Is SiriusXM Stock A Smart Long-Term Investment? Analyzing The Data.

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Is SiriusXM Stock a Smart Long-Term Investment? Analyzing the Data

SiriusXM Holdings Inc. (SIRI) has carved a niche as a leading provider of satellite radio and online audio entertainment. But with the ever-shifting landscape of the media industry, is SiriusXM stock a smart long-term investment? Let's delve into the data and explore the potential opportunities and risks.

SiriusXM's Strengths: A Solid Foundation for Growth?

SiriusXM boasts several key strengths that contribute to its long-term viability:

- Strong Subscriber Base: The company possesses a substantial and loyal subscriber base, demonstrating consistent growth despite competition from streaming services. This recurring revenue stream provides financial stability.

- Exclusive Content and Partnerships: SiriusXM's partnerships with renowned personalities and exclusive content offerings create a unique value proposition, differentiating it from free, ad-supported streaming platforms. This curated content keeps subscribers engaged.

- Expanding Digital Platform: SiriusXM isn't just about satellite radio anymore. Its expansion into digital platforms, including apps and online streaming services, allows it to reach a broader audience and cater to evolving consumer preferences. This strategic move is crucial for long-term growth.

- Pandemic Resilience: The COVID-19 pandemic, while challenging for many businesses, actually saw increased engagement with SiriusXM's services as people spent more time at home. This highlighted the resilience of their business model.

Challenges and Risks: Navigating the Competitive Landscape

While SiriusXM presents a compelling case, it's essential to acknowledge the challenges:

- Intense Competition: The streaming audio market is fiercely competitive. Established players like Spotify and Apple Music, along with emerging rivals, pose significant threats to SiriusXM's market share.

- Subscription Fatigue: Consumers are increasingly burdened by multiple subscription services. This "subscription fatigue" could impact SiriusXM's ability to acquire and retain subscribers.

- Technological Advancements: The rapid pace of technological change necessitates constant adaptation and innovation. Falling behind in technological advancements could erode SiriusXM's competitive edge.

- Debt Levels: SiriusXM carries a substantial debt load, which could impact its financial flexibility and long-term growth prospects. Investors should carefully consider this factor.

Analyzing the Data: Key Financial Indicators

To assess SiriusXM's long-term potential, let's look at some key financial indicators:

- Revenue Growth: Examine the historical revenue growth trends to identify patterns and potential future growth. [Link to SiriusXM investor relations page for financial data]

- Subscriber Growth: Consistent subscriber growth is a crucial metric for judging the health of the business. A declining subscriber base would raise serious concerns.

- Profitability: Analyze profitability metrics such as operating margins and net income to assess the company's ability to generate profits.

- Debt-to-Equity Ratio: This ratio provides insights into SiriusXM's financial leverage and risk profile. A high ratio suggests higher financial risk.

Conclusion: A Balanced Perspective

Whether SiriusXM stock is a smart long-term investment depends on several factors and your individual risk tolerance. While the company exhibits strength in its subscriber base and content offerings, the competitive landscape and debt levels present significant challenges. Thoroughly research the company's financial performance and future outlook before making any investment decisions. Consult with a financial advisor for personalized guidance. Remember that past performance is not indicative of future results.

Call to Action: Stay informed about SiriusXM's progress by regularly reviewing their investor relations reports and news releases. This diligent approach will help you make informed investment choices.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Is SiriusXM Stock A Smart Long-Term Investment? Analyzing The Data.. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

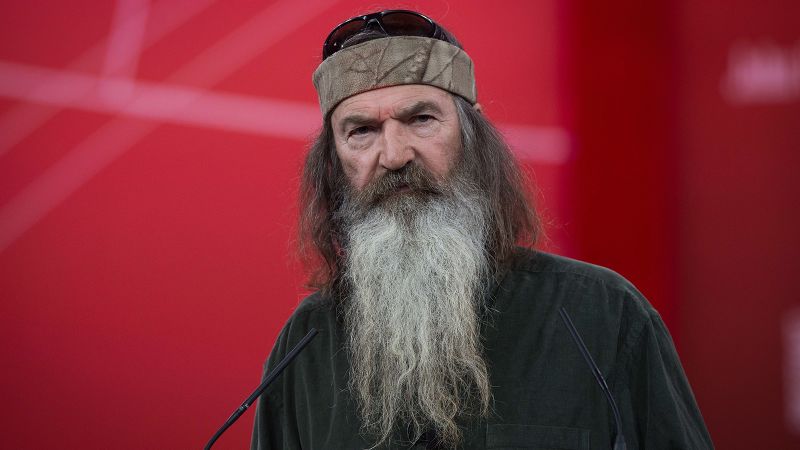

Duck Dynastys Phil Robertson Family Announces Death At Age 79

May 28, 2025

Duck Dynastys Phil Robertson Family Announces Death At Age 79

May 28, 2025 -

Diors Cruise 2026 Collection A Roman Narrative

May 28, 2025

Diors Cruise 2026 Collection A Roman Narrative

May 28, 2025 -

See Through Style Alexandra Daddarios Revealing Lace Gown

May 28, 2025

See Through Style Alexandra Daddarios Revealing Lace Gown

May 28, 2025 -

Hs 2 Staff Suppliers Face Investigation West Midlands Focus

May 28, 2025

Hs 2 Staff Suppliers Face Investigation West Midlands Focus

May 28, 2025 -

Is Amazon Amzn A Strong Momentum Stock Analysis And Outlook

May 28, 2025

Is Amazon Amzn A Strong Momentum Stock Analysis And Outlook

May 28, 2025

Latest Posts

-

Ukraines Summer Defense A Drone Based Strategy To Repel Russian Forces

May 31, 2025

Ukraines Summer Defense A Drone Based Strategy To Repel Russian Forces

May 31, 2025 -

California State Track Championships Rule Changes Considered After Transgender Athlete Competes

May 31, 2025

California State Track Championships Rule Changes Considered After Transgender Athlete Competes

May 31, 2025 -

Detroit Grand Prix 2025 Your Complete Guide To The Race Weekend

May 31, 2025

Detroit Grand Prix 2025 Your Complete Guide To The Race Weekend

May 31, 2025 -

French Open 2024 Rune Advances To Third Round With Convincing Win

May 31, 2025

French Open 2024 Rune Advances To Third Round With Convincing Win

May 31, 2025 -

California High School Track Finals Rule Change Fallout Following Transgender Athletes Victory

May 31, 2025

California High School Track Finals Rule Change Fallout Following Transgender Athletes Victory

May 31, 2025