Is Shared Ownership Right For You? Weighing The Risks

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Is Shared Ownership Right for You? Weighing the Risks and Rewards

Dreaming of owning a home but struggling with the upfront costs? Shared ownership schemes might seem like the perfect solution, offering a pathway to homeownership with a smaller initial investment. However, before you jump in, it's crucial to carefully weigh the potential risks alongside the enticing rewards. This article will explore the intricacies of shared ownership, helping you determine if it's the right choice for your circumstances.

What is Shared Ownership?

Shared ownership, also known as fractional ownership, is a part-buy, part-rent model. You purchase a share of a property's value, typically ranging from 25% to 75%, and pay rent on the remaining share. As your financial situation improves, you can gradually purchase larger shares, ultimately owning the property outright – a process known as staircasing.

The Allure of Shared Ownership:

- Lower Initial Costs: The most significant advantage is the reduced deposit and mortgage required compared to outright purchase. This makes homeownership accessible to those who might otherwise be priced out of the market.

- Easier Access to Mortgages: Securing a mortgage for a smaller share is often easier than obtaining one for the full property value, making it a viable option for first-time buyers.

- Stepping Stone to Full Ownership: Shared ownership provides a clear pathway to full ownership through staircasing, allowing you to increase your stake gradually as your finances allow.

The Potential Pitfalls:

While shared ownership offers significant benefits, potential downsides need careful consideration:

- Ongoing Rent Payments: You'll continue paying rent on the unsold share, which can be a considerable ongoing expense. These rent payments can increase over time.

- Staircasing Restrictions: The ability to staircase isn't always guaranteed or straightforward. Restrictions may be imposed by the housing association or lender, potentially limiting your ability to buy more shares when you want.

- Service Charges: Shared ownership often involves paying service charges to cover building maintenance and upkeep. These can be substantial and unexpected increases can put a strain on your budget.

- Limited Choice: The available properties in shared ownership schemes may be limited, potentially restricting your location and choice of property type. You may find fewer choices compared to the open market.

- Selling Challenges: Selling a shared ownership property can be more complex than selling a fully owned property. You need to find a buyer who is also eligible for shared ownership.

Is Shared Ownership Right for You? Key Questions to Ask:

Before committing to shared ownership, ask yourself these crucial questions:

- What are my long-term financial goals? Can you realistically afford the ongoing rent payments and potential staircasing costs?

- What are my lifestyle needs? Does the limited choice of properties within shared ownership schemes meet your requirements?

- What is my risk tolerance? Are you comfortable with the potential challenges and limitations associated with shared ownership?

Alternatives to Shared Ownership:

If shared ownership doesn't feel like the right fit, consider exploring other options like:

- Help to Buy schemes: Government-backed initiatives designed to assist first-time buyers with smaller deposits. [Link to relevant government website]

- Rent to Buy schemes: Allowing you to rent a property with the option to buy it at a later date.

- Saving diligently: Building up a larger deposit to purchase a property outright.

Conclusion:

Shared ownership can be a valuable stepping stone to homeownership, but it's not a one-size-fits-all solution. Carefully weigh the potential benefits against the risks, consider the long-term financial implications, and explore alternative options before making a decision. Seeking professional financial advice is always recommended before committing to any significant financial commitment like shared ownership.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Is Shared Ownership Right For You? Weighing The Risks. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

