Is The US Headed For Disaster? Billionaire's Stark Debt Warning.

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Is the US Headed for Disaster? Billionaire's Stark Debt Warning Sends Shockwaves

The US national debt has ballooned to unprecedented levels, sparking concerns about the nation's economic future. A recent stark warning from a prominent billionaire has amplified these anxieties, prompting urgent questions about the potential consequences of unchecked government spending. Is the US truly headed for a financial disaster? Let's delve into the details.

Billionaire's Dire Prediction:

[Insert Billionaire's Name], a renowned investor and [Billionaire's Industry/Area of Expertise], recently issued a grave warning regarding the escalating US national debt. In a [Source – e.g., recent interview, published statement], [he/she] emphasized the unsustainable trajectory of government spending and its potential to trigger a major economic crisis. [He/She] argued that the current path is not merely concerning, but potentially catastrophic. The specifics of their prediction should be included here, directly quoting the billionaire where possible and providing context. For example, did they predict a specific event, like a debt default? Did they mention a timeframe?

The Mounting National Debt: A Deeper Dive

The US national debt currently stands at [Insert Current National Debt Figure, with source citation]. This staggering figure represents the total amount of money the US government owes to its creditors, including individuals, businesses, and foreign governments. Several factors contribute to this alarming growth:

- Increased Government Spending: Government spending on programs like Social Security, Medicare, and defense continues to rise, straining the national budget. [Optional: Briefly touch on specific legislation or events that contributed significantly to increased spending].

- Tax Cuts: Tax cuts, while stimulating the economy in the short term, can exacerbate the national debt if not accompanied by corresponding spending cuts.

- Economic Slowdowns: Recessions and economic downturns often lead to decreased tax revenue, widening the budget deficit.

Potential Consequences of Unchecked Debt:

The long-term consequences of a rapidly expanding national debt are potentially severe:

- Increased Interest Rates: Higher interest rates make it more expensive for the government to borrow money, further increasing the debt burden. This can lead to reduced investment and slower economic growth.

- Inflation: Excessive government borrowing can lead to inflation, eroding the purchasing power of the dollar.

- Debt Default: A worst-case scenario involves the US government defaulting on its debt obligations, which would have devastating consequences for the global economy. This would significantly damage the U.S.'s credit rating and severely impact investor confidence.

Experts Weigh In:

While [Billionaire's Name]'s warning is alarming, it's crucial to consider other perspectives. Economic experts hold varying views on the severity of the situation and the potential for a major crisis. Some argue that the current debt levels are manageable, while others share similar concerns to the billionaire. [Link to a credible news source or economic analysis offering a contrasting viewpoint]. This diversity of opinion highlights the complexity of the issue and the need for careful analysis.

What's Next? Potential Solutions and Mitigation Strategies

Addressing the national debt requires a multifaceted approach involving:

- Fiscal Responsibility: Implementing measures to control government spending and increase tax revenue are crucial.

- Economic Growth: Sustained economic growth can help reduce the debt-to-GDP ratio.

- Debt Reduction Strategies: Exploring options like debt consolidation or targeted spending cuts can help alleviate the pressure.

Conclusion:

The billionaire's stark warning serves as a crucial wake-up call. While a financial disaster isn't inevitable, the current trajectory of the US national debt is undeniably concerning. Addressing this issue requires immediate and decisive action from policymakers and a national conversation about fiscal responsibility. The future of the US economy hinges on finding sustainable solutions.

Keywords: US national debt, national debt crisis, billionaire warning, economic crisis, government spending, fiscal responsibility, debt default, inflation, interest rates, economic downturn, financial disaster, [Billionaire's Name].

