Is Your Retirement Ready? Mitigating The Potential Impact Of A 2025 US Tourism Decline

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Is Your Retirement Ready? Mitigating the Potential Impact of a 2025 US Tourism Decline

The US tourism industry, a significant contributor to the national economy and a key source of income for many retirees relying on investment portfolios tied to tourism, faces potential headwinds in 2025. This uncertainty necessitates a crucial question for those nearing or already in retirement: Is your retirement portfolio prepared for a downturn in the tourism sector?

The projected decline, fueled by factors such as inflation, potential economic recession, and shifting global travel patterns, could significantly impact investment returns for those heavily invested in travel-related stocks or real estate. Understanding these risks and proactively mitigating them is paramount to ensuring a secure and comfortable retirement.

Understanding the Potential Risks

Several factors contribute to the predicted softening of the US tourism market in 2025:

- Inflationary Pressures: High inflation erodes purchasing power, leading consumers to curtail discretionary spending, including travel.

- Economic Uncertainty: A potential recession could further dampen travel demand, as consumers prioritize essential expenses.

- Global Competition: The rise of alternative travel destinations and changing global travel trends could reduce the influx of international tourists to the US.

- Geopolitical Instability: Unforeseen global events can significantly impact travel plans and investment confidence.

These risks translate to potential losses for investors with significant exposure to the tourism sector. This is particularly concerning for retirees whose retirement income relies heavily on these investments.

Strategies to Mitigate the Risk

Protecting your retirement savings from a potential tourism downturn requires a multi-pronged approach:

- Diversify Your Portfolio: The golden rule of investing is diversification. Don't put all your eggs in one basket. Spreading your investments across various asset classes (stocks, bonds, real estate, etc.) reduces your vulnerability to the fluctuations of a single sector. Consider investing in sectors less susceptible to economic downturns, such as healthcare or technology.

- Rebalance Your Portfolio: Regularly review and rebalance your investment portfolio to maintain your desired asset allocation. This helps to prevent overexposure to any single sector, including tourism.

- Consider Alternative Income Streams: Explore additional income streams beyond your investments, such as part-time work, consulting, or rental income. This provides a safety net in case your investment returns fall short of expectations.

- Consult a Financial Advisor: Seek professional financial advice to tailor a retirement plan that aligns with your risk tolerance and financial goals. A qualified advisor can help you navigate the complexities of investment diversification and risk management.

Looking Beyond 2025: Long-Term Retirement Planning

While mitigating the potential impact of a 2025 tourism decline is crucial, remember that long-term retirement planning is an ongoing process. Regularly review your financial plan and adjust it as needed to account for changing circumstances and market conditions.

Call to Action: Don't wait until it's too late. Review your retirement portfolio today and take proactive steps to protect your financial future. Consider scheduling a consultation with a financial advisor to discuss your specific situation and develop a personalized retirement strategy. [Link to a reputable financial planning resource or article].

This proactive approach will ensure your retirement remains secure, regardless of the fluctuations in the US tourism industry or broader economic landscape. Remember, planning for the unexpected is key to a comfortable and worry-free retirement.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Is Your Retirement Ready? Mitigating The Potential Impact Of A 2025 US Tourism Decline. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Renewed Russian Aggression Missile And Drone Barrage On Kyiv After Prisoner Release

May 26, 2025

Renewed Russian Aggression Missile And Drone Barrage On Kyiv After Prisoner Release

May 26, 2025 -

The Rise And Fall Of Black Lives Matter Plaza A Case Study In Public Discourse

May 26, 2025

The Rise And Fall Of Black Lives Matter Plaza A Case Study In Public Discourse

May 26, 2025 -

South Western Railway Returns To Public Ownership What Does This Mean For Passengers

May 26, 2025

South Western Railway Returns To Public Ownership What Does This Mean For Passengers

