Is SiriusXM Holdings Stock Overvalued? A Realistic Assessment.

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Is SiriusXM Holdings Stock Overvalued? A Realistic Assessment

SiriusXM Holdings Inc. (SIRI) has enjoyed a relatively smooth ride in recent years, but the question on many investors' minds is: is the stock currently overvalued? This in-depth analysis explores the company's performance, market position, and future prospects to provide a realistic assessment of SiriusXM's valuation.

SiriusXM's Current Market Position:

SiriusXM dominates the satellite radio market in North America, boasting a subscriber base exceeding 35 million. This significant market share provides a strong foundation for revenue generation. However, the company is facing increased competition from streaming services like Spotify and Apple Music, which offer diverse audio content, including music, podcasts, and audiobooks. This competitive landscape needs careful consideration when evaluating SiriusXM's stock.

Key Financial Metrics and Growth Potential:

While SiriusXM's subscriber numbers remain robust, its revenue growth has plateaued in recent quarters. Analyzing key financial metrics, such as revenue growth, earnings per share (EPS), and free cash flow, is crucial. Investors should scrutinize the company's ability to maintain subscriber growth and increase average revenue per user (ARPU) in the face of intensifying competition. Furthermore, assessing the potential for expansion into new markets or services is essential for predicting future growth.

Analyzing the Valuation:

Several valuation methods can be employed to determine whether SiriusXM's stock is overvalued. These include:

- Price-to-Earnings Ratio (P/E): Comparing SiriusXM's P/E ratio to its industry peers and historical averages can offer insights into its relative valuation. A high P/E ratio might suggest overvaluation, indicating that investors are paying a premium for future growth.

- Discounted Cash Flow (DCF) Analysis: This method projects future cash flows and discounts them back to their present value. A DCF analysis requires making assumptions about future growth rates and discount rates, which can significantly impact the valuation. (external link).

- Comparable Company Analysis: Comparing SiriusXM's valuation metrics to similar companies in the media and entertainment industry provides a benchmark for assessment.

Factors Affecting SiriusXM's Stock Price:

Several factors can influence SiriusXM's stock price, including:

- Subscriber growth and churn: The rate at which SiriusXM gains and loses subscribers directly impacts revenue and profitability.

- Competition from streaming services: The competitive landscape continues to evolve, requiring SiriusXM to adapt its offerings and pricing strategies.

- Technological advancements: The company's ability to innovate and integrate new technologies will be crucial for long-term success.

- Economic conditions: Broader economic factors, such as consumer spending and disposable income, can significantly affect demand for subscription services.

Conclusion: Is SiriusXM Overvalued?

Determining whether SiriusXM's stock is overvalued requires a comprehensive analysis of its financial performance, competitive landscape, and future growth prospects. While the company's dominant market position provides a solid foundation, the increasing competition from streaming services and the plateauing revenue growth raise concerns. A thorough evaluation using various valuation methods, considering the factors mentioned above, is necessary before making any investment decisions. Remember to consult with a financial advisor before making any investment choices. This article provides information for educational purposes only and does not constitute financial advice.

Call to Action: Stay informed about SiriusXM's performance by following financial news and conducting your own thorough research before investing.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Is SiriusXM Holdings Stock Overvalued? A Realistic Assessment.. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Liverpool Fc Parade Incident What Happened And Why

