Is The US Debt A Ticking Time Bomb? Billionaire Shares Dire Prediction

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Is the US Debt a Ticking Time Bomb? Billionaire Warns of Imminent Crisis

The US national debt has surpassed $31 trillion, a figure that continues to climb. This staggering sum has sparked intense debate, with some experts warning of a looming financial catastrophe. Recently, billionaire investor [Billionaire's Name], known for their [brief, accurate description of billionaire's investment expertise], issued a stark prediction, claiming the US debt is a "ticking time bomb" poised to detonate with devastating consequences. But is their assessment accurate? Let's delve into the details.

The Mounting Debt: A Closer Look

The US national debt has been steadily increasing for decades, fueled by factors like government spending, tax cuts, and economic downturns. While some argue that a large national debt isn't inherently problematic, particularly when interest rates are low, [Billionaire's Name]'s concerns highlight the potential risks associated with unchecked borrowing. The current trajectory raises critical questions about the country's long-term economic stability and its ability to meet its financial obligations.

[Billionaire's Name]'s Dire Prediction: What Did They Say?

[Billionaire's Name] recently [mention the source – e.g., stated in an interview with CNBC, published an op-ed in the Wall Street Journal] that the current trajectory of the US debt is unsustainable. They emphasized [summarize the billionaire's key arguments – e.g., the increasing interest payments crowding out other essential government spending, the potential for a debt crisis triggering a global recession]. Their prediction focuses on [mention specific timeframe or trigger event if mentioned, e.g., the next five years, a specific interest rate threshold]. This alarming forecast has ignited a renewed discussion on the urgent need for fiscal responsibility.

Counterarguments and Alternative Perspectives

While [Billionaire's Name]'s warning carries significant weight given their expertise, not all experts share their pessimism. Some economists argue that the current level of debt is manageable, citing [mention counterarguments – e.g., the ability of the US to borrow at low interest rates, the long-term growth potential of the US economy]. They emphasize the need for [mention alternative solutions – e.g., targeted spending cuts, tax reforms] rather than drastic measures. The debate underscores the complexity of the issue and the lack of consensus on the best path forward.

What Does This Mean for the Average American?

The escalating national debt has significant implications for ordinary Americans. Higher interest rates, potentially driven by increased borrowing costs, could lead to:

- Increased borrowing costs: Higher interest rates on mortgages, auto loans, and credit cards.

- Reduced government services: Potential cuts to social security, Medicare, and other crucial programs due to increased debt servicing costs.

- Inflationary pressures: Increased government borrowing could contribute to inflation, eroding purchasing power.

Understanding these potential consequences is crucial for making informed decisions about personal finances and advocating for responsible fiscal policy.

The Path Forward: Finding Solutions

Addressing the US national debt requires a multi-faceted approach. This includes:

- Enacting responsible fiscal policies: A balanced budget approach combined with efficient government spending.

- Promoting economic growth: Stimulating economic growth to increase tax revenue and reduce the debt-to-GDP ratio.

- Enhancing transparency and accountability: Improving the transparency and accountability of government spending.

The US debt situation is undoubtedly complex and demands careful consideration. While [Billionaire's Name]'s prediction is alarming, it serves as a crucial wake-up call, highlighting the urgent need for decisive action to address this looming challenge. Further research and informed debate are essential to navigate this critical issue and secure a sustainable economic future for the United States. Stay informed and engage in the conversation – the future of the US economy depends on it.

(Note: Remember to replace bracketed information with specifics related to the actual billionaire and their prediction.)

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Is The US Debt A Ticking Time Bomb? Billionaire Shares Dire Prediction. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Chef Anne Burrells Death Ruled A Suicide