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Is The US Headed For Disaster? Billionaire's Stark Debt Warning.. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

National Debt Danger A Billionaires Perspective On The Us Economic Future

Jul 26, 2025

National Debt Danger A Billionaires Perspective On The Us Economic Future

Jul 26, 2025 -

Eastern Massachusetts Residents Cope With Destruction After Severe Thunderstorm

Jul 26, 2025

Eastern Massachusetts Residents Cope With Destruction After Severe Thunderstorm

Jul 26, 2025 -

Professional Wrestling Mourns The Loss Of Hulk Hogan At 71

Jul 26, 2025

Professional Wrestling Mourns The Loss Of Hulk Hogan At 71

Jul 26, 2025 -

Colorado Rockies Road Trip A Crucial Test Of Their Winning Ways

Jul 26, 2025

Colorado Rockies Road Trip A Crucial Test Of Their Winning Ways

Jul 26, 2025 -

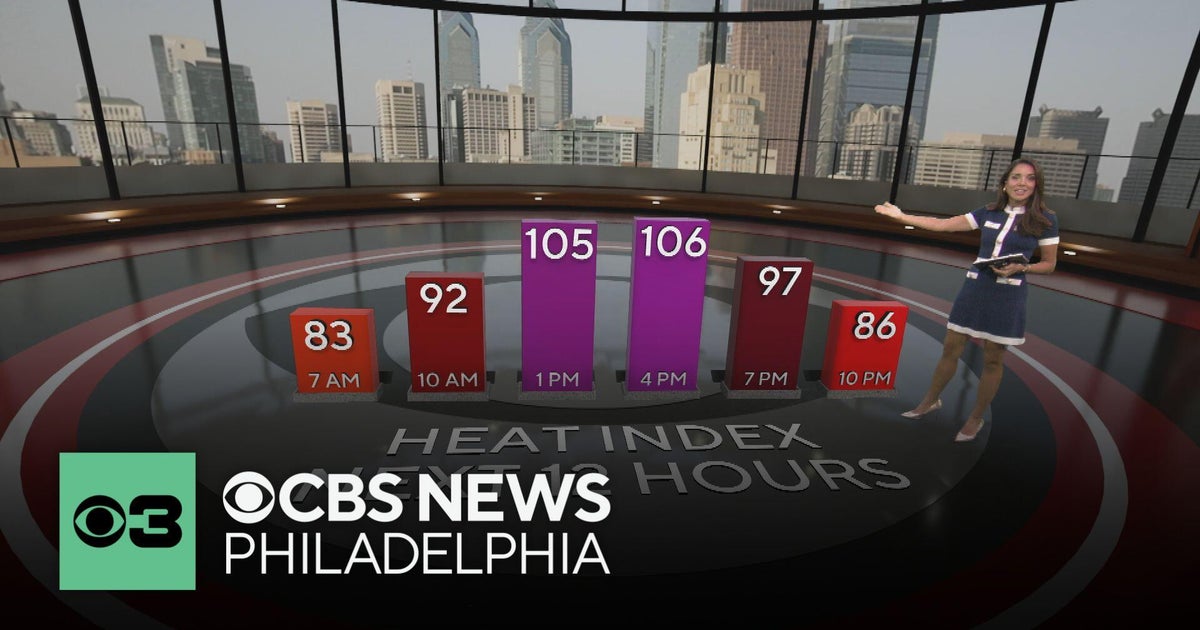

Philadelphia Swelters Under Extreme Heat 106 F Heat Index