May 28, 2025

Liverpool Fc Parade Incident What Happened And Why

May 28, 2025 -

Health Update Brunei Sultan In Kl Hospital For Fatigue

May 28, 2025

Health Update Brunei Sultan In Kl Hospital For Fatigue

May 28, 2025 -

Wwii Plane Crash Eleven Dead Four Airmen Finally Identified And Repatriated

May 28, 2025

Wwii Plane Crash Eleven Dead Four Airmen Finally Identified And Repatriated

May 28, 2025 -

Deep Dive Sirius Xm Dark Wave Playlist From Slicing Up Eyeballs 5 25 25

May 28, 2025

Deep Dive Sirius Xm Dark Wave Playlist From Slicing Up Eyeballs 5 25 25

May 28, 2025 -

Soaring Beef Prices Fuel Highest Food Inflation In A Year

May 28, 2025

Soaring Beef Prices Fuel Highest Food Inflation In A Year

May 28, 2025

Latest Posts

-

Kidnapped And Sold Joshlin Smiths Mother Receives Jail Sentence In South Africa

May 31, 2025

Kidnapped And Sold Joshlin Smiths Mother Receives Jail Sentence In South Africa

May 31, 2025 -

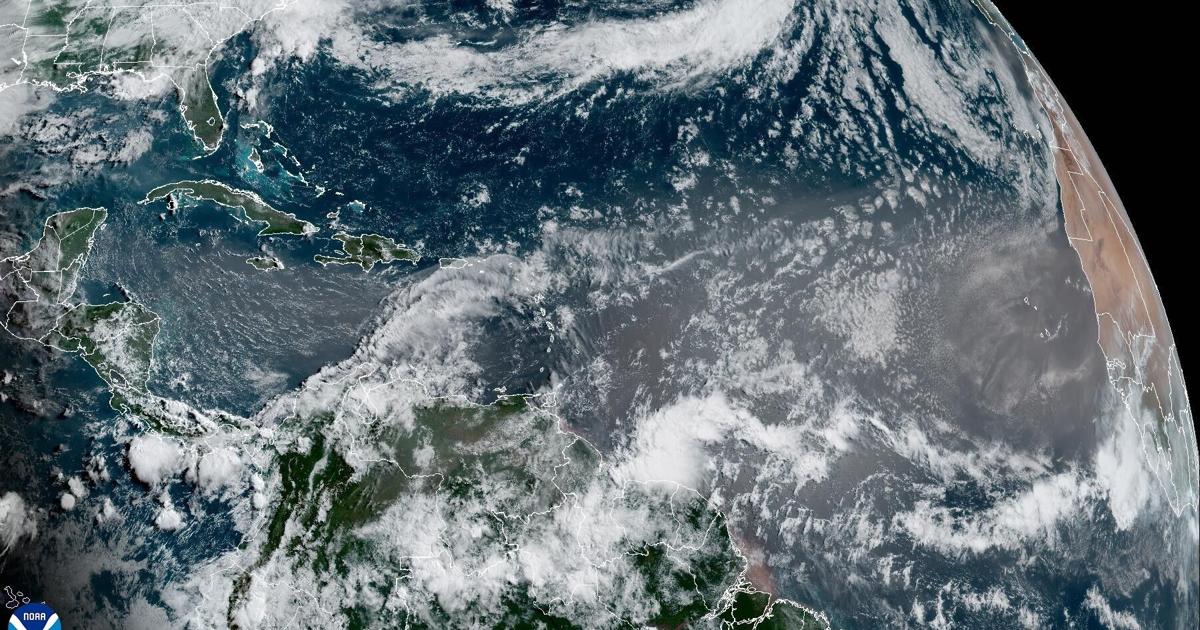

Dramatic Louisiana Sunsets Predicted Saharan Dust Plume On The Way

May 31, 2025

Dramatic Louisiana Sunsets Predicted Saharan Dust Plume On The Way

May 31, 2025 -

Air Traffic Control Crisis At Newark Airport A Proposed Solution

May 31, 2025

Air Traffic Control Crisis At Newark Airport A Proposed Solution

May 31, 2025 -

Holger Runes Third Round Berth At French Open A Dominant Display

May 31, 2025

Holger Runes Third Round Berth At French Open A Dominant Display

May 31, 2025 -

Joshlin Smith Kidnapping Mother Kelly Jailed In South Africa

May 31, 2025

Joshlin Smith Kidnapping Mother Kelly Jailed In South Africa

May 31, 2025