Jul 26, 2025

Chef Anne Burrells Death Ruled A Suicide

Jul 26, 2025 -

Yeovil Hospital Premature Baby Murder Father Found Guilty

Jul 26, 2025

Yeovil Hospital Premature Baby Murder Father Found Guilty

Jul 26, 2025 -

The Rise And Fall And Rise Of Hulk Hogan A Wrestling Icons Journey

Jul 26, 2025

The Rise And Fall And Rise Of Hulk Hogan A Wrestling Icons Journey

Jul 26, 2025 -

Dangerous Heat Find Out Where It Will Feel Like 110 Degrees This Week

Jul 26, 2025

Dangerous Heat Find Out Where It Will Feel Like 110 Degrees This Week

Jul 26, 2025 -

Colorado Rockies Game 103 Freeland Vs Kremer Live Game Thread

Jul 26, 2025

Colorado Rockies Game 103 Freeland Vs Kremer Live Game Thread

Jul 26, 2025

Latest Posts

-

Camden Yards Hosts Savannah Bananas Where And How To Watch

Jul 27, 2025

Camden Yards Hosts Savannah Bananas Where And How To Watch

Jul 27, 2025 -

Chaos At Rock Legends 82nd Birthday Police Presence Reported

Jul 27, 2025

Chaos At Rock Legends 82nd Birthday Police Presence Reported

Jul 27, 2025 -

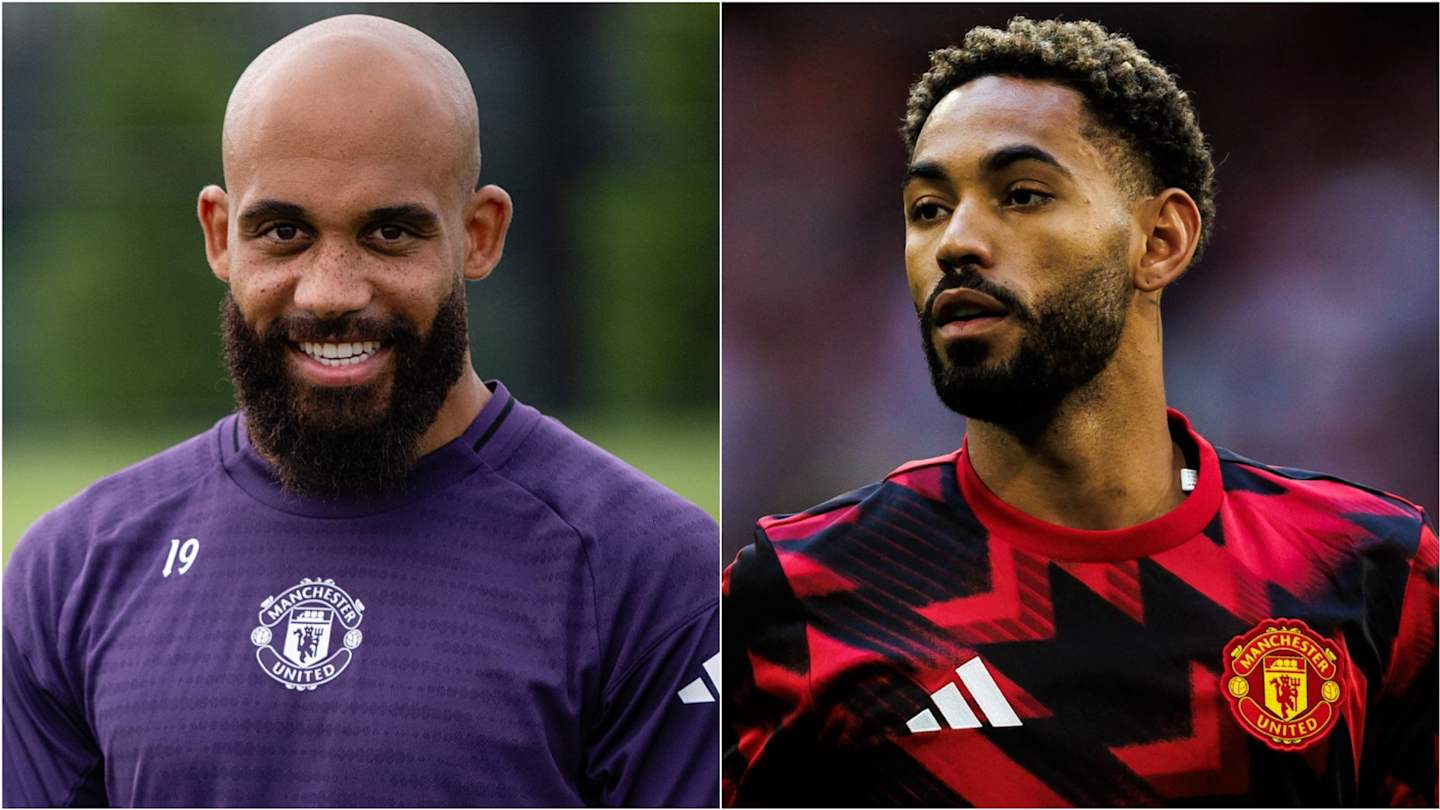

Mbeumo And Cunhas First Game Together Predicted Man Utd Lineup Vs West Ham

Jul 27, 2025

Mbeumo And Cunhas First Game Together Predicted Man Utd Lineup Vs West Ham

Jul 27, 2025 -

Los Angeles Sparks Vs New York Liberty Live Stream And Tv Guide

Jul 27, 2025

Los Angeles Sparks Vs New York Liberty Live Stream And Tv Guide

Jul 27, 2025 -

Update Kenny Mc Intosh Carted Off During Georgia Bulldogs Practice

Jul 27, 2025

Update Kenny Mc Intosh Carted Off During Georgia Bulldogs Practice

Jul 27, 2025