Is Shared Ownership Right For You? A Realistic Look At The Pros And Cons

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Is Shared Ownership Right for You? A Realistic Look at the Pros and Cons

Dreaming of homeownership but struggling with the upfront costs? Shared ownership might seem like the perfect solution, offering a pathway to owning a property without the hefty deposit traditionally required. But is it truly the right choice for you? This article dives deep into the realities of shared ownership, exploring its advantages and disadvantages to help you make an informed decision.

Shared ownership, also known as fractional ownership, is a scheme where you buy a share of a property, typically between 25% and 75%, from a housing association or similar provider. You then pay rent on the remaining share. As your financial situation improves, you can purchase additional shares, eventually owning the property outright – a process known as staircasing.

The Alluring Pros of Shared Ownership

-

Lower Initial Deposit: This is the biggest draw. Instead of needing a large deposit for a full mortgage, you only need a deposit for your initial share, significantly reducing the financial barrier to entry. This makes homeownership accessible to a wider range of people, particularly first-time buyers.

-

Affordability: Monthly payments are generally lower than a traditional mortgage, as you are only paying for a portion of the property's value. This can free up funds for other essential expenses.

-

Pathway to Full Ownership: The ability to staircase, buying additional shares over time, is a key benefit. This gives you greater control and potential long-term savings.

-

Building Equity: As you own a share of the property, you are building equity, increasing your asset value over time. This can be beneficial for future financial planning.

The Not-So-Glamorous Cons of Shared Ownership

-

Restrictions and Regulations: Shared ownership schemes often come with restrictions on renovations, pets, and subletting. These can impact your lifestyle choices and flexibility.

-

Ongoing Service Charges: You'll typically pay annual service charges to cover building maintenance and upkeep. These charges can be significant and can increase over time.

-

Staircasing Complications: While staircasing allows you to buy more shares, it's not always a smooth process. Securing the necessary financing and navigating the legal aspects can be complex and time-consuming.

-

Limited Choice: The selection of properties available under shared ownership schemes might be more limited compared to the open market. Location and property type can be restricted.

-

Potential for Rent Increases: The rent you pay on the remaining share isn't fixed and might increase annually, potentially affecting your monthly budget.

Is Shared Ownership Right for You? Ask Yourself These Questions:

- What are your long-term financial goals? Can you realistically afford to staircase to full ownership in the foreseeable future?

- What is your risk tolerance? Are you comfortable with the potential for increased service charges and rent?

- What are your lifestyle needs and preferences? Are you prepared to live with any restrictions imposed by the shared ownership scheme?

- Have you researched all available options? It's crucial to compare shared ownership with other homebuying options like Help to Buy or traditional mortgages.

Finding More Information and Next Steps

For more detailed information on shared ownership schemes in your area, it's recommended to consult with a financial advisor and contact your local housing association. They can provide personalized guidance based on your individual circumstances. Remember, thorough research is key to making an informed and confident decision about your future home.

Disclaimer: This article provides general information and should not be considered financial advice. Consult with a qualified professional before making any significant financial decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Is Shared Ownership Right For You? A Realistic Look At The Pros And Cons. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Mets Vs Braves A Critical Nl East Showdown

