Is Now The Time To Invest? Real Estate And The New Economic Landscape

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Is Now the Time to Invest? Real Estate and the New Economic Landscape

The global economy is a rollercoaster, and right now, many are wondering: is it a good time to invest in real estate? With inflation fluctuating, interest rates shifting, and geopolitical uncertainty looming, navigating the current economic landscape requires careful consideration. This article explores the key factors influencing real estate investment decisions in 2024 and helps you determine if now is the right time for you.

The Shifting Sands of the Economy:

The economic climate is undeniably complex. Inflation, while showing signs of easing in some regions, remains a significant concern. This impacts borrowing costs, directly influencing mortgage rates and the affordability of property. Rising interest rates, while aiming to curb inflation, make financing more expensive, potentially slowing down market activity. However, this also means potentially lower property prices in some sectors, creating opportunities for savvy investors.

Real Estate's Resilience:

Despite economic headwinds, real estate historically demonstrates resilience. It's a tangible asset, offering a hedge against inflation and a potentially stable long-term investment. While short-term market fluctuations are inevitable, the fundamental demand for housing remains strong. Population growth, urbanization, and the ongoing need for shelter continue to underpin the real estate market.

Analyzing the Current Real Estate Market:

Several key factors must be assessed before making an investment decision:

- Location, Location, Location: The adage remains true. Strong rental markets and areas with projected growth offer better investment potential than stagnant or declining ones. Research specific locations thoroughly, considering factors like job markets, infrastructure development, and local amenities.

- Property Type: The current market may favor certain property types over others. For example, demand for rental properties might be higher than for luxury homes in certain economic climates. Consider the long-term potential and rental yields of various property types.

- Interest Rates and Financing: Secure pre-approval for a mortgage to understand your borrowing capacity. Shop around for the best interest rates and consider the impact of potential rate hikes on your monthly payments.

- Market Research: Don't rely solely on anecdotal evidence. Consult reputable sources like Zillow, Realtor.com (US-focused), Rightmove (UK-focused), or local real estate agents for up-to-date market data and trends.

Opportunities and Challenges:

Opportunities:

- Potential for lower property prices: In some areas, a cooling market might present opportunities to purchase properties at more affordable prices.

- Strong rental yields: In high-demand areas, rental income can offer a steady stream of cash flow, offsetting mortgage payments and providing a return on investment.

- Long-term appreciation: Real estate historically appreciates in value over the long term, providing potential capital gains.

Challenges:

- Higher borrowing costs: Increased interest rates make financing more expensive, impacting affordability and potentially slowing market growth.

- Economic uncertainty: Geopolitical events and economic volatility can create market uncertainty, impacting investment decisions.

- Increased competition: Despite a cooling market in some sectors, competition among buyers can still be fierce, especially for desirable properties.

Conclusion: Making the Right Decision:

Investing in real estate requires careful planning and research. While the current economic landscape presents both opportunities and challenges, it's not necessarily a time to shy away from the market entirely. By conducting thorough due diligence, understanding your financial situation, and focusing on long-term strategies, you can make an informed investment decision that aligns with your personal goals and risk tolerance. Remember to consult with financial and real estate professionals to gain expert advice tailored to your specific circumstances. This is crucial to navigating the complexities of today's market effectively.

Call to Action: Consider seeking advice from a financial advisor and real estate agent before making any investment decisions. Are you ready to explore your real estate investment options further? [Link to a relevant resource, e.g., a financial planning website or a real estate search portal].

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Is Now The Time To Invest? Real Estate And The New Economic Landscape. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Kumingas Qualifying Offer A Complex Decision For The Warriors And Player