Jul 26, 2025

Philadelphia Swelters Under Extreme Heat 106 F Heat Index

Jul 26, 2025

Latest Posts

-

Camden Yards Hosts Savannah Bananas Where And How To Watch

Jul 27, 2025

Camden Yards Hosts Savannah Bananas Where And How To Watch

Jul 27, 2025 -

Chaos At Rock Legends 82nd Birthday Police Presence Reported

Jul 27, 2025

Chaos At Rock Legends 82nd Birthday Police Presence Reported

Jul 27, 2025 -

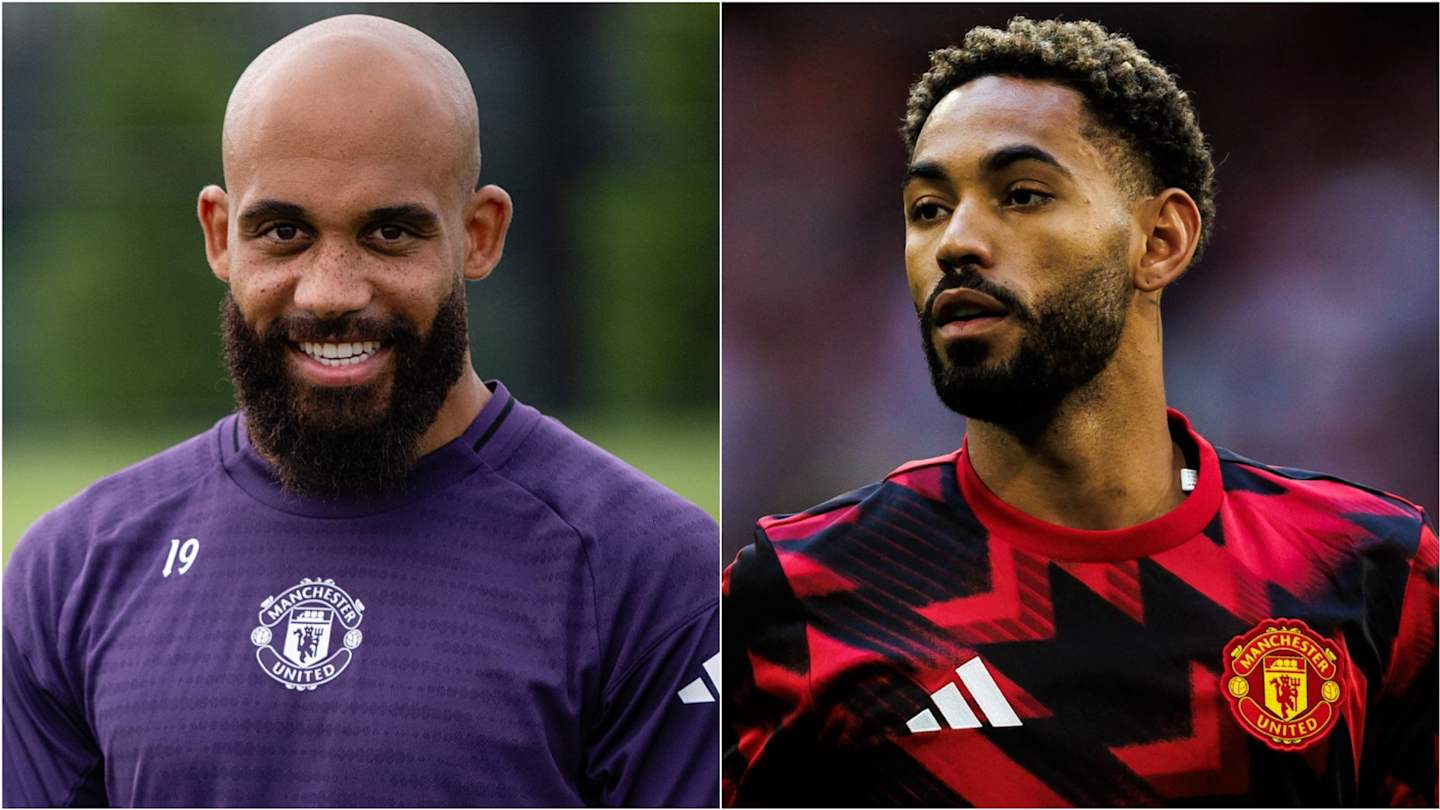

Mbeumo And Cunhas First Game Together Predicted Man Utd Lineup Vs West Ham

Jul 27, 2025

Mbeumo And Cunhas First Game Together Predicted Man Utd Lineup Vs West Ham

Jul 27, 2025 -

Los Angeles Sparks Vs New York Liberty Live Stream And Tv Guide

Jul 27, 2025

Los Angeles Sparks Vs New York Liberty Live Stream And Tv Guide

Jul 27, 2025 -

Update Kenny Mc Intosh Carted Off During Georgia Bulldogs Practice

Jul 27, 2025

Update Kenny Mc Intosh Carted Off During Georgia Bulldogs Practice

Jul 27, 2025