Jun 18, 2025

Mets Vs Braves A Critical Nl East Showdown

Jun 18, 2025 -

Live Updates Storms Bring Heavy Rainfall To Metro Atlanta And North Georgia

Jun 18, 2025

Live Updates Storms Bring Heavy Rainfall To Metro Atlanta And North Georgia

Jun 18, 2025 -

Top 5 Wnba Bets And Player Props For Tuesday June 17 2025

Jun 18, 2025

Top 5 Wnba Bets And Player Props For Tuesday June 17 2025

Jun 18, 2025 -

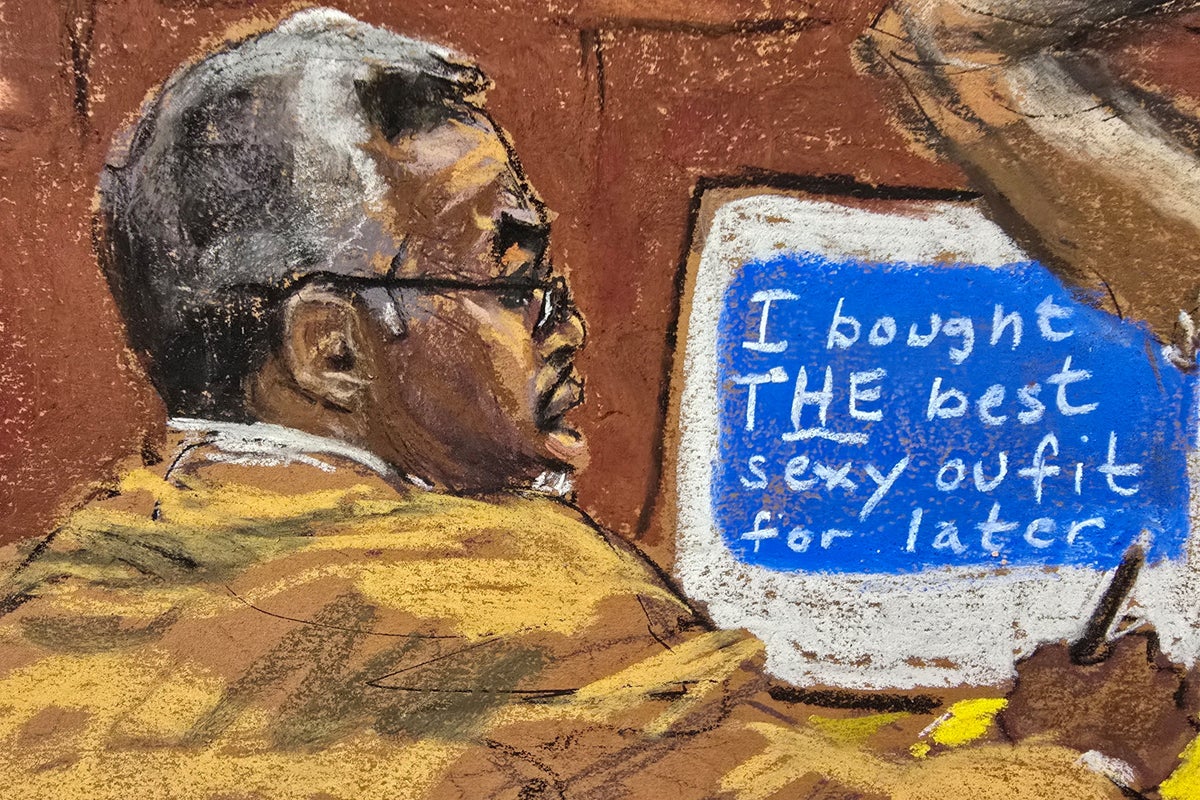

Sean Combs Trial Jurors Forced To Watch Graphic Video Evidence

Jun 18, 2025

Sean Combs Trial Jurors Forced To Watch Graphic Video Evidence

Jun 18, 2025 -

Blue Jays At Diamondbacks Best Bets And Game Analysis For June 17

Jun 18, 2025

Blue Jays At Diamondbacks Best Bets And Game Analysis For June 17

Jun 18, 2025

Latest Posts

-

The Mouth Tape Market Exploring The Billion Dollar Question Of Value

Jun 18, 2025

The Mouth Tape Market Exploring The Billion Dollar Question Of Value

Jun 18, 2025 -

Caitlin Clarks Record Breaking 3 Pointers A Legends Reaction

Jun 18, 2025

Caitlin Clarks Record Breaking 3 Pointers A Legends Reaction

Jun 18, 2025 -

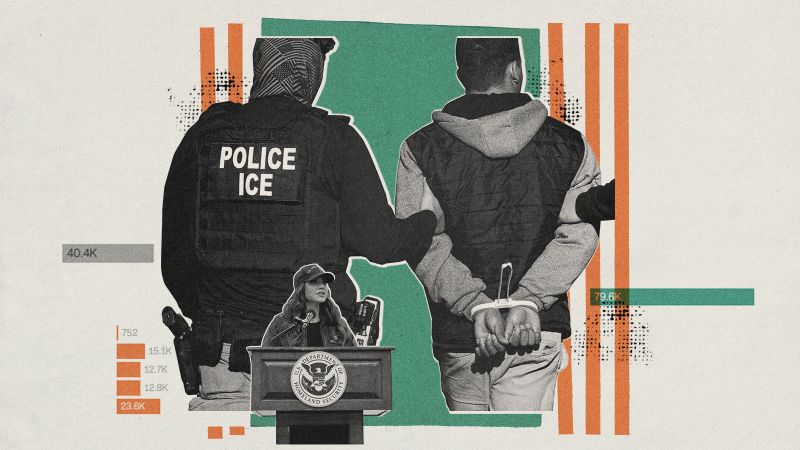

Serious Criminal Convictions Among Ice Detainees Internal Data Shows Low Percentage Since October

Jun 18, 2025

Serious Criminal Convictions Among Ice Detainees Internal Data Shows Low Percentage Since October

Jun 18, 2025 -

Caitlin Clark In Action Connecticut Sun Vs Indiana Fever Live Game Updates Tv Details And Streaming Options

Jun 18, 2025

Caitlin Clark In Action Connecticut Sun Vs Indiana Fever Live Game Updates Tv Details And Streaming Options

Jun 18, 2025 -

Billion Dollar Mouth Tape Industry Separating The Science From The Marketing

Jun 18, 2025

Billion Dollar Mouth Tape Industry Separating The Science From The Marketing

Jun 18, 2025