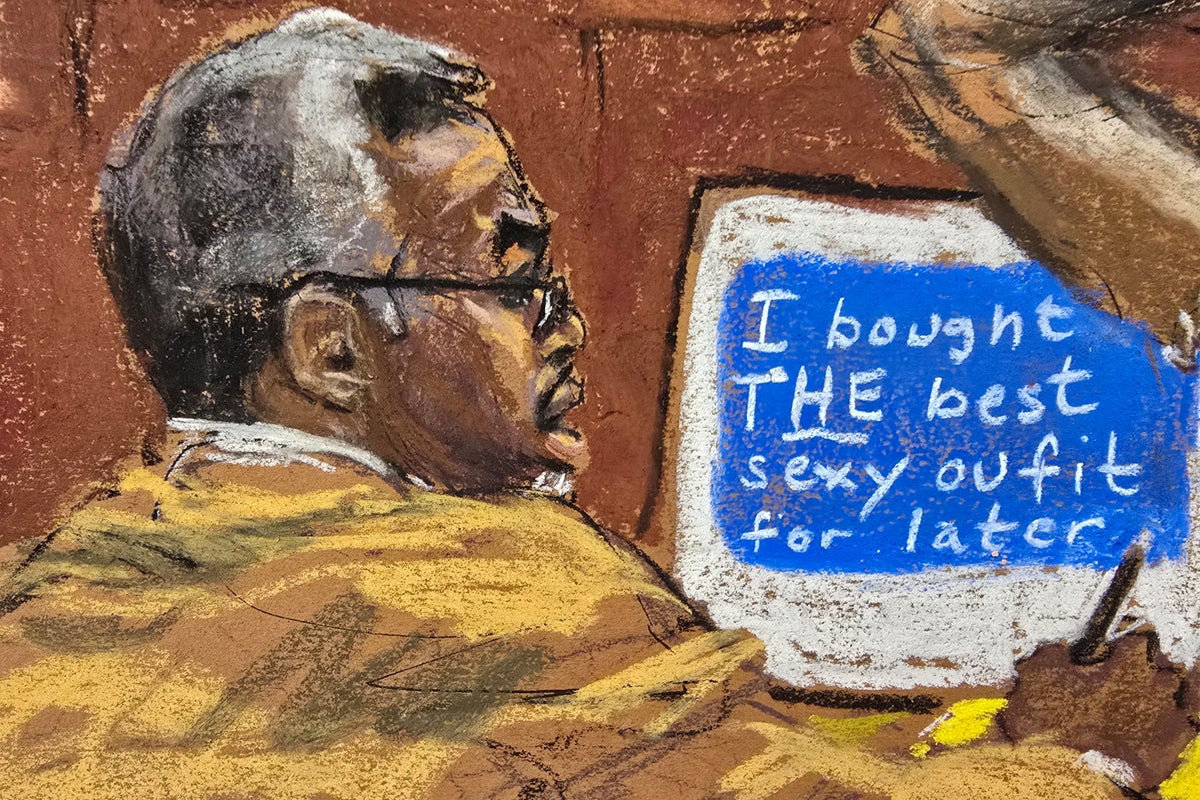

Diddy Trial Jurors View Explicit Footage A Deeper Look At The Evidence

Jun 18, 2025

Diddy Trial Jurors View Explicit Footage A Deeper Look At The Evidence

Jun 18, 2025 -

Heavy Rain And Storms Batter Metro Atlanta North Georgia Also Affected

Jun 18, 2025

Heavy Rain And Storms Batter Metro Atlanta North Georgia Also Affected

Jun 18, 2025 -

Marathons Release Date Bungie Delays Sci Fi Fps Indefinitely

Jun 18, 2025

Marathons Release Date Bungie Delays Sci Fi Fps Indefinitely

Jun 18, 2025 -

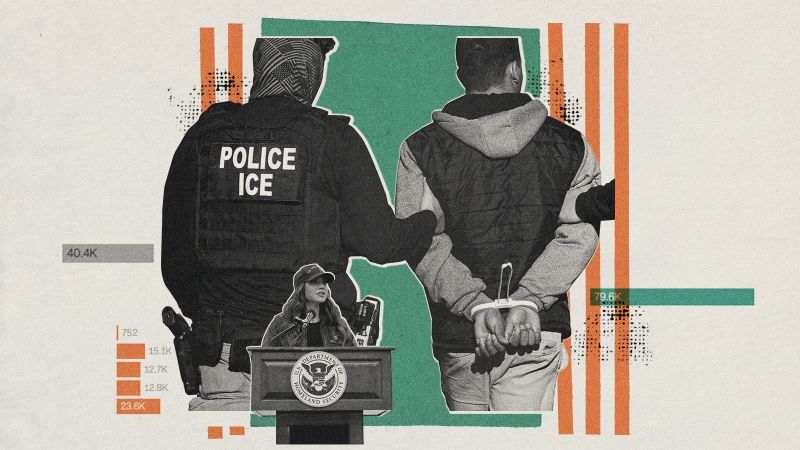

Analysis Of Ice Data Criminal History Of Immigrants In Custody Since October

Jun 18, 2025

Analysis Of Ice Data Criminal History Of Immigrants In Custody Since October

Jun 18, 2025 -

Recent Deaths At National Park Highlight Hiking Safety Concerns

Jun 18, 2025

Recent Deaths At National Park Highlight Hiking Safety Concerns

Jun 18, 2025

Latest Posts

-

60 Mph Wind Gusts Expected Severe Thunderstorm Warning For Ingham And Jackson Counties

Jun 19, 2025

60 Mph Wind Gusts Expected Severe Thunderstorm Warning For Ingham And Jackson Counties

Jun 19, 2025 -

Wnba Predictions Phoenix Mercury Vs Connecticut Sun Best Bets And Analysis

Jun 19, 2025

Wnba Predictions Phoenix Mercury Vs Connecticut Sun Best Bets And Analysis

Jun 19, 2025 -

Predicting Logan Hendersons Mlb Debut Fantasy Baseball Advice

Jun 19, 2025

Predicting Logan Hendersons Mlb Debut Fantasy Baseball Advice

Jun 19, 2025 -

Logan Henderson Mlb Call Up Fantasy Baseball Week 11 Update

Jun 19, 2025

Logan Henderson Mlb Call Up Fantasy Baseball Week 11 Update

Jun 19, 2025 -

Ingham And Jackson Counties Facing Damaging Winds Wednesday Thunderstorm Update

Jun 19, 2025

Ingham And Jackson Counties Facing Damaging Winds Wednesday Thunderstorm Update

Jun 19, 2025