Is Shared Ownership Right For You? Understanding The Risks

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Is Shared Ownership Right for You? Understanding the Risks and Rewards

Dreaming of homeownership but struggling with the hefty upfront costs and ongoing expenses? Shared ownership schemes might seem like the perfect solution, offering a pathway to owning a piece of the property pie. But before you jump in, it's crucial to understand the potential risks involved. This article explores the advantages and disadvantages of shared ownership, helping you decide if it's the right path for you.

What is Shared Ownership?

Shared ownership, also known as fractional ownership, is a model where you buy a share of a property, typically between 25% and 75%, and pay rent on the remaining portion. This significantly reduces the initial deposit required compared to outright purchase. The amount you own can increase incrementally over time, eventually leading to full ownership. This is particularly attractive to first-time buyers or those struggling to save for a large deposit.

The Allure of Shared Ownership:

- Lower Deposit: The most significant advantage is the significantly lower deposit required, making homeownership accessible to a wider range of people.

- Affordability: Monthly payments are generally lower than a mortgage on a whole property, making it more manageable financially.

- Pathway to Full Ownership: The ability to "staircase" – buying further shares over time – offers a clear route to full homeownership.

- Government Support: In many regions, shared ownership schemes benefit from government support and initiatives designed to increase affordability.

The Potential Pitfalls: Understanding the Risks

While shared ownership offers undeniable advantages, potential buyers should be aware of several crucial risks:

- Staircasing Costs: While the ability to staircase is appealing, the costs associated can be surprisingly high, potentially eroding the initial affordability benefits. It's essential to understand the valuation process and associated fees.

- Leasehold Complications: Shared ownership properties are typically leasehold, meaning you own the share but not the freehold. This involves ground rent payments and potentially restrictive covenants, which can limit your ability to renovate or alter the property. Research your lease carefully.

- Limited Control: You'll share the property with the housing association or other shareholders, meaning you won't have complete control over decisions affecting the building or your living space.

- Mortgage Restrictions: Securing a mortgage for the initial share can be more challenging than a traditional mortgage, as lenders might have stricter criteria.

- Rising Rent: The rent you pay on the unsold share can increase over time, impacting your overall monthly expenses. Understanding the terms of your rent review clause is critical.

- Selling Your Share: Selling your share can be more complex than selling a whole property, potentially leading to longer selling times and lower returns.

Is Shared Ownership Right for You? Key Considerations:

Before committing to shared ownership, ask yourself these questions:

- What are your long-term financial goals? Do you plan to staircase to full ownership?

- What is your risk tolerance? Are you comfortable with the potential complexities and financial uncertainties involved?

- Have you thoroughly researched the specific scheme? Understand the lease terms, ground rent, service charges, and staircasing costs in detail.

- Have you sought professional financial advice? A mortgage broker and financial advisor can provide invaluable insight into your specific circumstances.

Conclusion:

Shared ownership can be a viable pathway to homeownership, offering increased affordability and a route to full ownership. However, it's essential to weigh the potential benefits against the inherent risks. Thorough research, professional financial advice, and a realistic understanding of your financial situation are crucial before making this significant decision. Remember to compare different schemes and seek legal advice to fully grasp the implications before signing any contracts.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Is Shared Ownership Right For You? Understanding The Risks. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Frasiers Kelsey Grammer Expecting Child Number Eight

Jun 18, 2025

Frasiers Kelsey Grammer Expecting Child Number Eight

Jun 18, 2025 -

Is Shared Ownership Worth The Risk A Critical Analysis

Jun 18, 2025

Is Shared Ownership Worth The Risk A Critical Analysis

Jun 18, 2025 -

Iranian Concerns Rise After Israeli Strikes We Dont Want A Gaza Scenario In Tehran

Jun 18, 2025

Iranian Concerns Rise After Israeli Strikes We Dont Want A Gaza Scenario In Tehran

