Is SiriusXM Holdings Overvalued? A Deep Dive Into The Stock's Future

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Is SiriusXM Holdings Overvalued? A Deep Dive into the Stock's Future

SiriusXM Holdings (SIRI) has enjoyed a relatively smooth ride in recent years, but the question on many investors' minds is: is the stock's current price justified? This in-depth analysis explores the factors driving SiriusXM's performance, its potential for future growth, and ultimately, whether it's currently overvalued.

SiriusXM's Strengths: A Solid Foundation

SiriusXM boasts a dominant position in the satellite radio market, enjoying high subscriber loyalty and consistent revenue streams. This established market share provides a strong foundation for future growth, particularly as the company continues to diversify its offerings. Key strengths include:

- Subscription-based revenue model: This predictable revenue stream provides stability, even in fluctuating economic conditions. Unlike advertising-reliant businesses, SiriusXM's income is less susceptible to market downturns.

- Expanding content offerings: SiriusXM has been actively investing in expanding its content library, including podcasts, original programming, and partnerships with popular artists and personalities. This diversification attracts a wider audience and enhances subscriber retention.

- Integration with connected cars: The increasing integration of SiriusXM into new vehicles represents a significant growth opportunity. As more cars come equipped with built-in satellite radio, the potential subscriber base expands considerably.

- Pandemic resilience: Interestingly, the company showed remarkable resilience during the COVID-19 pandemic, demonstrating the enduring appeal of its subscription service even during periods of economic uncertainty.

Challenges and Risks: Navigating the Future

Despite its strengths, SiriusXM faces several challenges that investors need to consider:

- Competition from streaming services: The rise of streaming music services like Spotify and Apple Music poses a significant threat. These platforms offer on-demand music at competitive prices, potentially attracting subscribers away from satellite radio.

- Dependence on the automotive industry: SiriusXM's growth is heavily reliant on the automotive sector. A downturn in car sales could negatively impact subscriber acquisition and overall revenue.

- High debt levels: The company carries a considerable amount of debt, which could become a concern during periods of economic stress. This debt burden needs to be carefully monitored.

- Content acquisition costs: Maintaining a diverse and high-quality content library requires significant investment. The increasing costs associated with acquiring and producing content could impact profitability.

Valuation Analysis: Is the Price Right?

Determining whether SiriusXM is overvalued requires a comprehensive valuation analysis. While its current price-to-earnings (P/E) ratio might seem attractive compared to some competitors, investors should consider the company's growth prospects and future earnings potential. Factors to consider include:

- Future subscriber growth: Projections for subscriber additions will heavily influence future earnings and valuation.

- Content investment ROI: The return on investment for content acquisitions will be critical in determining long-term profitability.

- Debt reduction strategy: The company's plan for managing and reducing its debt load is crucial for long-term financial health.

Analyzing financial statements, comparing SiriusXM's performance to industry benchmarks, and using discounted cash flow (DCF) models are essential tools for a thorough valuation. Consult with a financial advisor for personalized advice.

Conclusion: A Cautious Outlook

SiriusXM holds a strong position in its market, but the competitive landscape and inherent risks warrant a cautious approach. While the company's subscriber base and revenue streams provide a degree of stability, potential threats from streaming services and economic downturns need to be carefully considered. A comprehensive valuation analysis, coupled with a thorough understanding of the industry dynamics, is essential before making any investment decisions. Further research and consultation with a financial professional are strongly recommended. Remember, past performance is not indicative of future results. This article is for informational purposes only and does not constitute financial advice.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Is SiriusXM Holdings Overvalued? A Deep Dive Into The Stock's Future. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Boost Your Gardens Health 3 Practical Uses For Spent Coffee Grounds

