JPMorgan Chase CEO Jamie Dimon Issues Economic Warning

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

JPMorgan Chase CEO Jamie Dimon Issues Stark Economic Warning: Recession Looms?

JPMorgan Chase & Co.'s CEO Jamie Dimon delivered a stark warning about the U.S. economy, fueling concerns of a potential recession. His comments, made during the bank's second-quarter earnings call, sent shockwaves through financial markets, highlighting the growing uncertainty surrounding the economic outlook. Dimon's pessimistic assessment underscores the challenges facing businesses and consumers alike as inflation remains stubbornly high and interest rates continue to climb.

Dimon, known for his candid assessments of the economic landscape, painted a picture of a brewing storm. He cited several factors contributing to his concerns, including the ongoing war in Ukraine, persistent inflation, and the Federal Reserve's aggressive interest rate hikes. These intertwined challenges, he argued, are creating a perfect storm that could easily push the economy into a recession.

The Key Concerns Highlighted by Dimon

Dimon didn't mince words, outlining several key areas of concern:

-

Inflation: The stubbornly high inflation rate continues to erode consumer purchasing power, squeezing household budgets and dampening consumer spending. This, Dimon warned, could lead to a significant slowdown in economic growth. He emphasized the need for the Federal Reserve to effectively manage inflation without triggering a deep recession.

-

Geopolitical Uncertainty: The ongoing war in Ukraine continues to disrupt global supply chains and energy markets, adding further inflationary pressure and increasing economic uncertainty. Dimon highlighted the unpredictable nature of the conflict and its potential to further destabilize the global economy.

-

Interest Rate Hikes: The Federal Reserve's aggressive interest rate hikes, aimed at curbing inflation, carry the risk of triggering a recession. While necessary to combat inflation, these hikes increase borrowing costs for businesses and consumers, potentially stifling investment and spending. Dimon cautioned against overly aggressive rate hikes, urging a more measured approach.

What Does This Mean for Consumers and Businesses?

Dimon's warning has significant implications for both consumers and businesses. Consumers can expect continued pressure on their budgets, with higher prices for goods and services alongside increased borrowing costs. Businesses, meanwhile, face challenges in managing rising input costs and navigating an increasingly uncertain economic environment. Many are already bracing for a potential slowdown in demand.

The Market's Reaction

The stock market reacted cautiously to Dimon's comments, reflecting the growing concerns about a potential recession. Investors are closely monitoring economic data and Federal Reserve announcements for further clues about the direction of the economy. The uncertainty is likely to persist in the near term.

Looking Ahead: Navigating Economic Uncertainty

While Dimon's assessment is undeniably pessimistic, it's crucial to remember that it's just one perspective. Economic forecasts are inherently uncertain, and many economists still hold out hope for a "soft landing"—a scenario where inflation is brought under control without triggering a significant recession. However, Dimon's warning serves as a stark reminder of the significant risks facing the economy and the importance of careful financial planning for both individuals and businesses.

It's important to stay informed about economic developments and consult with financial professionals for personalized advice. Staying up-to-date on economic news and analysis is crucial in navigating these turbulent times. [Link to a reputable financial news source] can provide further insights and analysis.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on JPMorgan Chase CEO Jamie Dimon Issues Economic Warning. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Your Guide To The Key Issues And Candidates In The New Jersey Governor Primaries

Jun 12, 2025

Your Guide To The Key Issues And Candidates In The New Jersey Governor Primaries

Jun 12, 2025 -

Tragic Loss You Tuber P2isthe Name 26 Dead In La Mailroom Cause Of Death Determined

Jun 12, 2025

Tragic Loss You Tuber P2isthe Name 26 Dead In La Mailroom Cause Of Death Determined

Jun 12, 2025 -

Extend Your Healthspan A Physicians Perspective On Successful Aging

Jun 12, 2025

Extend Your Healthspan A Physicians Perspective On Successful Aging

Jun 12, 2025 -

Hallucinations And Sleep Deprivation Inside Ultrarunner Will Goodges Epic Australian Run