Jul 30, 2025

Kumingas Qualifying Offer A Complex Decision For The Warriors And Player

Jul 30, 2025 -

Jonathan Kumingas Future Analyzing The Range Of Potential Contract Offers

Jul 30, 2025

Jonathan Kumingas Future Analyzing The Range Of Potential Contract Offers

Jul 30, 2025 -

Sportscaster Erin Andrews Signs Deal With Wwe Womens Fan Gear To Launch

Jul 30, 2025

Sportscaster Erin Andrews Signs Deal With Wwe Womens Fan Gear To Launch

Jul 30, 2025 -

Federal Judge Investigated For Misconduct In Significant Deportation Case

Jul 30, 2025

Federal Judge Investigated For Misconduct In Significant Deportation Case

Jul 30, 2025 -

Deadly Midtown Shooting In New York Leaves Four Dead One A Police Officer

Jul 30, 2025

Deadly Midtown Shooting In New York Leaves Four Dead One A Police Officer

Jul 30, 2025

Latest Posts

-

Dr Vinay Prasads Departure A Controversial Fda Exit

Jul 31, 2025

Dr Vinay Prasads Departure A Controversial Fda Exit

Jul 31, 2025 -

Trumps Aggressive Trade Policy Implications For Us China Relations

Jul 31, 2025

Trumps Aggressive Trade Policy Implications For Us China Relations

Jul 31, 2025 -

Escalating Tensions Greeces Response To Influx Of Asylum Seekers Via Crete

Jul 31, 2025

Escalating Tensions Greeces Response To Influx Of Asylum Seekers Via Crete

Jul 31, 2025 -

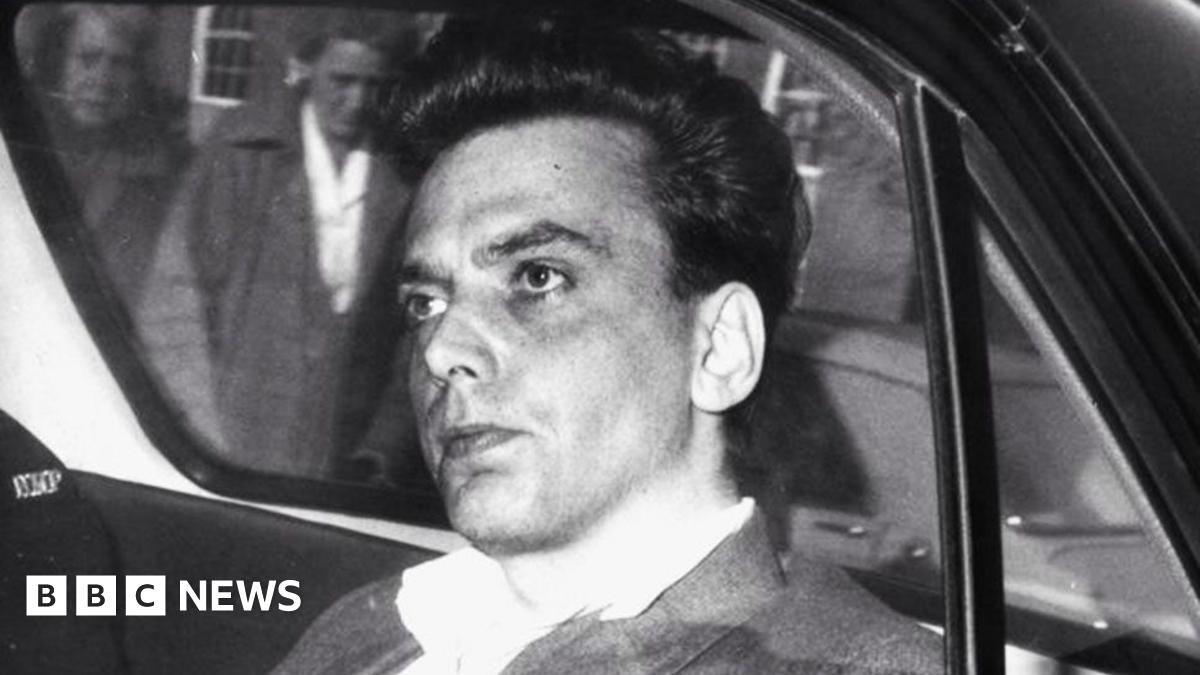

Brady Memoir Holds Clues To Unsolved Murder Burial Site

Jul 31, 2025

Brady Memoir Holds Clues To Unsolved Murder Burial Site

Jul 31, 2025 -

New Rape Support Service For Biological Women Launched Amidst Transgender Debate

Jul 31, 2025

New Rape Support Service For Biological Women Launched Amidst Transgender Debate

Jul 31, 2025