May 27, 2025

Boost Your Gardens Health 3 Practical Uses For Spent Coffee Grounds

May 27, 2025 -

I Os 18 4 1 Apples Signing Halt And Its Implications For Users

May 27, 2025

I Os 18 4 1 Apples Signing Halt And Its Implications For Users

May 27, 2025 -

Mens Lacrosse Championship Game Maryland Battles Cornell

May 27, 2025

Mens Lacrosse Championship Game Maryland Battles Cornell

May 27, 2025 -

Bates Battles Post Office Over Inadequate Compensation Payment

May 27, 2025

Bates Battles Post Office Over Inadequate Compensation Payment

May 27, 2025 -

Preserving George Floyds Memory A Portrait Of A Beloved Figure

May 27, 2025

Preserving George Floyds Memory A Portrait Of A Beloved Figure

May 27, 2025

Latest Posts

-

Kidnapped And Sold Joshlin Smiths Mother Receives Jail Sentence In South Africa

May 31, 2025

Kidnapped And Sold Joshlin Smiths Mother Receives Jail Sentence In South Africa

May 31, 2025 -

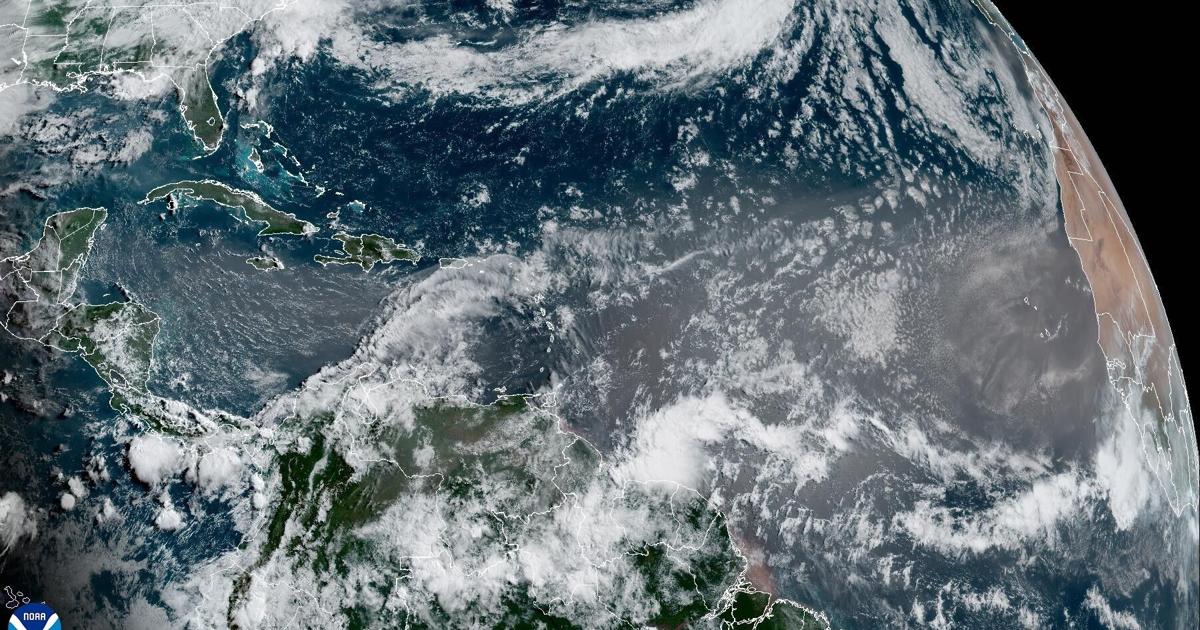

Dramatic Louisiana Sunsets Predicted Saharan Dust Plume On The Way

May 31, 2025

Dramatic Louisiana Sunsets Predicted Saharan Dust Plume On The Way

May 31, 2025 -

Air Traffic Control Crisis At Newark Airport A Proposed Solution

May 31, 2025

Air Traffic Control Crisis At Newark Airport A Proposed Solution

May 31, 2025 -

Holger Runes Third Round Berth At French Open A Dominant Display

May 31, 2025

Holger Runes Third Round Berth At French Open A Dominant Display

May 31, 2025 -

Joshlin Smith Kidnapping Mother Kelly Jailed In South Africa

May 31, 2025

Joshlin Smith Kidnapping Mother Kelly Jailed In South Africa

May 31, 2025