Jun 12, 2025

Hallucinations And Sleep Deprivation Inside Ultrarunner Will Goodges Epic Australian Run

Jun 12, 2025 -

Healthy Aging Evidence Based Strategies From A Leading Physician

Jun 12, 2025

Healthy Aging Evidence Based Strategies From A Leading Physician

Jun 12, 2025

Latest Posts

-

Bbc Responds To David Walliams Unacceptable Nazi Salute On Would I Lie To You

Jun 14, 2025

Bbc Responds To David Walliams Unacceptable Nazi Salute On Would I Lie To You

Jun 14, 2025 -

Four Dead Two Missing In San Antonio Following Devastating Flash Floods

Jun 14, 2025

Four Dead Two Missing In San Antonio Following Devastating Flash Floods

Jun 14, 2025 -

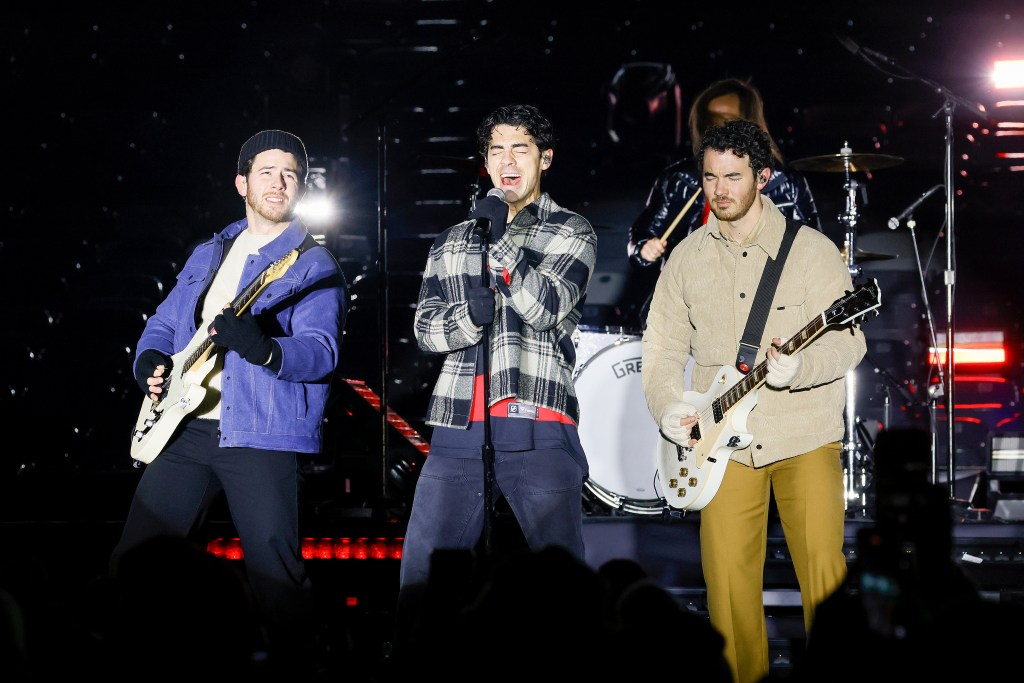

Listen Now Jonas Brothers Drop When You Know On New Live Album

Jun 14, 2025

Listen Now Jonas Brothers Drop When You Know On New Live Album

Jun 14, 2025 -

U S Open The Unlikely Pairing Of Two 17 Year Olds

Jun 14, 2025

U S Open The Unlikely Pairing Of Two 17 Year Olds

Jun 14, 2025 -

Jonas Brothers Concert Cancellation Wrigley Field And Other Dates Affected

Jun 14, 2025

Jonas Brothers Concert Cancellation Wrigley Field And Other Dates Affected

Jun 14, 2025