May 26, 2025 -

Is I Os 18 4 1 Worth Installing On Your I Phone A Detailed Look

May 26, 2025

Is I Os 18 4 1 Worth Installing On Your I Phone A Detailed Look

May 26, 2025 -

Jeanine Pirro Weighs In Israeli Embassy Murders

May 26, 2025

Jeanine Pirro Weighs In Israeli Embassy Murders

May 26, 2025

Latest Posts

-

Beyond Gates And Buffett Analyzing The 600 Billion Commitment To Charity

May 28, 2025

Beyond Gates And Buffett Analyzing The 600 Billion Commitment To Charity

May 28, 2025 -

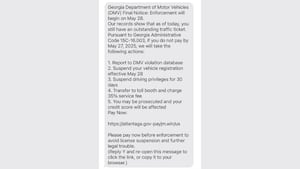

Did You Receive A Fraudulent Text From The Ga Dds Heres What To Do

May 28, 2025

Did You Receive A Fraudulent Text From The Ga Dds Heres What To Do

May 28, 2025 -

Liverpools Championship Parade Understanding The Recent Incident

May 28, 2025

Liverpools Championship Parade Understanding The Recent Incident

May 28, 2025 -

Harvards Elitism A Convenient Target For Trumps Rhetoric

May 28, 2025

Harvards Elitism A Convenient Target For Trumps Rhetoric

May 28, 2025 -

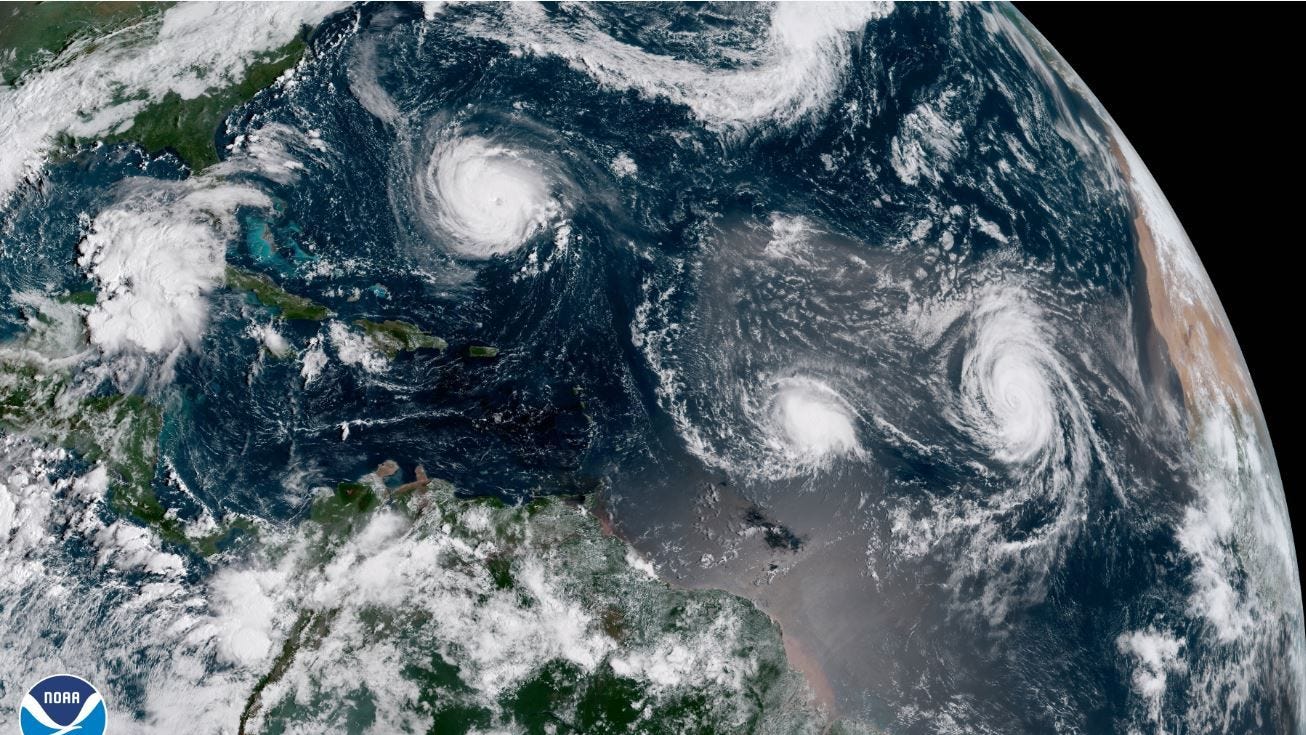

Frequently Asked Questions About The 2025 Atlantic Hurricane Season

May 28, 2025

Frequently Asked Questions About The 2025 Atlantic Hurricane Season

May 28, 2025