Jun 18, 2025 -

Indefinite Delay Bungie Postpones Marathon Release

Jun 18, 2025

Indefinite Delay Bungie Postpones Marathon Release

Jun 18, 2025 -

June 17th Mlb Blue Jays Diamondbacks Game Predictions And Betting Odds

Jun 18, 2025

June 17th Mlb Blue Jays Diamondbacks Game Predictions And Betting Odds

Jun 18, 2025

Latest Posts

-

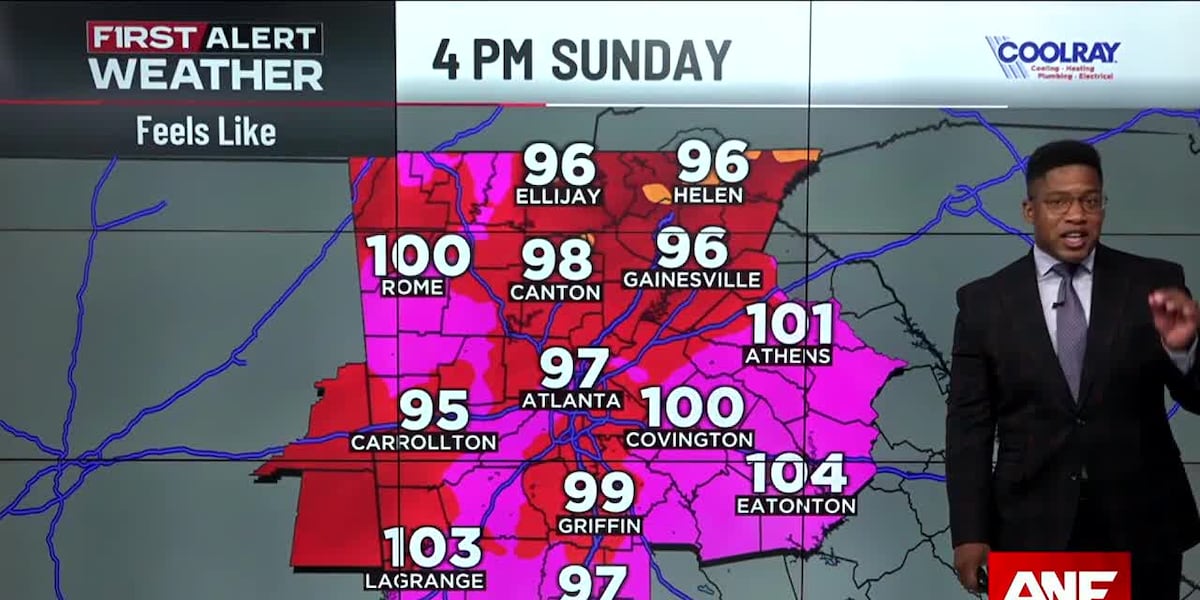

Tuesday Storms Latest Forecast And Timing

Jun 18, 2025

Tuesday Storms Latest Forecast And Timing

Jun 18, 2025 -

The Mouth Tape Market Exploring The Billion Dollar Question Of Value

Jun 18, 2025

The Mouth Tape Market Exploring The Billion Dollar Question Of Value

Jun 18, 2025 -

Caitlin Clarks Record Breaking 3 Pointers A Legends Reaction

Jun 18, 2025

Caitlin Clarks Record Breaking 3 Pointers A Legends Reaction

Jun 18, 2025 -

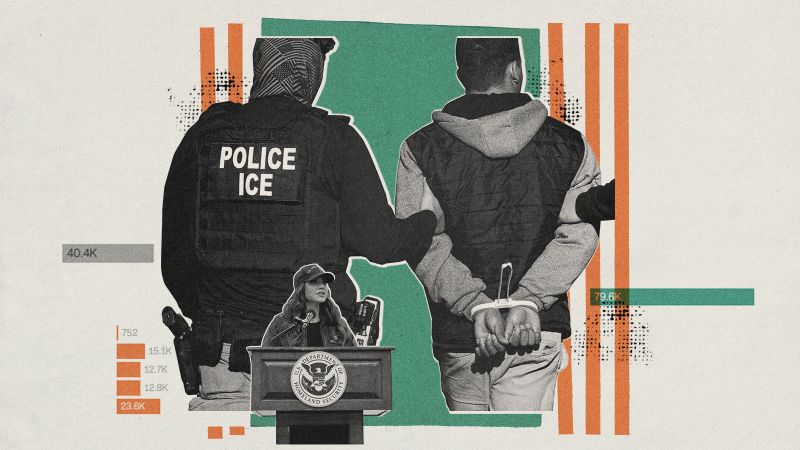

Serious Criminal Convictions Among Ice Detainees Internal Data Shows Low Percentage Since October

Jun 18, 2025

Serious Criminal Convictions Among Ice Detainees Internal Data Shows Low Percentage Since October

Jun 18, 2025 -

Caitlin Clark In Action Connecticut Sun Vs Indiana Fever Live Game Updates Tv Details And Streaming Options

Jun 18, 2025

Caitlin Clark In Action Connecticut Sun Vs Indiana Fever Live Game Updates Tv Details And Streaming Options

Jun 18, 2025