025 Fifa Club World Cup Schedule And Results

Jun 30, 2025

Your Guide To The 2025 Fifa Club World Cup Schedule And Results

Jun 30, 2025 -

Cnn Unveils 2025s Best Town Why Its A Must See

Jun 30, 2025

Cnn Unveils 2025s Best Town Why Its A Must See

Jun 30, 2025 -

Revelan El Motivo Por Que Las Hijas De Icardi Rechazan Convivir Con Eugenia Suarez

Jun 30, 2025

Revelan El Motivo Por Que Las Hijas De Icardi Rechazan Convivir Con Eugenia Suarez

Jun 30, 2025